Pandora A/S: A Nordic phoenix (Part 1 of 2)

Deconstructing the Rise, Fall, and Rebirth of a Danish global jewelry giant

I have followed the story of Pandora for many years, both from the sidelines and, at times, as an investor. From the outside, many see the famous charm bracelets, but there is a drama of epic proportions here. You have a staggering rise, a near-death collapse, and a spectacular comeback. It is a drama in four acts.

Golden age (2012-2016): Pandora experienced explosive growth fueled by its iconic charm bracelet, establishing itself as a dominant brand. However, this rapid expansion masked underlying weaknesses.

Collapse (2016-2020): The previous growth strategy proved unsustainable, leading to brand dilution, declining sales, and a catastrophic drop in the company’s stock price.

Turnaround (2020-2022): Under new leadership, a focused two-year plan successfully reset the commercial strategy, rebuilt brand desire, and instilled new operational and digital discipline.

New era (2022-Present): With its health restored, the company is now focused on long-term, sustainable growth by strengthening core markets and innovating beyond its original charm collection. Still the stock has recently taken a tumble and is down approx. 40% from its top during 2025.

This journey, with its latest dramatic twist, raises some fascinating questions. How did one of the world’s biggest brands nearly go under? How did they orchestrate such an impressive turnaround? And is this recent stock collapse a sign that the old problems are resurfacing, or is it a golden opportunity?

To truly grasp Pandora’s potential today, you first have to understand the crazy journey it went through. This article will lay out that story.

In a follow-up piece, I will share my detailed take on the company as an investment and where I believe it is headed from here.

Act I: Golden age (2012-2016) - Charming hyper-growth

When I look at the period from 2012 to 2016, I see a company that was on an absolute tear. Pandora was not just growing, it was exploding. This was the result of a perfect storm. They had a killer product that people fell in love with, and an aggressive, almost brutal, expansion plan that put that product in front of everyone.

A stroke of genius: The charm bracelet

The foundation of it all was the customizable charm bracelet. First launched in 2000, this idea was genius because it tapped into our desire to tell our own stories. It was a way to mark the “unforgettable moments” of your life. This created a business model based on collectability. Customers didn’t just buy once. Instead, they came back again and again for birthdays, anniversaries, and holidays. That kind of repeat business builds brand loyalty.

They poured fuel on this fire with smart marketing. The deal they signed with Disney in 2014 was a stroke of genius. By pairing their storytelling product with some of the most beloved stories in the world, they cemented Pandora’s place in popular culture.

Growth at all costs: A store on every corner

The real engine of this era was a relentless global expansion. The strategy was simple. Open as many stores as possible, as fast as possible. The pace was staggering. After opening their 1,000th store in 2013, it took them only three years to open the next thousand.

They could do this because they had a key advantage. They controlled their entire supply chain. With their own design teams and manufacturing plants in Thailand, they could produce jewelry efficiently and cheaply. This meant high profit margins, which gave them the cash to fund even more store openings. It was a well-oiled machine built for speed. In 2015 alone, they opened almost 400 new concept stores. That’s more than one a day.

