Ørsted: Reset, recapitalized, repriced

A battered renewables leader with a repaired balance sheet, a fully funded growth pipeline, and the scale advantages to mount a durable recovery.

Some of the most compelling opportunities emerge when a market darling falls from grace. Following my analysis of Embracer Group, a compelling "BUY," I am turning my attention to another of Europe's great fallen angels: Ørsted.

Just two years ago, Ørsted was the gold standard for ESG investing and flawless execution. Today, after a brutal series of project cancellations and impairments, the market has left it for dead. My process is built to filter for 20%+ CAGR potential, which forces a simple question. Has the 90% collapse in the share price created an opportunity, or is the company's compounding engine permanently broken?

The answer may lie in the company's most critical upcoming milestone, i.e., the massive Rights Issue designed to repair its balance sheet. This capital raise is a true fork in the road. It forces investors to decide whether this is a chance to recapitalize a world-class portfolio of European assets at a generational low, or if it is simply throwing good money after bad. Or somewhere in between. This analysis focuses on valuing that core portfolio to answer this very question.

The Business: History & operations

Origin story

To understand Ørsted today, you have to understand where it came from. The company was not born green, rather it was forged in fossil fuels. Established in 1972 as Dansk Olie og Naturgas (DONG Energy), it was the Danish state's vehicle for managing oil and gas resources in the North Sea. For decades, it was a traditional, carbon-intensive utility. By the mid-200s, it was one of the most coal-heavy energy companies in Europe.

The pivotal moment came in 2008. Facing a future of volatile fossil fuel prices and growing climate consciousness, management made a radical decision to transform the company from black to green energy. They articulated an "85/15" vision, i.e. to flip their energy generation from 85% fossil-based to 85% renewables-based. It was an audacious goal that few believed possible.

The company then embarked on a decade-long transformation. It began systematically divesting its upstream oil and gas assets, shutting down coal-fired power plants, and ploughing every available krone into a nascent technology, namely offshore wind. It built the world's first offshore wind farm in 1991, but the acquisition of Elsam in 2005 brought with it the world's first large-scale project, the 160 MW Horns Rev 1. This gave them a critical head start. In 2017, to mark the completion of this metamorphosis, DONG Energy shed its legacy name and rebranded as Ørsted, in honour of the Danish physicist Hans Christian Ørsted, who discovered electromagnetism.

What they actually do

Explaining Ørsted's business model requires an analogy. Think of Ørsted as a specialist real estate developer, but for the ocean.

Their "product" is a massive, operational offshore wind farm that generates stable, predictable cash flows for 25-30 years. They are involved in the entire value chain, from identifying a site to decommissioning it decades later. The ultimate goal is to steadily increase the total gigawatts (GW) of operational capacity, as each new wind farm adds another long-term, cash-generating asset to the portfolio.

Development (Acquiring the "Land"): Ørsted starts by securing rights to a specific area of the seabed, usually through government auctions. This is like a real estate developer buying a plot of land. This phase involves years of site surveys, environmental impact assessments, and securing permits.

Construction (Building the "Skyscraper"): This is the most capital-intensive phase. Ørsted manages a hugely complex logistical operation, contracting suppliers for everything from turbines and foundations to cables and substations. They orchestrate the assembly of these massive structures miles out at sea. This is a multi-year, multi-billion-euro undertaking.

Operation (Collecting the "Rent"): Once the wind farm is complete, it enters the operational phase. For the next 25-30 years, it generates electricity, which is sold to the grid. This is the long-term, cash-generating phase, analogous to a developer leasing out a completed building. Revenue is typically secured through long-term contracts like Contracts for Difference (CfDs) or Power Purchase Agreements (PPAs), which guarantee a fixed price for the electricity produced, insulating them from volatile wholesale power prices.

The "Farm-Down" Model (Selling a Stake): A key part of Ørsted's model is capital recycling. Once a project is de-risked, meaning it is either fully constructed or very close to it, Ørsted sells a stake (typically 50%) to institutional investors like pension funds. This "farm-down" accomplishes two things: it crystallises the development profit and brings in billions in cash that can be redeployed into the next project, funding the growth engine. This is like a developer selling a completed skyscraper to a real estate investment trust (REIT) and using the proceeds to buy the next plot of land.

