Evolution AB: The Price of Dominance

Why the market is mispricing the transition from hyper-growth to durable compounding.

Executive Summary

Perhaps this one is slightly above my mid-cap threshold, but indeed a very intriguing case and second part of my first three posts about Swedish compounders (Carasent, Evolution, and Vitec). See also my separate article about Evolutions headwinds in Asia, which is a critical parameter for this case. Happy reading!

Evolution AB is a world-class, near-monopolistic B2B supplier to the global online casino industry. It possesses a multi-layered competitive moat built on unparalleled scale, powerful network effects, and relentless product innovation. The business model is exceptionally capital-light, generating amazing free cash flow and best-in-class margins.

For years, the market rewarded this dominance with a premium valuation reserved for high-growth technology companies. Deceleration in top-line growth has caused the market to de-rate the stock, creating a narrative that the company's best days are behind it. This is a misreading of the situation. The slowdown is primarily the result of temporary, manageable, and in some cases, deliberately self-inflicted strategic actions to secure long-term market leadership.

My thesis is that the market is extrapolating these temporary headwinds into a permanent decline, creating an opportunity to own this category-defining compounder at a historically reasonable valuation. As the company moves through these challenges and its long-term growth drivers in North America, Latin America, and Asia become more apparent, the narrative will shift from one of deceleration to one of durable, profitable growth. I believe the business is capable of compounding revenue at a low-teens rate for the next five years while maintaining its exceptional profitability.

My analysis concludes this is a deep misreading of the situation. The market is extrapolating temporary headwinds into a permanent decline, creating a rare opportunity. My base case price target for mid-2030 is SEK 3,597, which implies a 5-year compound annual growth rate (CAGR) of 33%, making this a clear buy opportunity that easily passes my 20+% CAGR threshold. The single most important risk to this thesis is a severe, coordinated regulatory clampdown in key markets.

The Puzzle of a Stagnant Leader

I have always been fascinated by the inflection points in a company’s life. The most lucrative opportunities often appear when a business transitions from one stage to the next, and the market is slow to recognize the nature of that change. Some companies flame out, but others evolve from explosive, unpredictable growth into durable, cash-gushing compounders. It is this transition that drew me to Evolution AB.

For years, Evolution was a darling of the Nordic growth investor community, a true rocket ship. Its stock chart from 2017 to mid 2021 tells a story of near-vertical ascent as it cemented its dominance in the nascent market for live online casino games. But for the last years, the story has changed. The stock has gone nowhere, trading in a wide, volatile range. This stagnation presents a puzzle. How can a business with a near-monopoly in its core market, with EBITDA margins north of 65%, and with a clear strategy for returning capital to shareholders, see its stock tread water for the last years?

The market’s answer is simple: growth is slowing. And it is. The days of 50% year-over-year expansion are gone. The consensus narrative has shifted to focus on regulatory headwinds in Europe, operational challenges in Asia, and a maturing core business. The central question for any investor today is whether the market is correctly identifying a structural decline, or if it is failing to see through short-term noise and offering a rare opportunity to buy a category-defining leader at a fair price. After a deep dive into their operations, strategy, and financials, I have come to a firm conclusion: the market is getting it wrong.

The Setup: Key Data & Investment Thesis

💰 Stock Price: SEK 863.00 (as of Aug 1, 2025)

📄 Shares Outstanding: 202.73 million

🏢 Market Cap: SEK 174.95B (approx. EUR 15.4B)

🏦 Net Cash: EUR 408M

🌐 Enterprise Value: SEK 169.9B (approx. EUR 14.9B)

⚙️ Sector/Industry: iGaming / B2B Casino Supplier

💡 Investment Thesis: The market is misinterpreting a temporary, strategic slowdown as a structural decline, offering a rare opportunity to buy a near-monopolistic compounder at a deeply misunderstood valuation.

Sourcing: Company Q2 2025 Interim Report, Company FY 2024 Report, Financial Data Providers.

The Business: History & Operations

Origin Story

The idea for Evolution was born in 2006 from a simple but powerful insight. Founders Jens von Bahr, Fredrik Österberg, and Richard Hadida looked at the burgeoning world of online gambling and saw a gap. The experience was dominated by digital-only, computer-generated games (Random Number Generators, or RNG). What was missing was the human element; the trust, the social interaction, and the glamour of a real-life casino floor, like the world-renowned establishments in Monte Carlo. They believed they could use rapidly improving streaming technology to bring an authentic, live gaming experience into players' homes.

Their first move was to build a state-of-the-art studio in Riga, Latvia. This was a location that offered a deep pool of affordable, multi-lingual talent. In the early days, they had to prove the concept was even viable. To demonstrate that the streams were truly live and not pre-recorded, they famously kept a BBC newscast running in the background of their studio. The initial sell to online casino operators was difficult; many were skeptical that players would trust the product or that the technology would be reliable.

The turning point came when major operators like Unibet trialed the product. Player adoption was immediate and explosive. It turned out that players not only found the live games more engaging but also inherently more trustworthy than their digital RNG counterparts. The business hit a critical inflection point. Live Casino went from being a niche curiosity to a must-have category for any serious online operator. Evolution listed on the Nasdaq First North in Stockholm in 2015, and in 2016, Martin Carlesund took over as CEO, stewarding the company through its most explosive period of growth.

