The Q4-2025 earnings preview

A quick pulse check on the companies I have analyzed so far, where each thesis stands today, and the specific signals I will be watching as Q4 reports and outlooks come in.

Earnings season is here. This is the moment where theses are tested.

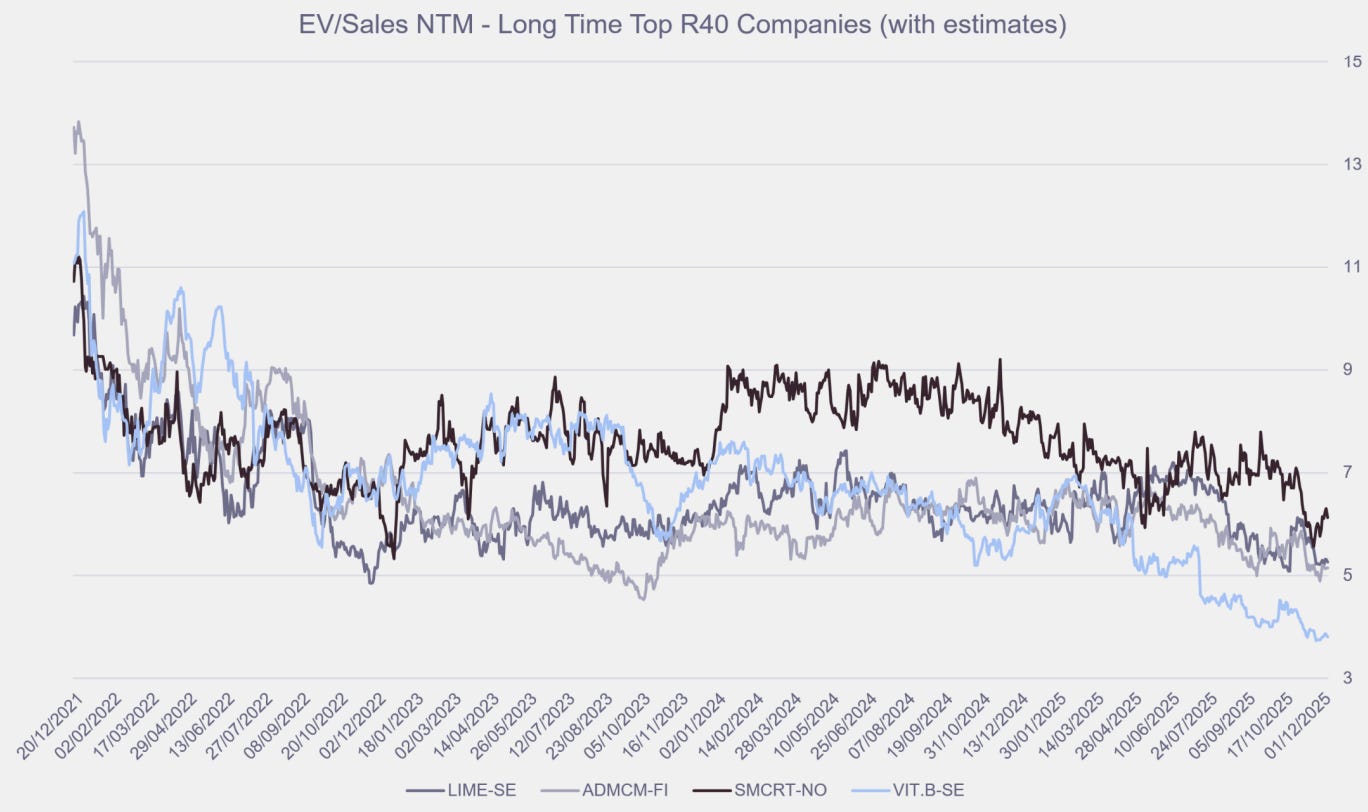

Over the next three weeks, the companies I cover will report their final 2025 numbers. Some, like Vitec, are trading at historical valuation lows despite strong compounding. Others, like Evolution, are battling narrative headwinds that need to be disproven.

