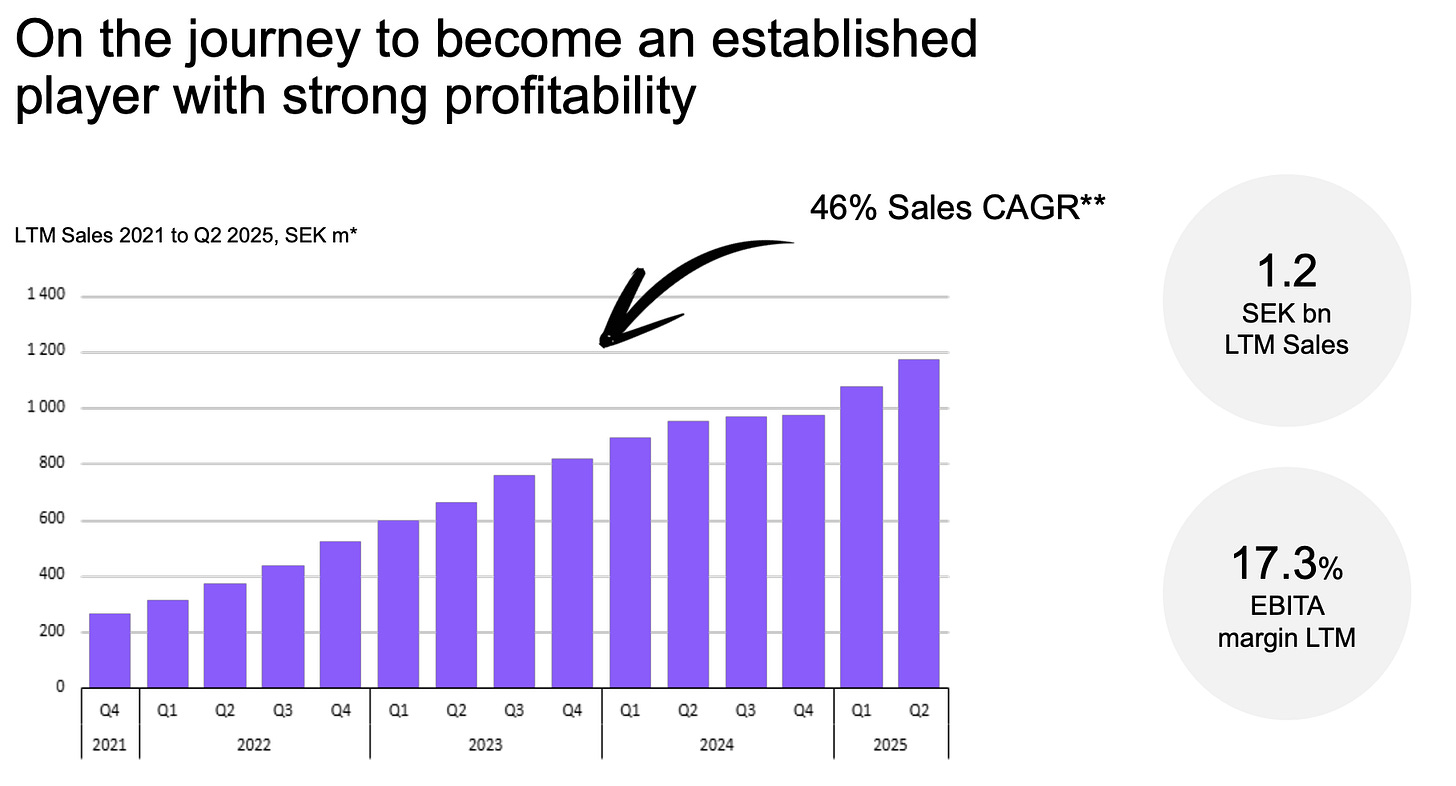

Hexatronic: Fallen Angel offers asymmetric opportunity

A deep dive into the battered Swedish fiber compounder, the aftermath of a short-seller attack, and the coiled spring of US infrastructure spending.