What They Actually Do

To understand Evolution, it is best to use an analogy: Evolution is the premier "picks and shovels" provider for the digital gold rush in online gambling.

They do not operate any online casinos themselves. They are not the "miners" taking on the high costs and risks of acquiring players, marketing, and managing customer relationships. Instead, they provide the essential, high-margin, and indispensable equipment that every miner needs to operate: the games themselves. They build and operate sophisticated television studios, hire and train thousands of professional game presenters, develop the streaming technology, and then license this entire turnkey solution to over 800 online casino operators globally, including giants like DraftKings, Flutter, and 888.

The business is divided into two core segments:

Live Casino: This is their crown jewel and the source of their dominance, accounting for roughly 86% of revenue (Q2 2025 report). They stream classic table games like Blackjack, Roulette, and Baccarat 24/7. More importantly, they have created an entirely new category of "Game Shows" with titles like Crazy Time, MONOPOLY Live, and Lightning Roulette. These games blend traditional casino mechanics with elements of popular TV game shows and interactive features, and they have become massive global hits that are unique to Evolution.

Random Number Generator (RNG): This is the traditional online slots business. Evolution built this segment almost entirely through a series of blockbuster acquisitions, most notably NetEnt (and its subsidiary Red Tiger) in 2020 and Big Time Gaming (BTG) in 2021. This was a masterful strategic move. As CEO Martin Carlesund stated regarding the NetEnt deal, the vision was to "become the global leading provider of online casino". By acquiring the leading slot developers, Evolution transformed itself into a comprehensive "one-stop shop" for operators, making its platform even stickier. It was also a defensive masterstroke, preventing a competitor from acquiring those assets and creating a more formidable rival.

Recent Developments & Performance

Business Update

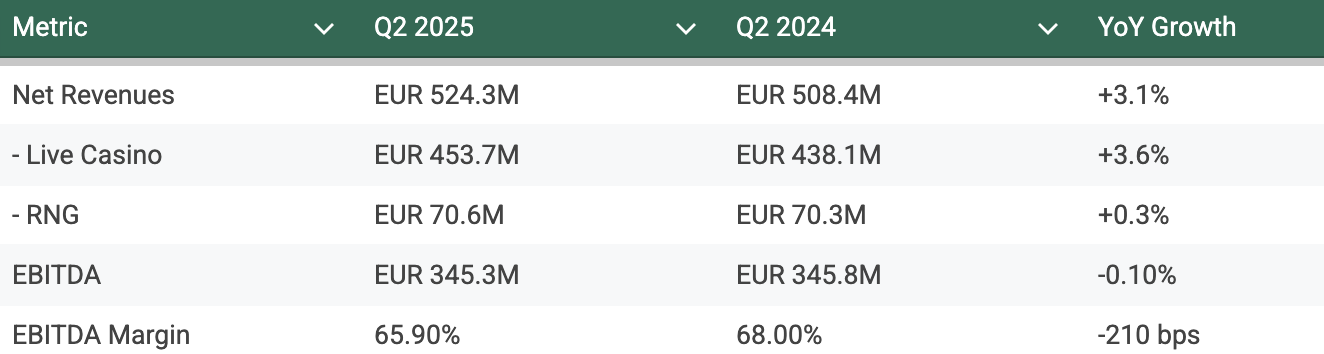

My analysis began by digging into the most recent quarterly results, because this is where the market's anxiety is rooted. The numbers from the second quarter of 2025 confirmed the slowdown narrative.

Source: Evolution Q2 2025 Interim Report.

A headline revenue growth rate of just 3.1% (or 8.8% in constant currency) is a far cry from the 30-40% growth rates of the past. However, the story is in the commentary from management, which was refreshingly direct. CEO Martin Carlesund stated plainly on the earnings call: “To be clear, though, we are not satisfied with this quarter's growth, and we are working hard to increase the pace”.

He then detailed the two primary causes of the slowdown:

European "Ring-Fencing": The negative growth in Europe was a direct result of proactive, self-inflicted measures taken by the company to "stay ahead of the curve in the regulatory landscape". They are tightening access to their games to ensure they are only available through locally licensed operators in regulated markets. This has had a "larger financial impact than anticipated" in the short term, but management maintains that "regulation is positive over time".

My read on this is that they are sacrificing some short-term revenue from "grey" markets to solidify their position as the trusted, compliant partner of choice for tier-one operators and regulators in the long run. This is a classic moat-building action.Asian Cybercrime: The company continues to battle sophisticated "criminal cyber activity" in Asia, where pirates hijack their game streams and rebroadcast them illegally. This has been a persistent headwind for several quarters. However, Carlesund noted that they are making good progress, and the region returned to sequential growth in Q2.

Beneath the headline weakness, there were significant bright spots. North America continues to deliver strong growth, up nearly 23% year-over-year. Furthermore, the company has made critical strategic moves, launching its first-ever Asian studio in the regulated market of the Philippines and opening a new state-of-the-art studio in Brazil to capitalize on that country's recent regulation.

Stock Price Context

Evolution's stock price reflects this complex narrative. After a phenomenal run, the share price has been range-bound for the last years. The market has effectively de-rated the stock, stripping it of its hyper-growth multiple and re-pricing it as a more mature, slower-growing business. The key debate is whether this de-rating is justified or an overreaction to temporary issues.