This post is my Game Plan. It is a checklist of what I am looking for in each report, what confirms the thesis, and what breaks it.

But before that…

Important Update: Moving to paid

This project has grown from a personal journal into a research operation, and I have decided to upgrade the publication with a paid tier.

The decision to introduce the paid tier is simply because high-conviction analysis takes time. Your support funds the hundreds of hours required to produce this level of depth. It ensures I can keep Fjord Alpha humming.

Starting February 1st, the detailed post-earnings analysis for these companies will mostly be moved to the paid tier. If you want the real-time breakdown of these reports as they land, upgrade your subscription today!

🚀 Launch Special: The Seed Round (Charter Member)

Secure the Charter Member rate during the Q4 Earnings Season.

Lock in the 20% seed round price reduction forever. Offer expires Feb 28th

The earnings prints I care most about

A few companies look more interesting than the rest going into reporting. The setups are similar across them. The underlying business trends have been broadly in line with my theses, but the share prices have been flat to down. That creates a situation where expectations feel more moderate, and where a report that confirms the direction can matter more than usual.

I am looking for continued execution in the key drivers, and for management commentary that reduces uncertainty for the next quarters.

Carasent AB

Original Analysis: Carasent: From messy roll-up to world-class compounder (Aug 1, 2025)

Base case 5Y CAGR: 22%

Price at analysis / current: SEK 28.60 → SEK 26.30 (–8%) 🔻

Thesis status: Intact, even stronger. The Q3 showed strong operational progress (growth, NRR, and margin trajectory), but the stock has not repriced beyond the day-of reaction. You can read the Q3 review here; Carasent Q3-25: The Inflection Point

Context & Recent developments: Stock has traded in a SEK 26-30 range. The company has repurchased 5% of their own shares, showcasing strong confidence in the future.

What I am watching:

Do we get concrete milestone updates for Germany, the surgical module rollout, and Medsum, and any indication of 2026 being a “harvest year”?

Does NRR stay firmly above ~110% (vs. 111% in Q3), and is churn stable?

Is organic growth still tracking 18% and are margins progressing towards 37% (my base case)?

Next Report: February 15, 2026

Hexatronic AB

Original Analysis: Hexatronic: Fallen Angel offers asymmetric opportunity (Dec 10, 2025)

Base case 5Y CAGR: 36.8%

Price at analysis / current: SEK 21 → SEK 24 (+14%) ✅

Thesis status: Main thesis is that US footprint, Data Center exposure and the massive BEAD investment program will drive meaningful growth for Hexatronic across coming years, combined with cost savings program that will drive higher margins.

Context & Recent developments: Stock price has moved well. I did this write-up not too long ago, so mainly looking for confirmation of the original thesis.

What I am watching:

Is the US and data center momentum clearly visible in both numbers and commentary (orders, backlog, customer wins)?

Do we see proof that the cost-savings program is flowing through to margins, and how quickly can it scale?

How is management framing BEAD timing and demand visibility for 2026?

Next Report: February 5, 2026

Evolution AB

Original Analysis: Evolution AB: The Price of Dominance (Aug 8, 2025),

Base case 5Y CAGR: 33%

Price at analysis / current: SEK 650 → SEK 588 (–10%) 🔻

Thesis status: My main thesis is that the market is extrapolating temporary headwinds into a permanent decline. I believe the thesis still to be true, but with some nuance. See here for my latest write-up. Evolution Q3-25: Finding the green shoots in a disappointing report

Context & Recent developments: Stock has traded down since last report in line with the broader iGaming market, lacking any short-term positive catalyst.

What I am watching:

Is Asia back on a growth path after the weak Q3, and do we get further explanation for what changed?

