Pexip: From video bridge to fortress

How this Norwegian mid-cap is shifting from a low-moat video bridge to a higher-growth, cash-generating, secure platform. Will it clear Fjord Alpha’s bar?

Pexip has had a volatile ride since its 2020 IPO. After a 90%+ collapse post-COVID surge, Pexip has emerged as a smaller but steadier business with a more defensible niche. Two things stand out immediately;

Supplying technology to the U.S. Department of Defense and the German Bundeswehr suggests its platform meets security and interoperability needs that the large consumer-focused players don’t address. This niche gives Pexip durability despite its smaller scale.

Capital allocation also tells a story. A NOK 2.50 per-share dividend and NOK 100 million buyback signal balance-sheet strength and confidence in recurring cash flow.

The geopolitical environment arguably tilts in its favor, and the current tailwinds and valuation look attractive enough to warrant a closer look from Fjord Alpha.

Let’s dig into it.

The setup: Key data

💰 Stock Price: NOK 57 (19 Nov 2025)

📄 Shares Outstanding: 102,476,199 (excl. Treasury shares, Q3’25)

🏢 Market Cap: NOK 5.80B

🏦 Net Cash: NOK 526M

🌐 Enterprise Value: NOK 5.30B

⚙️ Sector/Industry: Software / Unified Communications as a Service (UCaaS)

How Pexip evolved into a secure video specialist

Background story

Pexip’s story is one of Norwegian video-engineering DNA. It was founded in 2012 by a team of industry veterans from Tandberg, the legendary Norwegian video conferencing giant that was acquired by Cisco in 2010.

The company as it exists today was formed by a 2018 merger between the original Pexip (which specialized in self-hosted software infrastructure) and Videxio (a cloud-based video-conferencing-as-a-service provider). This created a single platform that could be deployed in any way a customer wanted.

They IPO’d on the Oslo Børs in May 2020, right into the COVID-19 pandemic. The stock soared on the “work from home” narrative, then subsequently crashed in 2021-2022 as the market lumped it in with every other “COVID winner” that was seeing growth normalize. Since 2022, management has executed a strategic pivot.

The Digital Switzerland of video conferencing

To understand Pexip, you have to understand that video conferencing is a mess in many large companies. A company may have a new Microsoft Teams Room, a legacy Cisco system in its main conference rooms, a Poly setup in another, and its clients and partners all use different platforms like Zoom or Google Meet. This creates silos where nothing can talk to anything else.

This is where Pexip comes in.

Pexip is a neutral, trusted, and secure intermediary that the major “superpowers” (Microsoft, Google, Cisco, Zoom) rely on to connect their incompatible systems and, more importantly, to handle their most sensitive data. Think of Pexip as a ‘Digital Switzerland’.

The business is now split into two very distinct segments, and this “two-speed” model is the key for the thesis:

Connected spaces (The “Utility”): This is the classic interoperability business. It is the “video bridge” that allows an organization’s old Cisco or Poly hardware to join a Microsoft Teams or Google Meet call. It is a mature, slow-growing, but profitable cash-cow business.

Secure & Custom spaces (The “Fortress”): This is the growth engine. This is Pexip’s proprietary, self-hosted software platform. It is sold to organizations that, for reasons of security, privacy, or national data sovereignty, cannot use the public cloud. Think defense agencies, national healthcare systems, and high-stakes judicial courts.

Recent developments & performance

Business update

On the surface the Q3 2025 results, released on November 6, were good, but not spectacular. Total Annual Recurring Revenue (ARR) grew to $122.2 million, up 12% year-over-year. It’s fine, but it doesn’t scream “buy.”

But the devil is in the details, in this case the segment data. Management breaks out the ARR growth for its two businesses, and the divergence is stark:

Pexip Secure & Custom ARR: Grew 30% year-over-year. This is a high-growth, premium SaaS profile.

Pexip Connected Spaces ARR: Grew 0% year-over-year. This is a stagnant utility.

This is the entire story. The market is anchored on the 12% “blended” number, but the reality is that a large part of the business is growing at 30%.

