Carasent: From messy roll-up to world-class compounder

How a durable moat and a proven CEO create a compelling investment case

Updates;

Read my note regarding the Q3-25 report here: Carasent Q3-25: The Inflection Point, and it was indeed an inflection-point quarter!

Note for Q4-25 found here.

This is an investment memo on Carasent AB, a Nordic vertical SaaS provider undergoing a pivotal transformation. The company is evolving from a scattered M&A roll-up into a focused, high-margin platform, and my analysis explores whether the market is correctly pricing this strategic shift.

Executive summary

My analysis concludes that the market is indeed mispricing this transformation. My base case fair value estimate is SEK 77 per share by mid-2030, implying a 22% compound annual growth rate (CAGR) that comfortably clears my 20%+ hurdle for high-conviction ideas.

This thesis is rooted in a clear path to significant margin expansion and a conviction that a proven new management team will outperform its own conservative guidance. The primary risk to this case is also the source of its greatest potential: the strategic expansion into Germany, which offers a massive upside opportunity if executed well.

Context

My process often involves searching for signals of fundamental change that the market has not yet priced in. The Nordic public markets, particularly in the post-2021 era, are full of with fallen software darlings and complex businesses. It is a landscape that rewards patience and a willingness to look for changing situations.

Carasent first appeared on my radar for exactly these reasons.

From the outside, the story appears complicated. The company's history was one of various acquisitions and shifting strategies, a classic roll-up that had yet to prove it could become more than the sum of its parts. But as I dug into the most recent quarterly reports and management commentary, a much clearer picture began to emerge. The noise of the past was being replaced by the signal of a disciplined strategy.

Old Carasent is now mostly gone, and a much higher-quality business is being built right under our noses.

The Setup: Key Data & Investment Thesis

💰 Stock Price: SEK 28.60 (end of July 2025)

📄 Shares Outstanding: 72.32 million

🏢 Market Cap: SEK 2.07B (approx. EUR 180M)

🏦 Net Cash: SEK 205M (approx. EUR 18M)

🌐 Enterprise Value: SEK 1.86B (approx. EUR 162M)

⚙️ Sector/Industry: Healthcare Technology / Vertical SaaS

💡 Investment Thesis: Carasent is a high-quality, transforming software business whose valuation does not yet reflect its potential to outperform conservative guidance, offering a compelling path to 20%+ returns

Source: Company Q2 2025 Report, Company Q1 2025 Report, Nasdaq Nordic, FT.com.

The Business: History & Operations

Origin Story

Carasent's path to its current form has been unconventional. It began its corporate life as Apptix, a US-based application service provider founded in 1997. Its modern identity, however, was forged in 2018. At that time, the company existed as a listed cash shell on the Oslo Børs and executed a complete pivot by acquiring Evimeria EMR AB, a Swedish provider of cloud-based Electronic Health Record (EHR) software.

This transaction set the company on a new course, squarely focused on the Nordic e-health market. The years that followed were defined by a classic roll-up strategy, involving a string of acquisitions to build out its product portfolio and market presence. Key acquisitions included Avans Soma, Metodika, Medrave, Confrere, and HPI Health Profile Institute. While this M&A activity successfully assembled a broad suite of healthcare software assets, it also created a complex and somewhat fragmented organization. This period of rapid, inorganic expansion built the foundation of today's Carasent but also set the stage for the necessary and value-unlocking strategic overhaul that is now underway.

What They Actually Do

To simplify a complex business, I use an analogy: Carasent is building the central nervous system for private healthcare clinics.

In any typical clinic, the daily workflow is a web of disconnected processes. Patient records are in one system (the EHR), scheduling is in another, billing has its own software, patient communication happens via phone or a separate portal, and business analytics are often cobbled together in spreadsheets. This fragmentation creates immense administrative friction, pulling clinicians away from their core purpose: treating patients.

Carasent's core value proposition is to solve this problem by unifying these disparate functions into a single, integrated, cloud-based platform. Its flagship Webdoc EHR system sits at the very core, acting as the single source of truth for patient data. Built around this core is an ecosystem of modules and services that handle everything from patient communication to business intelligence.

