Ovzon AB: Compounder of the New Space Race

Why the "Special Ops" of space connectivity creates a high-margin moat that mass-market constellations cannot touch, and a highly interesting investment case

1. Introduction and thesis overview

Ovzon AB is a Swedish company barely known outside defense circles in Stockholm and Washington D.C. that has effectively cornered a niche for which the Swedish government and the U.S. Department of Defense pay substantial premiums. For years, the market viewed Ovzon as a misunderstood middleman leasing bandwidth from Intelsat and packaging it with mobile terminals. This low-margin services label is now obsolete. While the stock has recently rallied, I believe the real upside remains ahead.

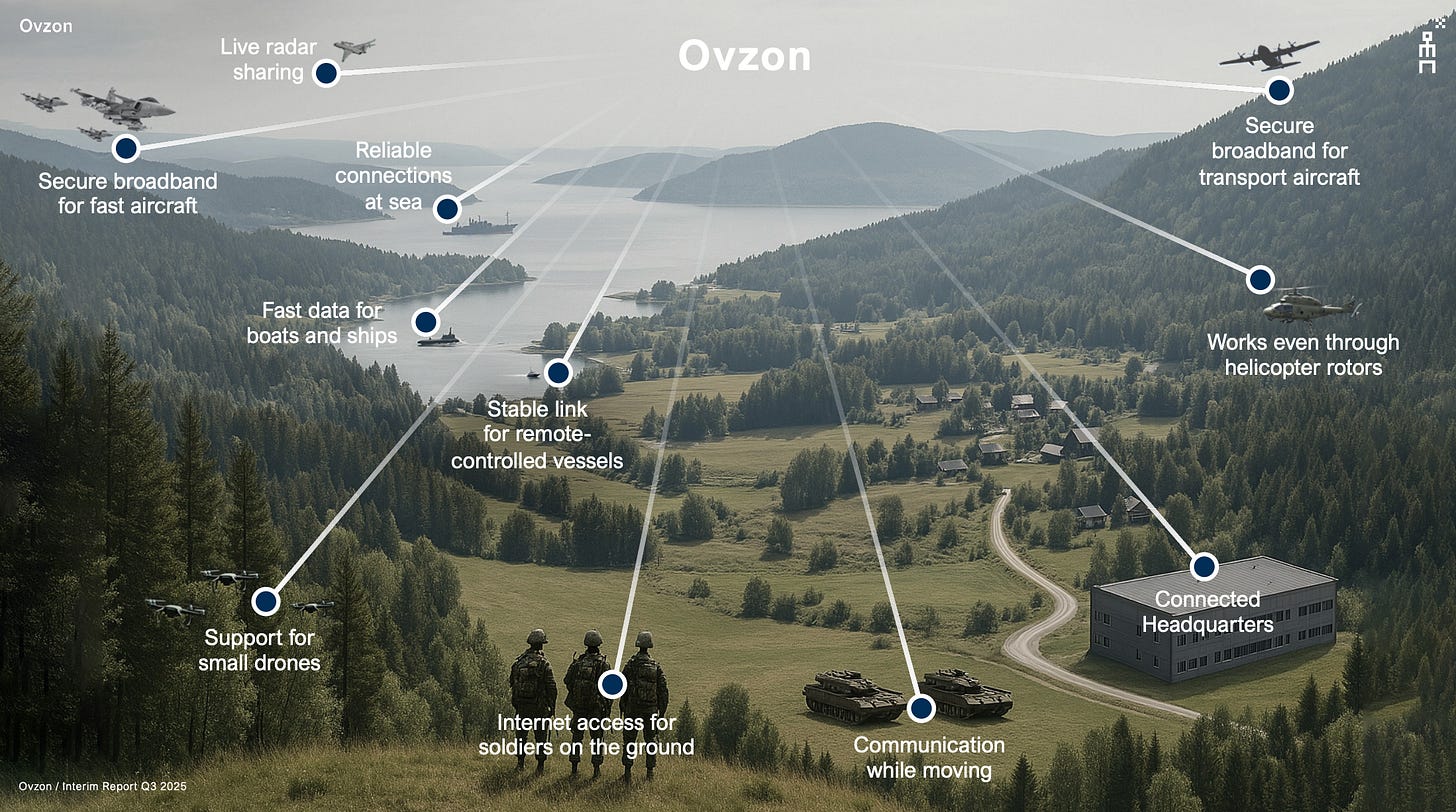

In short, Ovzon is a provider of critical mobile satellite communications for military purposes. The company launched its first proprietary satellite, Ovzon 3, in early 2024. This hardware, paired with their proprietary T6 and T7 mobile terminals, allows Ovzon to offer unique SATCOM-as-a-Service capabilities. It provides extreme mobility and high throughput with a proprietary On-Board Processor that ensures jamming resistance in tough environments.

The company is currently pivoting from negative to positive EBITDA. This shift marks a transition from a capital-heavy investment phase to a period of cash flow generation. It is also fueled by a geopolitical realization that mass-market satellite internet cannot meet the requirements of special operations.

The central questions for investors are clear. Can a single-satellite operator survive? Is the moat durable against SpaceX’s Starshield? Most importantly, can this model generate the cash flow required to justify a 20% plus CAGR over the next five years?

My thesis is built on three pillars.