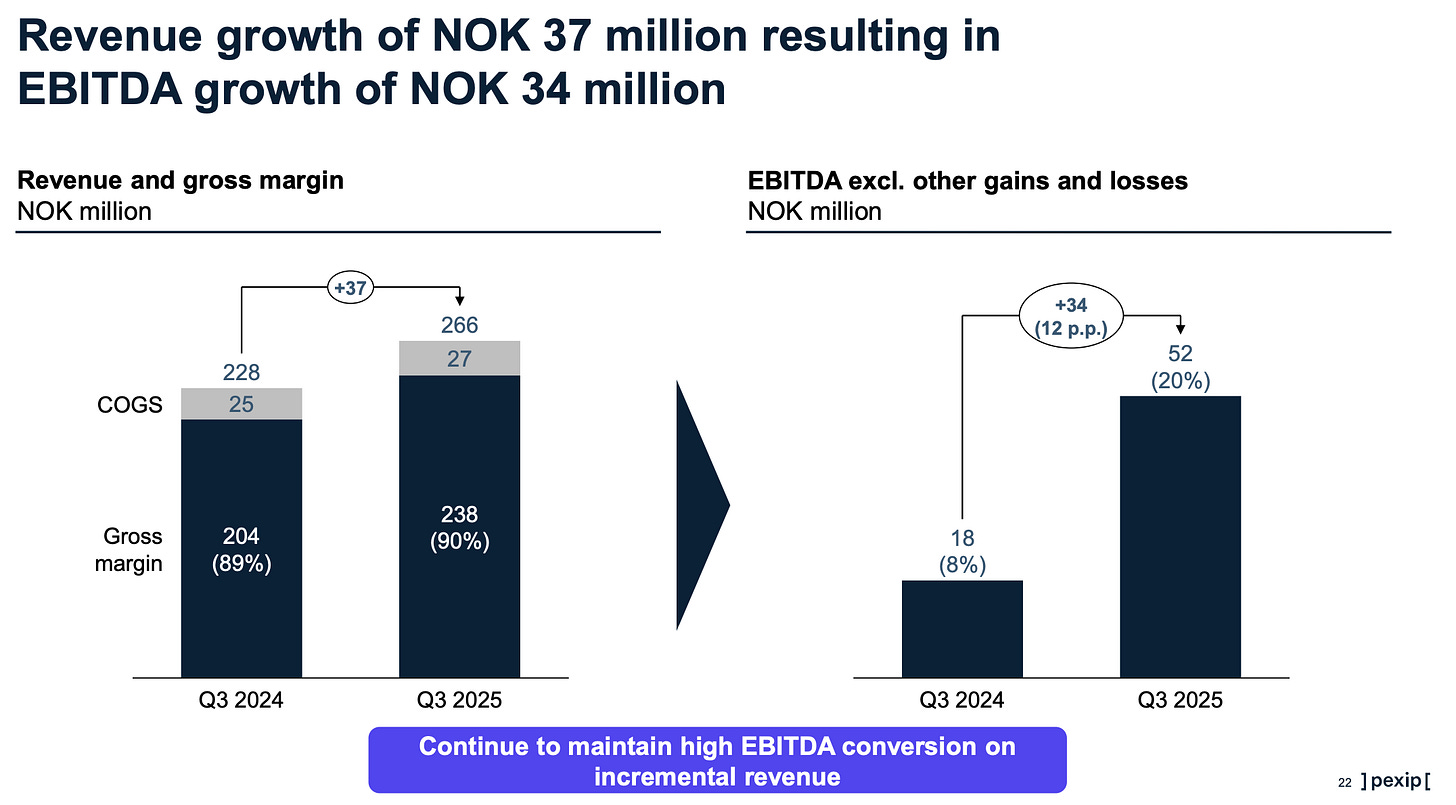

Simultaneously, the company is executing a sharp pivot to profitability. EBITDA was NOK 52 million (a 19.5% margin), up massively from NOK 18 million in the same quarter last year. Free cash flow was solid at NOK 29 million. This is disciplined, profitable growth.

Stock price context

The Pexip stock chart is a story in three acts, somewhat similar to Pandora A/S: A Nordic phoenix (Part 1 of 2)

Act I (2020-2021): The COVID-19-fueled “work from home” bubble. The stock IPO’d and rocketed to unsustainable highs.

Act II (2022): The “hangover.” The stock collapsed, dropping over 70% in 2022 as the market realized the growth was temporary and the company was burning cash. A new CEO, Trond K. Johannessen, was brought in.

Act III (2023-2025): The Turnaround. From its 2022 lows, the stock has been on a tear, recovering 80+% in 2023 and another 70+% in 2024. This year the stock is up about 30+%.

In 2023-2024, the market was rewarding the turnaround. New CEO Johannessen did exactly what he was hired to do. He cut costs, instilled discipline, and drove the company from heavy losses to solid profitability and cash flow.