This "one-stop shop" approach is powerful. It allows a clinic to run its entire operation through a single vendor, creating seamless workflows and eliminating the administrative burden of managing multiple, poorly integrated software solutions. The ultimate benefit is a more efficient and effective clinic, where caregivers can focus on delivering high-quality care. Carasent's primary customers are private clinics, specialist hospitals, and occupational health providers across the Nordic region, with a growing presence in Germany.

Recent Developments & Performance

Business Update

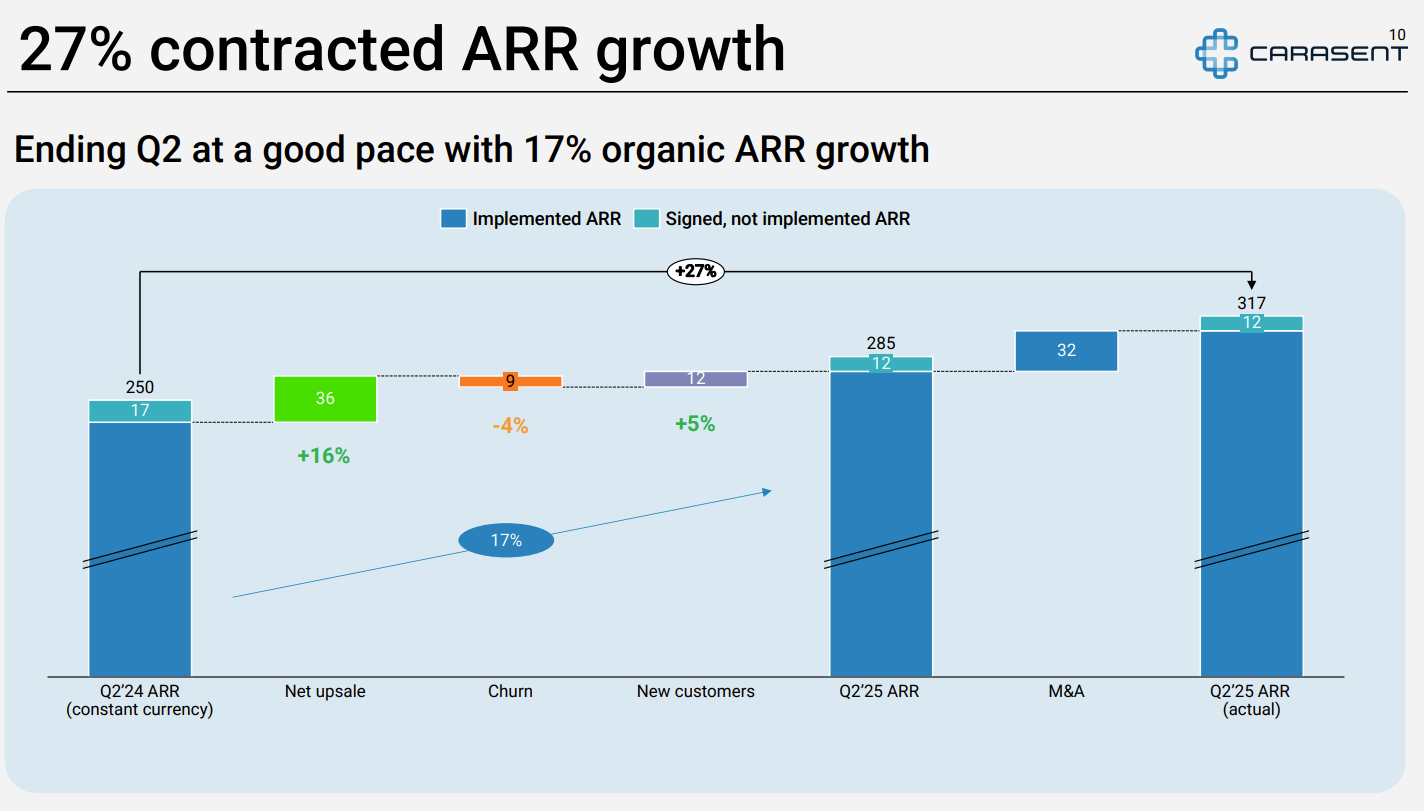

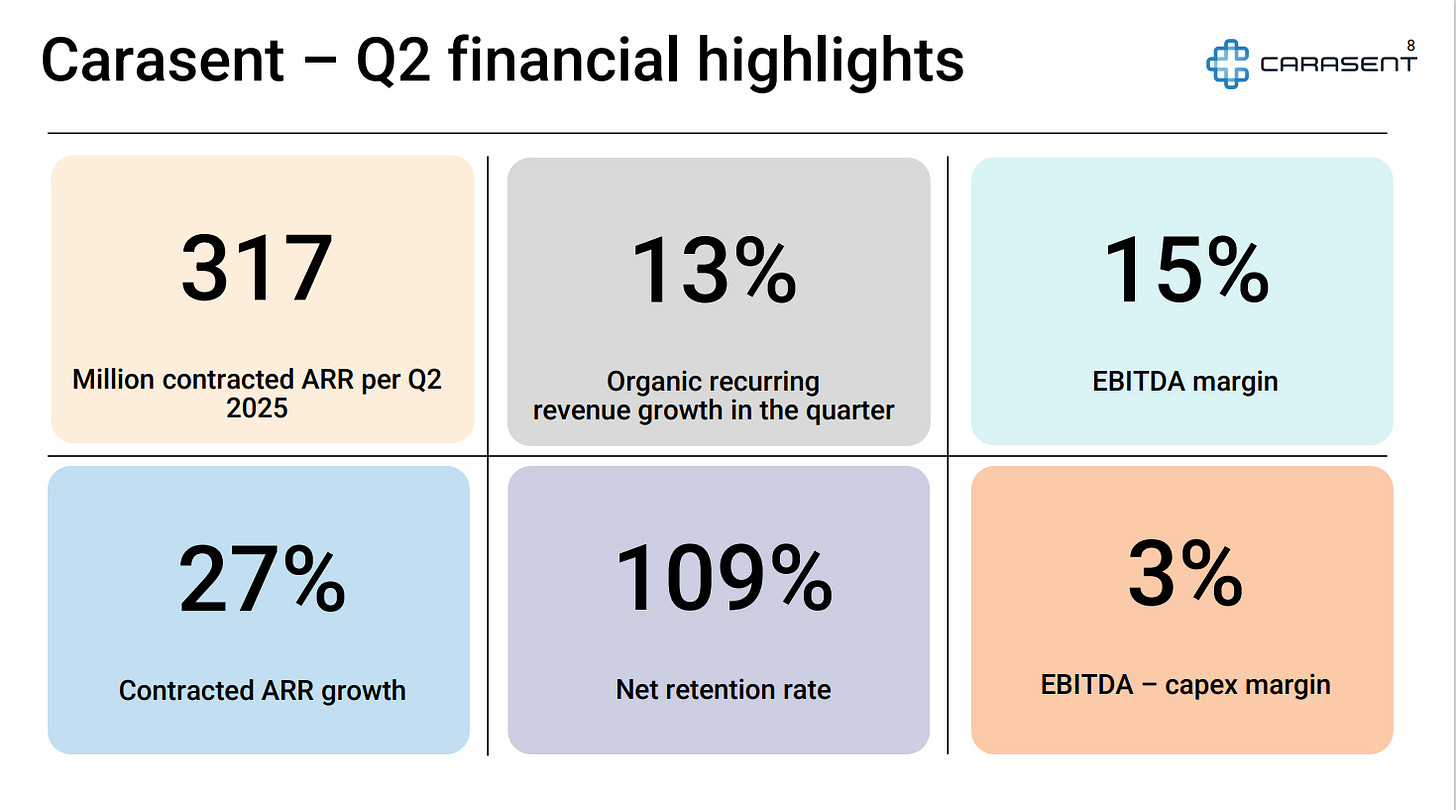

The most recent results from the second quarter of 2025 demonstrate that the company's strategic focus is beginning to yield tangible results. Net sales grew a healthy 26% year-over-year to SEK 82.9 million, supported by a solid organic recurring revenue growth of 13% (Q2 2025 report). This is the lifeblood of a quality SaaS business, and its continued strength is a positive indicator.

More importantly, we are seeing signs of operating leverage. The EBITDA margin for the quarter was 15%, a notable improvement from 12% in the same period last year (Q2 2025 report). This margin expansion, even while the company continues to invest in growth initiatives, is a crucial proof point for my thesis.