The business is primarily divided into two segments: Offshore and Onshore. The Offshore segment is the company's core, representing the vast majority of capital employed and earnings. The Onshore business, focused on wind and solar in the US and Europe, is smaller and the company is currently exploring a full divestment of its European Onshore assets.

Recent developments & performance

Business update

The first half of 2025 has been a period of intense activity focused on stabilising the business after the turmoil of 2023-2024. The H1 2025 report showed strong operational performance, with EBITDA (excluding new partnerships and cancellation fees) coming in at DKK 13.9 billion, a 9% increase from the prior year. This was driven by the ramp-up of new wind farms and higher availability across the fleet, though partially offset by lower wind speeds.

The most significant event was the announcement in August 2025 of the ongoing DKK 60 billion (approx. EUR 8 billion) rights issue. This was a direct consequence of the company's inability to complete the planned "farm-down" of its Sunrise Wind project in the US on acceptable terms. Management stated that "material adverse development in the US offshore wind market" meant they needed to fund the entire DKK 40 billion project on their own balance sheet, necessitating the capital raise to maintain a solid investment-grade credit rating. The Danish State, its 50.1% majority shareholder, has committed to participating.

Operationally, the company reported good progress on its 8.1 GW construction portfolio. Key milestones included achieving first power at Greater Changhua 2b & 4 in Taiwan and installing the first foundations at Sunrise Wind in the US. However, the company also discontinued the Hornsea 4 project in the UK in its current form, citing rising supply chain costs and interest rates.

Stock price context

Ørsted's stock performance over the last 24 months has been nothing short of brutal. The share price collapsed in late 2023 following the announcement that it was ceasing development of its Ocean Wind 1 and 2 projects in the US, triggering billions in impairments. This was the moment the market's perception of Ørsted's flawless execution shattered.

The pain continued into 2024 and 2025. The Capital Markets Update in February 2024, which slashed long-term growth targets and paused the dividend, failed to restore confidence. The final capitulation came in August 2025 with the announcement of the massive rights issue, which sent the stock plummeting another 29% in a single day as investors priced in the enormous dilution. The stock now sits at levels not seen in nearly a decade, a stunning fall from grace for a company that was once a market darling.

Connecting to the analysis

These developments are the entire basis for the bear case that you will find below. The narrative is that Ørsted's management was arrogant, overextended itself in an unfamiliar US market, and failed to anticipate the macroeconomic storm of inflation and interest rate hikes. The rights issue is seen as a forced rescue mission. My analysis does not dispute the severity of these missteps.

However, what the market seems to be missing is that these events have forced a necessary and, I believe, healthy reset. The company has now de-risked its portfolio, slashed its growth ambitions to a more manageable level, and shored up its balance sheet for the next three years. The pain has been taken, and the question now is what is the value of the business that remains.

The business model & unit economics

Revenue model

Ørsted's revenue model is designed to create long-term, predictable, and largely inflation-protected cash flows. It is a classic infrastructure model built on a few key pillars:

Development profits: The company creates significant value by taking a project from a raw seabed lease to a fully permitted, de-risked asset ready for construction. This value is crystallised and booked as profit when they "farm-down" a stake to a partner.

Long-Term Contracts (CfDs & PPAs): The vast majority of the electricity generated by its wind farms is sold under long-term contracts, typically 15-25 years in length. In Europe, these are often government-backed Contracts for Difference (CfDs), which guarantee a fixed "strike price." If the market price for electricity is below the strike price, the government pays Ørsted the difference. If it's above, Ørsted pays the difference back. This removes commodity price risk and creates a utility-like revenue stream. In the US, they use Power Purchase Agreements (PPAs) with utilities or corporations, which function similarly.

Merchant Exposure: A smaller portion of revenue comes from selling electricity at prevailing market prices. While this introduces volatility, it also provides upside in periods of high power prices.

