ChemoMetec: The Danish tollbooth for the cell therapy revolution

Mission-critical life science tools with dependable recurring revenue. This small-cap company ($CHEMM) is a superb business, but comes with a premium valuation. What’s the play?

This is my third deep-dive into notable cases in the Danish Medtech sector. You find the previous ones here; GN Store Nord: Finding signal in the noise and Ambu A/S: Beyond the Bag.

The search for picks and shovels

I have in the past spent significant time analyzing (and at times investing in) the biotech sector. It is a field of brilliant scientists tackling brutal diseases, but also a minefield for investors (tell me about it…). For every company that lands a blockbuster, many more burn through hundreds of millions only to fail in late-stage trials. Outcomes are often binary and picking the winner is a low-probability, high-stress bet.

That reality led me to a simple model. As the saying goes, in a gold rush, don’t go digging for gold, sell the picks and shovels. Tool makers that sell essential products to the entire industry can prosper without taking the existential risk of any single program. They are the tollbooths on the road to discovery.

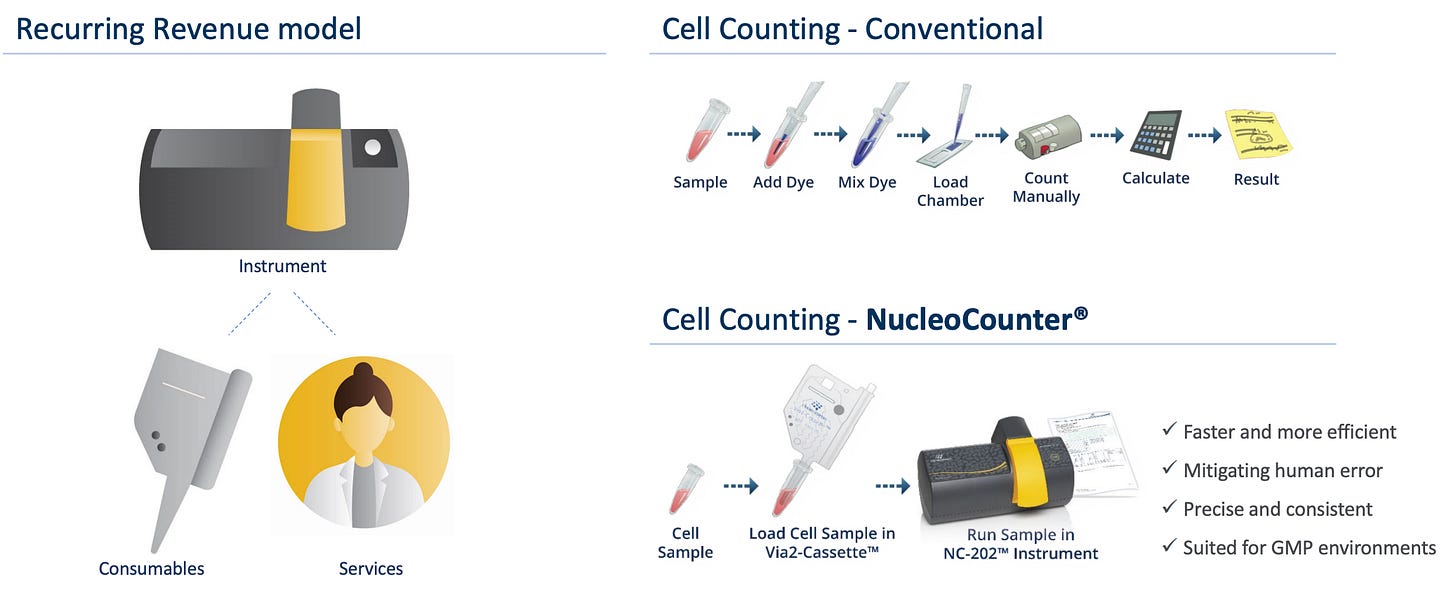

This search has now taken me to a small and unassuming place, a Danish company called ChemoMetec. This company occupies a sweet spot in life-science tools. It is mission-critical to cell- and gene-therapy workflows, where accuracy, reproducibility, and regulatory compliance are non-negotiable. The model is simple and powerful. They sell instruments, then monetize years of proprietary, high-margin consumables and services. Pencil on sticky GMP validations, high switching costs, and a brand that has become the default in its niche, and you get a company that compounds through cycles rather than riding them.