A key event that the market has focused on was the revised guidance issued on July 7, 2025. Management lowered its full-year 2025 revenue target slightly to SEK 345-350 million and, more significantly, trimmed its EBITDA target to around SEK 75 million from a previous range of SEK 82-87 million. On the surface, a guidance cut is a negative signal. My initial read was one of caution. However, to understand the true meaning, you have to look at the context.

This message was delivered by a new CEO, Daniel Öhman, who is methodically reshaping the company. It is common for new leaders to "re-base" expectations to set achievable targets they can confidently beat. The stated reason for the revision was not a systemic issue with the core platform, but rather "headwinds" and a necessary restructuring in Ad Opus, the company's smallest and underperforming business unit.13 This is portfolio clean-up, not a sign of core decay. In addition, margin is impacted short-term by investments in AI solutions and implementation of a new customer in Norway that will generate significant ARR in 2026 and onwards.

Crucially, this news was delivered with a powerful accompanying message. CEO Öhman stated that the short-term headwinds have "no impact on the long-term potential of the group" and that the company has a "good foundation to set the direction for the next few years". In the very same announcement, the company issued new, ambitious medium-term financial targets for 2026-2028, including the goal of reaching a 35% EBITDA margin. This was not a warning of failure; it was a signal of disciplined, long-term leadership clearing the decks for the next phase of growth.

Stock Price Context

Since the strategy overhaul, Carasents stock has ticked upward from a low-point at around 10 NOK a few years ago. Since its relisting on Nasdaq Stockholm in December 2024, Carasent's stock has been trading between approximately between SEK 20 and SEK 30 per share, now hovering just below 30 SEK for a while. The market is in a "wait-and-see" mode, waiting for further signs of the transformation story being checked off.

The Business Model & Unit Economics

Revenue Model

Carasent operates a classic and attractive Software-as-a-Service (SaaS) business model. The vast majority of its revenue is generated from recurring subscriptions, with fees typically based on usage, such as the number of users or patient visits. This model provides a high degree of revenue visibility and predictability.

A key indicator of the quality of this business is that over 90% of its revenues are recurring. This is a hallmark of a strong software company, as it creates a stable, compounding revenue base that is not dependent on large, one-off sales each quarter.

Recurring Revenue Analysis

We can track the health of the business through its organic recurring revenue growth. This metric has been consistently strong, running at 13-15% year-over-year in recent quarters, including 14% in Q1 2025 and 13% in Q2 2025. This is the core engine driving the company's growth.

Carasent Net Revenue Retention (NRR) in Q2 was 109% and despite this being an excellent number, it was actually negatively impacted by unusual bankruptcies for a few of its customers. An NRR above 100% is a powerful dynamic. It means that the revenue generated from the existing customer base is growing year-over-year, even after accounting for the small number of customers who leave. This growth comes from existing clients adding more users, adopting new modules (upselling), or through contractual price increases.

This creates a compounding growth flywheel. The business is growing organically from its installed base before signing a single new customer. This metric is also one of the strongest indicators of customer satisfaction and product value. Customers are not just staying; they are becoming more valuable over time. The likely NRR of over 100% provides a stable and resilient foundation for achieving the company's overall growth targets and significantly de-risks the investment case.

The Moat: Sustainable Competitive Advantage

I believe Carasent's primary competitive advantage, its moat, is built on one of the most durable forces in the software world: extremely high switching costs.

The company's core EHR platform is not a discretionary piece of software like a word processor that can be easily swapped out. It is the operational backbone of a medical clinic. Every patient record, every appointment, every billing cycle, and every clinical workflow is deeply embedded within the system. The entire staff is trained on its specific interface and processes.

For a clinic to switch to a competing EHR provider, they start on a significant task. This involves a complex, expensive, and high-risk data migration project, significant operational downtime, and retraining of every employee. For a small or medium-sized private clinic, the cost and disruption are often significant. This operational inertia is the primary reason why customer churn is exceptionally low.

The mission-critical nature of the software is what causes these high switching costs. These high switching costs, in turn, cause the low churn and the high proportion of recurring revenue. This causal chain is the fundamental pillar of the business's quality and durability. While the company's individual product brands like Webdoc and Metodika have strong reputations within their specific niches, it is this structural stickiness that forms the deepest part of the moat. This provides a secure foundation from which management can execute its strategy of upselling new modules and expanding into new markets.