Capital allocation - Buybacks and dividends

The capital allocation strategy at Pexip is a model of mature, shareholder-friendly discipline. This further supports the idea that this is a mature, “utility-plus” company, not a hyper-growth rocket.

Fortress Balance Sheet: The company is sitting on NOK 526 million in cash and money market funds. It has no material interest-bearing debt. This gives them immense flexibility and security.

Share Buybacks: The company just completed its NOK 100 million share buyback program in Q3 2025.

Dividends: The company also paid a substantial dividend of NOK 259.8 million in Q2 2025.

The combination of a fortress balance sheet, a major buyback, and a dividend is powerful. It tells me management is confident in its cash flows. But it also tells me they are a “total return” story, blending growth with capital returns.

Management

CEO: Trond Johannessen

The appointment of Trond Johannessen as CEO in May 2022 is a critical event in Pexip’s recent history.

He was brought in to replace the interim CEO (who was also the CFO) and clean up after the post-COVID crash. Johannessen’s mandate was not to chase hype, but to build a real, profitable, and durable business.

His track record is what I want to see. He successfully scaled a global IT and technology corporation (Embron Group), and, most importantly, he was an executive at Tomra. For any investor in the Nordic markets, the Tomra association is a powerful signal. It signifies a long-term, disciplined, profitable-compounding mindset.

Johannessen’s appointment marked the end of the old, undisciplined 2021 “growth-at-all-cost” strategy (which included a sporty $300 million ARR target by 2024) and the birth of the new, credible “Rule of 40” strategy.

The business model & unit economics

Revenue model

Pexip’s business model is clean. It operates on a subscription-based model. Revenue is recurring, primarily measured in Annual Recurring Revenue (ARR).

The company sells its solutions primarily through a global network of approximately 300 partners. However, as part of its new strategy, it is increasingly focusing its go-to-market activities on large enterprise and public sector customers directly, especially in its “Fortress” segment.

The ARR engine

This is where the two-speed business model becomes crystal clear. Let’s look at the numbers from the end of Q3 2025:

Total ARR: $122.2 million.

“Utility” (Connected Spaces) ARR: $68.8 million.