Let’s dive in!

The Setup: Key data & investment thesis

💰 Stock Price: DKK 519.00 (as of Sep 3, 2025)

📄 Shares Outstanding: 17.40 million

🏢 Market Cap: DKK 9.07B (approx. EUR 1.22B)

🏦 Net Cash: DKK 257M (approx. EUR 34.5M)

🌐 Enterprise Value: DKK 8.81B (approx. EUR 1.18B)

⚙️ Sector/Industry: Healthcare / Life Sciences Tools & Services

💡 Investment Thesis: ChemoMetec is a brilliant business with durable moats and dependable recurring revenue, but current valuation remains demanding.

Sourcing: ChemoMetec Q3 2024/25 Trading Statement, StockAnalysis.com, Investing.com.

The Business: History & Operations

Origin Story

Founded in Denmark in 1997, ChemoMetec began with a simple but powerful mission. It was to replace the tedious, error-prone, and subjective manual methods of cell counting with automated, high-precision instruments. For decades, scientists had relied on hemocytometers, essentially a microscope and a gridded slide, to manually count cells. It was a process ripe for disruption.

My read is that ChemoMetec was fortunate to be in the right place at the right time, with the right product. The development of advanced therapies involving the modification of a patient's own cells required precise and reliable cell counting, which elevated the discipline from a "nice-to-have" to an absolute "need-to-have" for regulatory approval. ChemoMetec’s instruments, with their emphasis on accuracy and consistency, were a perfect fit for this demanding, highly regulated environment. They didn't just find a new market, they became a foundational technology for it.

What they actually do: The Nespresso of cell counting

To understand ChemoMetec, it’s best to avoid the complex jargon of image cytometry and instead think of a more familiar business model: Nespresso.

The "Machine": ChemoMetec develops and sells a range of proprietary, automated cell counters. Their flagship products have been the NucleoCounter® series, like the workhorse NC-202™, and they are now rolling out the next-generation XcytoMatic® platform for higher-throughput applications (albeit facing tough competition in this segment). These instruments are the "Nespresso machines". They are sophisticated, reliable, easy to use, and represent the initial sale to a customer.

View of all products from a previous investor presentation.

The "Pods": The true core of the business model, and the heart of its economic engine, lies in the consumables. Every single analysis performed on a ChemoMetec instrument requires a proprietary, single-use, volume-calibrated slide called a Via-Cassette™. These are the "Nespresso pods."

These are not simple pieces of plastic. Each cassette is a microfluidic device that is individually calibrated and pre-loaded with fluorescent dyes. When a cell sample is drawn into the cassette, the dyes automatically stain the cells, distinguishing between live and dead cells with incredible precision. This patented design is what makes the whole system work so well. It eliminates pipetting errors, removes the need for technicians to handle potentially toxic dyes, and ensures that results are consistent and reproducible. For customers operating in regulated GMP (Good Manufacturing Practice) environments, this level of consistency is a regulatory necessity.

This razor-and-blade model is a thing of beauty. It provides customers with unparalleled speed, accuracy, and simplicity. And it provides ChemoMetec with a predictable, recurring, and exceptionally high-margin revenue stream that is locked in for the life of every instrument it sells.

Recent developments & performance

Business Update: The rebound

ChemoMetec’s performance during the last years perfectly illustrates the volatility that sometimes impacts this stock. The fiscal year 2022/23 was challenging. As the company noted in its annual report, a sharp rise in interest rates created a "biotech funding winter," which "significantly reduced the availability of new capital to businesses in the cell-based therapy area". This directly impacted ChemoMetec's customers, many of whom are smaller biotech firms, forcing them to delay investments. The result was a 17% decline in instrument sales for the year.

The market, fixated on this headline number, punished the stock. What it missed, however, was that even during this difficult period, sales of consumables grew by 18% and services grew by 39%. The installed base of “Nespresso machines" kept ordering "pods," demonstrating the resilience of the recurring revenue stream.