Energy Trading & Services: Ørsted also has an energy markets division that provides power trading and gas trading solutions for large customers, optimising its portfolio.

The combination of development profits from the farm-down model and the long-term contracted cash flows from the operational fleet creates a powerful financial engine. The farm-downs provide the capital to build the next wave of projects, which in turn become cash-generating assets that support the balance sheet for future growth.

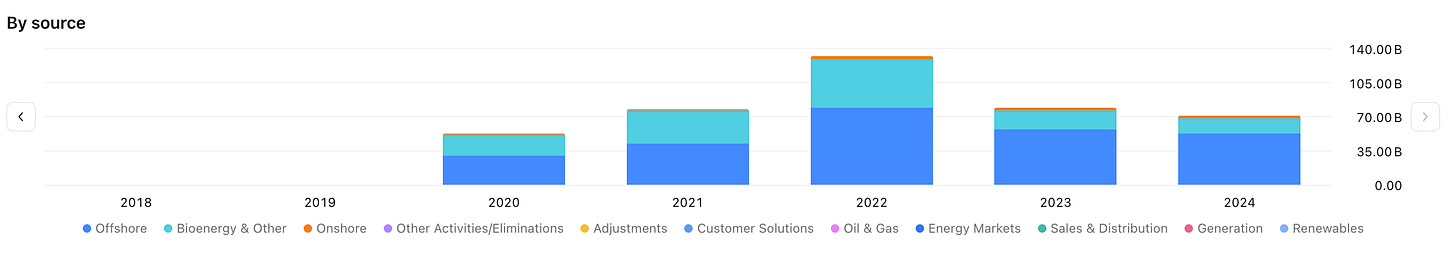

A quantitative look at the revenue streams

Annual revenue can be lumpy due to the timing of large "farm-down" transactions, but the image below makes it clear that Offshore is by far the most important segment, with Bioenergy & Other a distant second, and Onshore providing a smaller revenue contribution.

A look at the underlying operational earnings (EBITDA) provides a further picture of the core business drivers. The full-year 2024 results show the overwhelming importance of the Offshore segment, while the high Onshore EBITDA level (DKK 4.0 billion) shows the significant positive impact “farm down” can provide.

EBITDA from segments, excluding new partnerships, cancellation fees, and other items. Sourcing: Q2 2025 Report.

Geographically, the portfolio is heavily weighted towards Europe, with the United Kingdom being the single largest market for FY 2024, contributing DKK 32.47 billion in revenue. Earlier, Denmark has been the clear main contributor, with Germany in third place. This underscores the importance of the company's mature European asset base, which continues to be the primary engine for the group.

The Moat: Sustainable competitive advantage

My initial read on the recent US project failures was that Ørsted's competitive advantage had been eroded. But upon deeper analysis, I believe the core moat remains intact and is, in some ways, even stronger in the current environment. The moat is not a single attribute but a combination of reinforcing factors.

Cost advantages & scale

Offshore wind is a game of immense scale, and Ørsted is the undisputed global leader with a market share of approximately 25-30% (excluding China). This scale is not just about size. It also creates powerful, structural cost advantages that are difficult for smaller competitors to replicate.

Procurement power: As the largest buyer of turbines, foundations, and installation vessels in the world, Ørsted has enormous purchasing power. It can secure manufacturing capacity and favourable pricing from its suppliers that smaller players cannot access.

Logistical efficiency: Managing the construction of a multi-billion-euro offshore project is one of the most complex logistical challenges in the energy industry. With over 30 years of experience, Ørsted has built a deep well of proprietary knowledge in project execution, from optimising vessel schedules to managing complex supply chains. This experience translates directly into lower costs and faster, more reliable project delivery (its US stumbles notwithstanding). Their track record in Europe and Taiwan remains strong.

Operational data: With the world's largest fleet of operating offshore wind farms, Ørsted has an unparalleled dataset on turbine performance, maintenance schedules, and weather patterns. This data is used to optimise the output of its existing farms and to inform the design of new ones, leading to higher efficiency and lower lifetime operating costs.