The Investment Thesis: The 5 Year Outlook

This is the heart of my argument. The market is valuing Carasent based on its complex past, but I believe the next 5 years will reveal a much simpler, more powerful, and more profitable business. I see a clear path for the company to evolve into a leading Nordic healthcare software platform, and my outlook is based on four key, interconnected drivers.

Pillar 1: Margin Expansion Through Operating Leverage

I believe Carasent will achieve and outperform its stated target of a 35% EBITDA margin by 2028. This is not just an aspirational goal; it is a logical outcome of the SaaS business model when combined with disciplined execution. The company has already done the hard work of right-sizing its cost base, executing a cost savings program of around NOK 40 million annually. As a software business, Carasent has very high gross margins. With the core platform now largely built and the organization streamlined, each incremental dollar of revenue, whether from a new customer or an upsell to an existing one, will come at a very low marginal cost. As revenue scales on top of this optimized cost structure, a significant portion will drop directly to the bottom line, driving substantial margin expansion. This operating leverage is the primary engine for future profitability.

Pillar 2: The German Beachhead Strategy

The most significant catalyst for long-term growth is the company's recent entry into the German market. Germany's private healthcare market is substantially larger and more fragmented than the Nordics, representing a massive greenfield opportunity. What impresses me is not just the ambition, but the intelligence of the strategy. Rather than entering this new market cold, Carasent acquired Data-Al, a local German EHR provider with a 30-person team and over 1,000 existing customer relationships.

This was a strategically astute "land-and-expand" move. It provides Carasent with an immediate local presence, deep market knowledge, and a customer base to which they can introduce their modern, cloud-native Webdoc X platform. Management has been clear that the plan is to gradually migrate Data-Al's legacy customers onto the superior Webdoc X system (Q4 2024 earnings call transcript). This de-risks the market entry significantly and provides a clear path to gaining a foothold. Success in Germany is the primary driver of my bull case and represents a material, asymmetric upside opportunity that I believe is not currently reflected in the share price.

Pillar 3: Deepening the moat in the Swedish core market

While Germany represents future growth, Carasent is also focused on solidifying its leadership position in its core Swedish market. The key initiative here is the development of a new "Surgery" module for the Webdoc platform (Q4 2024 earnings call transcript). This is a critical piece of functionality required by larger, more complex specialist clinics; a segment of the market that Carasent has previously struggled to fully penetrate.

By adding this high-value module, the company can move upmarket, increasing its total addressable market in Sweden and raising its average revenue per customer (ARPU). Winning these larger, more sophisticated customers will not only drive revenue growth but also further entrench the Webdoc platform within the Swedish healthcare ecosystem, making the moat even deeper and more difficult for competitors to cross.

Pillar 4: A Diversified Engine for Sustainable Growth

These pillars combine to create a diversified and resilient growth engine that I believe can deliver and more on the company's medium-term target of 15% average annual organic revenue growth from 2026-2028. This growth will not come from a single source but from a combination of factors:

New Logos: Winning new customers in Sweden, enabled by the new Surgery module.

Upselling: Selling new modules and services into the sticky, installed base of existing customers.

Pricing Power: Implementing gradual price increases, supported by the mission-critical nature of the product and high switching costs.

Geographic Expansion: Acquiring new customers in the nascent but large German market.

This multi-levered growth profile is inherently more robust and less risky than relying on a single growth driver, giving me confidence in the company's ability to execute on its long-term targets.

Management & Capital Allocation

Management

The single most important factor in my thesis is the leadership of CEO Daniel Öhman. Appointed in late 2022, his arrival marked what I see as an ideological shift for Carasent. The company moved from a strategy led primarily by dealmakers to one led by a proven, industry-savvy operator. His track record is directly analogous to the task at hand: as CEO of GHP Speciality Care from 2013 to 2022, he doubled the company's turnover and quadrupled its EBITDA from SEK 50 million to SEK 200 million.

Crucially, Öhman knew Carasent from the outside before he joined. In the press release announcing his appointment, he stated he was a former customer and that "their platform is the best. The challenge is now to grow, and to become number one". This is a powerful endorsement from an industry veteran, signaling a clear focus on product-led, profitable growth rather than financial engineering. His significant ownership of 196,821 shares aligns his interests squarely with long-term shareholders.

