Vitec Software: A Swedish Constellation Software

After a 40% drawdown, the market is questioning the M&A playbook. I believe it's missing the durability of the underlying engine, and the valuation is now attractive.

Executive Summary

Vitec Software AB, a high-quality serial acquirer of Vertical Market Software (VMS), is currently mispriced. The market is overly focused on a cyclical slowdown in its small transaction-based revenue segment and recent equity raises, while ignoring the resilience of its core subscription business and its strengthened balance sheet for future M&A. This has created a dislocation between price and long-term value. I believe the market is extrapolating a temporary issue across a durable, high-moat portfolio, offering a rare opportunity to acquire a premier European compounder at a significant discount to its intrinsic value.

My base case projects a fair value of SEK 1,003 per share by mid-2030, implying a 5-year CAGR of approximately 23%. The single most important risk to this thesis is a structural decline in the returns on acquired capital, which would impair the company's proven compounding engine.

The puzzle of a stumbling compounder

I've always had a soft spot for the quiet compounders of the Nordics, businesses that decline glamour for the steady, relentless rhythm of value creation. Vitec Software, born from a university dorm room in Umeå, has been a textbook example for decades. It is a machine designed to do one thing exceptionally well. They acquire small, sticky, mission-critical software businesses, provide them with a permanent home, and reinvest the cash flows into the next acquisition. It is a simple, powerful, and proven model.

In 2025, the drumbeat has been different. Growth has stalled, margins now compressed, and the stock tumbling to 52-week lows. The market narrative shifted. This is precisely the kind of dislocation that sparks my interest. The market hates uncertainty, and Vitec's latest report was filled with it.

My task in this memo is to dissect this narrative. Is the market right to be so pessimistic, or is this a temporary squall for a fundamentally durable ship? To find out, I have gone deep into the numbers, the strategy, and the management's own words. Happy reading!

The Setup: Key Data & Investment Thesis

💰 Stock Price: SEK 362.20

📄 Shares Outstanding: 39.89 million

🏢 Market Cap: SEK 14.45B (approx. EUR 1.3B)

🏦 Net Debt: SEK 2.25B

🌐 Enterprise Value: SEK 16.70B (approx. EUR 1.5B)

⚙️ Sector/Industry: Technology / Vertical Market Software

💡 Investment Thesis: The market is punishing Vitec for a temporary, cyclical issue in a small part of its business, creating a compelling opportunity to buy one of Europe's most consistent VMS compounders at a significant discount to its intrinsic value.

Sourcing: Company Q2 2025 Interim Report, Company Filings as of August 2025.

The Business: History & Operations

Origin Story: The Umeå University spinoff that conquered the Nordics

Vitec's story doesn't begin in a slick Stockholm boardroom, but in a university lunch line in Umeå in 1984. As founder Lars Stenlund tells it, he and his fellow research student Olov Sandberg were looking for a hobby. Their ambitious goal, born out of the 1970s oil crisis, was to "save Sweden from the energy crisis" by developing software for property owners to monitor energy consumption. Working in Turbo Pascal on beige Ericsson PCs, they built a product that, by the spring of 1985, had attracted commercial interest. Vitec was born.

This origin is more than just a charming anecdote; it's the DNA of the company. It was founded by engineers to solve a specific, niche problem. This ethos has defined its trajectory ever since. After going public in 1998, Vitec formalized its acquisition-driven growth strategy in 2003. The expansion was patient and deliberate: the first acquisition outside Sweden came in 2011, and the first outside the Nordics (in the Netherlands) wasn't until 2021. This is not a company that rushes. It is a company that builds, methodically.

What they actually do

To understand Vitec, it's best to think of it not as a single software company, but as a federation of specialists. Vitec's business model is to acquire and perpetually hold small, profitable software companies that are leaders in specific, narrow ("vertical") markets. Today, this federation consists of 45 independent business units spread across more than 20 different verticals.

These are not glamorous, high-growth startups. They are the digital backbone of mature industries: software for pharmacies (Vitec Cito), ERP systems for the laundry industry (ABS), booking systems for taxi companies (Taxiteknik), and management software for real estate brokers and property managers. These products are mission-critical. As the company states, "In all honesty, there are many businesses that would stop without Vitec".