Regulatory & legal barriers

Building an offshore wind farm is not something a new entrant can easily do. It requires navigating a labyrinth of regulatory approvals that can take the better part of a decade.

Permitting expertise: Securing permits involves a complex web of stakeholders, from national governments and environmental agencies to local communities and fishing industries. Ørsted's long track record and dedicated teams give it a significant advantage in navigating this process.

Seabed leases: The "land" itself, the seabed lease, is a scarce resource controlled by governments. Ørsted has secured one of the largest pipelines of developable seabed leases in the world, creating a significant barrier to entry for new players.

Unique resources & distribution

The most critical unique resource in this industry is human capital. There is a finite pool of engineers, project managers, and technicians with the specific expertise required to build and operate these complex projects. As the industry leader, Ørsted is the employer of choice, allowing it to attract and retain the best talent. This intellectual capital is a core part of its moat.

In summary, while the company's execution has been flawed in the US, its fundamental competitive advantages in scale, experience, and regulatory know-how remain formidable. In a world where capital is now more expensive and investors are more risk-averse, these advantages become even more pronounced. The flight to quality will benefit the established leader.

The investment thesis: The 5 year outlook

The entire investment case hinges on a simple, powerful driver: the conversion of gigawatts (GW) under construction into operational, cash-generating assets. Each GW that comes online is not just a project completion. It is also the creation of a long-term annuity, a stream of predictable, largely contracted revenue that will flow for the next 25-30 years. The market's current pessimism stems from execution stumbles, but I believe the focus should be on the immense earnings power that will be unlocked as the company delivers on its construction pipeline. My core thesis is that the market is focusing on the DKK 60 billion hole that needs to be filled by the rights issue, rather than the DKK 145 billion investment programme that this capital will unlock. I see four key drivers that will transform Ørsted's financial profile by 2030.

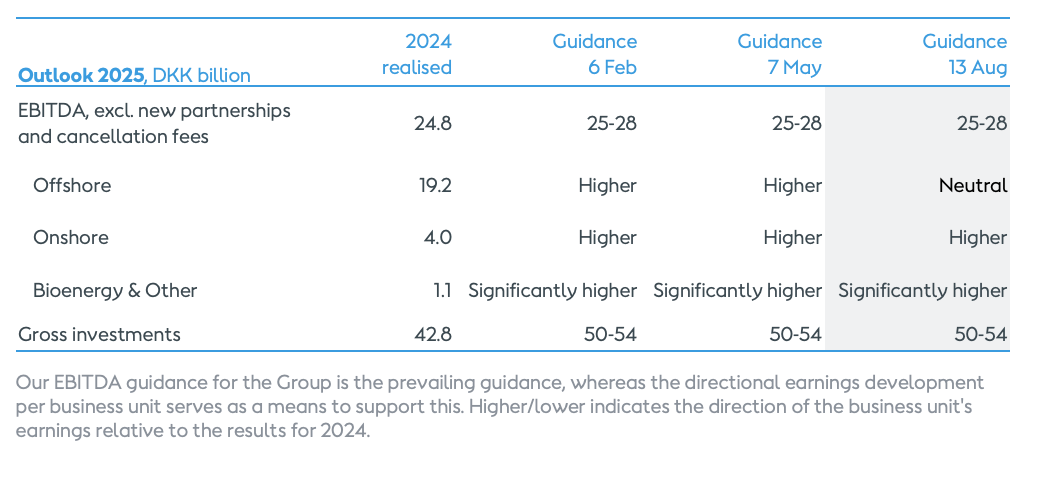

Driver 1: Executing the 8.1 GW de-risked construction portfolio

This brings us to the core catalyst. The company is currently constructing a massive 8.1 GW of new offshore wind capacity across the US, Europe, and Taiwan. This is the key. The capital has been raised, the projects are progressing, and the contracts are in place. As these projects come online between now and 2027, they will add a large new stream of contracted, long-term earnings. Management has guided that its EBITDA (excluding new partnerships) will grow from DKK 25-28 billion in 2025 to DKK 29-33 billion in 2026, a CAGR of 12% at the midpoint. I believe this predictable, locked-in growth is being overlooked by the market.

