Evolution Q3-25: Finding the green shoots in a disappointing report

A major revenue miss, FX headwinds and the Asian debacle are offset by resilient margins, US growth and emerging "green shoots" in Europe and RNG

Evolution’s Q3-25 report was a high-stakes event, which is very clear from my X/Twitter feed, with pretty much every second tweet being about the company. This article outlines my key take-aways - the good, the bad and the ugly, and a few deep-dives.

Before we start, I want to self-promote my main analysis on Evolution (Evolution AB: The Price of Dominance), and my two deep-dives (Evolution AB's Asian headwinds) and (Evolution: An American fortress).

There might be some text additions to the below, as more information becomes available across the next days. Happy reading!

My take-aways from Evolution’s Q3-25 report

The good

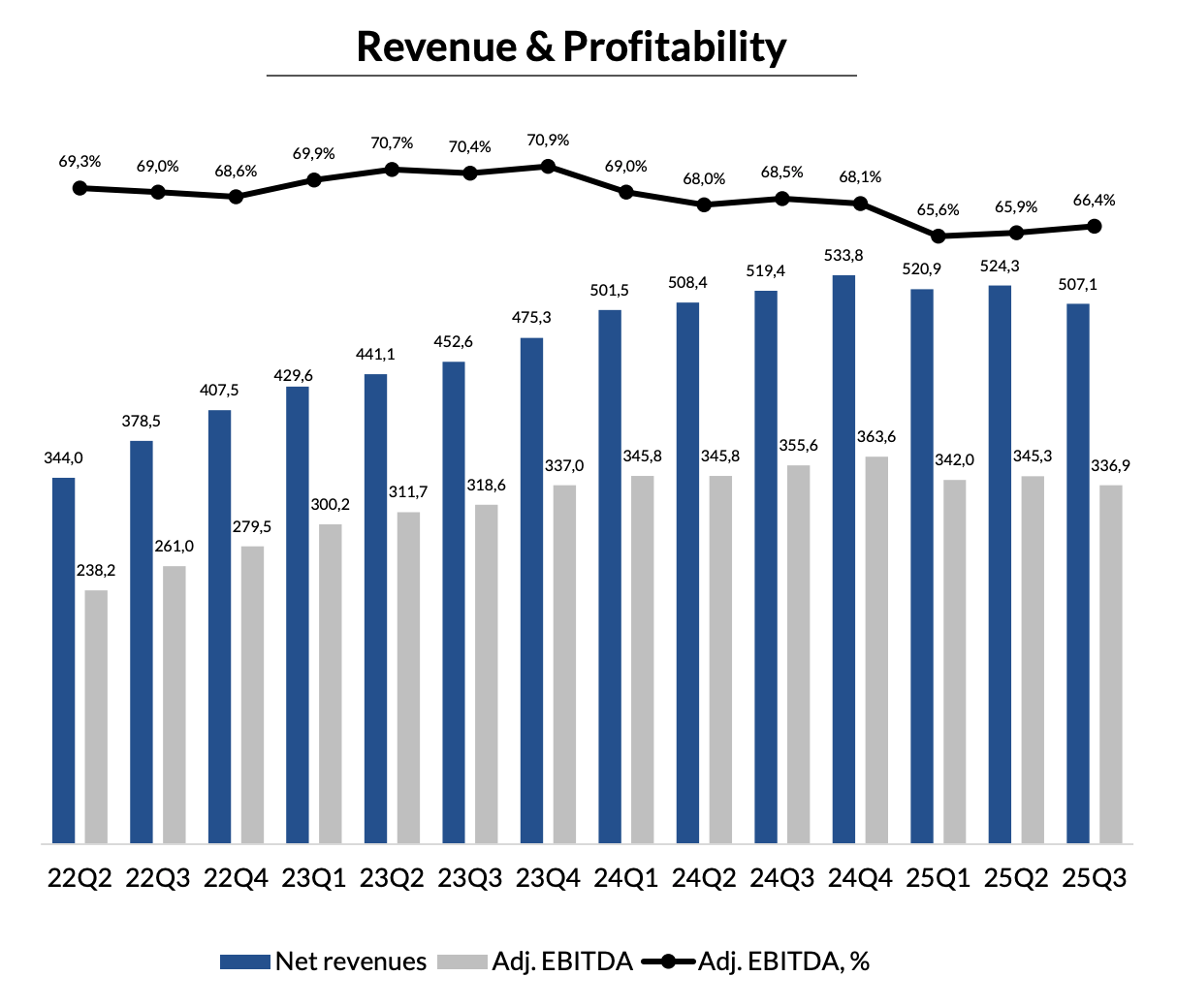

Margins still standing: Despite a material revenue shortfall that missed consensus by 6%, the EBITDA margin came in at a strong 66.4%. This performance is the single most important positive data point, landing within the company’s full-year guidance of 66–68% and beating analyst expectations.