Connecting to the Analysis

These recent developments are the bedrock of my investment thesis. The market is fixated on the headline slowdown. My analysis suggests the market is misinterpreting the character of this slowdown. It is treating strategic, long-term investments in compliance (ring-fencing) and temporary operational challenges (cybercrime) as if they are evidence of a permanent structural decline in the core business. This disconnect is the opportunity.

The Business Model & Unit Economics

Revenue Model

Evolution's business model is elegant, scalable, and immensely profitable. It primarily makes money in two ways:

Usage-Based Commission: The vast majority of revenue comes from a revenue-sharing agreement with its operator clients. Evolution takes a commission, typically around 10%, of the Gross Gaming Revenue (GGR), which is the net winnings of the casino operator from Evolution's games. This is a powerful model because it means Evolution's revenue grows directly with the underlying growth of the entire online casino market. As more players play more often, Evolution's revenue naturally increases.

Fixed-Fee "Subscription": For larger operators who want a bespoke experience, Evolution offers dedicated, fully branded tables and environments. For this service, operators pay a fixed monthly fee, which provides a stable and predictable recurring revenue stream.

This is a fundamentally capital-light business. Once a studio is built and a table is live, the incremental cost of adding one more player (or ten thousand more players) to a game like Roulette is virtually zero. This incredible operating leverage is the engine behind the company's phenomenal profitability.

The combination of a usage-based commission and fixed fees creates a powerful hybrid. The long-term contracts with operators, which typically run for three years, combined with extremely high switching costs, give the revenue base a subscription-like quality and predictability. At the same time, the revenue-share component provides direct exposure to the upside of the structurally growing global iGaming market. It is this blend of defensibility and upside potential that makes the business model so compelling.

The Moat: Sustainable Competitive Advantage

Evolution’s competitive advantage is not based on a single factor but on a series of interlocking, self-reinforcing moats that are exceptionally difficult for any competitor to replicate.

Cost Advantages & Scale

This is the deepest part of the moat. Evolution operates at a scale that dwarfs all competitors combined. With a network of global studios, over 1,700 live tables, and more than 22,000 employees, the company's fixed costs are spread across the industry's largest revenue base. This allows Evolution to achieve EBITDA margins above 65% while investing more in new games and technology than all its competitors combined. A new entrant would face a brutal reality: they would need to burn hundreds of millions of euros for years to build a comparable studio network and game portfolio, all while trying to compete on price against an incumbent whose marginal costs are near zero. It is an almost impossible task.

Network Effects

The business benefits from a powerful two-sided network effect.

Players are drawn to online casinos that offer the best, most engaging, and most popular games. Today, that means Evolution's portfolio, especially its unique game shows.

Operators, therefore, must feature Evolution's games on their sites to attract and retain those players.

This creates a virtuous cycle. The more operators that join Evolution's network, the more players have access to their games. This increases the player pool, making the games more liquid and exciting, which in turn makes the network more valuable for all operators. This flywheel also generates a massive proprietary data set on player behavior, which Evolution uses to refine existing games and develop new hits, further strengthening its product advantage.

Switching Costs

For an online casino operator, removing Evolution's games from their offering would be the equivalent of a grocery store deciding to stop selling Coca-Cola. It would be commercial suicide. Players who love games like Crazy Time or Lightning Roulette would simply migrate to a competing site that still offers them. The technical integration of Evolution's platform into the operator's own systems also creates friction and cost, but the primary switching cost is the massive and immediate loss of revenue an operator would suffer.

Proprietary Technology & Innovation

Evolution is, at its core, an entertainment and technology company. Its brand promise is to be "as real as it gets". The company's relentless focus on product innovation is a key differentiator. They are not simply streaming card games; they are creating entirely new forms of entertainment. Their announced product roadmap for 2025 includes over 110 new games, a pace of innovation that no competitor can match. This constant stream of new, engaging content keeps the player experience fresh and reinforces the idea among operators that Evolution is the indispensable engine of the online casino floor.

Regulatory & Legal Barriers

While often cited as a risk, regulation is also becoming a significant barrier to entry that protects incumbents. Acquiring the necessary licenses to operate in tightly regulated jurisdictions like New Jersey, Michigan, or the Philippines is an expensive, complex, and time-consuming process. Evolution has built a global compliance infrastructure and a proven track record of successfully entering these markets, creating a significant hurdle for smaller or newer competitors to overcome.

The Investment Thesis: The 3-5 Year Outlook

My core thesis is that over the next 5 years, the market narrative will shift away from the current focus on slowing growth and back toward an appreciation of Evolution's durable dominance and compounding power. I see four key drivers that will propel the business to a significantly higher valuation by 2030.

Key Driver 1: The North American Gold Rush

The online casino market in the United States is still in its very early innings. Legalization is proceeding on a state-by-state basis, and Evolution is perfectly positioned as the essential B2B partner. As of Q2 2025, the company is already live in all seven US states that currently offer online casino gaming. I believe the market is underestimating the long-term potential here. As more states inevitably turn to iGaming as a source of tax revenue, Evolution will be a primary beneficiary. Each new state that comes online represents a multi-year growth runway, and Evolution's established presence and regulatory expertise make it the default choice for operators entering these new markets.