“Fortress” (Secure & Custom) ARR: $53.4 million

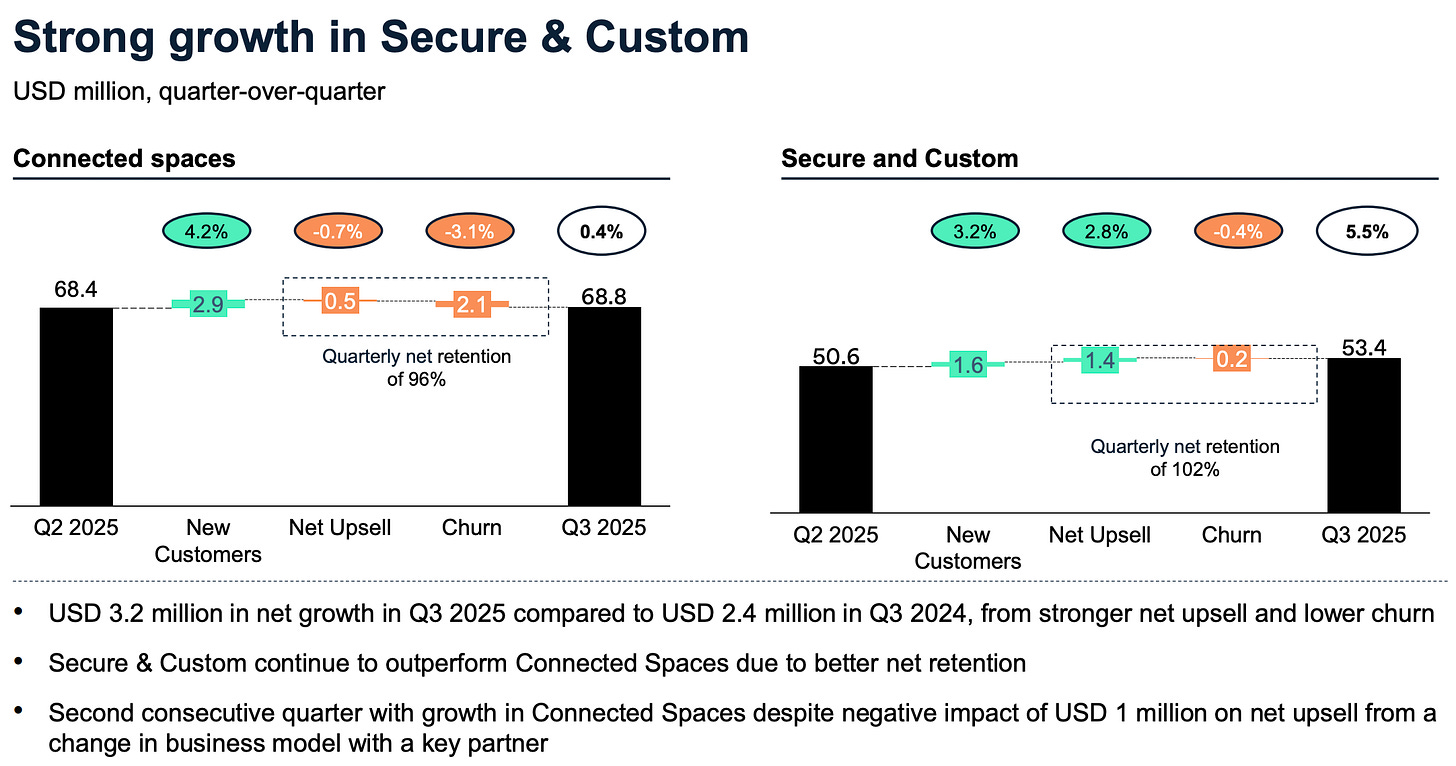

This is the key. The “Fortress” business, the one growing at 30% per year, now makes up 44% of the company’s total recurring revenue. A year ago, this figure was well below 40%.

At its current trajectory, the Secure & Custom segment will become the majority of Pexip’s business within the next 18-24 months. When that happens, the market may have to stop thinking of Pexip as a slow-growth company and start valuing it as a higher-growth company.

Net Revenue Retention

Net Revenue Retention (NRR) is a critical metric for understanding the health of a SaaS business. It tells you if existing customers are sticking around, spending more, or leaving.

Pexip gave a detailed look at its quarterly NRR by segment in its Q3’25 presentation.

Secure & Custom (”Fortress”) NRR: 102%

This is a decent figure, although not stellar (e.g., compare with Carasent). It is built on a 2.8% in “net upsell” (existing customers buying more), and a tiny -0.4% churn.

This tells me the Fortress customers (defense, healthcare, justice) are sticky and are actively expanding their use of the platform.

Connected Spaces (”Utility”) NRR: 96%

This is a slight contraction, which is exactly what we would expect from a mature, competitive market.

It reflects the “higher churn” that management has admitted to in earnings calls.

The high-growth segment is sticky and expanding. The low-growth segment is a “melting ice cube” but it is melting very, very slowly. This is a business being managed for cash, not growth.

The moat - Why the giants aren’t copying Pexip

This is the most important section of the analysis. Why can’t Microsoft, with its multi-trillion market cap, just build a “Pexip feature” and kill this tiny Norwegian company?

The answer is that Pexip’s moat is not just about technology. It is about architecture, trust, and regulation.

Proprietary technology

Pexip’s core intellectual property is its patented transcoding architecture. This is a highly efficient software engine that can “translate any real time media signal on the fly”. But this isn’t the real moat.

The real moat is the deployment model. Pexip’s platform is “agnostic infrastructure”. It is built to run anywhere the customer wants:

On-premise in their own data center.

In a private cloud (like Azure or Google Cloud).

Or completely “air-gapped” from the public internet.

This is the key distinction. Microsoft Teams, Zoom, and Google Meet are public cloud SaaS products. Their entire business model and technical architecture are fundamentally opposed to an on-premise, self-hosted model. They cannot offer a customer “total data control” because their business model is the public cloud.

Pexip is not a competitor. It is selling something the giants are unable to sell.

Regulatory & legal barriers (The “Sovereign” moat)

This is the direct result of the technology moat. Because Pexip’s platform can be self-hosted, it is one of the only modern, best-in-class platforms that can meet the stringent security and data sovereignty requirements of top-tier government and defense clients.

Pexip is certified for FedRAMP (US Government). It is used to meet HIPAA (US Healthcare). It is deployed in environments up to and including NATO SECRET.

When the US Department of Defense or the German Bundeswehr needs to conduct a secure video meeting, they cannot just “hop on a Zoom call.” They must use a platform that runs entirely inside their own firewall, where they control 100% of the data. This is not a “nice to have” feature, it is a legal and existential requirement for these customers. Pexip is their vendor of choice.

Switching costs

For these “Fortress” customers, the switching costs are immense. These are not simple monthly SaaS subscriptions. Rather, they are deep, multi-year integrations into critical government and healthcare workflows.