1. Situation overview and high-level thesis

In late 2022, Hexatronic was a market darling on the Stockholm exchange, a high-multiple serial acquirer rolling up the dull world of fiber ducts and cables. It exported the “Swedish Model” of fiber deployment and, for a while, could do no wrong.

Then came the triple whammy. (i) Interest rates spiked and killed the cheap debt arbitrage that fueled its M&A flywheel. (ii) Organic fiber demand in Europe hit a wall as the post-COVID spending faded and Germany stalled. And (iii) Viceroy Research, a short-seller, publicly accused management of aggressive accounting and overstated organic growth.

The share price collapsed from over SEK 160 to the high-teens, wiping out years of gains and dumping Hexatronic into the “too hard” pile. Most investors now see a broken chart, a departing CEO, short-seller noise and a company that sells plastic tubes in a market obsessed with AI software.

However, beneath the wreckage there is a different story emerging: a pivot toward US infrastructure, Data Centers and Harsh Environment applications that the market is largely ignoring. I have looked closely at the quality of the revenue that remains, especially in these segments, and the magnitude of authorized but unspent US infrastructure money (BEAD). Critically, this money requires products made in America, and Hexatronic has spent the last two years building factories there.

I believe the market is currently pricing Hexatronic as a failed roll-up with zero growth prospects. What the market might be missing is that the company has pivoted. It is no longer just a fiber-to-the-home (FTTH) play in Sweden or Germany. It is becoming a critical infrastructure provider for the US AI build-out and the re-industrialization of the Western power grid.

The “accounting fraud” noise has obscured a very real and tangible manufacturing footprint that is about to encounter a wall of government-mandated demand. We are standing at an inflection point:

The CEO who built the company is handing over the keys.

The short interest is high but arguably squeezed.

The valuation has compressed to levels where even modest execution offers significant upside.

This is far from a risk-free trade, but it has the asymmetric risk-reward that I am looking for.

2. Current setup and key facts

💰 Stock Price: SEK 21 (approx. EUR 1.8)

📄 Shares Outstanding: 205,637,228

🏢 Market Cap: SEK 4.35B (approx. EUR 378M)

🏦 Net Debt: SEK 1.7B (approx. EUR 148M)

🌐 Enterprise Value: SEK ~6.3B (approx. EUR 547M)

⚙️ Sector/Industry: Telecommunications / Industrial Goods

💡 Investment Thesis: Hexatronic is a mispriced “fallen angel” where the market has over-extrapolated a cyclical trough in European fiber demand and short-seller fear, ignoring a fully-funded US manufacturing expansion positioned to capture billions in delayed federal infrastructure (BEAD) stimulus and booming AI data center demand.

3. The business: History & operations

Origin Story: The Swedish fiber phenomenon

Sweden was one of the first countries to pursue Fiber-to-the-Home (FTTH) on a national scale. While Germany, the UK and the US were sweating legacy copper and DSL, Sweden was digging up streets and laying fiber, reaching penetration levels others could only dream of.

Hexatronic, founded in 1993, started as a small player in this ecosystem. Its modern incarnation began around 2014–2015 when Henrik Larsson Lyon took over as CEO and listed the company on Nasdaq Stockholm. His core insight was that selling commodity fiber cable is a race to the bottom; selling a system with cable, ducts, connectors, tools and training changes the conversation from “price per metre” to “total cost of installation”.

Under Lyon, Hexatronic became a serial acquirer, using richly valued equity and cheap debt to buy training companies (PQMS, Smart Awards), duct factories (Blue Diamond in the US) and high-end assembly plants (e.g. Data Center Systems). EBITA grew at 60%+ annually for five years as they bought assets at industrial valuations, plugged them into the “Hexatronic System” and enjoyed a re-rating. That flywheel worked until the macro environment broke the gear.

The “Pneumatic Tube” of the Internet

It is easy to get lost in the jargon of “passive fiber infrastructure”, such as Ribbonet, Micronet, air-blown fiber. Hexatronic doesn’t just sell fiber cables; it sells the plastic microducts they run through and a system called air-blown fiber. Instead of pulling heavy cables through ducts with winches (slow, high-friction, and risky for the glass), you first install empty ducts and later “blow” ultra-light fiber cables through them using compressed air so they float on a cushion of air and can travel kilometres, around corners, and into buildings.