Margin Expansion and Structural Economics: The shift from leased capacity to owned infrastructure through Ovzon 3 fundamentally alters the P&L. By owning the asset, Ovzon captures the full economic rent of the spectrum. I expect gross margins on proprietary traffic to expand from historical lows toward the 70-80% range, driving massive operating leverage as satellite utilization increases.

The Technological Moat: Ovzon’s On-Board Processor allows for direct terminal-to-terminal communication without a ground teleport. This offers sovereign and stealthy communications that LEO (Low Earth Orbit) networks struggle to match in high-threat zones. It effectively shortens the decision loop (OODA) for commanders while removing the vulnerability of ground-based infrastructure.

The Order Book Inflection: The SEK 1.04 billion contract with the Swedish Defence Materiel Administration validates the technology and provides a solid revenue floor. This significantly de-risks the financial profile. The subsequent expansion into broader NATO markets in late 2025 confirms that this demand is not a localized phenomenon but a structural shift in European defense.

Risks remain elevated. This is a binary asset play in the short term, heavily reliant on the health of a single satellite. Furthermore, the shadow of Starlink’s militarized Starshield remains a competitive factor.

Let’s dive in.

2. The Setup: Key Data & Investment Thesis

The following data underpins the quantitative side of this analysis. It reflects the company’s status as of 14 January 2026, following the transformational years of 2024-2025.

💰 Stock Price: SEK 50

📄 Shares Outstanding: 111,530,516

🌐 Enterprise Value: SEK 5.3B

⚙️ Sector/Industry: Telecommunications / Defense & Space

💡 Investment Thesis: The successful operationalization of Ovzon 3 and its proprietary On-Board Processor creates a defensive moat against mass-market LEO disruption. This positions the stock for a multi-year repricing as margins expand toward 40% plus and defense budgets prioritize resilient, jam-resistant connectivity.

3. The Business: History & Operations

From the Archipelago to Afghanistan

The narrative of Ovzon is one of Swedish engineering pragmatism meeting the extreme demands of asymmetric warfare. Founded in 2006, the company emerged from a specific tactical problem faced by special operations forces and emergency responders.

During the mid-2000s, a critical capability gap existed. Special units in remote environments had a binary choice for communications. They could use L-band satellite phones which were portable but painfully slow and barely capable of voice data. Alternatively, they could use VSAT dishes which provided high bandwidth but required a dedicated logistics train. A platoon operator often carried 20kg of gear and a dish that took 30 minutes to align, which is way too much in a firefight or rapid extraction.

Ovzon’s founders asked a simple question. What if we could deliver the speed of a large VSAT dish with the form factor of a laptop?

This question drove the company’s early years. They engineered mobile terminals that were significantly smaller, lighter, and faster to deploy than anything else on the market. However, physics dictates that to receive high bandwidth on a small antenna, you need a very powerful signal from space.

For its first decade, Ovzon solved this as a Virtual Network Operator. They leased high-performance beams from major operators like Intelsat. They would buy raw spectrum wholesale, optimize it with proprietary waveforms, and sell a bundled solution to the most demanding customers in the world. This included the U.S. Department of Defense and European civil defense agencies.

This reseller model was profitable but structurally limited. Ovzon was essentially renting a toll road and charging a premium for a faster car. Their margins were capped by the rent paid to Intelsat and their technical capabilities were restricted by the legacy hardware on leased satellites. To truly unlock the potential of their terminals and capture the economic value they were creating, they needed their own infrastructure.

In 2018, the decision was made to build Ovzon 3.

This was a bet-the-company moment. It transformed Ovzon from a small services entity into a capital-intensive infrastructure play. The journey was difficult. Delays in manufacturing and a forced switch in launch providers tested the resolve of every shareholder. But in early 2024, a SpaceX Falcon 9 successfully lifted Ovzon 3 into orbit.

What Ovzon actually does

To understand Ovzon’s value proposition, we must move beyond the standard concept of internet access. Ovzon serves a customer base for whom good enough is a life-safety risk.

Think of Starlink as a massive floodlight system in a stadium. It lights up the entire world with decent, uniform brightness. It is excellent for general visibility and available everywhere.

Ovzon is a military-grade laser pointer. It does not light up the entire stadium. It covers specific, targeted areas. But where it points, the intensity is blindingly strong. It can penetrate interference that would wash out a floodlight and supports massive data throughput from a tiny device. Crucially, it can be moved instantly to follow a target.

The Business Model Components

The Space Segment Ovzon 3 is a Geostationary (GEO) satellite, but it is not a standard broadcasting bird. Most GEO satellites act as mirrors that blast a wide beam over a fixed continent. Ovzon 3 features five independently steerable spot beams. Ovzon can physically steer these beams to focus intense capacity on a specific conflict zone or a moving carrier group. This concentration of power is what allows the small terminals to perform.

The Ground Segment The Ovzon T7 is the crown jewel of their hardware portfolio. It weighs just 2.8 kg and fits in a standard laptop bag. It can be set up by an untrained operator in under two minutes. Despite its size, it can push uplink speeds of 10 Mbps and receive 60 Mbps. In the world of satellite communications, getting 10 Mbps out of a 2.8kg device is an engineering marvel.

The On-Board Processor This is the core moat. Ovzon 3 has a powerful computer on the satellite itself. This allows a terminal to talk directly to another terminal via the satellite without the signal ever touching a ground teleport. This mesh networking capability creates a closed loop system.