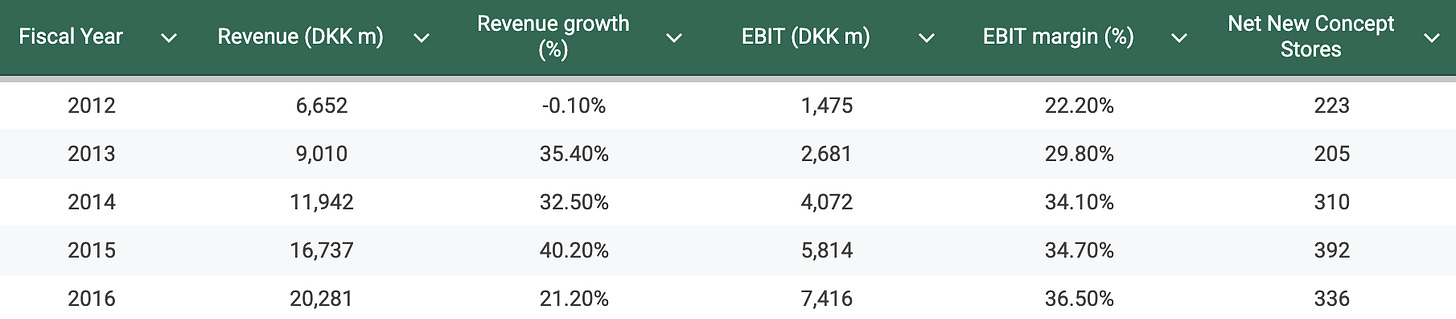

The staggering financials

The numbers from this period speak for themselves. Revenue growth was over 30% a year, and profitability was off the charts, with EBIT margins peaking above 36%. This was a company operating at the absolute top of its game, generating massive amounts of cash that it plowed back into more growth.

Key Performance Indicators (2012-2016)

But here is the fatal flaw in this perfect story. The company, and everyone watching it, was obsessed with total revenue growth, which came from opening new stores. They were so focused on expansion that they missed the warning signs in their existing stores. As Pandora became available everywhere, it started to feel less special.

To keep sales numbers high across this massive network, they began relying on promotions and discounts. This started a vicious cycle. The more common the brand became and the more it was on sale, the more it trained customers to see it as cheap, eroding the brand equity that had made it a powerhouse. The engine of their success was also the origin of the downfall.

Act II: Collapse (2016-2020) - When the charm fades

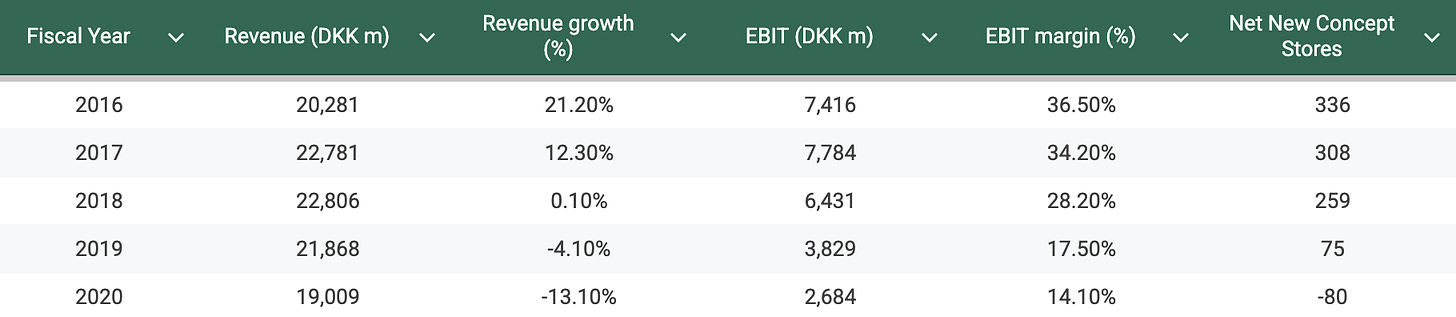

From late 2016 to early 2020, the Pandora growth story completely fell apart. The very strategy that made them a powerhouse, being everywhere, became their biggest liability. The charm had faded, and the business model was exposed as being built for a sprint, not a marathon.

Too big, too fast: The brand gets diluted

The core of the problem was that Pandora had become a victim of its own success. When you can buy something in every mall and on every high street, it stops feeling special. The brand lost its aspirational edge and started to feel like a mass-market commodity. The company even admitted it in their 2018 annual report, stating the brand “lacks clear positioning.”

Worse, they had become a one-trick pony. They had a significant reliance on the original charm bracelet, with a failure to innovate and get customers excited about other products like rings or earrings. People were getting bored. Even an internal review in 2017 pointed to a “lack of newness,” but they were too slow to fix it.