Economically, this is the key: installations are faster, require fewer man-hours, and the network is future-proof. When more capacity is needed, you don’t dig up streets again, you simply blow new cables through the ducts that are already in the ground.

The product mix

Hexatronic organizes itself into three newly defined business areas as of 2025, a shift designed to increase transparency and highlight the growth engines:

Fiber Solutions (approx. 65% of sales): This is the legacy business. Ducts, cables, and systems for FTTH. This includes the “Matrix” system used in the UK and the “Viper” micro-cables. This is the segment currently in the penalty box due to weak demand in Europe (Germany/UK) and the US inventory de-stocking cycle. It is the volume engine, but currently, it is sputtering.

Data Center (approx. 18% of sales): The crown jewel of growth. This is not just selling cables; it is providing high-density fiber connectivity and “Smart Hands” services (installation, maintenance, reconfiguration) for hyperscalers and colocation centers.

Harsh Environment (approx. 17% of sales): High-margin, bespoke cables for things that cannot fail. Think submarine cables, defense applications, offshore wind farms, and sensor arrays. This includes subsidiaries like Rochester Cable. This is a “moat” business, you don’t buy a submarine umbilical from the lowest bidder.

4. Recent developments & performance

Business Update: The “Kitchen Sink” quarters

I have reviewed the interim reports of recent years, and the picture they paint is of a company undergoing a painful but necessary surgery. The “growth at all costs” era is over, while the “margin discipline” era has begun - a common theme across many of my holdings.

Q2 & Q3 2025 overview

The numbers are messy, but the trend is clear. In Q2 2025, sales dropped 6% to SEK 1,906 million. The EBITA margin collapsed to 8.9% from 11.0% the previous year. This was likely the bottom of the cycle. The inventory glut in the US was at its peak, and the German market had frozen.

By Q3 2025, we see the first signs of stabilization. Sales were down 3% to SEK 1,883 million, but crucially, organic sales actually increased by 2%. This is a vital green shoot. It suggests that the de-stocking cycle is largely over and underlying demand is starting to flow through again. The Data Center segment is carrying the team, with sales up 43% in Q3, masking the continued weakness in Fiber Solutions.

However, the headline numbers for Q3 look ugly because management decided to rip the band-aid off. They booked SEK 202 million in one-off items related to a “Performance Improvement Program”. This pushed the reported EBITA to a loss of SEK -56 million.

My read is that the outgoing CEO, Henrik Larsson Lyon, and the Board are clearing the decks for the incoming CEO, Rikard Fröberg. They are taking the pain now, consolidating factories in Europe, shutting down inefficient lines, laying off staff, so that 2026 looks pristine.

The guidance suggests these savings will boost EBITA by SEK 110 million annually starting late 2025. This is “kitchen sinking” 101..

As of end November, Hexatronic made a bolt-on acquisition (Communication Zone) in the Data Center segment, which seems to be acquired at a reasonable multiple and expanding the US footprint further.

Stock price context and set-up

From highs above SEK 160 in late 2022/early 2023, Hexatronic now trades around SEK 21, i.e. a 90% drawdown. The combination of restructuring noise, uncertain US timing and a broken chart has pushed the stock into the “too hard” bucket for most investors. Yet Q3’s +2% organic growth suggests the patient is stabilising, and the “kitchen-sink” cost programme should lift margins even without much top-line help.

This is precisely the sort of maximum-pessimism point where the asymmetry begins to emerge.

5. The business model & unit economics

Revenue model

Hexatronic runs a hybrid model.

In Fiber Solutions and Harsh Environment, revenue is largely transactional manufacturing: ducts, cables and related hardware sold into projects, with margins driven by volume and factory utilization.

The Data Center segment is different: it combines high-density connectivity products with design, installation and “Smart Hands” services. That service layer makes revenue stickier, embeds Hexatronic in customer operations and deserves a structurally higher multiple than a pure manufacturing business.

Recurring revenue dynamics

The “system selling” model creates quasi-recurring behaviour. Once an operator standardises on Hexatronic’s Viper system, buys compatible blowing machines and trains technicians through Hexatronic-owned training companies, switching imposes real costs in retraining and tooling. Each installed base becomes a multi-year annuity of ducts, cables and accessories.