The magic of the model lies in its decentralized structure. When Vitec acquires a company, it doesn't absorb it into a corporate blob. The acquired company continues to operate with a high degree of autonomy, retaining its brand, culture, and deep industry expertise. The parent company, Vitec Group, provides three crucial things: capital for growth, strategic oversight, and a framework for sharing best practices (what they call the "Vitec culture"). It does not meddle in daily operations. This model allows Vitec to be both large and agile, benefiting from scale while preserving the entrepreneurial spirit that made its acquisitions successful in the first place.

Recent Developments & Performance

Business Update: A Tale of Two Tapes

To understand the current opportunity in Vitec, you have to look at two starkly different periods: the stellar full-year 2024 and the concerning second quarter of 2025.

First, the strong tape from 2024. The company delivered a record year. Net sales grew a robust 20% to SEK 3,334 million, a healthy blend of 9% organic and 11% acquired growth. EBITA increased by 14% to SEK 1,002 million, and earnings per share were up 19%. Most impressively, cash flow from operating activities surged by 45% to SEK 1,041 million. By all measures, the compounding machine was running beautifully.

Then came the second quarter of 2025, and the tape turned ugly. Net sales growth slowed to just 4%, reaching SEK 916 million. More alarmingly, EBITA declined by 11% to SEK 236 million, causing the EBITA margin to compress significantly from 30% in the prior year to just 26%.

My initial read on this was concern. A double-digit profit decline in a software business is a major red flag. However, the explanation from management on the Q2 2025 report provides crucial context. CEO Olle Backman attributed the weakness to an "uncertain global situation" that specifically impacted the smaller, more volatile part of the business: transaction-based revenues. One unit in particular, Vitec Enova, which provides software for energy grid management, had an exceptionally strong Q2 in 2024 due to high volumes and prices in the energy balance market. The Q2 2025 numbers were simply normalizing against an unusually tough comparison.

Stock Price Context

The market has reacted harshly to this slowdown. Over the past 12 months, Vitec's stock has fallen by more than 30%, hitting new 52-week lows in the wake of the Q2 earnings release. This sharp decline tells me that the market is pricing in a significant and potentially permanent deterioration of the business model. The narrative has shifted from celebrating a consistent compounder to fearing a broken growth story.

Connecting to the Analysis

What the market seems to be missing is the composition of the revenue decline. The market sees a 4% headline growth number and an 11% EBITA decline and sells. But digging into the Q2 2025 report reveals a more nuanced picture. Vitec breaks its recurring revenue into two categories:

Subscription-based revenue: This is the core, stable engine. In Q2, it grew impressively from SEK 520 million to SEK 613 million, an increase of roughly 18%.

Transaction-based revenue: This is the smaller, volatile part. In Q2, it fell from SEK 255 million to SEK 200 million, a decline of about 21%.

This breakdown is the key to my thesis. The negative headline numbers are being driven entirely by a predictable normalization in a smaller, non-core revenue stream. The larger, more important, and more profitable subscription business remains remarkably healthy. The market is making a category error, confusing a cyclical issue in one part of the portfolio with a structural problem in the whole.

The Business Model & Unit Economics

Revenue Model

Vitec's business model is built on a foundation of highly predictable, recurring revenues. For the full year 2024, recurring revenues accounted for 87% of total sales. This is the lifeblood of the company, providing the stable cash flow needed to reinvest in products and fund future acquisitions.

As noted, this recurring revenue is split between subscriptions and transactions. The vast majority is subscription-based, typically billed in advance, which provides exceptional visibility and stability. This is the crown jewel of the model. The smaller transaction-based portion is linked to customer activity levels, which introduces an element of cyclicality, as the recent Vitec Enova performance demonstrates. While this can create quarterly noise, the overwhelming stability of the subscription base defines the company's financial profile.

The Power of ~110% Net Revenue Retention

Vitec doesn't report Net Revenue Retention (NRR) directly, but they provide a good proxy: "organic growth in subscription-based recurring revenues calculated on a rolling 12-month basis." For the first quarter of 2024, management described this as a "solid organic growth of 10%".