In short, Ovzon sells the ability for a team in a contested environment to livestream drone footage using a device the size of a laptop without the enemy being able to jam the signal or trace it back to a physical ground station. This is a capability for which governments pay a premium.

4. Recent Developments & Performance

Business Update: The Inflection Point (Q3 2025)

I am analyzing the business through the lens of the Q3 2025 results released on October 31 and the activity that followed in late 2025. The narrative has shifted from whether the technology works to how fast the company can utilize its new capacity.

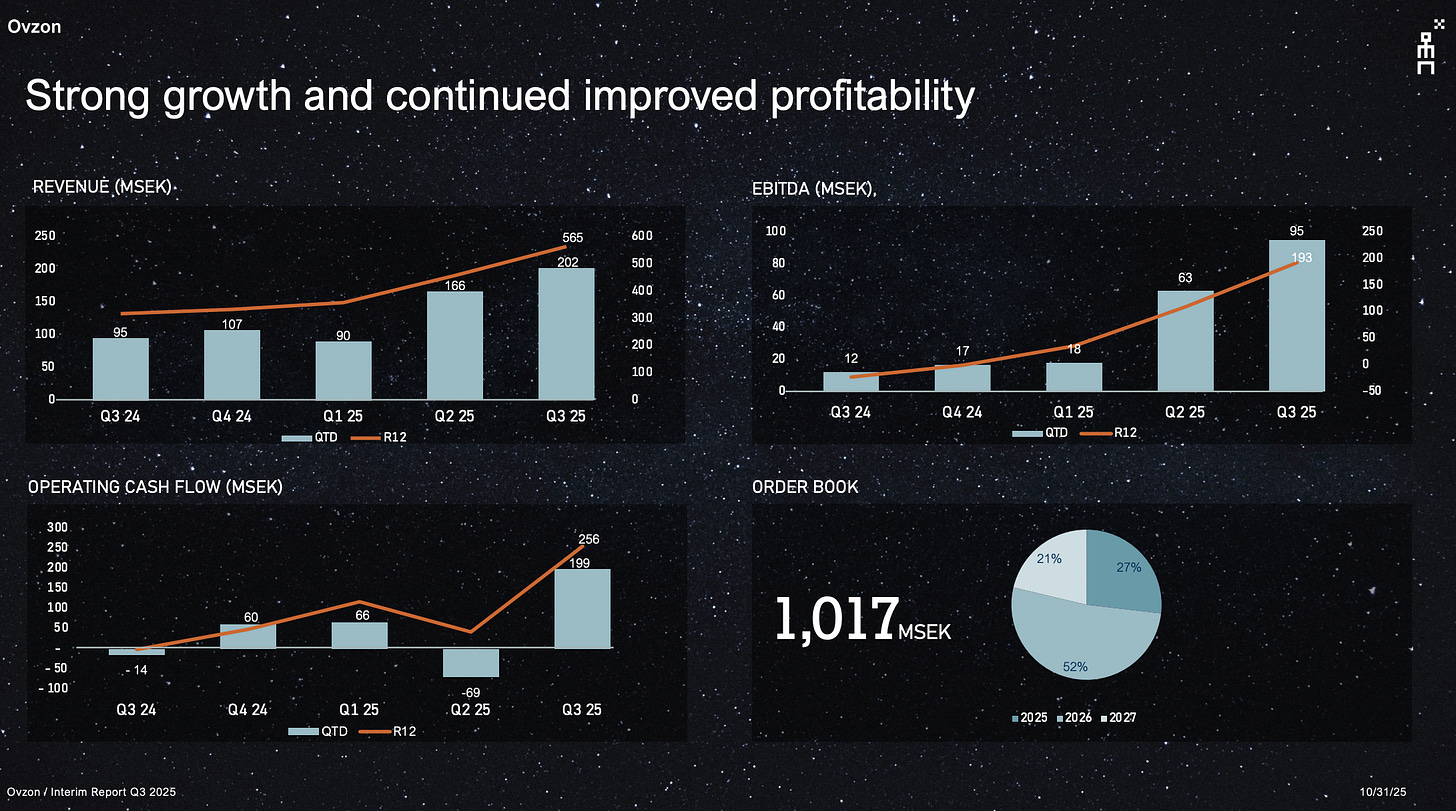

Revenue Growth: Revenue in Q3 2025 reached 202 MSEK, a significant increase from the 95 MSEK reported in the first quarter. This represents growth of 113% year over year. This surge is the direct result of the large Swedish Defence contract and the operational activation of Ovzon 3.

Profitability: The company has transitioned to positive EBITDA. After posting 81 MSEK in the first half of the year, the trend accelerated in Q3 as high-margin revenue from Ovzon 3 began to flow through the P&L. This validates the unit economics of a proprietary satellite. Once the fixed costs of the hardware are covered, incremental margins are immense.

The Swedish Defence Anchor: In May 2024, Ovzon signed a landmark 1.04 billion SEK contract with the Swedish Defence Materiel Administration. Deliveries began in earnest in 2025. In December 2025, the company received a supplementary terminal order for 58 MSEK. This contract provides a stamp of approval from a NATO-aligned government that has rigorously tested the system in Arctic conditions.

NATO Expansion: A significant development occurred in December 2025 when Ovzon signed a 240 MSEK agreement with another European NATO country. This deal validates the interoperability thesis. It confirms the Swedish contract was not a one-off instance of home bias but the start of broader NATO adoption. The contract includes both services and terminals with deliveries extending through 2026.