For example, Queensland Health, Australia’s largest public health system, built its entire telehealth infrastructure on Pexip. Why? Because Pexip could integrate with its existing systems, scale to hundreds of patients, and, most importantly, guarantee patient data privacy in a way public cloud solutions could not. Ripping this out would be a massive, high-risk undertaking.

Network effects (Co-opetition)

This brings us back to the “Switzerland” moat. Pexip is the only company that is a trusted, neutral partner to all the tech giants: Microsoft, Google, Cisco, Zoom, and HP/Poly.

As Pexip’s Chief Revenue Officer, Åsmund Fodstad, said on the Q1 2024 call: “These tech giants together with Microsoft, HP, Poly and Google choose to partner with Pexip rather than competing. That is a statement in itself.”

This creates a powerful, self-reinforcing loop. The more vendors Pexip supports, the more valuable its neutral platform becomes, and the less incentive any one vendor has to try and replicate its complex, multi-platform ecosystem.

The investment thesis: The 5 year outlook

This is the heart of my argument. Here is what I believe Pexip will look like by 2030, based on four key drivers.

Driver 1: The sovereign cloud megatrend

My primary thesis is that the 30% growth we see in Secure Spaces is not a blip. It is the start of a multi-decade tailwind. The current geopolitical environment and the accelerating push for “digital sovereignty” in Europe are forcing governments, defense agencies, and critical industries (like utilities, finance, and healthcare) to build their own “sovereign clouds,” free from the control of US hyper-scalers.

Pexip provides the only modern, best-in-class, and certified secure video component for this new sovereign tech stack. This is a large, non-discretionary, and rapidly growing market.

Driver 2: Secure vertical expansion

I expect Pexip to take this “sovereign” playbook and execute it aggressively in two other verticals where data privacy is paramount:

Healthcare: Building on wins like Queensland Health, Pexip is positioned to power telehealth consultations, virtual patient contact centers, and any workflow that involves sensitive patient data (HIPAA).

Justice: Powering virtual court proceedings, secure video meetings between attorneys and clients, and virtual prison visitations, all of which require high security and data control.

Driver 3: The Cash-Cow utility

The “Utility” (Connected Spaces) business is now a dedicated cash-generation machine. Its small growth is irrelevant. It is a stable, profitable business with high switching costs. The significant, predictable cash flow from this segment will be used to fund the dividend and buyback policy, providing a hard valuation “floor” for the stock and limiting downside risk.