Key Driver 2: New Frontiers in Latin America and Asia

While North America gets the headlines, the long-term potential in Latin America and Asia is arguably even larger. The company's recent strategic moves are clear indicators of its focus. The launch of a new, state-of-the-art studio in Brazil is perfectly timed to capitalize on that country's recent move to regulate online gaming. In Asia, while the cybercrime issues have been a headwind, the opening of their first-ever Asian studio in the regulated Philippine market is a landmark event. These studios are not just operational assets; they are strategic beachheads in two of the world's most populous regions. I expect these markets to be the primary engine of the company's growth as we approach the end of the decade.

Key Driver 3: Widening the Gap Through Innovation

Evolution's strategy is not just to maintain its lead but to actively "increase the gap" to its competitors. The product pipeline of over 110 new games in 2025 is central to this. A critical development here is the groundbreaking exclusive global licensing agreement with Hasbro, which begins in 2025. For the past two decades, this license belonged to a competitor. Now, Evolution will be the exclusive provider of online casino games for iconic brands like MONOPOLY, which have already proven to be massive hits in the game show format. This deal provides Evolution with a portfolio of unique, world-famous IP that cannot be replicated, further strengthening its value proposition to operators and its moat against competitors.

Key Driver 4: The Underappreciated RNG Turnaround

The RNG (slots) segment has been a clear drag on growth since the acquisitions of NetEnt and Red Tiger. The performance has been lackluster, and management has been transparent about the challenges. However, they are actively working on a turnaround. The continued strong performance of the Nolimit City brand, which was part of a smaller acquisition, serves as a proof of concept for what is possible within their RNG portfolio. My thesis does not require a heroic turnaround in this segment. I simply assume that over the next 5 years, management will successfully streamline the portfolio and return the division to modest, market-rate growth. If they achieve this, it will remove a significant drag on the group's overall growth rate and provide an underappreciated source of upside to the investment case.

Management & Capital Allocation

Leadership

The company is led by CEO Martin Carlesund, who has been in the role since 2016. My assessment from reviewing years of earnings calls and interviews is that he is a no-nonsense, operationally focused leader. He is direct about the company's challenges, as seen in his recent comments on the growth slowdown, but also projects a clear, long-term vision to "build the best company in the world".

Most importantly, his actions demonstrate profound conviction. In a series of transactions in June 2025, Carlesund purchased over SEK 33.6 million (approx. EUR 3 million) worth of Evolution shares on the open market. This is not a token purchase. For a CEO to be buying this aggressively in the face of a weak stock price and a negative market narrative is one of the most powerful bullish signals an investor can ask for.

The company also benefits from the continued involvement of its founders. Jens von Bahr serves as Chairman of the Board, and Fredrik Österberg also remains a director. This ensures that an owner-operator mindset, focused on long-term value creation, continues to permeate the company's culture and strategic decisions.

Capital Allocation

Evolution is a cash-gushing machine, and management has a clear, disciplined, and exceptionally shareholder-friendly framework for allocating that cash. The policy, formally adopted in July 2024, prioritizes capital allocation in the following order :

Organic Growth: The first priority is always to reinvest in the business to widen the moat and pursue growth. This includes developing new games and building new studios.

Dividends: The company maintains its policy of distributing a minimum of 50% of net profit as an annual dividend. For 2024, the board proposed a dividend of EUR 2.80 per share.

Strategic M&A: The company will consider acquisitions but has "no set annual amount" allocated and will only act if presented with a compelling, value-enhancing opportunity.

Share Buybacks: Crucially, the board has committed to distributing 100% of all excess cash (after the above priorities) to shareholders, primarily through share repurchases.

This is not just a theoretical policy. The company completed a EUR 400 million buyback program in 2024 and has authorized a new, even larger EUR 500 million program for 2025. This disciplined return of capital provides a strong underpin to shareholder returns and demonstrates a management team that views shareholders as true partners.

Valuation: A Triangulated Approach

To arrive at a defensible valuation, I will employ a triangulated methodology. The core of my analysis is a multiple approach based on my proprietary financial projections. I will develop three distinct scenarios; Base, Bull, and Bear, to model a range of potential outcomes. The fundamental analysis is contextualized through a careful valuation against a relevant peer group.

Relative Valuation

Evolution is a rare asset as a B2B technology provider with a dominant market position, a formidable competitive moat, and software-like margins. A simple screen of "gaming" companies is therefore inadequate. My peer group is intentionally selected to provide relevant benchmarks and is divided into two tiers: Tier 1 B2B iGaming & Technology Suppliers, which are the closest operational comparables, and Tier 2 B2C Online Operators, which serve as crucial barometers for ecosystem health.

Tier 1: B2B iGaming & Technology Suppliers (Core Comparables)

Playtech (PTEC.L): Often cited as Evolution's closest peer, I see Playtech more as a cautionary tale that highlights the value of Evolution's focused execution. Playtech is in the midst of a strategic pivot to become a "predominantly pure-play B2B business". This transition is proving difficult. Its H1 2025 adjusted EBITDA guidance of at least €90 million is underwhelming. Consensus forecasts point to low single-digit revenue growth in the coming years. The struggles of this legacy player to replicate Evolution's model underscore the deep, structural nature of EVO's competitive advantages.