Öhman is complemented by CFO Svein Martin Bjørnstad. Appointed in 2021, Bjørnstad's background in investment banking at DNB Markets brings a high level of financial discipline and capital markets expertise to the executive team. This combination of operational and financial leadership is exactly what a company at this stage of its evolution needs.

Capital Allocation

The company's recent capital allocation decisions provide strong evidence of this new, disciplined approach. In 2023, after a strategic review, the board made the decision to return NOK 250 million to shareholders through a share buyback and a cash distribution, explicitly stating their belief that the shares were trading at a "substantial discount to fair value".

This was followed by the announcement of a new SEK 150 million share buy-back program in July 2025. The shift in strategy is clear: the focus has moved from aggressive M&A to returning capital to shareholders and reinvesting in organic growth. This is a powerful signal. Management believes that the highest risk-adjusted return available to them is not in acquiring other companies, but in buying back their own undervalued stock. This is the hallmark of a disciplined and value-oriented management team.

Valuation: A Triangulated Approach

Introduction

My valuation of Carasent AB is anchored to a five-year investment horizon, projecting forward to mid-2030. This timeframe is necessary to allow the company's strategic pivot towards profitable growth to fully manifest in its financial results and, subsequently, its market valuation. To arrive at a defensible fair value estimate, I employ a triangulated methodology. This approach primarily relies on a forward-looking relative valuation, where I apply justified multiples derived from a carefully selected peer group to my own financial projections for the company. The analysis is structured across three distinct scenarios; Base, Bull, and Bear. This is done to stress-test my assumptions and provide a comprehensive view of the potential risk-reward profile.

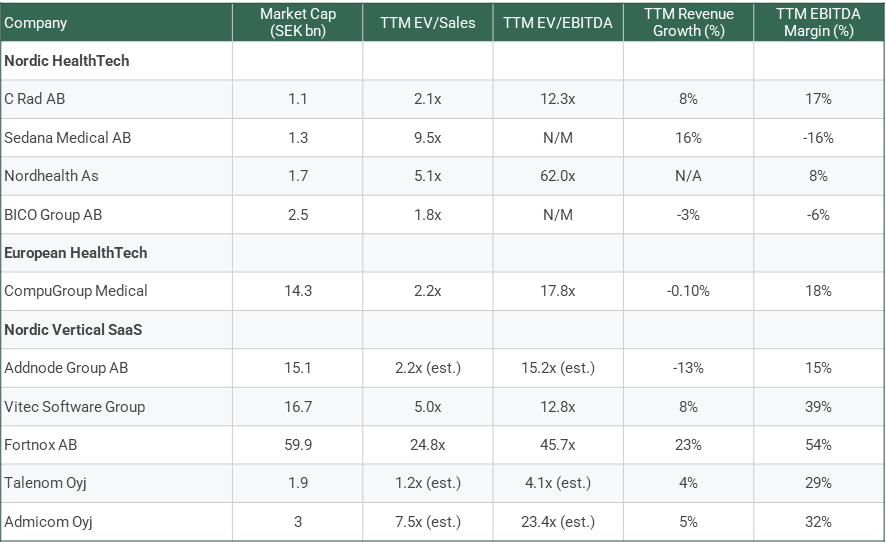

Relative Valuation: A Justified Peer Group

To properly contextualize Carasent's valuation, I have assembled a peer group of ten publicly traded Nordic and European software companies. The selection is intentionally focused on two core archetypes: 1) Nordic HealthTech and MedTech companies, which share a similar end-market, and 2) high-performing Nordic Vertical Market Software (VMS) providers, which share Carasent's focused, sticky, and high-margin SaaS business model. This dual focus provides a more robust set of comparables than a narrow view of HealthTech alone.

The peer group includes:

Direct HealthTech Peers: C Rad AB, Sedana Medical AB, Nordhealth AS, and BICO Group AB are Nordic players operating in adjacent healthcare technology fields. Germany's CompuGroup Medical is included as a large, mature European Health IT comparable, providing a useful benchmark for what a scaled player in the space can command.

Vertical SaaS Peers: Addnode Group AB, Vitec Software Group AB, Fortnox AB (to be delisted), and Talenom Oyj are premier examples of the Nordic VMS model. They are serial acquirers with strong track records of profitable growth and high recurring revenues, a model Carasent is increasingly emulating.