In Fiber Solutions, the swing factor is utilization. Raw materials (polyethylene, glass) are largely passed through with a lag; the real leverage comes from running plants at 90% rather than 50% capacity, which can mean the difference between single-digit margins and >15%. Today, parts of the US footprint operate well below designed throughput. Any BEAD-driven volume uplift therefore drops disproportionately to the bottom line.

Data Center and Harsh Environment add a higher-margin, less cyclical layer on top, smoothing group profitability as mix shifts toward these segments. In Data Centers, AI clusters and colocation sites need constant reconfiguration and capacity upgrades, keeping Hexatronic’s teams on site for years, i.e. an “install and evolve” relationship rather than a one-off project.

6. Competitive moat and strategic positioning

Hexatronic is not a global monopoly. It competes with giants like Prysmian (Italy), Corning (USA), and dozens of local players. However, a small fish can thrive by being faster, sharper, and more specialized.

Proprietary technology (The “Viper” Advantage)

Hexatronic’s “Viper” micro-cable series is a legitimate differentiator. It allows for higher fiber counts in smaller diameters. In a world where duct space is limited (you can’t just dig up London again to lay new pipe), the ability to blow more data through existing pipes is valuable. Their “air-blown” technology reduces installation time by up to 50-70% compared to traditional pulling methods. In Western markets, labor is 80% of the cost of a fiber rollout. If Hexatronic’s product costs 10% more but saves 20% on labor, the customer saves money. That is the moat. It is an arbitrage on labor costs.

Switching costs - The training lock-in

Hexatronic owns training companies like The Light Brigade in the US and others in the UK. They train thousands of technicians a year. These technicians are certified on Hexatronic gear. If an operator wants to switch to Prysmian, they have to retrain their entire workforce. This creates a behavioral lock-in that is stronger than a contractual one. The installers become evangelists for the product they know how to use.

Regulatory Barriers - BABA and BEAD

This is the most critical moat for the US market. The Build America, Buy America (BABA) Act requires that materials for federally funded projects (like BEAD) be manufactured in the US.

Hexatronic saw this coming. They acquired Blue Diamond Industries (ducts) and Rochester Cable, and they have invested heavily in new capacity in Ogden, Utah, and Clinton, South Carolina.

Many competitors import from Mexico or Asia. They are effectively locked out of the BEAD money. Hexatronic is inside the fortress. This regulatory wall is temporary (competitors can build factories), but it provides a 3-5 year window of protected pricing power.

Unique resources & Distribution

Hexatronic’s decentralized model allows it to act like a local player in key markets (UK, Germany, US) while having global sourcing power. Their acquisition of Blue Diamond Industries gave them an established channel into the US utility and telecom market that would have taken a decade to build organically.

Moat Durability

I assess the moat as Moderate to Strong in niche markets (Harsh Environment, US BEAD projects due to BABA) and Weak in generic European FTTH (where price competition is fierce).

The strategy to pivot toward the US and Data Centers is essentially a strategy to move from the weak moat areas to the strong ones.

7. The 2030 investment case and growth drivers

This is the heart of the argument. Where will this business be in five years, at the end of 2030? I believe Hexatronic can create massive value in this timeframe, driven by specific, identifiable levers that will play out over the second half of the decade.

a. The BEAD Tsunami (Peak Impact 2027-2029)

The Broadband Equity, Access, and Deployment (BEAD) program is a $42.45 billion federal grant program. While delayed, the timeline is now becoming clear. States are getting approvals in late 2025, meaning funds flow in 2026. My view, factoring in red tape, is that “peak build” years for BEAD will be 2027 through 2029.

Hexatronic’s US duct business (Blue Diamond) is perfectly positioned. The “Buy America” requirement filters out cheap imports. When this volume hits, the utilization of the Utah and Kentucky factories will spike. We are looking at a potential doubling of US revenues from current levels by 2030 simply by filling the factories they have already built.

b. The AI Data Center Supercycle

Data Centers are now being built on massive scale, and the AI revolution requires high-density fiber inside the data center to connect thousands of GPUs.

