Vitec Software Q3-25: A mixed bag, but investment thesis remains

Short-term noise continues for Vitec, mainly related to a non-core part of the business, but underlying, the engine keeps humming

The good and the bad

This was, on the surface, a disappointing quarter, and the 4-5% stock drop was an understandable reaction. The headline EBITA margin miss was real, confirming that the volatility in the non-core Enova unit is a persistent and frustrating problem.

However, this report perfectly illustrates the importance of the original thesis - which you can read here: Vitec Software: A Swedish Constellation Software. My thesis was never about perfect, linear earnings. Rather it was about a “Swedish Constellation” built on a decentralized VMS engine that generates cash to fund a disciplined M&A roll-up.

Viewed through that lens, the thesis remains intact. The “disappointment” was isolated to the non-core, non-VMS part of the business.

The core VMS engine itself, as measured by the all-important Cash EBIT (Vitec’s own key measure of profitability, similar to Carasent’s measure of EBITDA less capex), was strong, growing 9.8%. The M&A engine also proved it is still running with the NMG acquisition right after the quarter’s end, adding about SEK 100 million of yearly revenue.

Key numbers at a glance

Net Sales: SEK 855m (+6% YoY) - Missed consensus at SEK 895m

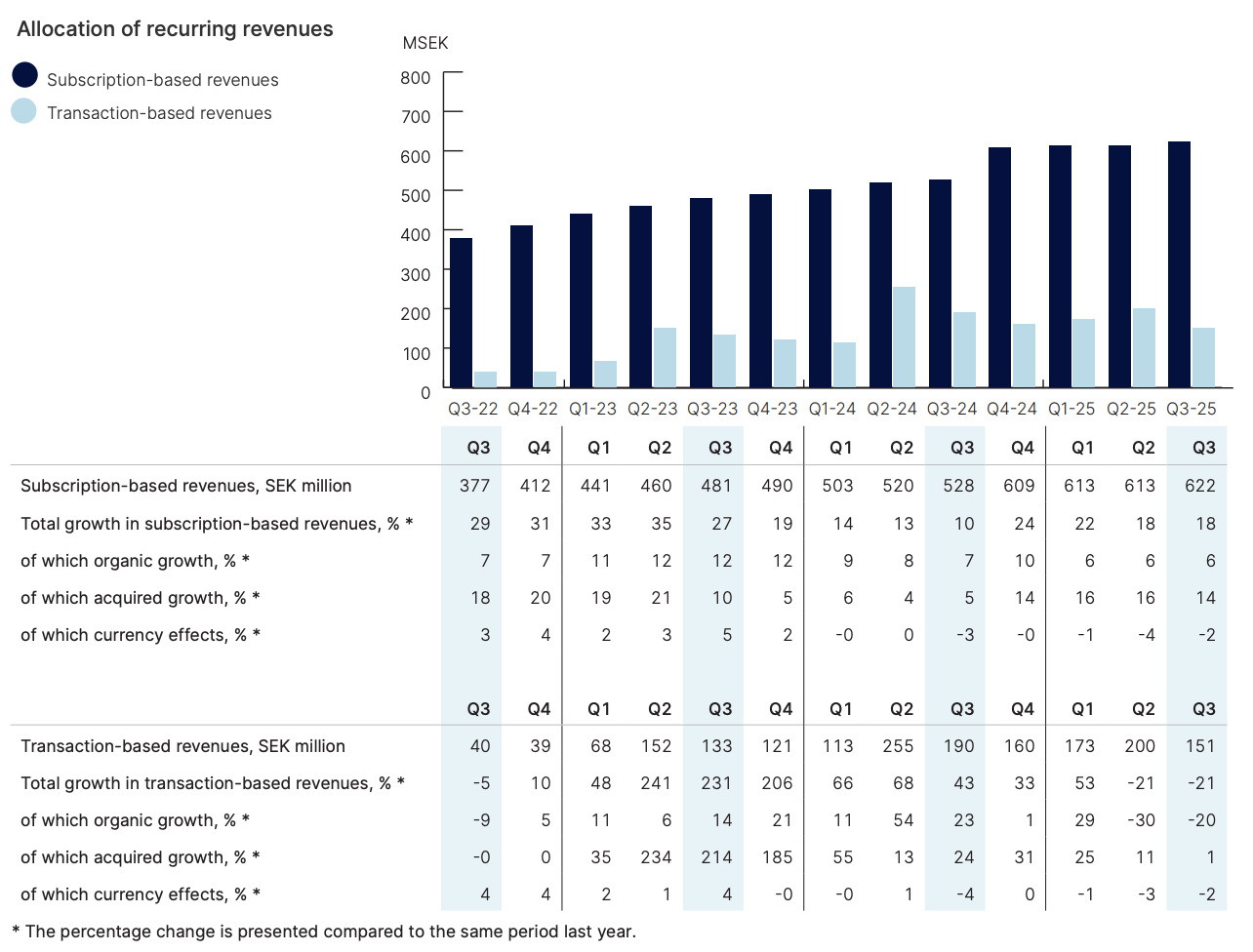

Recurring subscription revenue growth: +18% YoY

Reported EBITA: SEK 235m (-5% YoY) - Likely the main source of disappointment, missed consensus at SEK 247m

EBITA Margin: 28% (down from 31% in Q3 2024)

Cash EBIT: SEK 212m (10% YoY) - The core thesis metric, which was strong

Note: Consensus data from Modular Finance.

My key take-aways

The disappointment was real, but contained: There’s no sugar-coating the EBITA miss. It was driven entirely by the transaction-based Enova unit (impacting gross profit negatively by SEK 11 million), which continues to be a volatile headache. This is a clear negative and explains the market’s reaction.

Cash EBIT accelerated: Our thesis is built on Vitec’s VMS units generating cash. Reported EBITA is skewed by accounting. The truest measure of underlying profitability, Cash EBIT, surged 9.8%. This confirms the core business is healthy and performing its function perfectly.

The “Constellation” playbook continues: Management’s actions prove their focus has not wavered. They used the strength of the core business to execute the NMG acquisition in Poland, expanding the VMS footprint. This is the thesis in action.

Outlook into Q4

This quarter’s noise is precisely why we have the “Swedish Constellation” thesis in the first place. We need to separate the long-term compounding signal from short-term operational volatility. The market sold off on the volatility (Enova), which is fair. But long-term investors should focus on the signal (Cash EBIT and M&A).

The thesis remains as before: Vitec is a high-quality compounder, and this quarter’s “disappointing” headline miss, driven by a non-core issue, does not change that fundamental truth. The current 4-5% dip looks more like a buying opportunity, offering a chance to add for those who share that conviction.