This is a critical data point that the market seems to be ignoring. An organic growth rate of 10% on the existing customer base is effectively an NRR of 110%. This indicates two things: customer churn is very low, and Vitec is successfully upselling additional modules and implementing price increases. Most of these price adjustments are contractually linked to inflation (CPI), providing a built-in hedge and demonstrating significant pricing power. This is the key assumption you have to believe: that despite the recent headline noise, the core economic engine of Vitec, its ability to retain and expand revenue from its existing, sticky customer base, is not only intact but performing at a high level. An NRR of 110% is a hallmark of a high-quality software business, and it provides a powerful, compounding tailwind to growth.

The Moat: Sustainable Competitive Advantage

Vitec's competitive advantage, its 'moat', is not a single attribute but a powerful combination of factors that reinforce each other. It's a fortress built not from one thick wall, but from a thousand interconnected niches.

Extreme Switching Costs: The Primary Moat

The most powerful element of Vitec's moat is extremely high switching costs. The software provided by its business units is described by the company as "mission-critical" and is deeply embedded in the daily workflows of its customers. This isn't discretionary software; it's the system that runs the pharmacy, manages the real estate portfolio, or dispatches the emergency vehicles. Very similar to the situation of Carasent AB, analyzed by yours truly last week.

Furthermore, the cost of this software typically represents a tiny fraction of a customer's total operating budget, often less than 1%. The operational risk, business disruption, and retraining costs associated with ripping out an embedded system and replacing it are enormous. Therefore, customers are highly unlikely to switch providers to save a small amount of money, given the immense risk of disrupting their entire business. This dynamic creates tremendous customer inertia, which translates into very low churn, predictable revenue streams, and significant pricing power.

Unique Resources & Distribution: The M&A Moat

Vitec's second moat lies in its M&A strategy. Its brand as a "permanent home" for acquired companies is a unique and valuable asset. Unlike a typical private equity buyer, Vitec does not acquire companies with the intention of flipping them in 3-5 years. They buy to hold forever. This makes Vitec a highly attractive acquirer for founders who care about the long-term future of their employees and their legacy.

This value proposition is reinforced by the decentralized organizational model. Acquired companies are promised, and given, a high degree of autonomy. This unique positioning gives Vitec a durable competitive advantage in the M&A market for the small, niche VMS companies it targets, allowing it to see a proprietary deal flow and win bids against buyers with a purely financial orientation.

Proprietary Technology & Innovation

Vitec's technological strength does not come from a single, cutting-edge platform. Instead, its moat is derived from its diverse portfolio of dozens of proprietary, highly-specialized applications, each tailored to the unique needs of its vertical market.

Innovation is also decentralized. Each of the 45 business units is responsible for its own product development, ensuring that investments are closely aligned with customer needs. This is funded by the Group's strong and stable cash flows. The group is also increasingly focused on leveraging AI, both to improve its own internal efficiency and to deliver new, automated features to its customers. This federated approach to innovation ensures that the product portfolio remains relevant without the risk of a single, monolithic technology stack becoming obsolete.

The Investment Thesis: The 3-5 Year Outlook

I believe the market is making a classic short-term error, focusing on a single weak quarter and ignoring the multi-decade track record and underlying strengths of the business. Here is what I see unfolding over the next 3-5 years that will drive the stock toward my SEK 1 003 target.

1. Continued M&A Execution with a Strengthened Balance Sheet

The core of the Vitec story is M&A, and I believe the company is better positioned than ever to continue executing. They have a 40-year track record, completing a record seven acquisitions in 2024 alone. Following a recent directed share issue that raised over SEK 1.1 billion and with annual operating cash flow exceeding SEK 1 billion, Vitec's balance sheet is strong. This gives them significant "fire power" to pursue acquisitions.

I believe Vitec is now well-capitalized to accelerate its M&A pace, potentially at more attractive valuations if the macro environment remains challenging for smaller, independent operators. I expect them to continue acquiring 5-7 companies per year, adding a durable 8-10% to top-line growth annually.