Hexatronic has set a target for the Data Center segment to reach SEK 3 billion in sales by 2028 with a 15% EBITA margin. Given the current trajectory (>40% growth in 2025), I believe they can exceed SEK 4 billion by 2030. This would make the Data Center business almost as large as the entire group is today. This segment commands a higher valuation multiple due to its “Smart Hands” service component and secular growth tailwinds.

c. Harsh Environment: The Defense Dividend

The geopolitical situation in Europe has led to a rearmament supercycle. Modern warfare requires sensors, secure communications, and durable cables (tow cables for sonar, umbilical cables for ROVs). Hexatronic’s Rochester Cable and Fibron units serve this market.

Hexatronic targets SEK 2 billion in sales for this segment by 2028. By 2030, assuming continued defense spending of 2-3% of GDP across NATO, this segment provides a stable, high-margin (15%+) floor to the group’s earnings, acting as a hedge against economic cyclicality.

d. The margin recovery story

The “Performance Improvement Program” announced in Q3 2025 is real. They are taking SEK 122 million in costs out of the business.

By 2030, the “kitchen sinking” of 2025 will be a distant memory. The mix shift is the key driver here. As low-margin European FTTH becomes a smaller part of the pie, and high-margin US Data Center/Harsh Environment becomes >50% of sales, the group’s structural margin profile elevates. I model a return to 12-14% EBITA margins by 2030, driven by this mix shift and operational leverage.

8. Management & Capital allocation

The CEO Transition: From founder-mode to scaler-mode

Henrik Larsson Lyon is leaving after 10 years. This usually makes me nervous. He built the culture, the strategy, and the vision.

However, the replacement, Rikard Fröberg, is an interesting choice. He comes from Ansell, a global safety protection company.

Why do I like this? Ansell is a business of consumables and protection sold into industrial and medical markets. It requires rigorous supply chain management, commercial execution in the US market (where Fröberg was based), and operational efficiency.

Hexatronic needs to transition from a “deal-making” culture (M&A) to an “execution” culture (running the factories efficiently, managing working capital). Fröberg fits this mandate. He is an operator.

Insider ownership is decent. Previous CEO Henrik Larsson Lyon holds over 4 million shares. Deputy CEO Martin Åberg also has a significant stake via Chirp AB. The alignment is there. They have felt the pain of the share price collapse personally. Their net worth is tied to the recovery.

Capital allocation

Historically, Hexatronic used its highly-valued stock to buy companies. That window is closed.

The current focus is on deleveraging. Net debt is around 1.9x EBITDA. This is manageable, but high for the current interest rate environment.

They have paused the dividend, which I applaud. It shows discipline. Cash should be used to pay down debt and finish the US factory ramp-up + very selective M&A, e.g. like the Communication Zone acquisition end of November.

This is a “digest and optimize” period. The decision to delay the fiber cable factory in South Carolina to 2027 further demonstrates capital discipline, they are waiting for the demand signal before spending the Capex.