Light & Wonder (LNW): A high-quality peer that has successfully transformed from the legacy Scientific Games into a diversified gaming technology powerhouse. LNW operates across land-based gaming, iGaming, and social gaming, providing a broad view of the industry. Its financial performance is strong, with FY2025 Adjusted EBITDA guidance of approximately $1.45 billion and a robust 44% Adj. EBITDA margin reported in Q2 2025. LNW serves as an excellent benchmark for a well-managed, scaled supplier. However, its margins remain over 2,000 basis points below Evolution's, a quality gap that must be considered in any valuation comparison.

Aristocrat Leisure (ALL.AX): The undisputed global leader in land-based slot machines, Aristocrat is now making a formidable push into online Real Money Gaming (RMG) through its strategic acquisition of NeoGames. Its H1 2025 results were impressive, delivering a 41.1% EBITDA margin on the back of continued strength in its North American gaming operations. Aristocrat represents a scaled, profitable, and disciplined gaming technology supplier. Its current valuation, with an LTM EV/EBITDA multiple around 17-18x, provides a critical data point for what a premium, albeit lower-margin, supplier can command in the public markets.

Kambi Group (KAMBI.ST): I include Kambi, a pure-play B2B sportsbook provider, primarily to illustrate the superior economics of the Live Casino vertical where Evolution dominates. Kambi faces intense competition and significant pricing pressure, which is reflected in its declining Q2 2025 revenue and a weak EBITA margin of just 9.2%. Kambi's financial struggles put Evolution's sustained 65%+ EBITDA margins into stark relief and demonstrate the value of operating in a less commoditized segment of the market.

Tier 2: B2C Online Operators (Ecosystem Barometers)

DraftKings (DKNG) & Flutter (FLTR): These two giants form the duopoly in the critical and rapidly growing U.S. online sports betting and iGaming market. They are among Evolution's most important customers. Their financial health, aggressive growth trajectories (DraftKings reported 37% revenue growth in Q2 2025), and public commentary on the iGaming opportunity serve as leading indicators for a key pillar of my investment thesis. While their B2C business models and nascent profitability profiles are fundamentally different from Evolution's, their multi-billion-dollar market capitalizations underscore the immense total addressable market that Evolution is uniquely positioned to supply.

The table below summarizes the current financial standing of this peer group based on Next Twelve Months (NTM) consensus estimates.

Note: Data as of early August 2025. Market Cap and EV converted to USD for comparison. NTM estimates are based on consensus forecasts from sources. Evolution's metrics are based on LTM data where NTM is not explicitly available, adjusted for recent performance.

The core of the relative value argument is the glaring disconnect between operational superiority and valuation. Evolution's LTM EBITDA margin of approximately 66% is structurally superior, not cyclically high, standing a full 2,000+ basis points above its best-in-class peers like Light & Wonder and Aristocrat. A company with such a profound margin advantage, a wider competitive moat, and a more scalable capital-light business model should, all else being equal, command a significant valuation premium. Yet, the market is currently ignoring this fundamental principle. It has become fixated on a temporary growth deceleration caused by proactive, long-term strategic decisions, namely, regulatory "ring-fencing" in certain European markets and addressing cyberattack disruptions in Asia. This has created an unsustainable anomaly where the highest-quality asset in the sector trades at a valuation multiple (NTM EV/EBITDA of ~10.4x) that is in line with or at a discount to its lower-margin peers.

As growth inevitably re-accelerates, a significant re-rating is not just possible, but logical. This peer set provides the primary evidence to justify a Base Case exit multiple for Evolution that is at a material premium to its B2B supplier comparables.