2. Resilient Organic Growth Driven by Subscriptions

The market is spooked by the Q2 headline numbers, but the true pulse of the company is the organic growth of its subscription business, which is running at a healthy ~10%. This is the engine room of the Vitec ship. My outlook is that the volatile transaction-based revenue will normalize, while the core subscription business continues its steady march forward. This growth will be driven by a combination of contractual, CPI-linked price increases and the upselling of new modules to a captive customer base. I model a conservative 5-7% total organic growth annually, which I view as highly achievable.

3. Gradual Margin Expansion

Management has a stated long-term financial target of achieving an operating margin of at least 20%. In 2024, they hit 21% on an operating profit basis, while the EBITA margin was a much healthier 30%. As Vitec scales, there is clear potential for operational leverage. The company actively fosters knowledge-sharing forums between its business units, which helps disseminate best practices and drive efficiency gains across the group.

I believe the EBITA margin can gradually expand from its current 30% level towards 32-33% over the next five years as they integrate new acquisitions and realize scale benefits.

4. The Underappreciated Power of Decentralization at Scale

Vitec's decentralized model is its secret sauce. It allows the company to effectively manage a highly diverse portfolio of 45+ business units without creating a bloated, inefficient central bureaucracy.

I believe this is a scalable competitive advantage that the market fundamentally undervalues. As the group grows larger and more complex, this model allows it to remain agile and entrepreneurial at the business unit level, which is where the real value is created for customers. It is the organizational architecture that enables the entire compounding machine to function.

Management & Capital Allocation

The Founder's Legacy and the CEO's Test

The leadership structure at Vitec is, in my view, a significant strength. Olle Backman was appointed CEO in 2021 after serving as CFO since 2019. His background is in finance and M&A, making him a logical choice to execute Vitec's acquisition-led strategy. He is now facing his first major test as CEO, navigating a tougher macro environment and a skeptical market.

Crucially, founder Lars Stenlund, who served as CEO for 36 years, has transitioned to the role of Chairman of the Board. He and co-founder Olov Sandberg retain significant voting control through their ownership of Class A shares. This setup provides the best of both worlds: a financially disciplined, operationally focused CEO is running the day-to-day business, while the founder remains in a key governance role to safeguard the long-term vision and unique corporate culture he built. With insider ownership at a healthy 12.5%, alignment with long-term shareholders is strong.

Critically Evaluating Capital Allocation

The primary bear case against Vitec centers on its capital allocation. A notable institutional investor, REQ, recently sold its position, arguing that Vitec is no longer self-funding its growth and that high acquisition prices are leading to weak incremental returns on capital. The recent SEK 1.1 billion equity issue is their Exhibit A. To stress-test this idea, I considered the counterarguments.

My analysis leads me to a different conclusion. First, Vitec's 23-year track record of consistently increasing its dividend is the ultimate proof of a disciplined, cash-generative culture that prioritizes shareholder returns. This fact sits in direct opposition to the "weak cash culture" argument.

Second, I view the recent capital raises not as acts of desperation, but as opportunistic moves to fortify the balance sheet. In an uncertain world, having a strong financial position allows Vitec to be aggressive when M&A opportunities arise. Management themselves stated the share issue was "future-oriented and strengthens our balance sheet... to leverage acquisition prospects".

Finally, the business is fundamentally cash-generative, producing over SEK 1 billion in operating cash flow in 2024. The decision to raise external capital is a strategic choice to accelerate growth, not a necessary one to fund operations. While it is true that M&A multiples in the software space have been elevated, Vitec's long-term, disciplined approach provides a defense against systematically overpaying. Their strategy of combining steady reinvestment in M&A with a consistently growing dividend is, in my view, a prudent and value-accretive long-term strategy.

Valuation: A Triangulated Approach

To arrive at a robust conclusion, I will not rely on a single methodology. My valuation is based on a triangulated approach, anchored by a multiples-based analysis applied to my proprietary five-year financial projections. These projections are developed under three distinct scenarios; Base, Bull, and Bear. This primary methodology will be cross-referenced and contextualized by a deep relative valuation against a hand-picked peer group of premier European Vertical Market Software (VMS) companies, for which no substitute exists.