Driver 2: A return to the farm-down model

The rights issue was necessary because the farm-down model temporarily broke in the US due to political uncertainty. However, the model is not dead. The company successfully farmed down a stake in the UK's West of Duddon Sands project in May 2025. Management has clearly stated they expect to secure over DKK 35 billion in proceeds in 2025 and 2026 from selling stakes in Hornsea 3 and Greater Changhua 2 (Q2 2025 Earnings Call). I believe the successful execution of these large-scale farm-downs will be a powerful catalyst, proving the model is intact and demonstrating the significant value created in their development portfolio.

Driver 3: Capital discipline and a higher return hurdle

The crisis of the past two years has forced a much-needed dose of reality and discipline. The company has abandoned its aggressive 50 GW by 2030 target, replacing it with a more focused 35-38 GW ambition. It has exited higher-risk markets like Norway and Spain and is focusing its capital on core regions where it has a clear competitive advantage. Critically, management is holding firm on its target of achieving a 150-300 basis point spread over its weighted average cost of capital (WACC) for new projects. In a higher interest rate world, this means the company will only proceed with higher-return projects, which should lead to better value creation for shareholders over the long term.

Driver 4: Reinstatement of the dividend

Management has suspended the dividend for the financial years 2023-2025 to preserve capital. However, they have explicitly targeted reinstating it for the financial year 2026. I believe this will be a significant catalyst. The return of a dividend will signal that the balance sheet has been repaired and that the company is back on a stable financial footing, attracting a new class of income-oriented investors to the stock.

Management & capital allocation

The leadership team at Ørsted has undergone significant change. The CFO and COO departed in late 2023 following the US impairments. Mads Nipper, who had been CEO since 2021, stepped down in early 2025, taking "full accountability" for the company's predicament. He has been replaced by Rasmus Errboe, a company veteran who was previously Deputy CEO and Chief Commercial Officer.

My assessment of the new leadership is cautiously optimistic. Errboe is an insider who knows the business intimately. His initial actions and the new business plan presented in February 2024 signal a clear shift away from the "growth at any cost" mentality of the past towards a more disciplined, value-focused approach. As he stated in the H1 2025 report, the focus is on four priorities: ensuring a robust capital structure, executing the construction portfolio, maintaining capital discipline, and increasing organisational efficiency. This is exactly what the company needs right now.

The capital allocation strategy has been completely reset. The DKK 60 billion rights issue, while painful for existing shareholders, is the correct, decisive action to fix the balance sheet. The decision to pause the dividend is prudent. The plan to accelerate farm-downs and divest the European onshore business demonstrates a clear focus on recycling capital back into the highest-return offshore wind projects. While the previous management team made significant strategic errors, I believe the new team has a credible plan to right the ship and is now allocating capital in a much more disciplined and shareholder-friendly manner.

Valuation: A triangulated approach

My valuation will be triangulated using a forward multiple analysis based on three distinct operating scenarios (Base, Bull, and Bear) and put in context through a relative valuation against a carefully selected peer group.

Relative Valuation: A Justified Peer Group

To accurately benchmark Ørsted's valuation, I have assembled a focused peer group of global renewable energy players. This group is intentionally structured to compare Ørsted against its direct competitors and the broader ecosystem.

Integrated Renewable Utilities: This core group includes European giants like RWE, Iberdrola, and SSE, who, like Ørsted, are aggressively building out large-scale renewable, particularly offshore wind, portfolios. They represent the most direct comparables in terms of strategy, market, and scale. I have also included Equinor, a traditional oil and gas major rapidly pivoting into offshore wind, whose strategic 10% stake in Ørsted makes it a particularly relevant peer and potential corporate catalyst. To provide a best-in-class North American perspective, I have included NextEra Energy, the largest U.S. utility and a premier renewables developer.

Pure-Play Developers: This group includes Northland Power, Brookfield Renewable Partners, and Scatec. These companies share Ørsted's developer DNA, focusing on project pipelines and asset development, but often with different geographic or technological concentrations. They provide a benchmark for how the market values growth-oriented, non-integrated renewable asset developers.