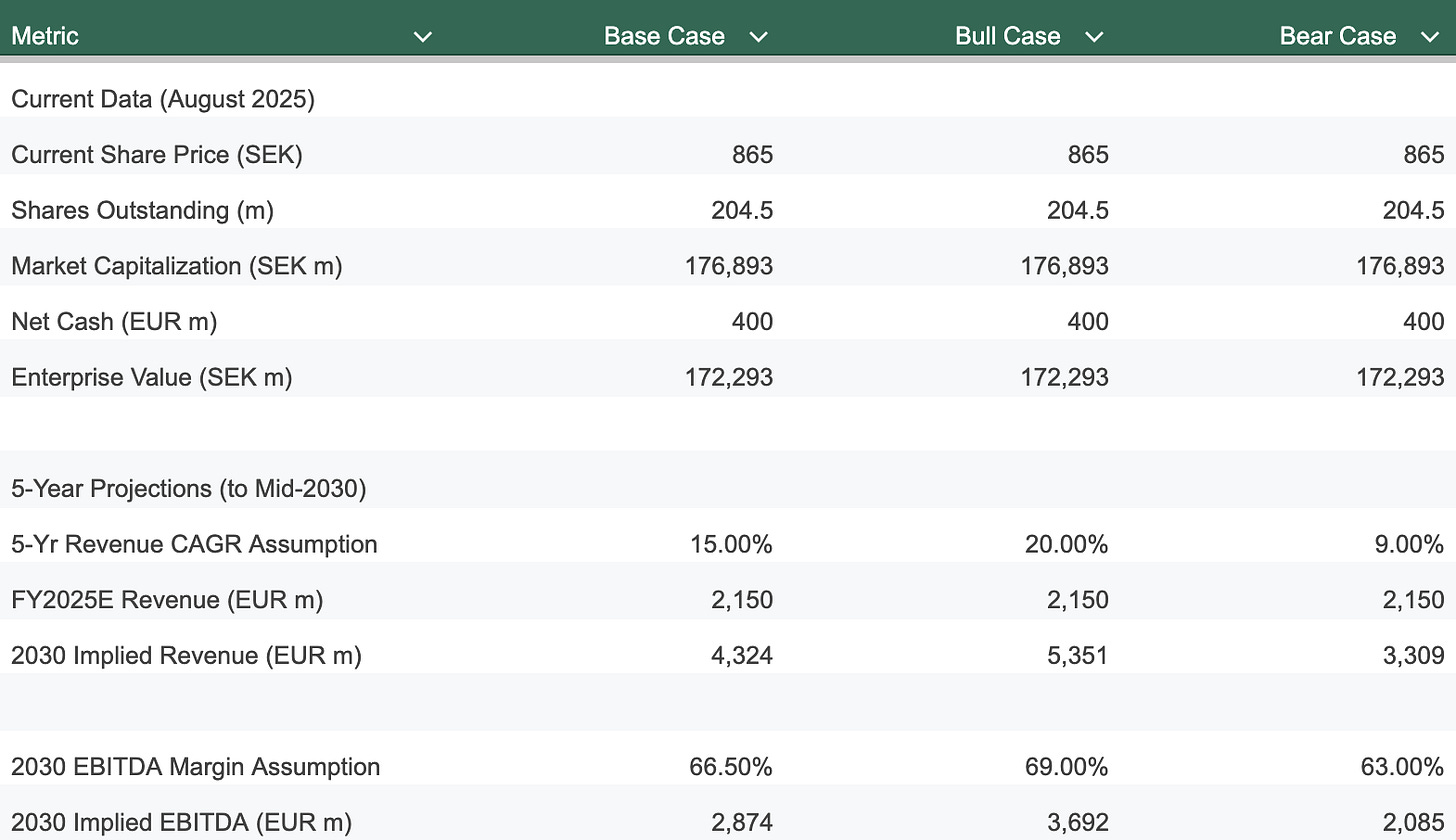

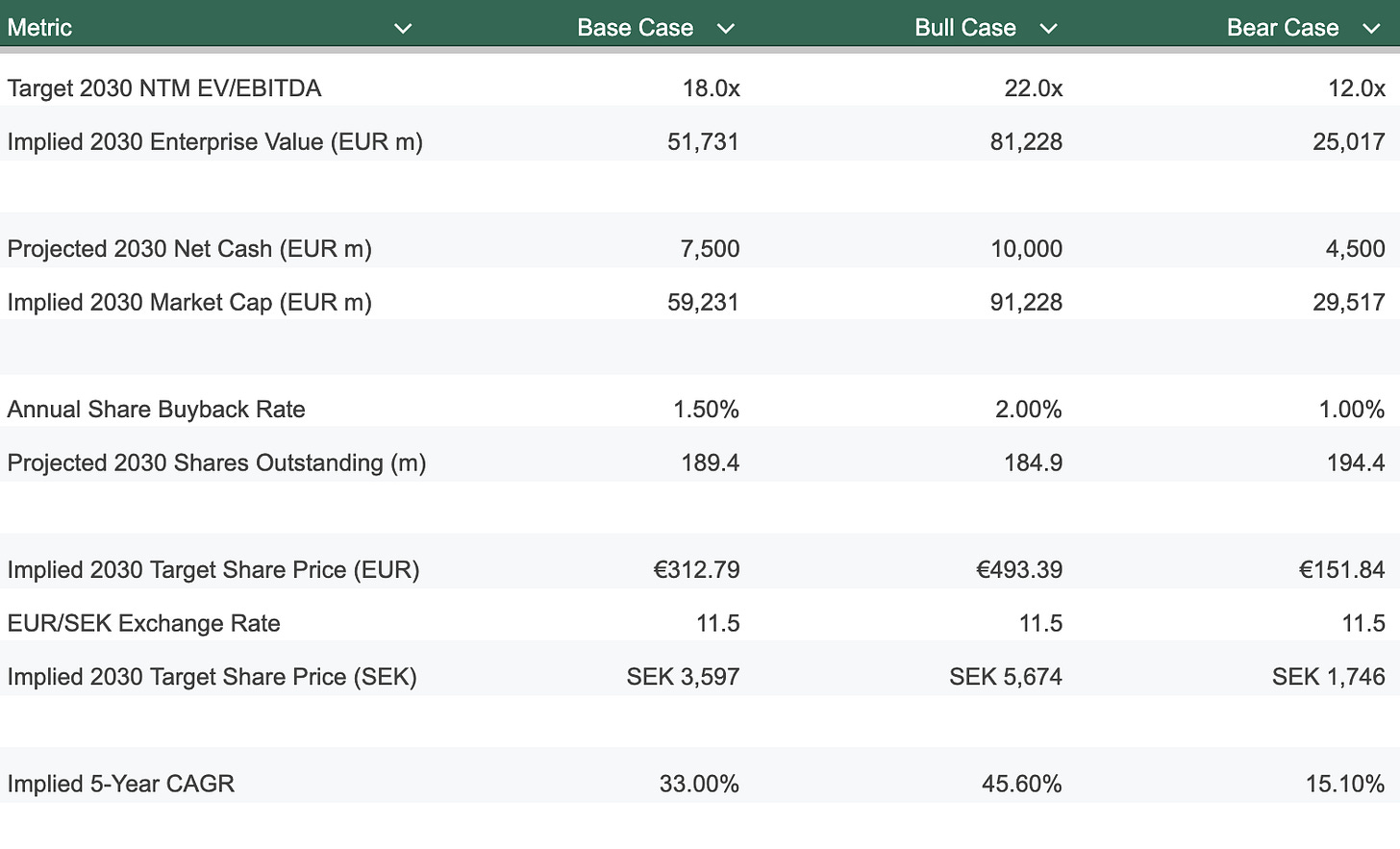

Triangulated Valuation & Scenarios for 2030

My valuation is anchored in a five-year forecast, projecting Evolution's performance out to mid-2030. I utilize the NTM EV/EBITDA multiple as my primary valuation tool. This metric is the industry standard for profitable companies in this sector and is well-supported by available research and transaction precedents. The choice of a forward-looking multiple is deliberate; it aligns the valuation with future potential rather than backward-looking performance, which is particularly relevant given Evolution is at an inflection point after a period of slower growth. My financial projections are built around three distinct scenarios, each with a clear narrative and a set of explicit assumptions about revenue growth, profitability, and the terminal valuation multiple the market will assign in 2030.

A critical, and often underappreciated, component of the equity return story is capital allocation. Evolution's management has demonstrated a clear shift from large-scale M&A towards consistent and aggressive share buybacks, having repurchased €154.1 million in Q1 and €65.4 million in Q2 of 2025 alone. At the current depressed share price, these buybacks are highly accretive to per-share value. Over a five-year horizon, this consistent reduction in the share count acts as a powerful multiplier on the final share price. My valuation model explicitly forecasts a declining share count in all three scenarios, providing a crucial tailwind to the final CAGR calculation and reflecting a more nuanced understanding of total shareholder return beyond just operational growth.

Scenario Assumptions

Base Case: The compounding machine re-accelerates

Narrative: This scenario assumes management successfully navigates the current headwinds. The negative financial impact of European ring-fencing and Asian cyberattacks is fully annualized by early 2026. Growth re-accelerates, driven by the powerful combination of a robust product pipeline (over 110 new games planned for 2025), continued market share gains in North America, and the successful scaling of new studios in high-growth regions like Brazil and the Philippines.

Key Assumptions: I model a 15% revenue CAGR from FY2025 to mid-2030. This is a significant step-up from the ~7% consensus growth for FY2025 but is a reasonable expectation given the multiple growth levers and the law of large numbers. I assume a stable EBITDA margin of 66.5%, which sits comfortably within management's guided 66-68% range and balances the natural operating leverage of the business with necessary investments in new studios and technology.

For the exit multiple, I assign a 2030 NTM EV/EBITDA of 18.0x, reflecting a re-rating back to a premium valuation justified by its superior margins and market leadership, placing it above where peers like Aristocrat trade today.