Valuation: A triangulated approach

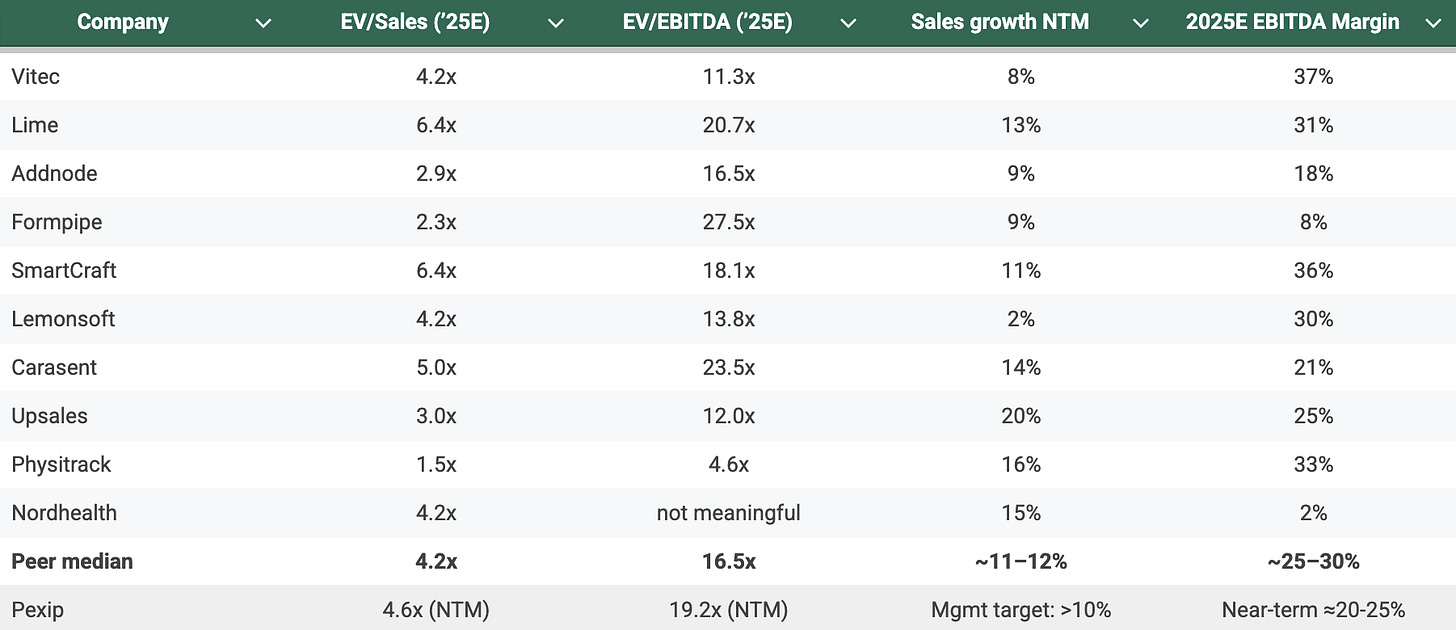

Pexip’s valuation must be understood through the lens of its “two-speed” model, i.e. the high-growth Secure segment and a mature, cash-generating Connected segment. The market today is effectively pricing the company as a blended average of the two, rather than rewarding the Secure business’s 30%+ growth potential. This makes sense. While the Secure segment is scaling rapidly, the slower Connected base still represents more than half of total ARR and acts as a drag on blended growth metrics.

The valuation analysis below triangulates from the following perspectives: (1) a relative-valuation comparison versus Nordic vertical-software peers, (2) a scenario-based valuation to FY 2030

Relative valuation

To anchor the discussion, I have compiled a set of Nordic vertical-software peers that share similar recurring-revenue structures, capital efficiency, and end-market exposure. These companies provide a relevant benchmark for both growth and quality.

Vitec: Nordic vertical‑software consolidator. Mature, sticky, and subscription heavy, very useful “quality” benchmark. Read my latest perspective here: Vitec Software Q3-25: A mixed bag, but investment thesis remains

Lime Technologies: CRM/SME SaaS with higher growth and margins. Good premium multiple comparison.

Addnode: Application software & IT services mix. Steady growth/profitability baseline.

Formpipe: Public‑sector content/ECM software. Nordic government exposure and margin recovery case.

SmartCraft: Construction vertical SaaS with high margins and good growth. A “quality SMID” comparable.

Lemonsoft: SME ERP based out of Finland.

Carasent: e‑health practice software (Webdoc). Scale and profitability rising. Read my latest perspective here: Carasent Q3-25: The Inflection Point

Upsales: Nordic CRM/marketing SaaS with profitable growth.

Physitrack: Digital health platform. Profitable and smaller scale, shows “value” end of spectrum.

Nordhealth: Veterinary/therapy PMS. Growing ARR but still low profitability.

On this basis, Pexip trades slightly above the Nordic peer median on both EV/Sales and EV/EBITDA, despite comparable growth and margin levels. This premium likely reflects its strong balance sheet and the defensibility of its Secure customer base. However, without clear evidence that the Secure segment can dominate group ARR in the near term, the current multiple appears justified rather than mispriced.

In short, the stock is fairly valued on near-term blended metrics, but there is emerging upside via the Secure segment.