The warning light: Sales go into reverse

For years, Pandora could hide its problems by simply opening more stores. But once that slowed down, the truth came out. A key metric to look at for a retailer’s health is like-for-like sales, i.e. how existing stores are performing. This number tells you if customers are still excited about your brand. For Pandora, it was a disaster.

Like-for-like sales fell by -4% in 2018 and then accelerated downward to -8% in 2019. This was the signal that the core business was broken. Once the momentum from new stores was gone, their incredible profitability evaporated.

The market’s hard verdict

Investors did not wait around. The judgment was swift and brutal. Pandora’s stock cratered. The share price collapsed, wiping out billions in value. This was a massive vote of no confidence.

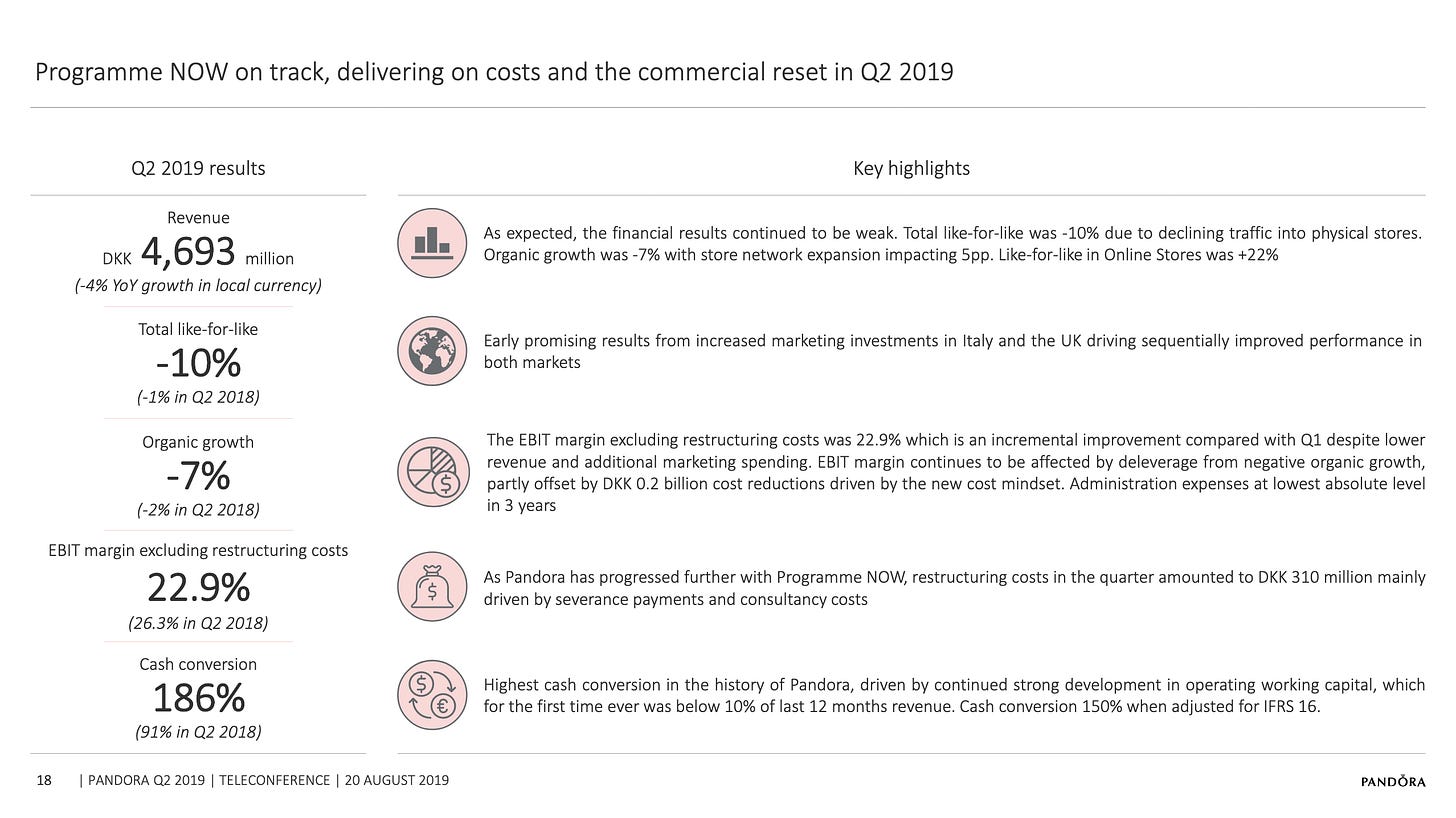

The crisis forced management’s hand. In late 2018, they finally waved the white flag on the old strategy and announced “Programme NOW”, which was a massive, two-year plan to reset the entire business.

Key Performance Indicators (2016-2020)

As devastating as this was, the collapse was the best thing that could have happened to Pandora. It was the brutal wake-up call they needed. The crisis created the mandate for real change, allowing them to bring in a new CEO, Alexander Lacik, from the outside, in 2019. He had the power to make tough, painful decisions that would have been challenging otherwise, such as cutting back on the promotions that were cheapening the brand, even though it hurt sales in the short term.

The destruction of this era was the necessary precondition for the successful turnaround that followed.

Act III: Turnaround (2020-2022) - Programme NOW: Forging a new core

From 2020 to 2022, Pandora went into emergency surgery. The turnaround plan, called “Programme NOW,” was all about tearing down the old, broken model and building something that could actually last.

What’s incredible to me is that they pulled this off during the COVID-19 pandemic. A crisis that should have been the final nail in their coffin actually ended up accelerating their comeback.

The “Programme NOW” playbook

When you dig into the plan, you see four clear, pillars they built their recovery on:

Commercial reset: This was the boldest move in my opinion. They had to stop the constant sales and deep discounts that were cheapening the brand. This meant taking a painful hit to revenue in the short term to restore the brand’s value for the long term. They also bought back old, unsold inventory from their partners to clean up the market. It was a bitter medicine.

Reigniting the brand: They had to remind people why they loved Pandora in the first place. This meant a huge new investment in marketing, a fresh look for their stores, and finally building an e-commerce experience that was up to modern standards.

Cutting costs: To pay for all this new marketing and technology, they had to find savings. They launched a major cost-cutting program to free up over a billion DKK to reinvest in the brand.

New ways of working: Finally, they had to fix how the company actually operated. I see this as getting everyone on the same page with a single, global plan for what products to launch and when, moving from a chaotic system to a disciplined, data-driven approach.

Executing during COVID-19

Just as they started this painful process, COVID-19 hit. For a global retailer, this should have been a catastrophe. But for Pandora, it turned into a powerful catalyst. This is where they got a bit lucky, but as I see it, they had already made their own luck. The investments they had just made in their website and online capabilities paid off massively when their physical stores were forced to shut down. Online sales doubled in 2020, saving their business.

On top of that, their “affordable luxury” positioning was the perfect product for the moment. With no one spending money on travel or restaurants, people turned to buying meaningful gifts for loved ones, and Pandora was perfectly positioned. The discipline they had just installed allowed them to navigate the chaos, and by the end of 2020, they were actually growing again. This was the clearest sign I could find that the turnaround was real.

Key Performance Indicators (2020-2022)

The financial results were stunning. Profit margins (EBIT) bounced back from their lows and surged to 25% by 2021. The business was once again a cash-generating machine.

Investors took notice. The stock price staged an unbelievable recovery. To me, this was the market’s verdict. Pandora had been rebuilt into a fundamentally stronger and more resilient company.

Act IV: New era (2022-Present) - The Phoenix Strategy - What’s next?