Bull Case: Flawless execution & market expansion

Narrative: The Base Case scenario plays out, but faster and more powerfully. Key U.S. states like New York and Illinois legalize iGaming, significantly expanding the total addressable market. The RNG product pipeline delivers several blockbuster hits that become meaningful contributors to top-line growth, exceeding current expectations. The new studios in Latin America and Asia scale faster and more profitably than anticipated.

Key Assumptions: I model a more aggressive 20% revenue CAGR for the period. EBITDA margins expand to 69.0% as the highly profitable Live Casino segment benefits from operating leverage in new markets and the RNG business achieves scale.

The market recognizes Evolution as a premier, high-growth global technology platform, awarding it a 22.0x NTM EV/EBITDA multiple, a level that approaches its historical highs but remains justifiable given the growth and margin profile.

Bear Case: The slowdown lingers

Narrative: The "temporary" headwinds of 2025 prove to be more structural. Regulatory pressures in core European markets intensify, and new market openings are slower or more restrictive than currently anticipated. The RNG segment fails to produce meaningful growth, and increased competition from well-capitalized peers like Light & Wonder and Aristocrat begins to erode market share and pricing power at the edges.

Key Assumptions: I model a disappointing 9% revenue CAGR, reflecting a failure to meaningfully re-accelerate beyond the current trend. EBITDA margins compress to 63.0% due to a combination of increased compliance costs, higher marketing and R&D spend to defend market share, and a general lack of operating leverage.

The stock remains in the "penalty box," and the market continues to value it as a mature, low-growth cash cow. I assign a 12.0x NTM EV/EBITDA multiple, only a slight premium to its current depressed level.

The following table synthesizes these narratives and assumptions into a comprehensive five-year valuation model.

Conclusion on Valuation

My analysis presents a range of potential outcomes, from a Bear Case CAGR of 15.1% that falls short of our hurdle rate to a Bull Case CAGR of 45.6% that would represent a grand slam. Even in the Bear Case, the company's immense profitability and cash flow generation provide a significant cushion, limiting the absolute downside risk. However, my conviction lies firmly with the Base Case. The confluence of factors, 1) a dominant and defensible market position 2) a clear and tangible path to growth re-acceleration, with unparalleled and durable profitability, and 3) a management team making rational capital allocation decisions, provides an exceptionally compelling setup for long-term investors. The market's current pessimism is an opportunity, not a permanent state of affairs.