US Department of Defense: Traction In August 2025, Ovzon received a 6.2 million USD order for Ovzon 3 capacity from the U.S. DoD via Viasat. While the dollar amount is smaller than the Swedish deals, it proves the U.S. military is transitioning from legacy leased services to proprietary Ovzon 3 capabilities. This opens the door for larger program-of-record contracts in the future.

Stock price context

The stock has had a volatile 24 months, reflecting the risk profile of a pre-launch satellite company.

Between late 2023 and the end of 2024, the stock was depressed and traded between 10 and 20 SEK. This reflected market fears regarding launch delays, potential technical failure, and balance sheet concerns. The narrative changed in 2025. The landmark Swedish Defence order in May acted as the catalyst for a significant re-rating.

As of January 2026, the stock is trading near 50 SEK, marking a return of roughly 200% over the last year.

The market has rewarded the technical de-risking of the proprietary satellite and the initial commercial validation. However, I believe the commercial scaling is not yet fully priced in. The 240 MSEK NATO order in December 2025 is a leading indicator that the sales cycle is shortening and that Ovzon is becoming a standard part of the NATO communications kit.

The stock has successfully transitioned from distressed tech to growth infrastructure. Even after the recent rally, the multiple expansion phase is likely in its early stages as the market begins to model the long-term cash flow profile of the proprietary constellation.

5. The Business Model & Unit Economics

Revenue Model: SATCOM-as-a-Service

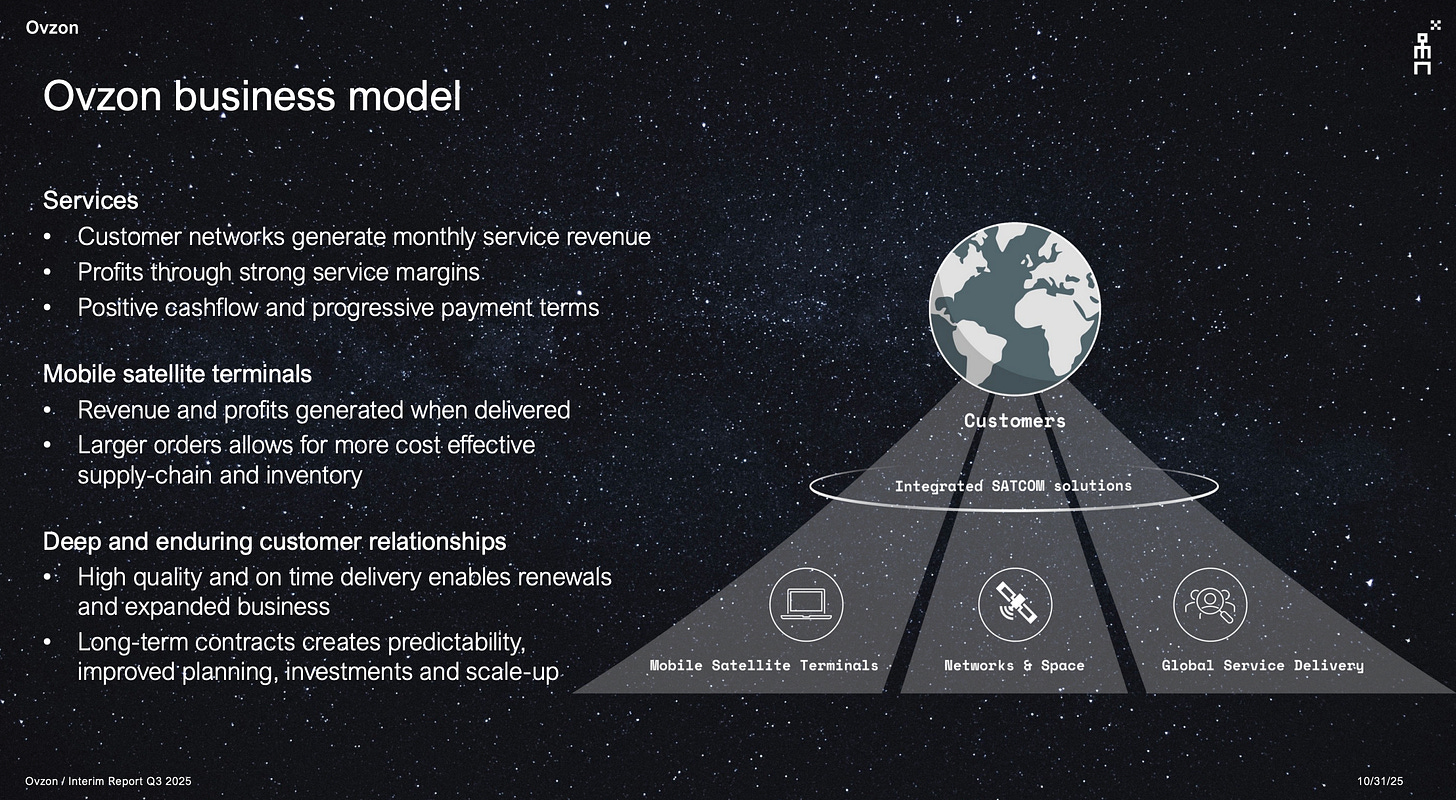

Ovzon does not sell bandwidth as a commodity. They provide SATCOM-as-a-Service, an integrated model that blends three distinct revenue streams into a unified high-moat offering.