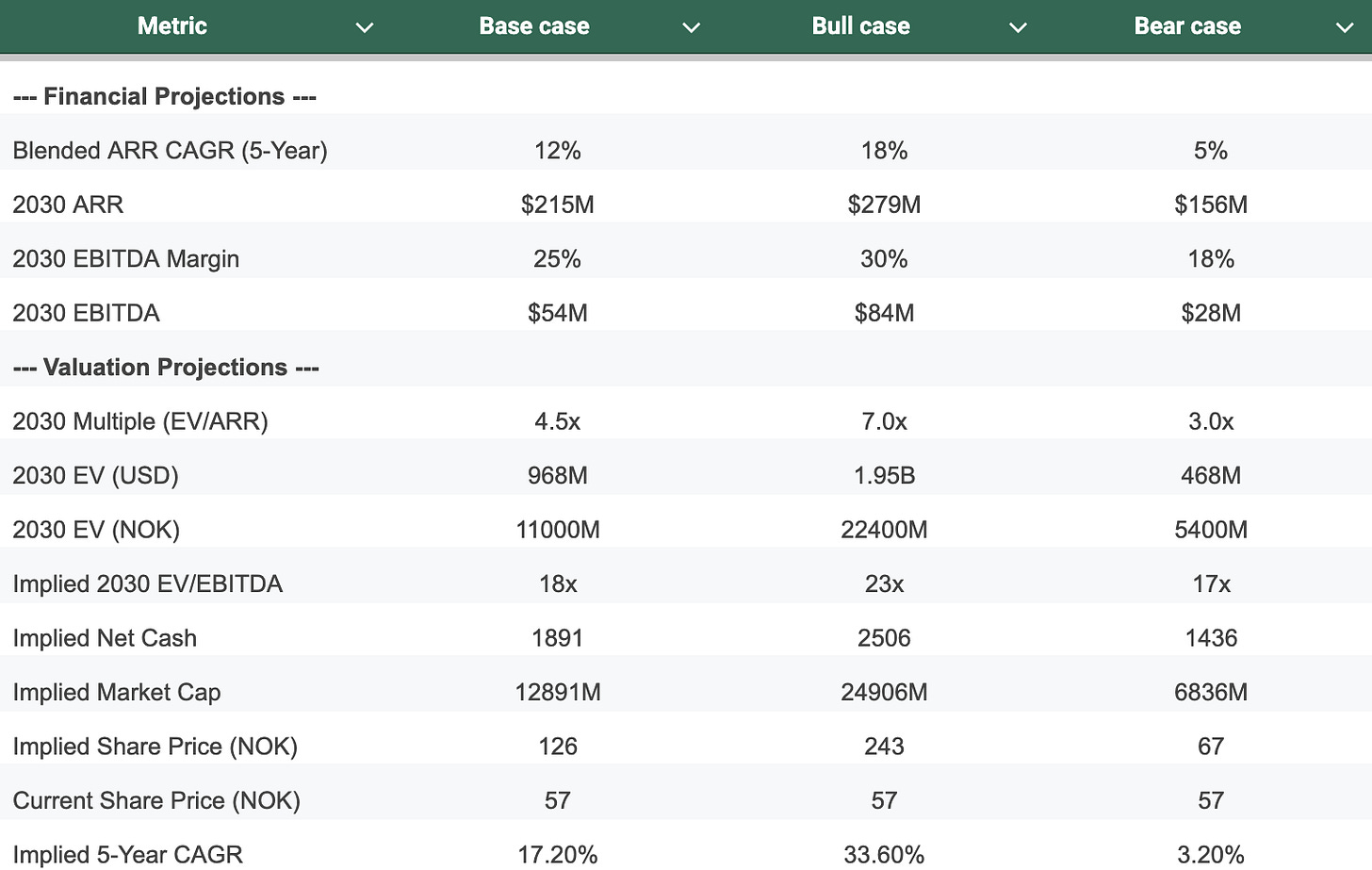

Valuation Scenarios (5-Year Outlook to FY 2030)

This analysis outlines the projected financial outcomes for Pexip in 2030 across three distinct scenarios (Base, Bull, and Bear) to frame the risk and reward associated with the current investment opportunity. The core determinant of value is the successful migration and growth of the “Secure” segment relative to the churn in the legacy “Connected” segment.

Current State (Nov 2025): ARR $122.2M. Share Price ~NOK 57.

The valuation projections are based on achieving specific compound annual growth rates (CAGRs) for blended Annual Recurring Revenue (ARR) over the next five years, coupled with corresponding changes in EBITDA margins and market multiples (EV/ARR).

To accurately capture the total return, I assume that 100% of generated Free Cash Flow (FCF) is retained on the balance sheet (i.e. no dividends or buy-backs), reflecting the total cash value accreted to the Enterprise Value over the 5-year forecast period from a starting point of NOK 526m. I assume that 70% of EBITDA is converted to FCF, accounting for e.g. modest capital expenditure.

1. Base Case: “The Blended Reality”

This scenario represents the reasonable growth outcome, which currently holds my highest conviction. It assumes the continued growth in the Secure segment somewhat outweighs a decline in the Connected segment.

Key Metric: Blended ARR grows at a 12% CAGR.

Outcome: The company achieves $215M in ARR and a 25% EBITDA margin. The market multiple remains at 4.5x EV/ARR, yielding a 17.2% 5-Year CAGR for the investor.

2. Bull Case: “The Great Re-Rating”

This scenario requires an acceleration of the Secure mix-shift, dramatically pulling the blended growth rate higher and proving the business model’s scalability.

Key Metric: Blended ARR accelerates to an 18% CAGR.