Key Equipment Suppliers: I have included Vestas Wind Systems and Siemens Energy not for direct valuation comparison, but as a crucial barometer for the health of the underlying supply chain. Their performance and valuation provide critical context on the cost pressures, technological risks, and margin challenges that directly impact developers like Ørsted.

The following table presents consensus forward-looking estimates for this peer group, providing a snapshot of how the market is currently valuing growth and profitability in the sector.

My analysis of the peer data reveals that Ørsted, trading at 7.5x forward EBITDA, is valued at a slight discount to the peer group average of 9.5x. This discount likely reflects market concerns over the recent project impairments and execution risk in the U.S. portfolio. The market appears to be pricing in execution failure, while a successful delivery of the business plan could lead to a significant re-rating.

Triangulated valuation & scenarios

To answer that question, I have built a five-year valuation model based on three distinct scenarios. My go-to and primary valuation metric is the forward EV/EBITDA multiple, as it best reflects the operational cash-generating capability of Ørsted's asset base, independent of its capital structure. I use EV/Sales as a secondary check for consistency. The scenarios are defined not by macro forecasts, but by a single, critical variable: Ørsted's ability to execute. The recent rights issue will repair the balance sheet. Now, everything hinges on management's ability to build projects on time and on budget.

Base Case: This scenario assumes Ørsted successfully delivers the majority of its 8.1 GW construction portfolio by 2030, albeit with some moderate, industry-typical delays and cost overruns. The company methodically de-risks its U.S. exposure and solidifies its leadership in core European markets, reaching approximately 33 GW of installed capacity by mid-2030. This steady execution allows EBITDA margins to recover towards historical norms as the new, profitable offshore wind farms come online, leading to a partial re-rating of its valuation multiple as investor confidence is gradually restored.

Bull Case: This scenario envisions a near-flawless execution of the current project pipeline. Major projects like Hornsea 3 and Sunrise Wind are commissioned on schedule, demonstrating renewed project management prowess. This operational excellence, combined with its fortified balance sheet, allows Ørsted to capture new, high-return project awards in Europe. The company reaches the high end of its strategic ambition, hitting 38 GW of capacity by mid-2030. The market fully rewards this turnaround, assigning a premium valuation multiple that reflects its restored status as a best-in-class global offshore wind leader.

Bear Case: This scenario assumes the problems that plagued Ørsted in the U.S. persist. The company faces further significant delays and material cost overruns in its U.S. portfolio, severely impairing projected returns and cash flow. The successful delivery of the 8.1 GW pipeline is jeopardized, and total installed capacity falls short of 30 GW by mid-2030. This failure to execute results in a permanent loss of management credibility, and the market assigns a depressed, "show-me" valuation multiple, viewing the company as a high-risk, low-growth utility.

The culmination of this analysis is presented in the unified valuation table below. All calculations are based on a post-rights-issue share count of 1.321 billion shares and a starting share price of DKK 118.10 as of September 24, 2025.

Conclusion on Valuation

My analysis indicates that Ørsted stands at a critical inflection point, with a valuation that reflects deep market skepticism but also holds significant potential for a re-rating. The relative valuation clearly shows the stock trading at a discount to its peers, a direct consequence of the operational missteps in the U.S. and the subsequent, highly dilutive, but necessary, balance sheet recapitalization. The market is pricing Ørsted for a future of high risk and low returns.

However, my forward-looking scenario analysis suggests this pessimism may be overdone. The valuation is now a highly leveraged play on execution. The completion of the 8.1 GW construction portfolio will be a strong catalyst. My Base Case, which assumes a reasonably successful, albeit imperfect, project rollout, points to a substantial recovery in both earnings and valuation. This scenario yields a mid-2030 fair value estimate of DKK 289 per share.

From the current share price of DKK 118.10, this target implies a 5-Year CAGR of 19.6%. Based on my analysis, the implied 5-year CAGR in my Base Case is very much borderline to reach Fjord Alpha target of 20%+ annual returns.