Service Revenue: This is the recurring core of the business where customers pay for guaranteed throughput and availability. This is the highest quality revenue in the P&L. Under the previous model, Ovzon paid a significant toll to Intelsat for leased spectrum. With Ovzon 3 now operational, this revenue is extremely high margin. Contracts are typically multi-year, such as the 1.04 billion SEK Swedish Defence deal, which provides long-term cash flow visibility.

Terminal Sales: These are one-time sales of the T7 and T6 mobile terminals. While non-recurring, these terminals act as the razors that sell the blades. The hardware is proprietary. A generic VSAT dish cannot access the unique features of the Ovzon 3 On-Board Processor. This creates a powerful lock-in effect where the hardware purchase effectively commits the customer to the Ovzon service ecosystem.

Support and Training: This includes dedicated 24/7 support for mission-critical operations. Government and defense customers require Service Level Agreements that commercial users do not, and they are willing to pay a substantial premium for guaranteed uptime and specialized technical assistance in the field.

Unit Economics: The “Owned” vs. “Leased” Arbitrage

This is the most important financial mechanic to understand for the investment thesis. It explains why revenue growth will lead to disproportionate profit growth.

The Old Ovzon (Leased Capacity Model):

Ovzon would lease a transponder from Intelsat for, say, $1 million/year.

They would optimize it and resell it to the DoD for $1.3 million.

Gross Margin: ~20-30%.

Constraint: Pricing power was limited by the underlying cost of the lease. If they wanted to sell more, they had to lease more, increasing COGS linearly.

The New Ovzon (Ovzon 3 Owner Model):

Ovzon owns the asset. The satellite is a fixed cost (depreciated over 18 years).

The marginal cost of adding a customer to an operational satellite is near zero (until the satellite reaches full capacity).

Gross Margin: Potential for 70-80%+ on proprietary traffic.

Constraint: The fixed depreciation cost of the satellite is significant, but it is a non-cash charge. The cash COGS is minimal (telemetry, ground control).

Recurring revenue analysis

With the Swedish Defence contract and the new NATO agreement, Ovzon is building a layer of recurring revenue that covers its fixed costs. Every additional dollar of revenue from the U.S. Department of Defense or other NATO allies now drops almost entirely to the EBITDA line.

We are already seeing this in the numbers. Gross margins reached 48.5% in the trailing twelve-month period ending Q3 2025, a significant rise from historical levels in the mid-20s. I expect this to trend toward 60 to 70% as the revenue mix shifts further toward Ovzon 3 and away from legacy leased capacity. The Annual Recurring Revenue of the business is becoming Sovereign ARR. This is backed by government defense budgets which are far stickier than standard enterprise contracts.

6. The moats and competitive advantage

In a world where Elon Musk is launching thousands of Starlink satellites, does a small Swedish company with one satellite really have a moat? The answer is yes, but it is specific and relies on a philosophy of “Performance over Ubiquity.”

Proprietary Technology: The On-Board Processor (OBP)

This is the castle wall. Ovzon 3 contains a proprietary On-Board Processor.

The Physics: Traditional “bent-pipe” satellites take a signal from a user, bounce it down to a ground station (teleport) to process it, and then send it back up or to the internet. This creates latency (double hop) and, critically, a point of vulnerability. If you bomb the ground station, or cut the undersea cables leading to it, the network dies.

The Ovzon Advantage: The OBP allows the satellite to route traffic in space. A T7 terminal in Ukraine can speak to a T7 terminal in Stockholm directly through the satellite.

Result: It enables mesh networking, reduces latency, and significantly increases security. The signal never touches the public internet or a physical teleport in a hostile region. This is a “Sovereign Cloud” in orbit.

Anti-Jamming & Resiliency

The war in Ukraine has taught us that commercial satellites (like Viasat’s KA-SAT) are vulnerable to cyberattacks and jamming. Starlink has performed well, but is constantly battling Russian electronic warfare.

Ovzon 3 features unique waveforms and “frequency hopping” enabled by the OBP. It can operate “below the noise floor,” effectively hiding the signal from enemy jammers. For a Special Forces operator, this is the difference between life and death.

Switching Costs: Once a defense force integrates this level of resilience into their doctrine, training soldiers on the T7, integrating the OBP into their command structures, the switching costs are immense. They do not switch back to a standard commercial provider to save pennies.

Steerable Beams

Ovzon 3 has five independently steerable spot beams. Most satellites have fixed beams. Ovzon can physically move the coverage area to follow a carrier group or a moving front line.

Comparison: Starlink covers everywhere, but with fixed power density spread over thousands of cells. Ovzon concentrates power. This Unique Resource allows them to support high-bandwidth uplinks (e.g., 10 Mbps from a laptop-sized terminal) that LEOs struggle to sustain consistently from such small form factors without a larger dish.

Beyond physics, Ovzon offers diversification away from the US. European NATO members view total reliance on US-controlled Starshield as a strategic risk. Ovzon provides a non-US, EU-controlled alternative that ensures strategic autonomy for the Northern Flank.

Regulatory & Legal Barriers

Ovzon holds orbital slots and frequency rights that are scarce assets. Furthermore, the rigorous certification process for defense hardware (like the T7 terminal) creates a barrier to entry. You cannot just “startup” a defense contractor. Ovzon has spent 15 years building trust with the DoD and FMV.