Fast forward to the most recent quarter, Q3 2024/25, and the picture has dramatically improved. As the funding environment stabilized, pent-up demand was unleashed. The company reported a stunning 26% year-over-year revenue growth to DKK 124.2 million, with an incredible EBITDA margin of 51%. Instrument sales roared back, growing 23%, while the underlying engine continued to hum, with consumables growing 18% and services an impressive 47%.

Stock price context

ChemoMetec's stock chart tells this story visually. A phenomenal run-up during the biotech euphoria of 2020-2021 was followed by a sharp and painful correction throughout 2022 and 2023 as the funding winter took hold. The recent string of strong results in the 2024/25 fiscal year has sparked a significant recovery, but the stock remains well below its all-time highs.

This volatility reveals the market's behavior. It sometimes prices ChemoMetec based on its most cyclical and unpredictable revenue stream, instrument sales. This creates opportunities for long-term investors who understand that the true value lies in the ever-growing, high-margin annuity of the consumables business. The market at times sees a cyclical hardware company, when really it is a compounding machine temporarily obscured by macro noise.

The Business Model & Unit Economics

Revenue model: The razor and the blade in detail

ChemoMetec’s revenue is generated from three sources: one-time sales of instruments, recurring sales of proprietary consumables, and recurring service contracts. The dynamic between these segments is the key to understanding the investment case.

The vast majority of volume, according to my understanding over 90%, is generated once a therapy enters the commercial production phase. The average cassette consumption is between 15 and 30 cassettes per patient for a specific therapy, meaning every new therapy approval acts as a massive trigger for both instrument and consumable sales.

The table below, using data from the first nine months of the current fiscal year, quantifies this dynamic and proves the core thesis.

Source: ChemoMetec Q3 2024/25 Trading Statement.

This data is powerful. It shows that nearly 70% of the company's revenue is now derived from recurring or semi-recurring sources (consumables and services). While the 37% growth in instrument sales is impressive and drives the headline numbers, the steady 18% growth in the larger consumables segment is the real engine of long-term value creation.

This business model is not just recurring, it is in essence anti-fragile. A boom in instrument sales, like the one we are seeing now, has a lasting positive effect. Each new instrument placed in a lab permanently increases the size of the installed base. This, in turn, creates a larger, more stable foundation for future high-margin consumable sales. It’s a ratchet effect and once an instrument is sold, it creates an annuity stream for years to come, structurally increasing the company's baseline profitability.

The Moat: A system of interlocking advantages

ChemoMetec’s durable competitive advantage is not derived from a single factor but from a powerful system of interlocking moats that are exceptionally difficult for a competitor to breach.

Proprietary technology & innovation

The foundation of the moat is the company's intellectual property, centered on the Via-Cassette™ technology. These patented, single-use cassettes are the source of the system's precision, ease of use, and reproducibility. The use of fluorescence-based image cytometry provides a technically superior method for cell analysis compared to older techniques, offering more accurate data by effectively distinguishing cells from debris, which is a critical factor in sensitive biological applications. This technological edge is a primary reason customers choose ChemoMetec in the first place.

High switching costs

This is the deepest and widest part of the moat. A vast majority of ChemoMetec's key customers in cell and gene therapy operate in highly regulated GMP environments. When developing a new therapy, a company must validate every single piece of equipment and every step of its manufacturing and quality control process with regulatory bodies like the FDA.

Once a ChemoMetec instrument is written into these validated protocols, it becomes almost impossible to replace. A customer cannot simply swap it out for a cheaper alternative. Doing so would require them to re-validate their entire process, a monumentally expensive and time-consuming task that would delay their drug's path to market and introduce significant regulatory risk. This effectively locks customers into the ChemoMetec ecosystem, ensuring a predictable stream of high-margin consumable sales for the lifetime of that therapy, which can be decades.

Brand strength & customer loyalty

In the world of science and medicine, reputation is everything. ChemoMetec has meticulously built a brand synonymous with accuracy, consistency, and reliability. Customer reviews and testimonials are overwhelmingly positive, frequently citing the instruments' robustness and the reproducibility of their results. Over time, ChemoMetec has become the gold standard for cell counting in the cell therapy space. This creates a powerful virtuous cycle as new labs and researchers adopt ChemoMetec's technology because it is the industry standard, further cementing its dominant position.