Admicom Oyj is a Finnish peer with a similar focus on ERP systems for niche verticals.

This curated group provides the necessary data to understand how the market values companies at different stages of the growth and profitability curve.

Source: Financial data providers, company reports. Market data as of late July 2025. Currency conversions applied. N/M denotes a non-meaningful multiple due to negative EBITDA.

The analysis of this peer set reveals a clear valuation premium for companies that combine consistent growth with high profitability, exemplified by Fortnox and Vitec.

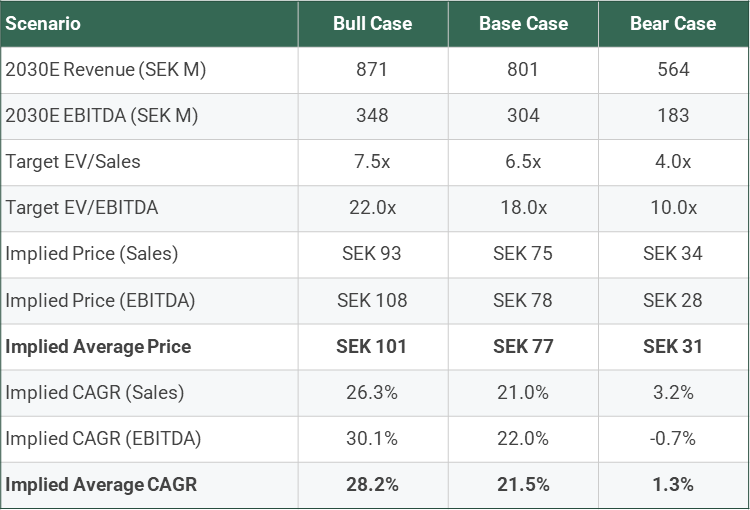

Triangulated Valuation & Scenarios

I have constructed three scenarios to model Carasent's potential trajectory to mid-2030. My valuation is triangulated by applying both an EV/EBITDA multiple to capture the value of future profitability and an EV/Sales multiple, which is standard for SaaS businesses and reflects the value of sticky, recurring revenue streams. The final target price for each scenario is an average of the outcomes from these two multiples.

The core of my thesis is that management's stated growth targets are conservative. The combination of strong NRR, new surgery module adoption, and the German expansion creates a plausible path to outperformance. I have therefore constructed my scenarios with a higher growth rate in the Base Case than company guidance.

Base Case: This scenario assumes management successfully executes its stated plan. Revenue grows at 18% annually post-2025, and the EBITDA margin reaches and stabilizes at the 37% target. This represents the most probable outcome if the current strategy unfolds as intended.

Bull Case: This optimistic scenario models an acceleration of growth to 20% annually, driven by strong market adoption and accretive bolt-on acquisitions. Superior operational execution and economies of scale allow the EBITDA margin to expand further to 40% by 2030.

Bear Case: This cautious scenario reflects potential execution risks. Growth slows to 10% annually, and competitive pressures or cost overruns cap the EBITDA margin at 30%, below the company's target.

The table below summarizes my projections and the resulting valuation for each scenario.

Note: Calculations are based on 72.32 million shares outstanding and a SEK 200M net cash position in 2030. The current share price is assumed to be SEK 29.00 as of late July 2025.

Summary on Valuation

My analysis indicates an attractive risk/reward profile, hinging on management's ability to deliver on its promise of profitable growth. The Bear Case suggests the downside is well-protected, with a potential outcome near the current share price. The Bull Case, however, reveals a compelling opportunity for significant value creation, with the potential for returns approaching 30% annually.

Based on this triangulated approach, my Base Case fair value estimate for Carasent AB in mid-2030 is in the SEK 75-78 range. This target implies a 5-Year CAGR of approximately 21-22% from the current share price.

This result clears the Fjord Alpha internal target of 20%+ annualized returns. The investment thesis is validated by a valuation that shows the market is not fully pricing in a scenario where management successfully executes its strategic plan and outperforms its initial and what I believe, more conservative, guidance. The risk-reward profile is skewed favourably to the upside.