Do we get a concrete update on cybercriminal activity, including impact, mitigation, and residual risk? Read my deep dive; Evolution AB’s Asian headwinds

Does the US keep delivering strong underlying growth around 20 percent plus on a constant currency basis, and how large is the FX drag this quarter? Read my deep dive; Evolution: An American fortress

Next Report: February 5, 2026

GN Store Nord

Original Analysis: GN Store Nord: Finding signal in the noise (Aug 30, 2025)

Base case 5Y CAGR: 21%

Price at analysis / current: DKK 116.00 → DKK 110 (-5%) 🔻

Thesis status: My main thesis is that GN Store Nord has successfully executed on a painful turnaround, and now sees the light at the end of the tunnel. This thesis is intact and even stronger. I did a write-up following the Q3-2025 report that you can find here: GN Store Nord: Thesis and mispricing intact

Context & Recent developments: Virtually no updates from the company, and stock still trading in the DKK 105-120 interval.

What I am watching:

Does the hearing (MedTech-tilted) division continue to outperform?

Do we see continued margin expansion despite tariffs, and does cash generation improve meaningfully?

Are Enterprise and Gaming stabilizing, and is there any signal of a return to growth rather than just cost control?

Next Report: February 5, 2026

Vitec Software Group

Original Analysis: Vitec Software: A Swedish Constellation Software (Aug 15, 2025)

Base case 5Y CAGR: 23%

Price at analysis / current: SEK 362 → SEK 264 (–27%) 🔻

Thesis status: Intact.

Context & Recent developments: Vitec is now trading at a very significant discount vs. peers, after a continued stock decline. The ‘vibe coding will kill SaaS’ narrative has weighed on sentiment.

In the meantime, CEO Olle Backman is making a major purchase of 10,000 shares, and both a co-founder and BoD member have made significant purchases. There is also generally positive broker coverage.

What I am watching:

Is subscription-based revenue still growing at a healthy double-digit rate, and does management sound confident about demand durability?

Is transaction-based revenue stabilizing after recent declines (or at least becoming less of a drag)?

Is Cash EBIT still compounding at a double-digit pace, supporting the quality compounder case, even in a softer sentiment?

Next Report: February 6, 2026

Further companies on the conviction list

Ovzon AB

Original Analysis: Ovzon AB: Compounder of the New Space Race (Jan 15, 2026)

Base case 5Y CAGR: 24.9%

Price at analysis / current: SEK 50 → SEK 56 (+12%) ✅

Thesis status: Not changed since the above write-up just a few weeks ago.

Context & Recent developments: Stock continued to rally after my memo, but has since stabilized in the mid-50s.

What I am watching:

What does management say about the outlook for 2026 and beyond, including demand drivers and contract momentum?

Are there any near term wins or partnerships that further de-risk the growth plan?

Do we see signs of operating leverage improving as capacity utilization increases?

Next Report: February 19, 2026

Ørsted

Original Analysis: Ørsted: Reset, recapitalized, repriced (Sep 25, 2025) - at that point not crossing the 20+% threshold, but after the Q3 report I made an entry into this stock, see write-up here: Ørsted Q3’25: It is windy - but now a buy!

Base case 5Y CAGR: 20.6%

Price at analysis / current: DKK 113 → DKK 145 (+28%) ✅

Thesis status: Balance sheet improved and company in prove-it phase.

Context & Recent developments: Stock has traded generally positively following secured financing and announcement of a large cost-out program. Now, focus is all on execution of the large projects.

What I am watching:

Do we get project level updates that change confidence in delivery, especially on timelines and cost control?

Are there additional impairments, or does asset quality look stable after the reset?

How does management frame EBITDA for 2026, and how much confidence do they attach to that outlook?