Relative Valuation

The Vertical Market Software (VMS) acquirer model is, in my opinion, one of the most compelling and proven business models for long-term value creation. These businesses acquire and hold companies that provide mission-critical, deeply-entrenched software for specific niche industries. The global standard-bearer, Canada's Constellation Software, stands as a testament to the extraordinary wealth this strategy can generate over decades.

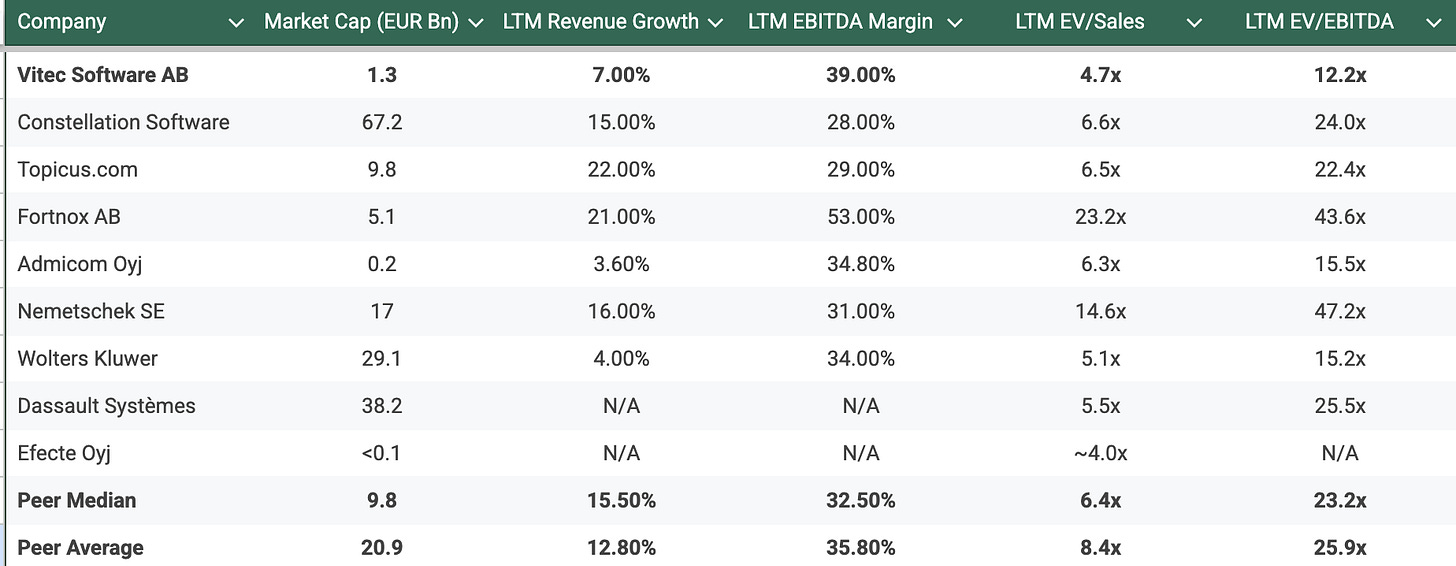

Therefore, a generic "software" peer group is analytically lazy and ultimately useless for valuing Vitec. Its valuation must be assessed against companies with a similar DNA. My selected peer group focuses on firms that are primarily serial acquirers of VMS businesses, with a geographic focus in the Nordics and broader Europe, providing the most relevant context for Vitec's own operations and potential.

Core VMS Acquirers: Constellation Software is the non-negotiable benchmark for operational excellence and valuation in the VMS space. Its European spin-off, Topicus.com, is arguably the single most relevant public comparable for Vitec, executing the same playbook in the same core geographies.

While now private, Norway's Visma was a dominant Nordic VMS player, and its historical transaction multiples provide a critical data point for valuing a top-tier European asset in this space.