The Pre-Mortem: A Case for Failure

Let's assume it's 2029, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The most plausible reason for failure, and the number one risk to the thesis, is execution failure in Germany. We were wrong about the ease of entry. The integration of Data-Al was fraught with cultural and technical challenges we underestimated. The Webdoc X product, despite its technical superiority on paper, failed to gain traction against entrenched local incumbents like CompuGroup Medical, who defended their turf aggressively with deep customer relationships and localized know-how. The German expansion, which we saw as a catalyst, became a cash-burning quagmire that drained resources and management focus.

Second, the margin dream was just a dream. We overestimated the speed and magnitude of the operating leverage. Scaling the business, particularly supporting a multi-country operation, required far more sustained investment in sales, marketing, and local customer support than we modelled. Competition intensified, putting pressure on pricing. The company never managed to sustainably push its EBITDA margin past 25%, and the market, rightly, continued to value it as a mid-tier IT services firm, not a premium SaaS platform.

Third, we underestimated the competitive threat in the core Nordic market. A larger, pan-European player like Visma, seeing the attractive margins in the private healthcare vertical, decided to target the space aggressively. They used their superior scale and balance sheet to out-invest Carasent in R&D and out-compete on price, slowly commoditizing the market and eroding Carasent's pricing power.

Finally, our faith in management was misplaced. The operational discipline that CEO Daniel Öhman demonstrated at GHP did not translate to the more complex, multi-product software environment at Carasent. Key product development deadlines, such as the crucial Surgery module, were repeatedly missed. This led to the loss of key potential customer contracts, damaged the company's credibility, and caused the growth story to fizzle out.

Conclusion: The Final Verdict

My analysis of Carasent leads me to a clear conclusion: this is a compelling investment opportunity, offering a rare combination of business quality, a credible transformation, and a valuation that underestimates the company's true potential.

There is much to admire here. The business is rooted in a powerful moat of high switching costs, which produces a sticky and predictable recurring revenue stream. The transformation, led by a proven operator in CEO Daniel Öhman, is methodically creating a more streamlined and profitable company.

The main investment thesis, however, hinges on one core belief: that management's official guidance of 15% growth and 35% EBITDA margin is too conservative. I believe it is. With a Net Revenue Retention of 109%, the business has a high single-digit growth floor built-in before signing a single new customer. When you layer on the multiple new growth vectors, such as soon opening a new market with the new surgery module, regular growth in existing markets, and the massive, asymmetric opportunity in the German market; a path to sustained high-teens growth seems not just possible, but probable.

My valuation reflects this conviction. The Base Case yields a fair value of SEK 77 per share and a 5-year CAGR of 22%. This clears my 20%+ hurdle and provides a significant margin of safety against the very real risks outlined in the pre-mortem. The market, anchored to recent underperformance and conservative guidance, has not priced in this likely scenario of outperformance.

I believe that as management continues to execute, the market will further recognize the high-quality, high-margin business that is emerging, leading to a significant re-rating of the stock and substantial value creation for shareholders.

✅ Thesis Pillar 1: A credible management team is executing a strategic pivot from a complex roll-up to a focused, high-margin vertical SaaS platform.

✅ Thesis Pillar 2: There is a clear path to significant margin expansion, with a conservative stated target of 35% EBITDA, driven by operating leverage on a scalable software model.

✅ Thesis Pillar 3: The strategic, low-risk entry into the large German market provides a material call option for accelerated long-term growth.

⚠️ Key Risk (from Pre-Mortem): Execution failure in the German market entry, where a failure to gain traction could lead to significant cash burn and invalidate the long-term growth thesis.

🎯 Target Price (Base Case): SEK 77 by 2030.

📈 Implied 5-Year CAGR (Base Case): ~22%.

Primary Sources Used

Carasent AB (publ) – Interim report January–June 2025

Carasent AB (publ) – interim report Q1 2025

Carasent AB (publ) – Year-end report January–December 2024

Carasent ASA – Annual Report 2023

Carasent ASA – Annual Report 2022

Carasent AB (publ): Revised 2025 targets and new medium-term financial targets (Press Release, July 7, 2025)

Carasent ASA: Daniel Öhman appointed new CEO (Press Release, June 16, 2022)

Carasent ASA acquires Data-Al and enters the German market (Press Release, October 28, 2024)

Q4 2024 Earnings Call Transcript (as synthesized from AlphaSpread)

Never heard about the company before. Thanks for the read.