The investment thesis: The 5-year outlook

Looking ahead to 2030, I see four primary drivers that will propel ChemoMetec's growth and value creation. My conviction is that the market is underestimating the combined power of these forces.

1. Riding the wave of commercialized cell therapies: The cell and gene therapy market is still in its early innings. While hundreds of therapies are in clinical trials, only a handful have reached full commercialization. As more of these therapies gain regulatory approval and move into large-scale production, the volume of cell counting required will explode. A process that required dozens of counts during a clinical trial might require thousands for a commercial product. ChemoMetec, as the incumbent and gold standard, is the primary beneficiary of this massive increase in testing volume.

2. The XcytoMatic® platform: Expanding the addressable market: These new instruments are designed for higher throughput and greater automation, making them ideal for the much larger, more established bioprocessing market, which includes the manufacturing of vaccines, antibodies, and other biologics. Early signs from the company are encouraging: the number of customer validations in progress for the XcytoMatic platform has tripled year-over-year (Q3 2024/25 Trading Statement).

To stress-test this idea, however, one must acknowledge that there are hurdles. The bioprocessing market is a different ball game, dominated for a long time by Beckman Coulter's Vi-CELL platform. The workflows and culture within these labs are built around the incumbent technology, creating strong inertia. A fast penetration into this market seems challenging.

3. The inexorable mix shift to high-margin consumables: This is a mathematical certainty. As the installed base of instruments continues to grow, the revenue mix will inevitably and permanently shift further towards the higher-margin consumables and services. Today, consumables already generate more revenue than instruments and carry substantially higher gross margins. I expect this favorable mix shift will be the primary driver of margin expansion over the next five years, pushing the corporate EBITDA margin from its current level of ~51% towards a sustainable 55-60%.

4. Disciplined, technology-driven M&A: ChemoMetec has a fortress balance sheet with a significant net cash position. The recent acquisition of Ovizio Imaging Systems in late 2024 demonstrates a clear and disciplined capital allocation strategy. Ovizio specializes in on-line, real-time cell analysis, a technology that could eventually allow ChemoMetec to move its analytical capabilities directly into the manufacturing bioreactor. This was not a deal to buy revenue. Rather, it was a strategic tuck-in to acquire a promising technology that could become a significant future growth driver. I expect management to continue this prudent approach, using its cash to acquire technologies that enhance its moat and expand its capabilities.

Management & Capital allocation

A new generation of leadership

In March 2024, ChemoMetec appointed Martin Helbo Behrens as its new CEO. At just 31 years old, his appointment might seem surprising, but my read is that this was a deliberate and intelligent choice by the board. Mr. Behrens is an internal promotion, having previously served as both COO and CFO of ChemoMetec's crucial US subsidiary. The US is by far the company's largest and most important market, accounting for over 60% of revenue. The board has not appointed an outsider, but rather a key operator from the company's primary growth engine who has a proven track record of commercial success.

This move was complemented by the appointment of a new CFO, Kim Nicolajsen, in July 2024. Together, they represent a new, young, and internally-seasoned leadership team tasked with guiding ChemoMetec through its next phase of growth.

A prudent and focused capital allocation strategy

ChemoMetec's capital allocation priorities are clear and shareholder-friendly.

Reinvestment in R&D: The top priority must be maintaining its technological leadership. The development and launch of the XcytoMatic platform and the upcoming NC-203 instrument are testaments to its commitment to internal innovation.

Strategic M&A: As shown with the Ovizio deal, the company favors small, strategic technology acquisitions over large, risky, "transformational" deals. This is a disciplined approach that I find commendable.

Shareholder Returns: The company has a consistent policy of returning excess capital to shareholders via dividends. This signals a mature and confident management team that balances investment for future growth with rewards for current owners.

Valuation: A triangulated approach

As we turn to the quantitative core of this investment memo, my valuation of ChemoMetec is anchored to a five-year investment horizon. My approach is not predicated on a single methodology. Instead, I triangulate a final conclusion from two distinct analytical frameworks, being 1) a relative valuation against a handpicked peer group of public life science tools companies, and 2) a forward-looking multiple analysis applied to three proprietary operating scenarios in a Base Case, a Bull Case, and a Bear Case.