Regional & Specialized Peers

Fortnox of Sweden is a high-growth, high-margin peer in accounting software, setting the bar for what a premium Nordic SaaS business can command. Finland's

Admicom, focused on the construction vertical, serves as a good comparable for a niche, regional champion.

On the larger end of the spectrum, Germany's Nemetschek in construction software, France's Dassault Systèmes in industrial design, and the Netherlands' Wolters Kluwer in professional services software represent the highest tier of mission-critical vertical software and provide high-end valuation data points. Finally, Finland's Efecte Oyj offers a data point for smaller, specialized Nordic players.

The following table provides a snapshot of how the market currently values this elite group.

Note: Data as of mid-August 2025. LTM = Last Twelve Months. Financial data sourced from a compilation of public filings and market data providers. Dassault and Efecte data are partial due to availability.

The conclusion from this analysis is stark and immediate. Vitec currently trades at an LTM EV/EBITDA multiple of 12.2x, a roughly 50% discount to the peer median of 23.2x. The market is pricing Vitec as a structurally inferior business, likely as a direct and severe overreaction to the weak Q2 2025 results, where management cited a "cautious" market and macro uncertainty impacting M&A and transaction-based revenues. The pivotal question for this investment thesis is whether this slowdown is structural or cyclical. I firmly believe it is the latter. The company's proven, decade-plus model of 20%+ annualized growth did not suddenly break. The market is extrapolating a short-term, macro-driven problem into a long-term valuation, creating a compelling opportunity for investors who can look beyond the immediate noise.

