Evolution: An American fortress

Why slow U.S. regulation, once seen as a headwind, is quietly entrenching Evolution's dominance in live dealer iGaming in the U.S.

Evolution is the king of the online casino world, providing the essential "picks and shovels" that power the industry's most profitable segment (= the live dealer games). Please also see my introduction memo to Evolution, and my separate article about recent Asian headwinds.

I now turn my gaze towards the US.

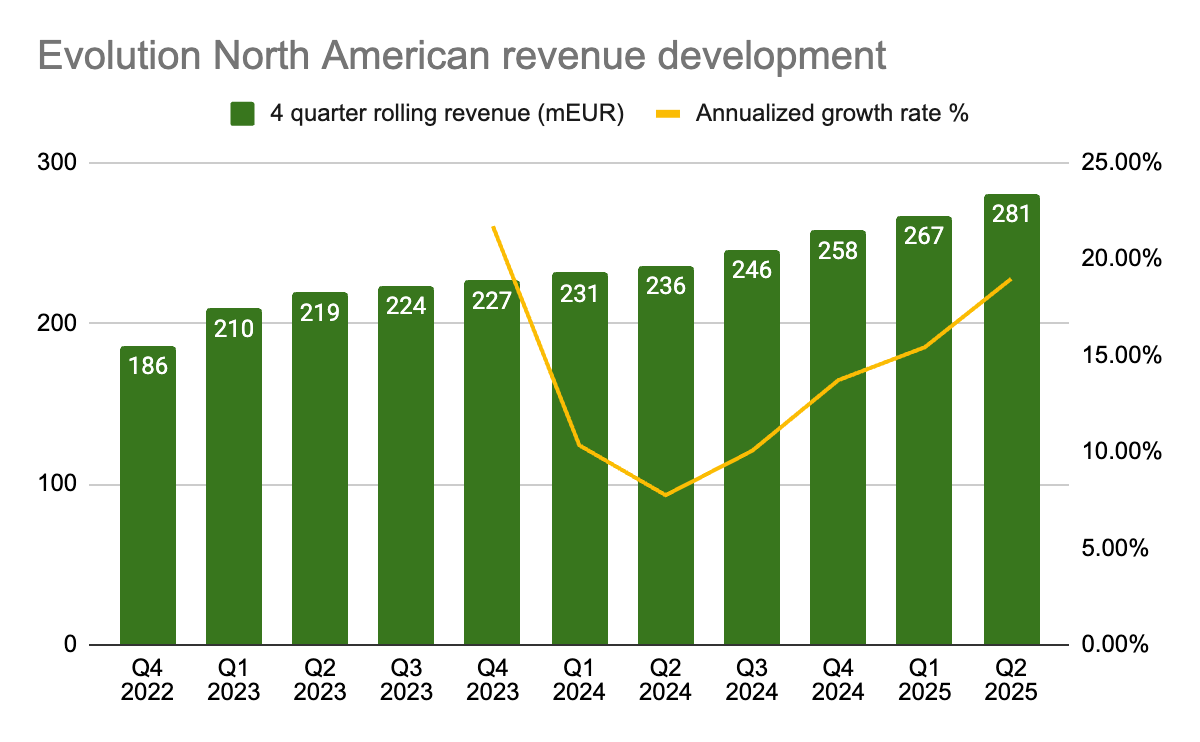

For nearly a year (Q3’23 to Q2’24), the narrative around one of Evolution's biggest growth engines went cold. North American revenues were flat, and the slow pace of state-by-state regulation felt like a powerful headwind holding growth back.

But Evolution has regained momentum in recent quarters. This acceleration is the direct payoff from earlier investments in studio capacity and product development. The new studios built in 2022–23 are now fully operational, and the game portfolio in key states has become broader and more compelling.

Looking ahead, the growth trajectory is powerful. I model a five-year CAGR of roughly 25% for the U.S. live dealer market, driven by both the anticipated legalization in new states and deeper product penetration in existing markets. With each passing year, live dealer is steadily capturing a larger share of total U.S. iGaming revenues.