Outcome: ARR hits $279M with significant margin expansion to 30%. Crucially, the market “discovers” the company as a premium SaaS business, resulting in a re-rating to 7.0x EV/ARR. This results in a highly attractive 33.6% 5-Year CAGR.

3. Bear Case: “The Melting Ice Cube”

This outcome represents a failure of the investment thesis. The accelerated churn in the legacy Connected segment completely offsets or overwhelms the growth in the Secure segment.

Key Metric: Blended ARR only manages a minimal 5% CAGR.

Outcome: ARR stalls at $156M, margins compress to 18%, and the market de-rates the company to a low 3.0x EV/ARR multiple. The result is an implied 3.2% 5-Year CAGR, which clearly is not great.

The analysis shows that the Base Case delivers an implied 17.2% 5-Year CAGR.

While this is a respectable return, it falls below the 20% hurdle rate required for a Fjord Alpha single-stock, mid-cap investment.

The pre-mortem: A case for failure

Let’s assume it is 2030, and our investment has been a total failure. Our thesis was wrong, and we’ve lost significant capital. Working backward from this failed future, what went wrong?

Failure 1 (The Big One): The “Switzerland” moat was a myth. We were fundamentally wrong about the moat. Microsoft (or Google) got tired of paying partners. They released a “good enough” CVI interoperability feature for free as part of their standard E5 enterprise license. This completely destroyed the Connected Spaces cash cow. The segment that we counted on to fund the dividend and provide a valuation floor went to zero.

Failure 2: The “Sovereign” niche was just a niche. We mistook a small pond for an ocean. The 30% growth we saw in 2025 was simply the last of the “easy” wins. It turned out the true market for “sovereign video” was just a few dozen defense and government agencies (like the DoD and Bundeswehr), not the broad-based megatrend we predicted. The market saturated by 2027, growth stalled, and Pexip became a “one-trick pony” serving a market that was far too small to justify a growth multiple.

Failure 3: Management folly (Diworsification). The pivot to profitability worked too well. By 2027, management was sitting on NOK 1.5 billion in cash. Instead of returning it to shareholders via the dividend policy they set in 2023, they got ambitious. They levered up and made a large, value-destructive acquisition in an adjacent, competitive field, trying to recapture the “growth-at-all-cost” glory of 2021. The integration failed, the culture was ruined, and the balance sheet was destroyed.

Conclusion: The final verdict

Pexip’s turnaround is real and increasingly visible in the numbers. The Secure segment’s 30% growth, disciplined cost structure, and fortress balance sheet have reshaped the company into a durable, cash-generative software platform with meaningful upside optionality.

The market, however, still values Pexip primarily as a blended 12% ARR grower, underestimating the structural tailwinds in sovereign cloud, defense, and healthcare, and the accelerating mix shift toward higher-margin Secure revenues. As this dynamic compounds, the current valuation could prove conservative.

At a projected 17% five-year CAGR, Pexip offers a respectable return profile that comes close to our 20% hurdle. While it falls short of immediate inclusion, the improving fundamentals, strong management execution, and growing strategic relevance make it a name worth watching closely. With continued Secure-segment momentum or a modest pullback in the share price, Pexip could soon cross into investable territory.

I will be watching carefully from the sidelines. Entry price, all things equal, would be around 50 NOK.

✅ Thesis Pillar 1: The “Secure” segment’s 30% growth is real but is offset by the 0% growth “Connected” segment, making the 12% blended growth a fair representation.

✅ Thesis Pillar 2: With increasing revenue, EBITDA margins will improve meaningfully, something we saw clearly in the Q3 report.

✅ Thesis Pillar 3: The market is not fully pricing in the outlook, but at the moment Pexip falls slightly short of our 20% hurdle rate.

⚠️ Key Risk (from Pre-Mortem): The “Connected” segment is not just flat, but a “melting ice cube,” and accelerating churn could drag blended growth well below 10%, leading to a de-rating.

🎯 Target Price (Base Case): NOK 108 by YE 2030.

📈 Implied 5-Year CAGR (Base Case): ~17.2%

Primary Sources Used:

Pexip Report & Presentations

Pexip Earnings Call Transcripts

Pexip Annual Reports

Pexip Capital Markets Day Presentation

The soverein cloud angle is really compelling here. What sticks out most is how the defensive sector wins (DoD, Bundeswehr) signal something bigger than just niche contracts. If geopolitical tensions keep escalating, that regulatory moat around data soverignty could become even more valuable. The two speed model makes sense, but I wonder if the Connected segment churn acelerates faster than expected?

What about the dividend and share buybacks - these are missing in your valuation/CAGR?