RNG becomes a growth engine: For the first time in the company’s history, the RNG business, with +4.0% YoY growth, outgrew the core Live Casino business, which declined by 3.4% YoY. This is an important achievement, and proves that Evolution is building a second growth pillar to complement its live-dealer dominance. The report singled out the NoLimit City studio for its strong performance.

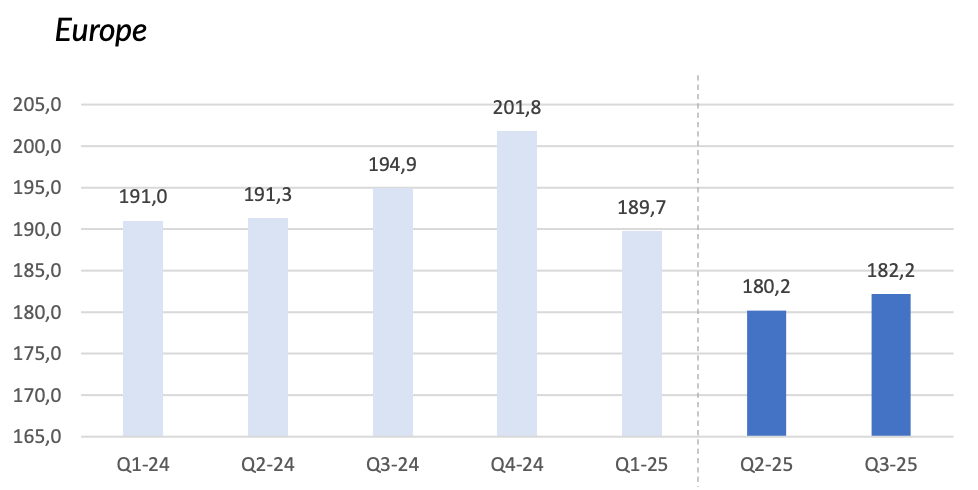

Europe finds a floor: After several quarters of decline due to regulatory clean-ups and self-imposed “ring-fencing,” Europe returned to growth with a +1% increase vs. last quarter. While still down 7.0% YoY, this stabilization suggests the worst of the regulatory headwinds may be over.

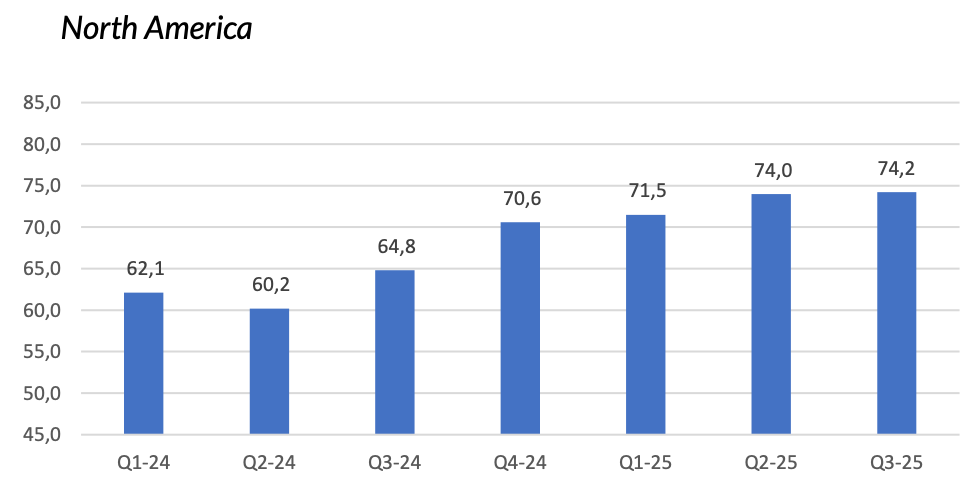

North America has underlying strength: The reported +14.5% YoY growth in North America appears weak at first glance. However, this figure is misleading as it is reported in EUR. When adjusting for the 6.4% currency headwind, the underlying growth was 20.9%. This performance is in line with key operators (such as BetMGM’s 21% iGaming growth), meaning that Evolution defends its market share.