While all this is happening, Evolution is building a formidable fortress, brick by brick, across the American landscape.

To me, this isn't really a story about legislative timing.

It’s a story about a moat so deep that the slow, state-by-state pace of regulation becomes less a headwind and more a strategic advantage.

The scale of the prize

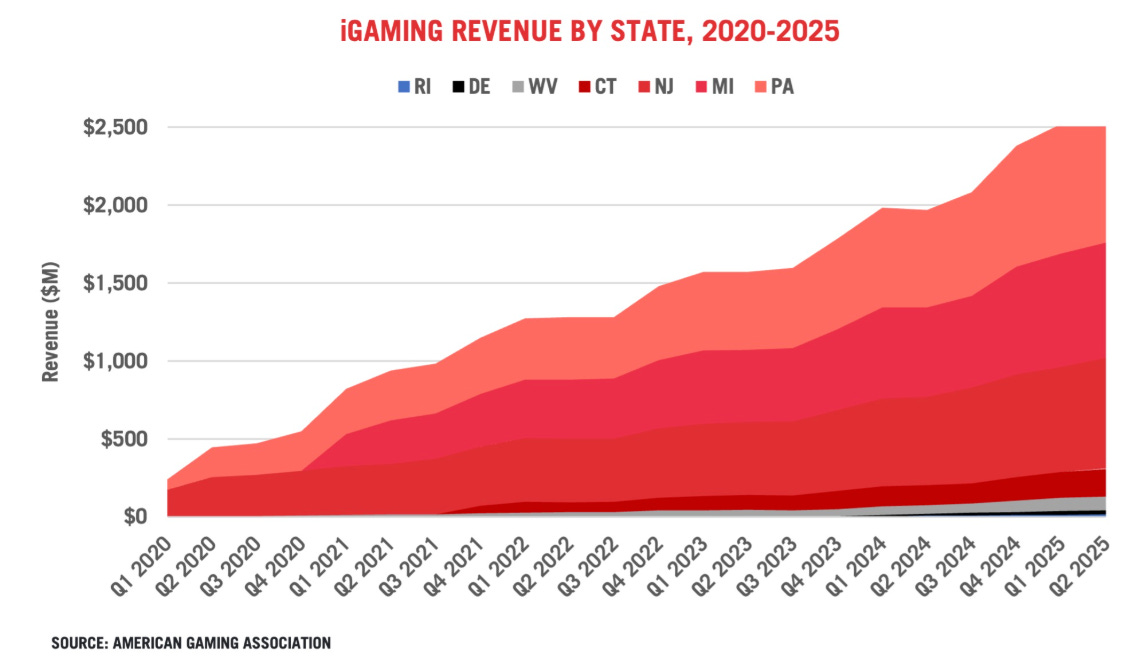

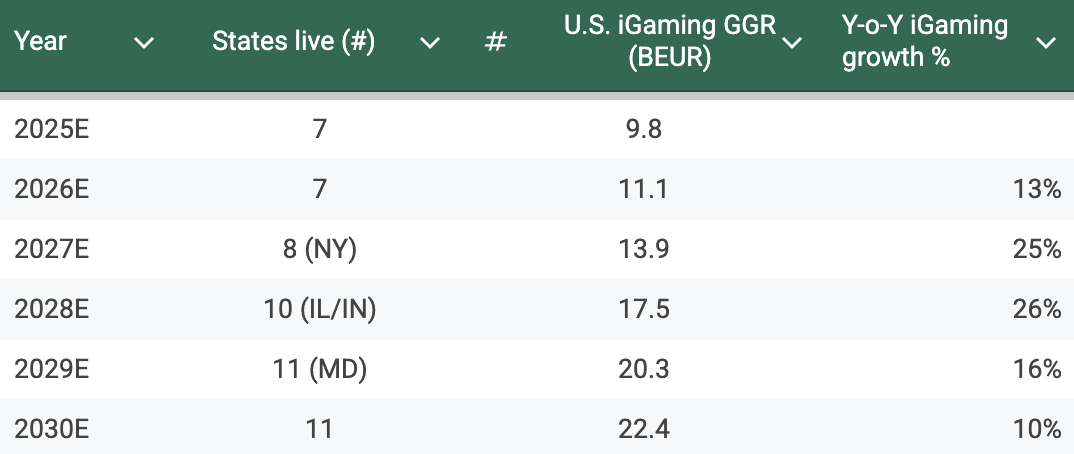

Let's first size the opportunity, because it is immense. The legal U.S. online casino market is already a giant, projected to generate approx. 9.8 billion EUR in Gross Gaming Revenue (GGR) in 2025. Yet, this is just the beginning. My estimate is that this figure will more than double to over 22 billion EUR by 2030 as more states come online (see my estimate further down).

There is a large prize in converting the vast, illegal offshore market. The American Gaming Association posted research in August this year, estimating that Americans are spending nearly $19 billion a year on unregulated casino sites. As states legalize, a large portion of this money will flow to trusted, legal platforms.

These players do not need to be taught how to play online blackjack. They just need a legal and high-quality place to do it.

This migration will happen on the platforms of a select few operators. The U.S. market is a tight-knit club, with just three names, namely FanDuel, DraftKings, and BetMGM. These three companies are controlling over 80% of the market.

For this trio, a premium live dealer casino is an absolute necessity to attract and retain high-value players. This makes Evolution, as the dominant and best-in-class provider, the key partner.

Massive barriers to entry

The central point in the thesis is actually the slow, state-by-state nature of U.S. regulation. The market sees as a risk, but it is also Evolution’s greatest competitive advantage.