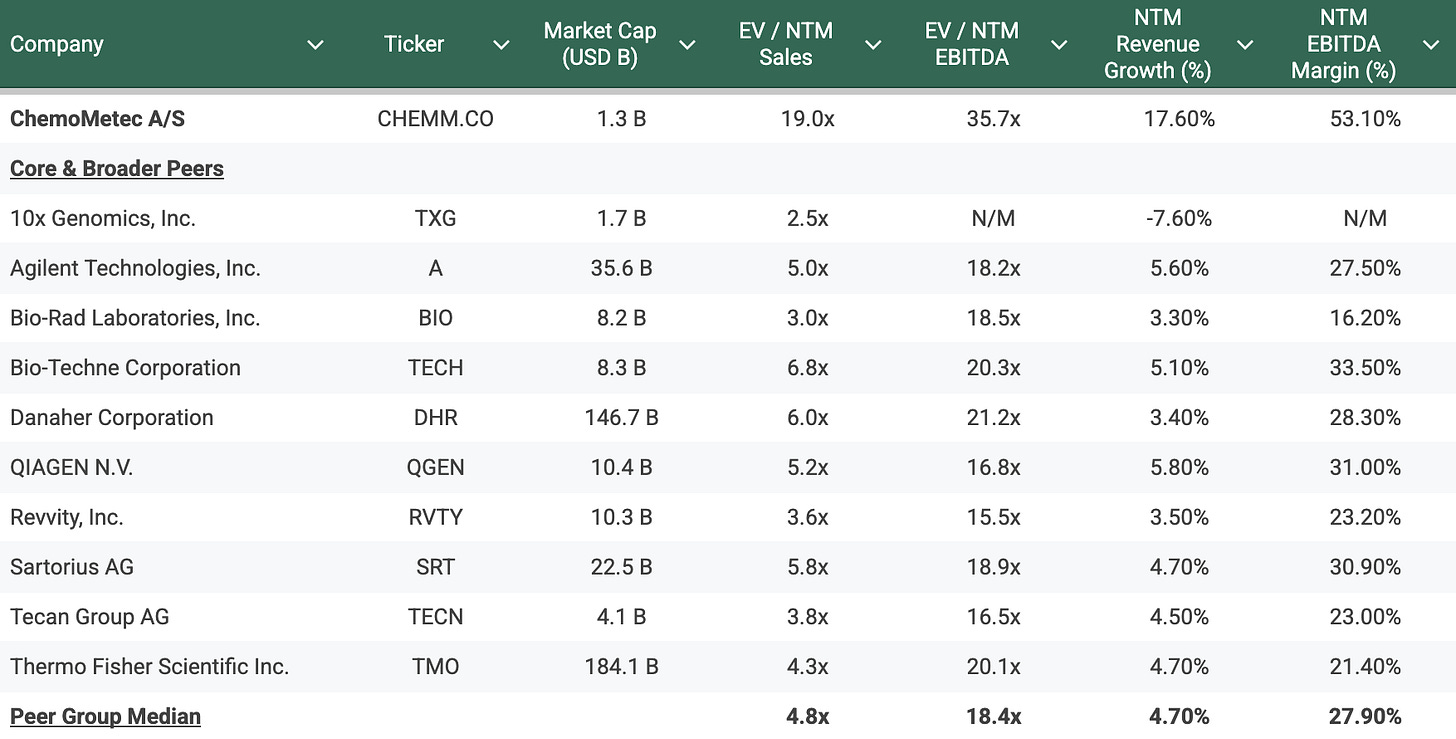

Relative Valuation: A justified peer group

To properly frame ChemoMetec's valuation, it is essential to select a peer group that reflects its specific business model and end-market exposures. Consequently, the most relevant comparables are not broad-based diagnostics conglomerates, but rather focused players in cell analysis, genomics, and bioprocessing that share these fundamental characteristics.

My selected peer group is structured to provide a multi-layered view of the life sciences tools landscape:

Core cell analysis & genomics peers: Companies like 10x Genomics (TXG) and Bio-Rad Laboratories (BIO) are direct comparables. 10x Genomics, a leader in single-cell analysis, shares exposure to biopharma R&D budgets and a similar instrument/consumable model, serving as a high-growth benchmark. Bio-Rad offers a more mature, diversified profile in life science research and diagnostics, providing a stable valuation reference point.