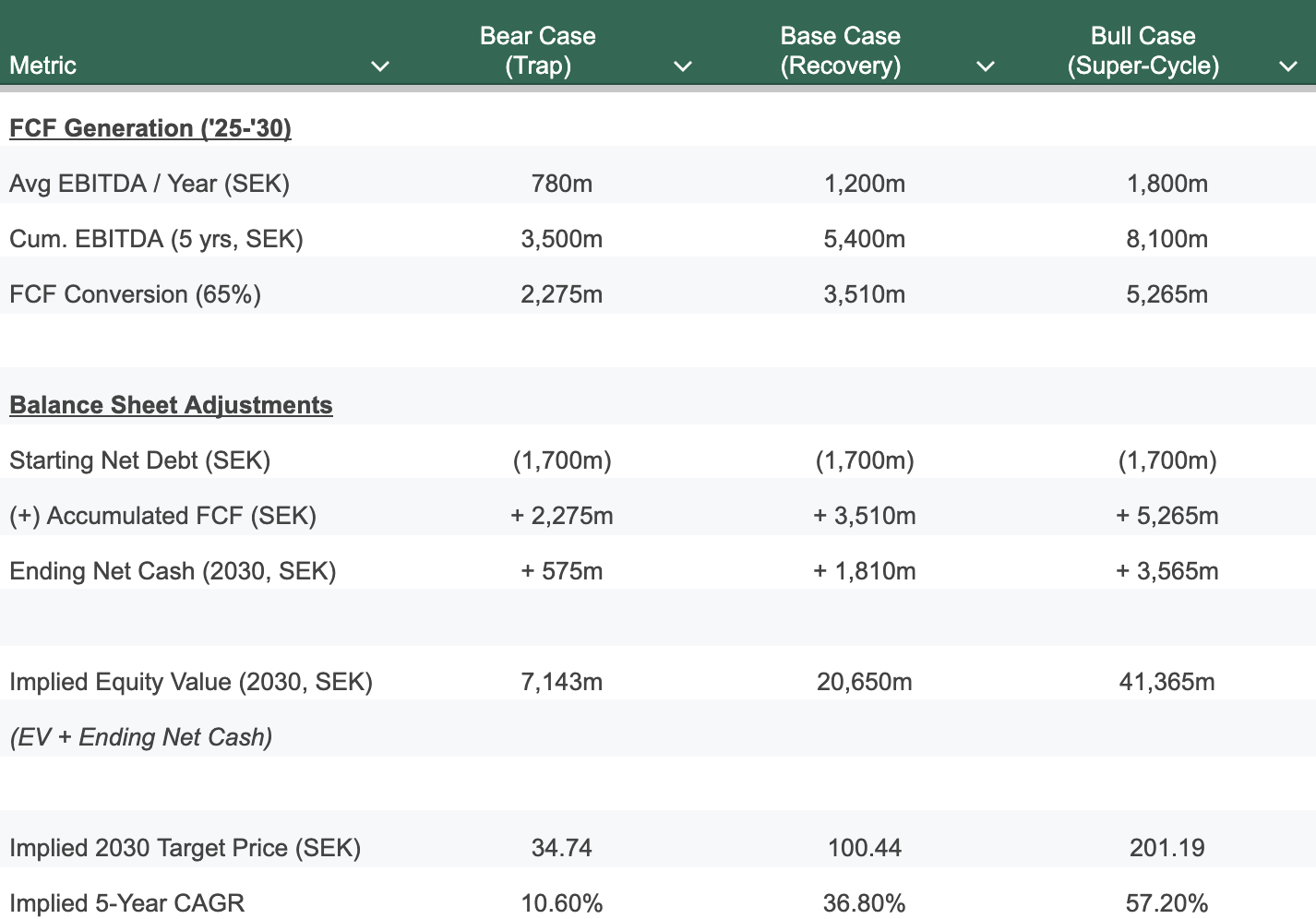

9. Valuation and expected returns to 2030

This analysis triangulates a fair value using two distinct yet complementary methodologies:

Relative Valuation against a “Justified Peer Group”: A granular comparison against selected global peers, adjusting for business model quality, geographic exposure, and industrial classification.

Scenario-Based Total Shareholder Return (TSR) Model: A fundamental, forward-looking model that projects the Company’s financial state to 2030 under Bear, Base, and Bull scenarios. This model explicitly incorporates a 100% Free Cash Flow (FCF) retention assumption to capture the full power of deleveraging and compounding.

Peer comparison

The peer work compares Hexatronic against a focused set of connectivity and infrastructure names: cable industrials like Prysmian, Nexans and NKT; solution-oriented and data-center-exposed players like Belden, Legrand, Corning and Amphenol; and a distressed US benchmark in CommScope.

On NTM EV/EBITDA, these peers cluster around 12–14x, with distressed and commoditised names at 7–9x and high-quality, data-center-levered businesses in the mid-teens. Hexatronic at ~8.2x is priced closer to the distressed and commoditised end of this spectrum, despite having growth and balance sheet characteristics that fit much better with the solutions group.

The following table aggregates the financial metrics for the Justified Peer Group using the latest available consensus estimates (NTM - Next Twelve Months) as of December 2025.