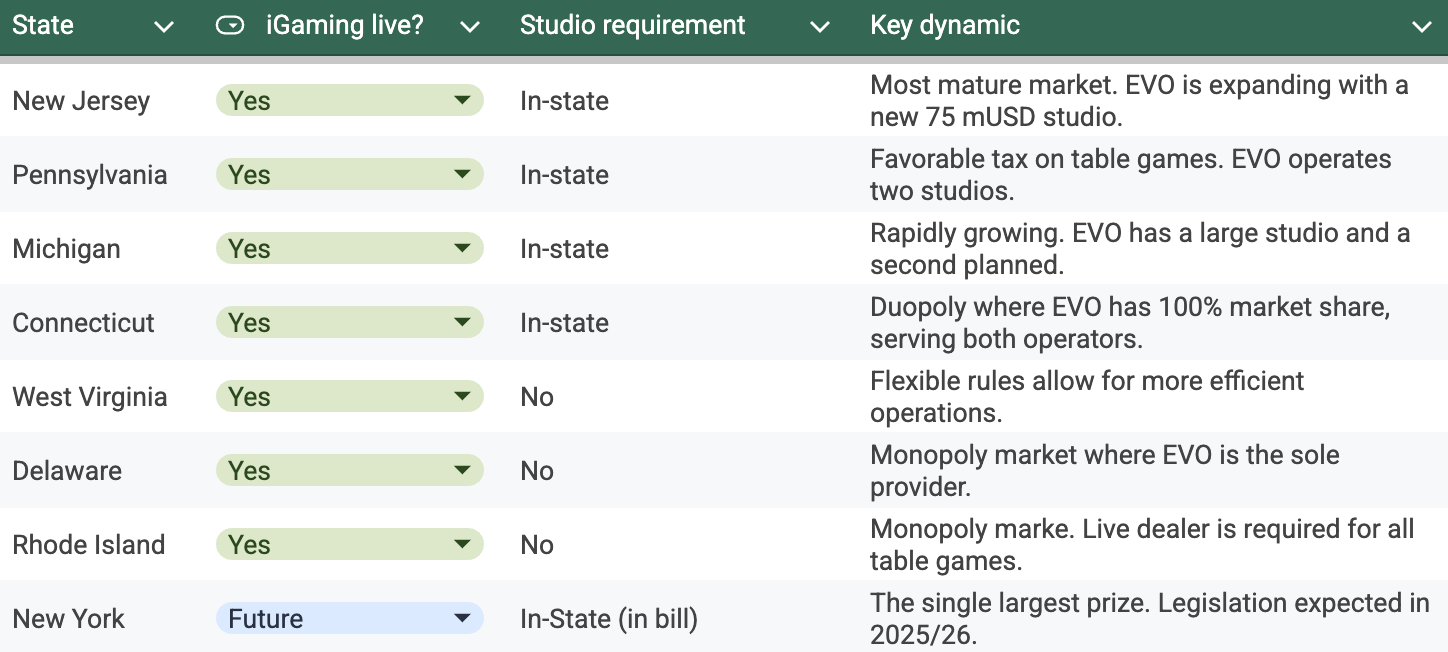

Unlike in Europe, key U.S. states like Pennsylvania and Michigan mandate that live dealer games must be broadcast from a physical studio located within that state. This creates a massive barrier to entry. A competitor cannot simply stream games from a central European location. Instead, they must commit tens of millions of dollars to build a studio, navigate a complex state licensing process, and hire hundreds of local staff for almost every single major state they want to enter.

This slow rollout allows Evolution to be methodical. It enters a state, builds its studio, locks in partnerships with the major operators, and establishes an unassailable position before anyone else can get a foothold.

It is a land grab in slow motion, and Evolution is the only one with the full map, the capital, and the experience to execute it.

The power of this moat was proven in early 2025. Light & Wonder, a multi-billion dollar global gaming giant, tried to enter the U.S. live dealer market. After building a studio and attempting to compete, they abruptly shut down the entire division, citing the inability to generate "superior returns."

If a large competitor like Light & Wonder can't justify the cost of competing with Evolution, what chance does a smaller startup have?

Playtech is Evolution's most credible global competitor. They have established a U.S. presence with three studios. However, its reported revenue from the North America remains a small fraction of Evolution's.

This has left the market as a near-monopoly. With a competitor in retreat and exclusive deals locked in with market leaders like FanDuel, Evolution has built a fortress in each key state, surrounded by a regulatory moat that it helped dig.

25% CAGR on the underlying Live Casino market until 2030

I have built a forecast based on a granular analysis of each state’s potential, modeling the legalization of key states like New York (2027 launch, a key state that adds revenue in line with New Jersey and Michigan) and Illinois/Indiana (2028 launch), followed by Maryland (2029).