Moat Assessment

The moat is durable within its niche. Ovzon cannot compete with Starlink for the consumer, the average soldier, or the cruise ship. That battle is lost. But for the top 5-10% of mission-critical users (Special Ops, Government Leaders, High-Value Assets), Ovzon provides a capability that Starlink effectively cannot, which is sovereign, stealthy, teleport-free connectivity.

7. The Investment Thesis: The 5 Year Outlook

I am looking at a 5-year horizon. By early 2031, I believe Ovzon will have transformed from a single-satellite bet into a multi-asset defense prime, generating substantial free cash flow.

Key Drivers:

The “Fill Rate” of Ovzon 3: I believe the key driver will be the utilization rate of Ovzon 3. Currently, the FMV and initial DoD orders utilize only a fraction of the total capacity. As utilization climbs from ~40% (estimate) to ~80%, the operating leverage will be massive. The fixed costs are paid and the rest is profit. I expect the satellite to be “sold out” effectively by 2028.

NATO’s 2% Reality & The Northern Flank: The geopolitical supercycle is real. European defense spending is skyrocketing. Sweden and Finland joining NATO changes the map. The Arctic (”High North”) is a strategic flashpoint with terrible connectivity. Ovzon provides the standard for “Northern Flank” comms. I expect Ovzon to become the “Red Phone” provider for NATO northern operations, driving revenue from Norway, Finland, the UK, and Germany.

US DoD Conversion: The US DoD is the whale. They have been a customer for a decade (using leased capacity). The 2025 transition to Ovzon 3 is just the tip of the iceberg. I expect the DoD to eventually contract for full spot-beams, potentially consuming 30-40% of the satellite’s capacity. The renewal of contracts in late 2025/early 2026 suggests this relationship is deepening.

Satellite Lifespan Extension: The recent confirmation that Ovzon 3’s life expectancy is 18 years (up from 15) is a massive hidden value driver. It lowers annual depreciation by ~20 MSEK and extends the cash-generating tail of the asset by 3 years. This is pure free cash flow at the back end.

New Satellite Orders (Ovzon 4): By 2027/2028, seeing the success of Ovzon 3, I expect the company to order “Ovzon 4.” Unlike Ovzon 3, which required equity dilution, Ovzon 4 will likely be funded by internal cash flow and debt, marking the company’s transition to a mature infrastructure compounder.

8. Management

CEO: Per Norén

Per Norén took the helm in May 2021. His background is key. He is a dual US/Swedish citizen with deep roots in the US tech and satellite sectors (ex-Boeing, ex-Carmen Systems).

Track Record: He was hired to bridge the gap between Swedish engineering and US DoD contracts. He delivered the launch of Ovzon 3 (despite inheriting delays) and closed the massive FMV deal. His execution on the commercial side in late 2025 (NATO deal, DoD renewal) builds credibility.

Alignment: He owns 170,000 shares and has been buying recently (e.g., ~24,000 shares bought in Nov 2025).

CFO: André Löfgren

André joined Ovzon in May 2025. Former Skanska background implies a focus on project discipline and capital structure. His primary task has been refinancing the debt and managing the transition to a CAPEX-light, cash-flow-positive phase. The recent refinancing (lowering interest rates to ~4.5%) was a strong move.

Assessment

Management has transitioned from “Visionaries” (founders) to “Operators” (Norén/Löfgren). This is exactly what is needed at this stage. Insider ownership is healthy, though I would like to see it higher across the broader board.

9. Capital Allocation

Ovzon is emerging from a heavy investment cycle and entering a harvest cycle.

Past (2018-2024): High CAPEX/Burn to build Ovzon 3. Funded by equity issuance (dilution) and high-yield debt. This was painful for long-term holders but necessary to build the asset base.

Present (2025): De-leveraging. The focus is on paying down the 62.5 MUSD debt facility. Cash flow from the FMV prepayments has been used intelligently to bolster the balance sheet and reduce net interest expense.

Future (2026+): I expect cash accumulation. Dividends are unlikely in the next 3 years. The strategy should be (and likely will be) to accumulate cash to fund the next satellite (Ovzon 4) without diluting shareholders.

M&A: I see limited M&A activity. The company needs to focus on organic growth. Any acquisition of a terminal manufacturer would likely be value-destructive compared to just buying the components.

Management must resist the urge to buy unrelated businesses or expand into low-margin commercial verticals. The discipline should be: Fill Ovzon 3 -> Pay Debt -> Order Next Sat. So far, they are sticking to this.