Broader bioprocessing & tools peers: This group includes companies like Germany's Sartorius AG (SRT), a giant in bioprocessing solutions whose valuation is highly relevant due to its focus on providing critical tools to the biopharma industry. It also includes Agilent Technologies (A), QIAGEN (QGEN), Tecan Group (TECN), Bio-Techne (TECH), and Revvity (RVTY). These firms represent a cross-section of the industry, from diversified instrument makers to specialists in sample and assay technologies, each providing a valuable data point on how the market values different growth and profitability profiles within the tools sector.

Large-Cap Benchmarks: Industry titans such as Thermo Fisher Scientific (TMO), Danaher (DHR), Merck KGaA (Life Science division), and Becton, Dickinson and Company (BDX) are included for contextual purposes. While their immense scale and diversification make them imperfect direct peers, their valuation multiples effectively set the ceiling for the sector and reflect best-in-class operational and capital allocation standards.

The following table presents key forward-looking valuation metrics for this peer group, based on the latest available consensus estimates.

Note: Data as of September 3, 2025. ChemoMetec figures based on FY25 guidance. Peer data based on consensus estimates and latest available financial data. NTM (Next Twelve Months) is used where available; TTM (Trailing Twelve Months) or next fiscal year estimates are used as proxies otherwise.

The data clearly illustrates two critical points.

First, ChemoMetec commands a substantial valuation premium. Its forward EV/Sales multiple of 19.0x and EV/EBITDA multiple of 35.7x are multiples of the peer group median. This premium, may be, justified by its extraordinary profitability. They have a forward EBITDA margin of over 53% is in a class of its own compared to the peer median of ~28%. The market is willing to pay a premium for this highly efficient, cash-generative business model.

Second, and more importantly, this valuation creates a significant disconnect with the company's recent growth profile. After a sharp slowdown in instrument sales in fiscal 2023 due to the biotech funding winter, the market is pricing the stock for a swift and powerful return to high-growth territory.