The results point to a powerful growth trajectory, even with conservative assumptions. CAGR for the total iGaming market until 2030 would be approx. 18% by my estimate, driven by new states above - but also the growth in existing markets, modeled at high single-digit.

On top there is an on-going shift to Live dealer that adds a powerful boost. Live dealer GGR is assumed to begin at approximately 15% of total iGaming GGR in the first year of a new market, ramping to a mature share of 25-30% by the fourth year, consistent with trends observed in New Jersey and Michigan.

My estimation would be that this adds about 5-7% percentage points to live dealer growth.

With all of the above considered, we are likely looking at a total CAGR at around 25% (likely +/- 5 percentage points) for live dealer GGR until 2030, with Evolution extremely well positioned to leverage this.

The verdict: An enormous prize with Evolution in pole position

All in all, if you are an investor in Evolution, the day-to-day headlines about legislative delays can be frustrating. The primary risk to this thesis is that the big states like New York take even longer than expected to legalize, pushing the growth curve to the right.

However, the catalysts are powerful and tangible. It is the inevitable advancement of iGaming bills in major states, the opening of new studios, and the signing of more exclusive deals. The real story here is not the timing, but the structure of the market.

The market sees a slow-moving political process and calls it a risk. But what looks like legislative drag is in fact cement that is slowly but surely locking Evolution into an impenetrable, state-regulated monopoly.

The prize is enormous, and Evolution seems to be the only company with the key to the vault.

Great article and insights, thank you!

really good article, being a shareholder in this company is really frustrating. thanks for the insight! 🤍