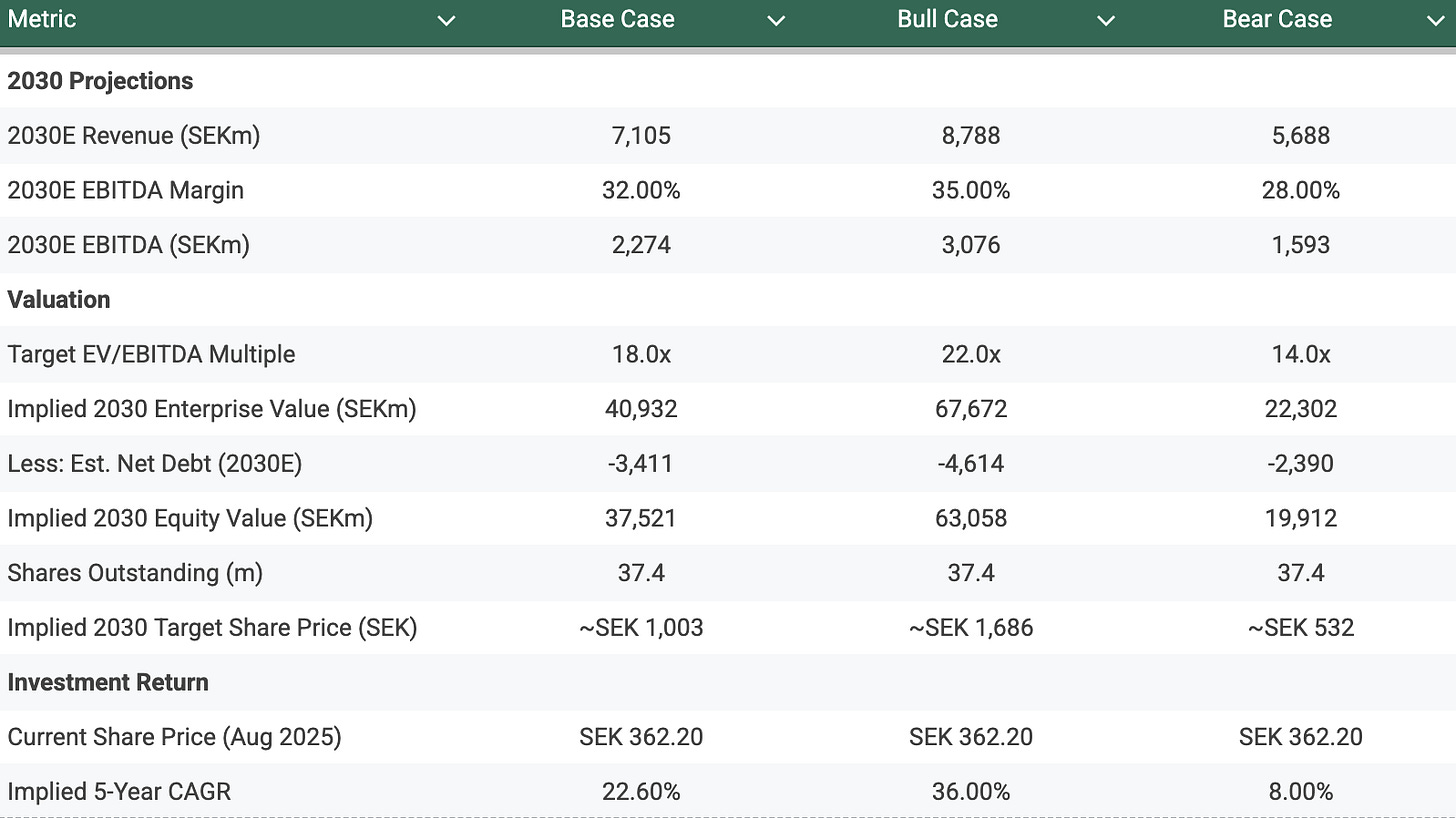

Triangulated Valuation & Scenarios

To translate this opportunity into a tangible price target, I have built a five-year forecast under three scenarios. My primary valuation metric is EV/EBITDA. For a mature, cash-generative, and acquisitive company like Vitec, this multiple is the most appropriate yardstick as it is capital structure-neutral and serves as a clean proxy for the pre-tax cash flow that fuels future acquisitions. I use EV/Sales as a secondary check to ensure consistency and to contextualize the valuation against peers with varying margin profiles.

Base Case - The compounder restarts: This scenario assumes the macro headwinds of H1 2025 prove temporary. Vitec's proven management team resumes its disciplined M&A cadence, which has historically contributed ~11% to annual growth. Organic growth recovers towards its long-term trend, and margins expand with scale.

Bull Case - Flawless execution & market tailwinds: Here, a strong economic recovery creates a target-rich M&A environment, allowing Vitec to accelerate its acquisition pace. Strong end-markets and successful cross-selling drive organic growth above historical averages, and significant operating leverage is realized.

Bear Case - The slowdown lingers: This scenario assumes the "cautious" market described by the CEO persists. The M&A pipeline remains sluggish, organic growth is muted, and margin pressures from integration costs and inflation continue to weigh on profitability.

The table below synthesizes these narratives into a five-year valuation, projecting from mid-2025 to mid-2030. The outcome is highly sensitive not just to earnings growth, but to the exit multiple the market is willing to pay in 2030. My central thesis is that as Vitec demonstrates the temporary nature of its recent slowdown and continues to scale, its valuation multiple will re-rate closer to its higher-quality peers. The Base Case assumes a simple reversion to the peer group's current median, while the Bull and Bear cases model a premium and a persistent discount, respectively.

Note: Projections are my own. 2030E Revenue based on 5-year CAGR from LTM revenue of SEK 3,532m. Est. Net Debt assumes a 1.5x Net Debt/EBITDA ratio. Shares outstanding of 37.4m based on latest reports.

Conclusion on Valuation

My analysis indicates that Vitec Software's current share price reflects a deeply pessimistic view of its future, an overreaction to what I assess to be cyclical, not structural, headwinds. The relative valuation clearly shows a steep and, in my view, unjustified discount to its closest peers. The triangulated, scenario-based valuation reveals a compellingly asymmetric risk/reward profile over a five-year investment horizon.

Based on this detailed analysis, my Base Case projects a fair value of SEK 1,003 per share by mid-2030. This target price implies a 5-year Compound Annual Growth Rate (CAGR) of 22.6% from the current price of SEK 362.20. Therefore, my analysis concludes that an investment in Vitec Software AB meets the Fjord Alpha goal of targeting 20%+ annual returns.