Next Report: February 6, 2026

Embracer Group

Original Analysis: Embracer: Forged in fire, awaiting a new fellowship (Sep 16, 2025)

Base case 5Y CAGR: 37%

Price at analysis / current excl. Coffee Stain: SEK 65 → SEK 52 (-20%) 🔻

Thesis status: Intact, monitoring execution. This is a classic turnaround story. If the AAA pipeline delivers and costs remain disciplined, the re-rating potential is substantial. Looking ahead, there is both Metro (likely 2026) and Tomb Raider (2026-27) in the pipeline.

Context & Recent developments: Coffee Stain separation executed according to plan in December.

What I am watching:

Do we get higher confidence on the AAA pipeline (timing + quality), and any signs of further slippage?

Do we see licensing progress (e.g., new LOTR deals) and what is the earnings impact?

Is cash discipline holding under the leaner cost structure?

Next Report: February 12, 2026

The Watchlist

These are high-quality companies whose current valuations, based on my analysis, do not yet offer a clear path to my 20%+ annual return hurdle. I am watching them closely for either a significant operational improvement or a more attractive entry point.

Pexip

Original Analysis: Pexip: From video bridge to fortress (Sep 25, 2025)

Base case 5Y CAGR: 17.2% (just below threshold)

Price at analysis / current: NOK 57 → NOK 77 (+35%) ✅

Thesis status: My thesis is that strong growth in Secure will continue, partly being offset by Connected decrease. At the same time, growth will meaningfully increase margins and open up for a multiple expansion.

Context & Recent developments: Stock has rallied recently. I am waiting on the sidelines for a better entry.

What I am watching:

Is Secure still growing fast enough to more than offset the decline in Connected?

Are margins expanding in a way that supports a rerating case, not just a steady state story?

Do bookings and pipeline commentary improve visibility for the next two quarters?

Next Report: February 12, 2026

ChemoMetec

Original Analysis: ChemoMetec: The Danish tollbooth for the cell therapy revolution (Sep 6, 2025)

Base case 5Y CAGR: 10%

Price at analysis / current: DKK 519 → DKK 640 (+23%) ✅

Thesis status: Watchlist, somewhat stronger fundamentals, valuation stretched.

Context & Recent developments: Strong report and very positive guidance for next year (EBITDA DKK 295-315 million) on 11 September sent the stock surging. Seems to be on track for automated solutions for advanced therapies.

What I am watching:

Do instrument sales stay strong enough to keep feeding the recurring consumables and services base?

Is growth consistent with a high teens type trajectory without giving up margin quality?

Does guidance look sustainable beyond the next year, or are there signs of demand being pulled forward?

Next Report: February 4, 2026 (trading statement)

Ambu

Original Analysis: Ambu A/S: Beyond the Bag (Aug 22, 2025)

Base case 5Y CAGR: 12%

Price at analysis / current: DKK 94 → DKK 85 (-10%) 🔻

Thesis status: On my watchlist, new strategy, stretched valuation.

Context & Recent developments:

Stock trading sideways, currently down slightly since original memo.

Executing on a buyback program, which I am somewhat skeptical about given what I believe is a stretched valuation.

What I am watching:

Are growth and margins tracking what management communicated at CMD?

Do we see clearer proof points of execution improvement in mix, pricing, and utilization?

Does capital allocation, including buybacks, look aligned with value creation at the current valuation?

Next Report: February 4, 2026

Next week, when e.g. Hexatronic and Evolution report, I will be sending out immediate, actionable notes to paid subscribers detailing exactly how the numbers impact our long-term valuation models. Subscribe today to make sure you get the updates fresh of the press!

🚀 Launch Special: The Seed Round (Charter Member)

Secure the Charter Member rate during the Q4 Earnings Season.

Lock in the 20% seed round price reduction forever. Offer expires Feb 28th

The preemptive checklist approach is smart here. Laying out your specific signals before earnings drops helps you avoid confirmation bias when the numbers hit. I've noticed most investors get caught rewriting their thesis live durin reports instead of sticking to predetermined breakpoints. The distinction between what confirms vs breaks each position is particularly useful for Vitec given the AI coding narrative mess.