My Base Case projects a mid-2030 fair value estimate of SEK 3,597 per share. This implies a 5-Year CAGR of 33.0% from the current share price of approximately SEK 865.

Based on this analysis, I conclude that Evolution AB decisively meets the Fjord Alpha target of generating 20%+ annual returns and represents a compelling long-term investment opportunity at the current valuation.

The Pre-Mortem: A Case for Failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. The stock is trading at SEK 450. Working backward from this failed future, what went wrong?

Regulatory strangulation. This is the most plausible path to failure. Our thesis assumed that regulation would be a net positive, creating barriers to entry. We were wrong. A wave of populism led to a coordinated global clampdown on online gambling. Instead of the favorable GGR-share model, key markets like the US implemented a "turnover tax" or high fixed license fees. This completely destroyed the unit economics for B2B suppliers. Simultaneously, strict player protection rules (e.g., low stake limits, bans on popular game features) were introduced, which dramatically reduced player engagement and the overall size of the market. Evolution's revenue and margins collapsed.

The Asian challenges were permanent. We believed the cyber-attacks in Asia were a temporary, solvable technical problem. In reality, they were a symptom of a fundamentally hostile and legally opaque operating environment. The stream-hijacking became more sophisticated, and Evolution found itself in a costly and unwinnable technological arms race. Revenue from the region never recovered, and the investment in the new Philippines studio was eventually written down.

The moat was not there. We overestimated the durability of Evolution's competitive advantages. A well-funded competitor, perhaps a spin-off from a major tech company, finally created a "good enough" live casino product. Tired of Evolution's pricing power and dominant position, a consortium of large operators banded together to support this new rival, shifting significant volume away from Evolution. This broke the network effect, and the industry devolved into a price-based competition, leading to severe margin compression for Evolution.

Reputational meltdown. The risks of operating in unregulated "grey" markets, which we had discounted, finally came home to roost. A major scandal involving money laundering or widespread problem gambling linked directly to Evolution's platform in one of these markets became a global headline. This triggered license reviews in key regulated markets like the UK and New Jersey. To protect their own brands, major operators began de-platforming Evolution's games, leading to a cascading loss of revenue and trust.

Conclusion: The Final Verdict

My analysis of Evolution AB leads me to a clear and conviction-driven conclusion: this is a world-class business with an exceptionally deep and widening moat, trading at a deeply misunderstood valuation due to market anxiety over a temporary and strategic slowdown in growth.

The evidence supporting the long-term health of the business is compelling. The unparalleled scale advantages, powerful network effects, and relentless product innovation create a fortress that is, in my view, almost unbreachable. The company is led by a highly-aligned and operationally-astute management team that is actively buying its own stock and is committed to a disciplined and shareholder-friendly capital allocation framework. The growth runways in the Americas and Asia remain vast and are only in their early stages.

The risks, while real, appear manageable and more than priced in. The slowdown in Europe is a strategic choice to build a more sustainable business, and the challenges in Asia are being actively addressed. Based on my valuation work, the current share price offers a favorable asymmetric return profile, with a clear path to mid-teens annual returns in my base case and limited downside in a more pessimistic scenario.

The market is offering a rare chance to acquire a dominant, high-return global leader at a price that does not reflect its long-term compounding potential. My Base Case projects a mid-2030 fair value estimate of SEK 3,597 per share, implying a 5-Year CAGR of 33.0%. This decisively meets the Fjord Alpha target of generating 20%+ annual returns and represents a compelling long-term investment opportunity.

I believe that five years from now, we will look back at the current period of uncertainty not as the beginning of the end for Evolution, but as the last best chance to board a durable compounding machine before its next chapter of growth became obvious to all.

✅ Thesis Pillar 1: A near-monopolistic B2B provider with a multi-layered moat (scale, network effects, innovation) that is widening, not shrinking.

✅ Thesis Pillar 2: Multiple untapped growth runways in North America, Latin America, and Asia will re-accelerate growth as temporary headwinds subside.

✅ Thesis Pillar 3: Exceptionally shareholder-aligned management team executing a clear and disciplined capital allocation framework of dividends and aggressive buybacks.

⚠️ Key Risk (from Pre-Mortem): A fundamental shift in global regulation towards a model that is hostile to the B2B revenue-share structure, permanently impairing the company's profitability.

🎯 Target Price (Base Case): SEK 3,597 by 2030.

📈 Implied 5-Year CAGR (Base Case): ~33%.

Primary Sources Used:

Evolution AB: Year-end report 2024

Evolution AB: Interim report January-June 2025

Evolution AB: Q1 2025 Earnings Call Transcript

Evolution AB: Q2 2025 Earnings Call Transcript

Evolution AB: Q2 2025 Investor Presentation

Evolution AB: Press Releases on Capital Allocation and Share Repurchases (2024-2025)

Great read! Well structured, detailed and not beating around the bush. I subscribed. I must say that I think the valuation you came up with is a bit rich, however I do agree that the current price is a good point of entry. Certainly if you want to hold for the long term (10 years).

nice i made a post too not too long ago 🤍