The Bull Case suggests the potential for returns exceeding 30% annually, while the Bear Case still provides a positive, albeit subpar, return, offering a reasonable margin of safety. The investment hinges on management's ability to reignite its proven M&A engine and restore margin discipline, a bet I believe is favorable given their long and highly successful track record.

The Pre-Mortem: A Case for Failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The M&A Engine Seized. The bear thesis proved correct. Competition for quality VMS assets from both private equity and other strategic acquirers intensified, driving acquisition multiples to irrational levels. Vitec, sticking to its disciplined criteria, was priced out of the market. Its acquisition pipeline dried up, and growth stagnated. The company became a low-growth software conglomerate, and the market de-rated its multiple accordingly.

Cultural Dilution Led to Decay. As the group expanded, particularly with larger acquisitions outside its Nordic home markets, the unique "Vitec culture" of decentralized autonomy and trust began to erode. A growing central bureaucracy started to impose standardized processes, stifling the entrepreneurial spirit of the individual business units. The best managers left, innovation slowed, and organic growth turned negative. The federation collapsed into a dysfunctional empire.

A Key Vertical Was Disrupted. A major vertical, such as real estate or financial services, was fundamentally upended by a new, aggressive, cloud-native competitor with a superior product. Vitec's decentralized model, a strength in stable markets, proved too slow and uncoordinated to mount an effective response. A key earnings driver went into secular decline, and the market lost faith in the stability of the entire portfolio.

Capital Structure Mismanagement. In a bid to reignite growth and appease the market, management abandoned its prudent approach. They took on too much debt to fund a large, transformative acquisition just before a sharp rise in interest rates. The burden of servicing this debt crippled their ability to invest in existing products and make smaller, bolt-on acquisitions. The company entered a downward spiral of declining organic growth and financial distress.

Conclusion: The final verdict

The legitimate near-term concerns are clear. The slowdown in transaction revenues is real, and the need for external capital to fuel M&A is a valid point of debate. However, my analysis suggests these concerns are disproportionately priced into the stock. The market is focusing on the cracks in the facade while ignoring the steel foundation.

That foundation is built on three pillars: a resilient business model dominated by 1) mission-critical subscription software with ~110% net revenue retention 2) a powerful moat built on extreme customer switching costs and a unique "permanent home" M&A brand, and 3) an aligned and experienced management team executing a proven, 40-year playbook. With a newly strengthened balance sheet, Vitec is not retreating but reloading.

My Base Case valuation points to a fair value of SEK 1,003 per share by 2030, implying a ~23% CAGR that comfortably clears my 20%+ hurdle. The current price offers a rare chance to acquire a dominant, high-quality European compounder at a significant discount.

✅ Thesis Pillar 1: Resilient Business Model: The core subscription-based software business, with ~110% NRR (estimated), remains robust and is being unfairly penalized for weakness in the smaller, cyclical transaction segment.

✅ Thesis Pillar 2: Reloaded M&A Firepower: After a period of consolidation and a recent capital raise, Vitec is well-positioned to accelerate its proven, 40-year M&A strategy into a potentially less competitive market.

✅ Thesis Pillar 3: Valuation Dislocation: The stock trades at a significant discount to its higher-growth VMS peers, reflecting short-term sentiment rather than long-term fundamentals.

⚠️ Key Risk (from Pre-Mortem): Capital Allocation Failure: A structural decline in returns from M&A due to overpaying for assets would permanently impair the company's compounding ability.

🎯 Target Price (Base Case): SEK 1003 by 2030

📈 Implied 5-Year CAGR (Base Case): ~23%

Primary Sources Used:

Vitec Software Group Annual Report 2024

Vitec Software Group Interim Report January-March 2025

Vitec Software Group Interim Report January-June 2025

Vitec Software Group Investor Presentation Q4 2024

Vitec Software Group Earnings Call Transcripts (Q2, Q3, Q4 2024; Q1, Q2 2025)

What makes it similar to Constellation? It cannot be ROIC, which isn’t even close to 10pc (long-term average).

I would consider it to be very expensive at +30 multiples.

Thanks a lot for this great article. I am considering investing in Vitec and for me, one of the potential red flag is the share dilution. Do you consider it as a concern ?