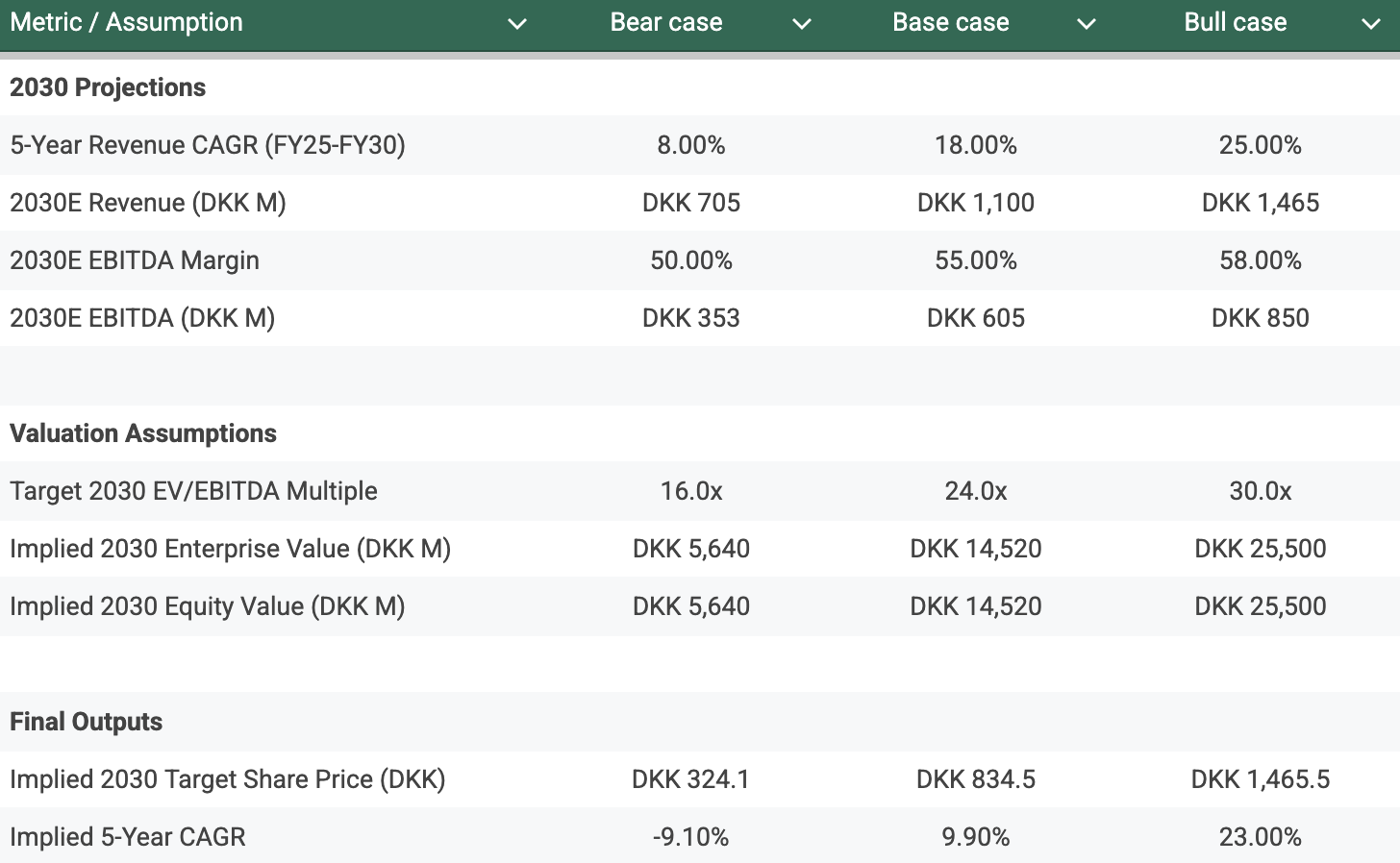

Triangulated valuation & scenarios

To quantify the range of potential outcomes over our five-year investment horizon, I have developed three distinct scenarios. These narratives are driven by the interplay between the macroeconomic funding environment for ChemoMetec's core biopharma customers and the company's own success in executing its product roadmap. For this analysis, I have selected EV/EBITDA as my primary valuation metric, as it best reflects the underlying operating profitability and cash-generating capability of the business, neutralizing for differences in capital structure. EV/Sales is used as a secondary reference, particularly useful for contextualizing growth.

Base Case: Return to normalcy. This scenario assumes a gradual recovery in the biotech funding landscape through 2026 and 2027. The new XcytoMatic platform achieves steady market adoption, becoming a meaningful contributor to growth by 2028. The core instrument provides solid growth, driving a consistent expansion of the high-margin consumables business. Overall revenue increase by 18% every year. Multiples contract slightly but remain above peer group.

Bull Case: Innovation super-cycle. This scenario envisions a powerful rebound in biotech funding in early 2026, catalyzed by major clinical breakthroughs in the CGT space. The XcytoMatic platform proves to be a disruptive technology, rapidly gaining market share and driving a super-cycle of instrument placements and exceptionally strong, high-margin consumables growth. Top-line grows by 25% per year. Current high multiples remain in place.

Bear Case: Stagnation and Competition. In this scenario, the biotech funding winter is prolonged, leading to a weak and protracted recovery. The XcytoMatic platform fails to gain significant traction, and the core business stagnates. Consumables growth slows dramatically as new instrument placements falter, leading to margin pressure as competition intensifies. Growth per year becomes a meager 8%. Multiples collapse.

The following table synthesizes my financial projections and valuation analysis for each scenario, culminating in a target share price for mid-2030 and the implied 5-year CAGR from the current share price of DKK 519.

Conclusion on valuation

My triangulated analysis reveals a wide spectrum of potential outcomes for ChemoMetec, underscoring the significant operational leverage and inherent risk in this investment. The Bull Case presents a compelling 23.0% annualized return, driven by flawless execution and a favorable market tailwind. Conversely, the Bear Case highlights the considerable downside risk, especially given today’s premium valuation, with a potential for a -9.1% annualized loss if growth stagnates and the company's premium valuation multiple compresses toward the industry median.