10. Peer group comparison

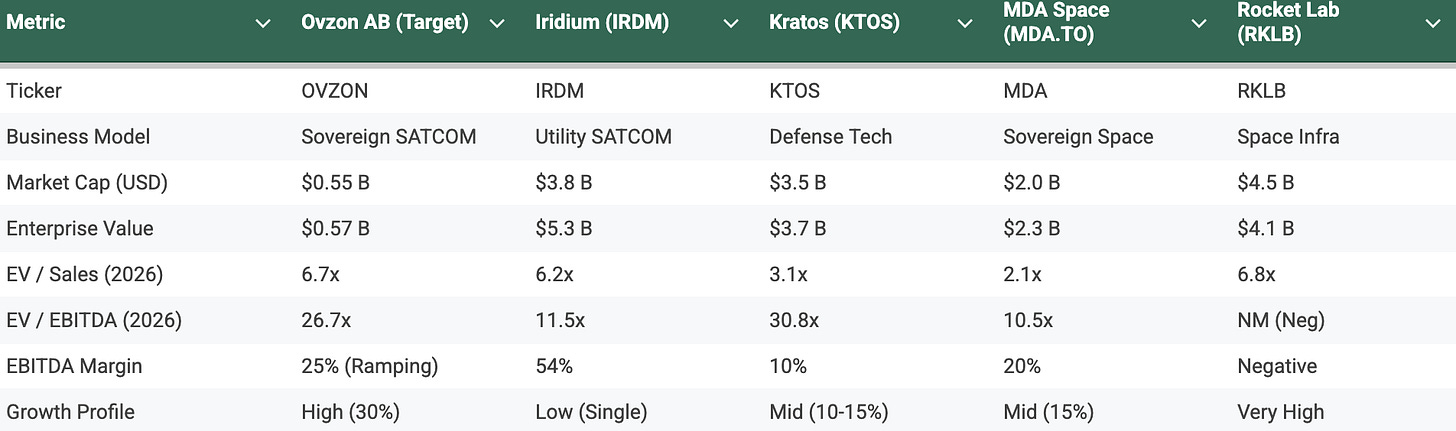

To ensure the peer group reinforces the high-margin / critical infrastructure thesis, I have been strict in our selection. I have removed distressed legacy operators (like EchoStar) and commercial broadband commodity players (like Viasat) to focus exclusively on Sovereign Space and Defense Tech peers. These are the companies that, like Ovzon, command a premium for proprietary technology and government-hardened infrastructure.

Iridium Communications (IRDM): The closest economic analog. Iridium proves the end-state economics of this model: high-margin (50%+), proprietary network, heavy government exposure. It is a “post-capex” cash machine.

Kratos Defense (KTOS): The pure-play Defense Tech analog. Kratos trades at massive multiples because it sells technology (software-defined systems/drones), not just bandwidth. If Ovzon successfully markets its On-Board Processor as a unique “Space Edge Compute” capability, Kratos is the valuation target.

MDA Space (MDA.TO): A Canadian champion capitalizing on the same Arctic/Sovereign defense trends. MDA shows that the market awards premium multiples to companies that secure long-term “National Security” status (e.g., Canadarm3, LEO constellations).

Rocket Lab (RKLB): The Space Infrastructure analog. Rocket Lab proves investors will pay for vertical integration. Like Ovzon, they are moving from a single service (launch) to owning the infrastructure (satellites), driving a massive re-rating.

Comparison of peers (NTM)

The following table synthesizes the financials for the peer group. Ovzon’s metrics are based on our 2026 Base Case Estimates (900 MSEK Revenue / 225 MSEK EBITDA) and the assumed share price of 50 SEK.

The Growth Premium: Ovzon is currently trading at 6.7x Sales, which is in line with the high-growth peers like Rocket Lab (6.8x) and the high-margin utility Iridium (6.2x). This suggests the market is giving Ovzon some credit for its growth.

The Kratos Comparison: Kratos trades at 3.1x Sales but has a much lower margin profile (~10%). Ovzon’s trajectory toward 40%+ margins justifies a premium over Kratos on a revenue basis.

The Opportunity: While Ovzon looks “fairly valued” on 2026 numbers relative to peers, the disconnect lies in the growth rate. Ovzon is growing at 30%+, significantly faster than Iridium or Kratos. If Ovzon executes, it will grow into a much lower multiple very quickly, whereas peers are largely in steady-state.