The comparative analysis highlights a glaring valuation disconnect. Hexatronic trades at approximately 8.2x NTM EV/EBITDA, a very clear discount to the peer average of 13.5x.

The “Distress” pricing: Hexatronic is currently priced in the same tier as Nexans (7.2x) and NKT (8.5x), companies that are traditionally viewed as lower-margin, capital-intensive industrial manufacturers. It is priced below CommScope (9.7x), a company with a distressed balance sheet (6.5x leverage), which is analytically indefensible given Hexatronic’s manageable leverage (2.0x) and positive cash flow.

The “Growth” gap: The market is ignoring the Data Center growth engine. Peers with significant data center exposure (Corning, Amphenol, Legrand, Belden) all trade at multiples exceeding 13x. Hexatronic’s Data Center segment grew 39% organically in Q3 2025, yet the stock attracts no “growth premium.”

Margin compression penalty: The market is heavily penalizing Hexatronic for the recent margin compression (from ~17% peaks down to ~7-10%). However, the peer group shows that companies with normalized margins in the 11-14% range (Prysmian, TKH, Belden) still command 13x+ multiples. This suggests that if Hexatronic can execute its SEK 122m cost-savings program (with 2/3 being lay-offs which should be straightforward) and return margins to a modest 12-13%, a re-rating of 5-6 turns of EBITDA is justified.

Hexatronic is misclassified. The market is pricing it as a commoditized plastic pipe extruder facing a cyclical downturn, rather than a diversified connectivity player with a booming data center division. A convergence to the peer average of 13.5x, or even a conservative discount to 12.0x, would imply nearly 50% upside from multiple expansion alone, irrespective of earnings growth.

Scenario outline and simulation (Bear / Base / Bull)

The future of Hexatronic hinges on the interplay between three forces: the recovery of the FTTH market (driven by the US BEAD program), the durability of the AI Data Center capex cycle, and the company’s ability to protect margins in a commoditizing world.

Bear Case – “Commoditization Trap”

~4% revenue CAGR, ~9% EBITDA margin.

BEAD is delayed or diluted, wireless (Starlink/FWA) takes more of rural demand, and price pressure in ducts absorbs most of the cost savings. Data Center growth slows sharply and Hexatronic ends up looking like a cyclical industrial rather than a growth compounder.

Base Case – “Balanced Recovery”

~10% revenue CAGR, ~13% EBITDA margin.

BEAD rolls out with bureaucratic friction but ultimately drives a solid US FTTH build-out from 2026 onward, Data Center growth normalizes to mid-teens, Harsh Environment grows slightly above GDP, and the SEK 122m performance program plus footprint rationalisation restore margins to low-teens.

Bull Case – “Infrastructure Super-Cycle”

~16% revenue CAGR, ~16% EBITDA margin.

BEAD and related US infrastructure programs create a multi-year volume squeeze in ducts, AI data center capex stays elevated through the decade, and US factories run near full utilization. Mix shifts toward Data Center and Harsh Environment, with operating leverage driving margins back toward historical peaks.

I use EV/EBITDA as the primary valuation multiple because it is capital-structure neutral and better captures operating performance through the deleveraging phase. I assume a 65% FCF conversion from EBITDA, which is conservative versus Hexatronic’s historical cash generation and already reflects taxes, maintenance capex, and working-capital needs. This keeps the model intentionally cautious while still capturing the value of balance-sheet strengthening over time.

A critical component of this valuation is the Total Shareholder Return (TSR) Principle. We assume 100% of Free Cash Flow generated is retained on the balance sheet. Whether this cash is used for dividends, buybacks, or M&A, it represents shareholder value creation. By accumulating it on the balance sheet as “Net Cash,” we mathematically capture its value in the final share price without making assumptions about specific M&A targets or dividend yields.

The following table presents the summary of my valuation:

10. The final verdict

Hexatronic is not for the faint of heart. It is a battleground stock with a complicated recent history. However, the sell-off has been indiscriminate. The market has thrown out the high-growth Data Center baby with the muddy Fiber Solutions bathwater.