Product innovation continues: Evolution continues to execute on its product roadmap. During the quarter, it launched 22 new RNG titles and the anticipated live game show “Ice Fishing”. Furthermore, the launch of the new “Sneaky Slots” brand demonstrates a strategic commitment to filling portfolio gaps between its existing NetEnt and NoLimit City styles.

The bad

A clear top-line miss: Total revenue of €507.1 million was a significant 6% miss versus consensus expectations of EUR 538 million, driving the negative market reaction. The reported year-over-year decline of 2.4% is a horrible result for what has been a high-growth compounder. Note that the underlying business is still growing, albeit slowly, with constant currency revenue up +3.9%. FX rates will reverse at some point.

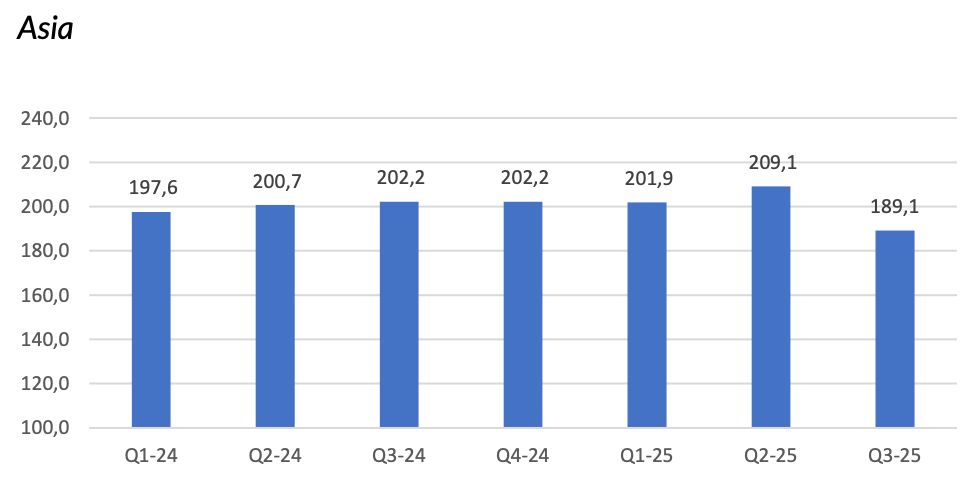

Live casino stagnation: The core live casino business, the engine of Evolution’s dominance, declined by 3.4% year-over-year. This was dragged down entirely by the poor performance in Asia and raises questions about its historical reliance on less-regulated markets for outsized growth.

The ugly

The Asian debacle: The situation in Asia is the ugliest element of the report. Revenues in the region declined by 6% year-over-year and a staggering 10% quarter-over-quarter. Crucially, CEO Martin Carlesund admitted this was a self-inflicted wound, stating with candidness that in the fight against cybercrime, “we over-extended our countermeasures and our revenue was affected negatively”. This is to some extent both good and bad as it shows internal execution failure, but at the same time is something that is in Evolutions’s hands to fix.

Key KPI:s from the Q3 report at a glance

Total Revenue: EUR 507m (-2.4% YoY) - clear miss vs. EUR 538m consensus

Adj EBITDA: EUR 336.9m (-5.3% YoY)

Adj EBITDA margin: 66.4% (-210bps) - beat vs. expecations

EPS: EUR 1.25 (-20.4% YoY)

Deep-dive: The profitability fortress still holds

The most impressive aspect of the third quarter was the defense of profitability. In the face of the significant revenue miss, the 66.4% EBITDA margin and the confident reiteration of full-year guidance speaks volumes about the resilience of Evolution’s business model.

The commentary pointed to a “disciplined approach to our cost base,” which was essential in offsetting the revenue shortfall from Asia. This likely involved tight controls on discretionary spending, marketing, and non-essential headcount. However, this also shows the high operating leverage in the business. The fixed costs of running studios are spread across a massive global player base. Even with one major region faltering, the profitable growth from North America and the sheer scale of the European base were sufficient to protect group-level profitability.

This performance provides a buffer. While the market rightly punishes growth stocks for revenue misses, Evolution’s valuation is also built on its incredible profitability and cash generation. This resilience acts as a de-risking factor for the investment case. While the growth story is now clouded by uncertainty in Asia, the “cash machine” aspect of the business has been proven to be robust, which should provide a fundamental valuation floor for the stock. The company’s strong financial position, ending the quarter with a net cash balance of €656 million, further underpins this stability

US - FX a temporary drag, underlying momentum

The North American region continued to be a growth driver, delivering +14.5% year-over-year revenue increase. This figure is denominated in EUR and is misleading when compared to the USD-denominated results of competitors.