With the turnaround complete, Pandora entered its next phase with the “Phoenix” strategy. The brutal work of survival was over and the focus shifted to smart, sustainable growth. The company had a healthy brand, a solid operation, and a clear plan to prove it could be much more than just the charm bracelet company.

The four pillars of smart growth

The core idea behind the Phoenix strategy is to become a “full jewellery house.” The plan breaks down into four clear priorities:

Brand: Keep Pandora cool and relevant, especially for younger shoppers like Gen Z, ensuring it remains a brand people aspire to own and are excited to wear.

Design: Continue to innovate on the core charm bracelets while launching exciting new product lines. The “Pandora ME” collection and the big move into lab-grown diamonds are perfect examples of this.

Personalisation: Use customer data to create a better, more seamless shopping experience, both online and in-store, to drive loyalty.

Core markets in US and China: This is a total reversal of their old strategy. They stopped trying to be everywhere at once and are pouring money and effort into their biggest markets in the US and China.

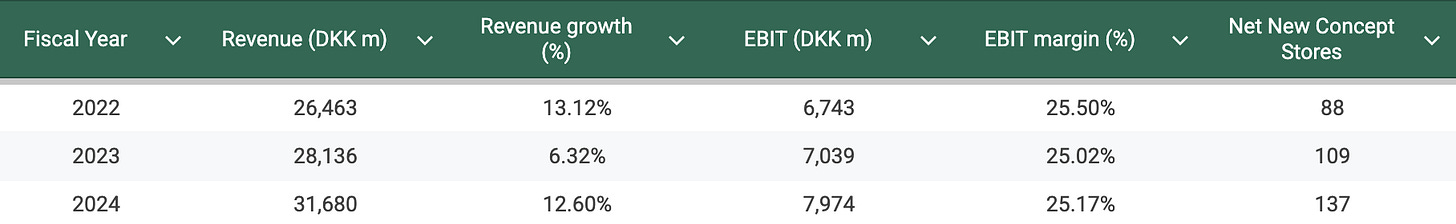

Key Performance Indicators (2022-2024)

In 2022-24, EBIT margin has been stable at around 25%, and growth solid albeit not as strong as during some previous eras.

The 2025 reality check

On paper, the strategy looked solid, and for a couple of years, it has delivered. So why has the stock taken such a beating in 2025, tumbling around 40% year-to-date? The answer lies in the collision between a good long-term strategy and a harsh short-term reality.

Shaking up the diamond market: Their launch of “Diamonds by Pandora” using lab-grown diamonds remains a game-changer in my view. It allows them to enter a higher-priced market while appealing to younger, ethically-conscious consumers. This part of the strategy continues to show promise.

Winning in the US, but not yet: They put their money where their mouth was in America, successfully hitting their ambitious goal to double revenue there ahead of schedule. But 2025 has thrown a wrench in the works. Persistent inflation and nervous consumers have led to a sudden and sharp slowdown, with U.S. sales declining in the first half of the year. The American growth engine has sputtered.

A disciplined (but slow) store strategy: In a challenging market like China, they are doing the opposite of what they did in the old days. They are closing underperforming stores to improve profitability. While this discipline is smart, the market recovery there has been far slower than anyone hoped, testing investor patience and acting as a continued drag on growth.

What’s next? The big question

Pandora rose from the ashes with a clear strategy, but now that strategy is facing a major test. This brings us to the most important questions of all.

Is the 40% stock drop in 2025 a temporary setback creating a massive buying opportunity, or is it a warning sign that the Phoenix strategy is flawed?

Has the company’s competitive moat been breached, or is it simply navigating a tough economic cycle better than its peers?

And most critically for us as investors, after this punishing sell-off, what is the business actually worth and what stock CAGR can we expect the coming years?

In my next piece, I’ll move from history to analysis, breaking down Pandora’s business moats, its 5-year outlook, and my own valuation of the company to answer the key question: Is now the time to buy?