11. Triangulated valuation & scenarios

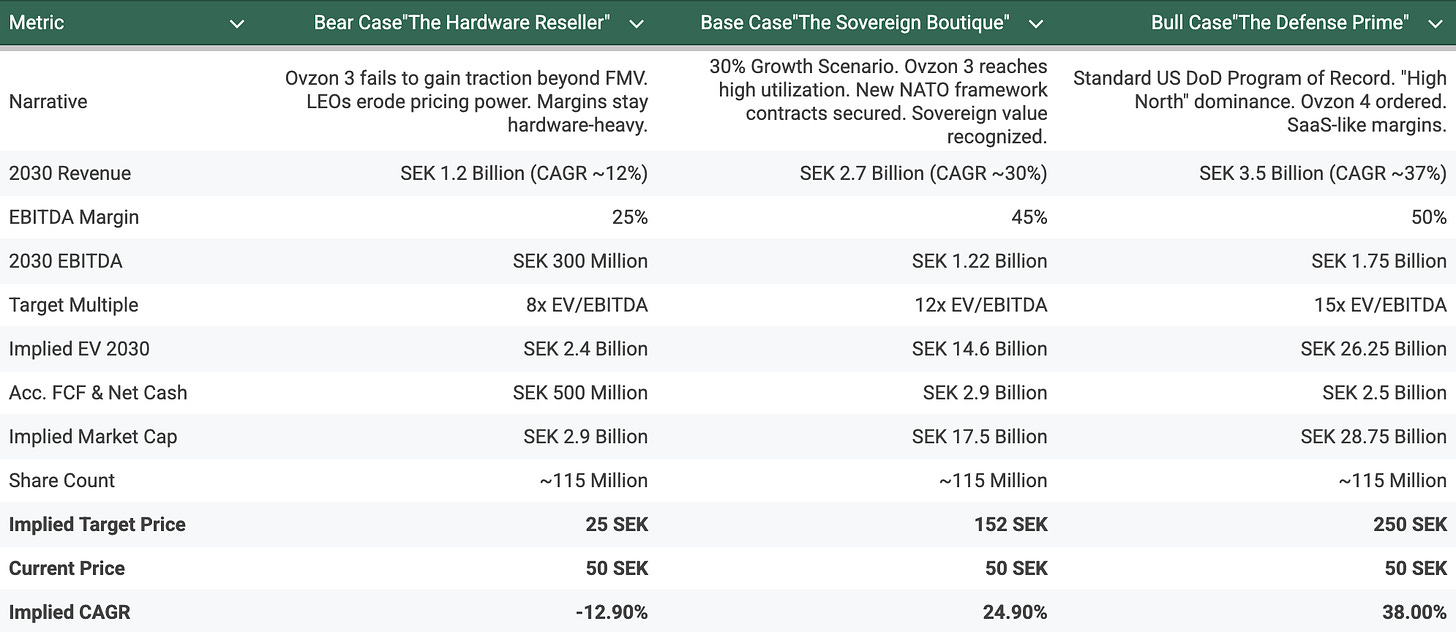

To determine the 5-year fair value, we model three scenarios. Our methodology focuses on 2031 Exit Multiples applied to projected EBITDA, discounted back if necessary, but primarily viewed through the lens of potential market capitalization in year 5.

A critical component of the analysis is the use of Free Cash Flow. In the Base and Bull cases, Ovzon generates significant excess cash starting in 2026/2027.

Capex holiday: With Ovzon 3 launched (15-18 year life), major capex is behind them until Ovzon 4 is being built. Maintenance capex is minimal. In the Bull case we assume SEK 1.0 billion is spent on Ovzon 4 during the 5 year period.

Conversion: We estimate FCF conversion from EBITDA will approach 60-70% (similar to Iridium’s 61% conversion).

Compounding: Cash can be used to buy back shares or issue dividends. Our price targets assume the cash builds on the balance sheet, adding to the equity value directly.

12. Conclusion and verdict

The analysis confirms that Ovzon AB meets the stringent criteria of the Fjord Alpha mandate. In short:

Technology: Ovzon 3 is a strategic asset with unique OBP capabilities that create a moat against commoditized LEO constellations.

Economics: The shift from leasing to owning expands margins from ~20% to ~50%. This is a transformation the market has not yet priced in.

Momentum: The SEK 1.04bn FMV order proves the thesis is not theoretical. It is a funded program of record.

Valuation: While currently trading in line with peers, there is compelling upside via the growth trajectory across the coming years.

Outlook: My Base Case projects a share price of 152 SEK by 2030. This represents a 24.9% CAGR, comfortably clearing the 20% hurdle.

Risks: While the upside is clear, this remains a binary bet on hardware. The company relies entirely on Ovzon 3. If that satellite fails, the business model breaks. Additionally, the long-term threat of SpaceX’s Starshield encroaching on this niche is real. For a full breakdown of the risks, please refer to the Pre-Mortem chapter immediately following this section.

I have started accumulating at just below 50 SEK. It might be a volatile ride for the next weeks/months as the stock has climbed quickly recently, but I view the current volatility not as risk, but as the friction of a micro-cap pricing mechanism adjusting to a new fundamental reality. The asymmetric risk/reward profile suggests the real upside is just beginning.

The Pre-Mortem: A Case for Failure

Let’s assume it’s 2031, and our investment has been a total failure. Ovzon is trading at 5 SEK or has been taken private for pennies. What went wrong?

Technical Failure (The “One Basket” Risk): Ovzon 3 is a single asset. A solar flare, a debris strike, or an OBP software failure turns the satellite into a brick. Insurance covers the debt, but the business is dead because they have no service to sell for 3 years while building a replacement. The customer base evaporates.

Starshield Commoditization: We underestimated SpaceX. Starshield rolls out “Laser-link” capabilities to the backpack level, offering the same anti-jamming and low-latency features as Ovzon but at 1/10th the cost. The “Sniper Rifle” market becomes too small to support a public company.

Execution Risk on Utilization: Management fails to sell the remaining 70% capacity. The FMV contract ends up being the only major contract. The fixed costs of operating the satellite (telemetry, ground ops) eat up the gross margin. The company becomes a “zombie” with high assets but no growth.

Summary Box

✅ Thesis Pillar 1: Margin Transformation: Transition from low-margin resale to high-margin (70%+) proprietary capacity via Ovzon 3 drives massive operating leverage.

✅ Thesis Pillar 2: Technological Moat: On-Board Processor (OBP) enables jam-resistant, stealthy mesh networking (”Sovereign Cloud”) that LEO constellations struggle to match for tactical users.

✅ Thesis Pillar 3: Defense Supercycle: Massive order book growth (1.04B SEK FMV anchor + 240M SEK NATO) validates the tech and provides a cash flow floor.

⚠️ Key Risk (from Pre-Mortem): Single Asset Risk: Dependence on one satellite (Ovzon 3) creates a binary failure mode if technical issues arise.

🎯 Target Price (Base Case): SEK 152 by early 2031

📈 Implied 5-Year CAGR (Base Case): 24.9%

Primary Sources:

Ovzon Interim Reports

Ovzon Annual Report 2023 & 2024

Press Releases

Q2/Q3 2025 Earnings Call Transcripts

Excellent write-up. We gave it the best idea award in our stock pitches newsletter - https://www.capitalemployed.com/p/29-stock-pitches-12th-19th-january