The asymmetry is strikingly favorable. The downside appears capped by the robust cash generation and deleveraging profile (10.6% CAGR in the Bear Case), while the upside offers a credible path to 5x returns (Bull Case) if the sector tailwinds materialize as expected. The “Relative Valuation” analysis further supports this, showing that Hexatronic trades at an unjustified ~40% discount to its peer group average of 13.5x EBITDA.

Investors are effectively being paid to wait for the cycle to turn. The combination of a depressed entry multiple (8.2x), a good balance sheet trajectory (moving to Net Cash), and exposure to the secular megatrends of AI and Fiber Infrastructure creates a setup that is rare in modern equity markets.

I view this as a Strong Buy for the patient, risk-tolerant investor.

While BEAD is a major upside driver, this is not a binary “BEAD or bust” equity story. The Bear Case already assumes a weaker, slower BEAD roll-out and more wireless substitution, yet still delivers ~10%+ annual CAGR driven by Data Center growth, Harsh Environment and cost savings. In other words, BEAD is best thought of as an out-of-the-money call option: failure hurts but does not destroy the equity story, while successful execution pushes returns toward the Bull Case multi-bagger outcome.

We are buying a company with:

Hard assets: Brand new US factories protected by “Buy America” laws.

Secular tailwinds: AI Data Centers and Defense spending are not going away.

Self-help potential: The cost savings program puts a floor under earnings.

A free call option: The BEAD program is essentially a free option at this price. If it happens, the stock is a multi-bagger. If it does not, the current valuation likely holds based on the other segments.

My conviction lies in the tangible nature of their US expansion. You can fake accounting, but you can’t fake a factory in Utah. They have built the capacity, now they are waiting for the rain. I believe the likelihood it will pour is high.

I expect Hexatronic to reclaim its status as a high-quality company through organic execution in the US. By 2030, this should be a SEK 100+ stock. At a 37% CAGR across next 5 years, it clearly passes the Fjord Alpha bar of 20+% CAGR

11. Pre-Mortem: How this thesis could fail

Let’s assume it’s 2030, and our investment has been a total failure. We lost 50% of our capital. What went wrong?

The BEAD Mirage: The US government is notoriously inefficient. If the BEAD funds are delayed indefinitely, or if the rules change to allow cheap imports (waiving BABA), Hexatronic’s expensive US factories (Utah/SC) will be albatrosses. They will have high fixed costs and no volume, dragging Group margins down.

Technological disruption (Wireless): Starlink and 5G Fixed Wireless Access (FWA) could make digging trenches for fiber obsolete in rural areas. If rural America decides “good enough” wireless is better than expensive fiber, the addressable market for Hexatronic shrinks significantly. This is a real risk for the BEAD thesis.

Execution Risk: The new CEO, Fröberg, might clash with the entrepreneurial culture of the acquired subsidiaries. If key personnel leave (the founders of the acquired companies), the “Smart Hands” capability evaporates, and Hexatronic becomes just a holding company of empty shells.

12. Summary Box

✅ Thesis Pillar 1: The US Pivot: Massive investment in US manufacturing (Utah/SC) positions Hexatronic to be a primary beneficiary of the delayed $42.5B BEAD infrastructure stimulus, protected by “Buy America” laws, with peak impact 2027-2029.

✅ Thesis Pillar 2: Data Center Hypergrowth: The Data Center segment is growing >40% organically and targeting SEK 3B in sales by 2028. By 2030, this high-margin segment could rival the legacy fiber business in size, driven by AI infrastructure needs.

✅ Thesis Pillar 3: Operational Reset: The Q3 2025 “kitchen sink” restructuring and the incoming CEO (Rikard Fröberg) signal a shift from “growth at all costs” to margin discipline, targeting SEK 110m in annualized savings.

⚠️ Key Risk (from Pre-Mortem): BEAD Execution Failure: If US federal funding is further delayed or diluted by wireless substitution (Starlink/FWA), the new US factories will suffer from low utilization and drag margins down.

🎯 Target Price (Base Case): SEK 100 by End of 2030.

📈 Implied 5-Year CAGR (Base Case): ~37%

Primary Sources Used:

Hexatronic Interim Reports

Hexatronic Annual Reports

Hexatronic Investor Presentation Materials