The pre-mortem: A case for failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The most plausible reason for failure is that the US market proved to be a value trap. We correctly identified the operational risks but underestimated the political ones. The hostile administration actively worked to block offshore wind development, creating years of delays and uncertainty. This prevented Ørsted from ever achieving the scale and cost efficiencies it enjoyed in Europe. The farm-down model, critical for capital recycling, remained broken in the US, turning the remaining projects into capital sinks that continuously drained the parent company.

A second, related failure point would be execution risk. Our thesis rests on the successful delivery of the 8.1 GW construction portfolio. If the company were to face another major cost blowout or delay on a mega-project like Hornsea 3, it would destroy management's credibility and force another balance sheet repair, further diluting shareholders. The market's trust, once broken, would be impossible to regain for many years to come.

Finally, a technological disruption could have upended the thesis. Perhaps advances in floating offshore wind technology happened faster than we thought, making Ørsted's portfolio of fixed-bottom assets less valuable. Or, more dramatically, a breakthrough in another clean energy technology, like next-generation nuclear or green hydrogen storage, could have fundamentally altered the long-term economics of offshore wind, rendering our long-term growth assumptions obsolete.

Conclusion: The final verdict

Ørsted sits at a moment of maximum pessimism, but also maximum potential. The last two years have exposed the fragility of its execution and the dangers of overreaching in the U.S. market. Yet after this painful reset, the balance sheet will be repaired, the construction pipeline will be funded, and the core European business remains a formidable moat of scale, data, and experience.

At today’s depressed share price, my Base Case points to a 5-year CAGR of 19.6%. This falls just shy of my strict hurdle rate, preventing an outright “BUY” rating for now. The Bull Case shows the upside could be larger if execution surprises to the upside, while the Bear Case is a reminder that operational and political risk remain real.

In short, this is the kind of setup my process is built to find. The downside is understood, priced in (I believe), and to some extent limited by the scale and durability of Ørsted’s European assets. The upside, should execution normalize, is significant.

My process demands discipline. A prospective return of 19.6% is compelling, but it does not clear the 20% CAGR hurdle required for a ‘BUY’ rating. Therefore, while the turnaround thesis is appealing, the current price is not quite there yet. Ørsted moves to the top of my watchlist, pending going below 116 DKK again, where the hurdle rate becomes 20%.

The results of the Rigths Issue will be published on the 6th of October, with trading of subscription rights ending 30th of September. I will be monitoring closely.

Summary

✅ Thesis Pillar 1: Ørsted remains the undisputed global leader in offshore wind, with unmatched scale, 30 years of execution experience, and a portfolio of prime European assets that form a durable competitive moat.

✅ Thesis Pillar 2: The valuation has reset to generational lows. At today’s price, the Base Case projects a 5-year CAGR just below 20%. I will be monitoring closely for a better entry that will allow me to clear my 20% hurdle rate

✅ Thesis Pillar 3: A fully funded, de-risked 8.1 GW construction pipeline, coupled with capital discipline, a higher project return hurdle, and the planned reinstatement of the dividend in 2026, set the stage for both earnings growth and a re-rating.

⚠️ Key Risk (from Pre-Mortem): Persistent political hostility in the U.S. could impair cash flow from the American portfolio, forcing capital to remain trapped in underperforming projects.

🎯 Target Price (Base Case): DKK 289

📈 Implied 5-Year CAGR (Base Case): 19.6%

Primary Sources Used:

Ørsted Annual Reports

Ørsted Interim Reports

Earnings Call Transcript & Presentation

Ørsted Capital Markets Update Presentation (February 2024)

Company Announcements & Press Releases (2023-2025)

Great post here. Thanks so much for this. Been looking very closely at them too. Distressed, caught up in US politics. This does indeed have the makings of a company pushed down too low by temporary negative sentiment. But I wonder what you think about them in terms of quality? I see a lot I like. But I also see very low figures for things like ROA, ROCE and ROIC. Any thoughts there? Thanks.

Can you explain how you get to 4x ebitda? With 1.32b pro forma shares and a px of 118DKK, that is a market cap of 155b DKK. I think that is $24b market cap. You have a lower market cap in your table. Thanks.