Based on the 6.4% currency headwind from the strengthening EUR, the true, underlying growth in USD was 20.9%. This is essentially in line with major operators like BetMGM (at 21%). The ‘fortress’ is intact, with its true strength simply being obscured by unfavorable foreign exchange translation.

The company continues to invest heavily in the region, with several large dedicated studio environments going live for customers in both the USA and Canada, alongside the strategic re-launch of its second live casino brand, Ezugi.

Asia - From normalization to crisis management

The outlook for Asia has shifted dramatically from one of “cautious optimism” to active crisis management. The disastrous financial results, a 6% year-over-year decline and a 10% sequential fall, were compounded by the CEO’s candid admission of an operational misstep.

The “balancing act” described by management highlights the difficulty of operating in this region. If security measures against cybercrime are too stringent, legitimate player traffic and revenue are choked off. If they are too light, the platform is exposed to fraud and abuse. In Q3, they got this balance wrong by over-extending their countermeasures. This introduces a major element of execution risk and uncertainty into the company’s overall growth algorithm.

The single silver lining was the report of a “great start” for the newly opened, regulated studio in the Philippines, which represents a key part of a long-term strategy to pivot toward more stable, regulated Asian markets. However, this is a small positive in a sea of negatives. The key question for investors now is how long it will take for management to find the right operational balance in the region.

Europe - Green shoots emerging

In contrast to Asia, the narrative in Europe has turned more positive. The key data point was the return to growth of +1% quarter-over-quarter, a welcome sign after a prolonged period of decline. Although year-over-year growth remains negative at -7.0%, the sequential turn suggests that the painful process of adapting to stricter regulations and “ring-fencing” certain markets is largely complete.

Europe appears to be emerging from this transition as a mature, stable, and profitable business. The company’s formidable moat in the region, built on its vast scale, multi-studio network, and unmatched portfolio of native-language tables, remains firmly intact.

Playtech situation

One of the most extraordinary revelations just before the release of the Q3 report is the confirmation that competitor Playtech was the client behind the 2021 smear campaign against Evolution.

Playtech paid the Israeli intelligence firm Black Cube over £1.8 million to create a defamatory report. That 2021 report, which alleged operations in sanctioned markets, caused a large drop in Evolution’s stock and triggered regulatory inquiries, which have since cleared Evolution of wrongdoing. Playtech has admitted to commissioning the report but claims it was “legitimate due diligence.” The market has clearly rejected this explanation, with Playtech’s own stock dropping over 30% on the news. As Evolution’s CEO Martin Carlesund noted, the act “hurts not only Evolution but the reputation of the entire industry.”

Evolution has now added Playtech to its ongoing lawsuit, which is expected to continue through 2026.

From an investor perspective, this episode may strengthen Evolution. By taking public legal action, the company is demonstrating transparency and refuting the claims. This reinforces trust with regulators and investors. Furthermore, the lawsuit itself could conclude with a good financial outcome for Evolution.

Outlook into Q4 and 2026

The Q3 results force a recalibration of the near-term outlook for Evolution. The path forward is more complex, with heightened risks balanced by proven core strengths.

Key themes for Q4 2025 and into 2026 in my opinion will be:

Asia watch: The number one priority for the market will be any evidence of stabilization in Asia. Commentary in the next report on finding the correct “balance” with security countermeasures will be critical to restoring confidence in the region’s growth trajectory.

Margin discipline: A key test will be whether the company can continue to deliver within its 66–68% EBITDA margin guidance if top-line growth remains muted. The Q3 performance suggests it can, but sustained pressure would test this resilience.

US market share: Key will be whether the North America region can maintain its strong underlying growth rate. Any significant deceleration, or evidence that this pace is lagging competitors, would ignite fears of market share loss may force a re-evaluation of long-term growth potential in the region.

RNG momentum: The ability of the RNG segment to continue its strong performance is now crucial. It must establish itself as a consistent and reliable growth driver, providing a much-needed offset to any volatility or maturity in the live casino business.

Ultimately, Evolution’s investment case has become more nuanced. The company is now a story of managing a complex global portfolio. We have a growing US market, a stable and cash-generative European base, and a volatile, high-risk/high-reward Asian operation.

The share price has come down significantly, but the underlying thesis still holds, despite recent headwinds.

Does your valuation change seeing this new information?

Thanks a lot