Ultimately, my investment conclusion is anchored to the Base Case, which I believe represents the most probable path forward. This scenario balances the company's strong market position and superior profitability against a realistic view of market recovery and new product adoption. My Base Case analysis yields a 2030 target share price of DKK 835, implying a 5-year CAGR of 9.9% from the current price of DKK 521.00.

While this represents a decent absolute return, it falls short of our 20%+ annualized target. The analysis indicates that at its current valuation, ChemoMetec's stock is pricing in a robust recovery and offers an insufficient margin of safety to compensate for the execution and market risks ahead. Therefore, it does not meet the Fjord Alpha investment hurdle.

The Pre-Mortem: A case for failure

Let's assume it is 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The biotech winter never ended: The funding crunch of 2022-23 was not cyclical but the start of a new, harsher reality. A series of high-profile clinical failures in cell and gene therapy caused a collapse in R&D investment. Instrument sales stagnated, the installed base stopped growing, and our thesis about compounding consumables revenue never came to fruition. The growth simply was not there.

The allogeneic shift happened faster than expected: This was the key technological risk we underestimated. The industry rapidly pivoted from autologous (patient-specific) to allogeneic (one-donor-for-many) therapies. This meant customers no longer needed one cell counter per patient, but perhaps one per thousand patients. The market shifted to high-throughput systems, a category dominated by competitors like Beckman Coulter. ChemoMetec's technology was not suited for this new paradigm, and its core market shrank dramatically.

Execution and R&D fumbled: The new, young management team proved unequal to the task. The XcytoMatic launch into bioprocessing failed because the technology was inferior and they could not overcome the cultural and workflow incumbency of Beckman Coulter. The small R&D department failed to produce any meaningful new innovations, leaving ChemoMetec as a "one-trick pony" whose trick was no longer in high demand.

The moat was a mirage: Our central assumption about high switching costs proved to be flawed. A disruptive new technology emerged that made cell counting so cheap and simple that customers found it worthwhile to go through the pain of re-validating their processes. Alternatively, a competitor successfully challenged ChemoMetec's core patents on the Via-Cassette, opening the floodgates to low-cost generic consumables that destroyed the lucrative razor-and-blade model.

Conclusion: The final verdict

ChemoMetec is a Danish MedTech company that possesses a dominant position in a structural growth market, a stellar razor-and-blade business model, industry-leading profitability, and a pristine balance sheet.

The risks, as outlined in the pre-mortem, are present. The business is undeniably tied to the cyclical fortunes of the biotech industry, and competition is a constant threat. However, I believe the strength of its interlocking moat, built on proprietary technology, regulatory lock-in, and a gold-standard brand, provides substantial protection against these risks.

The current valuation already reflects much of what makes ChemoMetec exceptional. The market is not blind to the durability of its consumables annuity or the quality of its execution. With the shares pricing in excellence and leaving limited margin of safety, this is a name for the watchlist rather than an immediate purchase. I would prefer to build a position on weakness, when instrument-order noise, funding lulls, or sentiment-driven multiple compression offer a better entry.

My verdict is that this is a world-class business that requires a patient posture. ChemoMetec is well managed, highly profitable, and levered to one of the most important trends in modern medicine. But at today’s price, forward returns look more reliant on flawless execution than I am comfortable underwriting.

I am waiting for either a more attractive valuation or evidence that the consumables flywheel is outpacing expectations. Until then, it remains atop my list of high-quality Northern European compounders to buy on dislocation.

✅ Thesis Pillar 1: A dominant "picks and shovels" provider to the high-growth cell and gene therapy market.

✅ Thesis Pillar 2: Quickly growing base of high-margin, recurring consumables revenue.

✅ Thesis Pillar 3: A strong moat built on proprietary technology and high customer switching costs in regulated GMP environments.

⚠️ Key Risk (from Pre-Mortem): A prolonged, structural downturn in biotech funding that stalls the growth of the instrument installed base, or a shift to high-throughput systems with intense competitions from large competitors.

🎯 Target Price (Base Case): DKK 835 by 2030.

📈 Implied 5-Year CAGR (Base Case): 10%

Primary Sources Used:

ChemoMetec Annual Report 2023/24

ChemoMetec Investor Presentations

ChemoMetec Company Announcements (2020-2025)