GN Store Nord: Finding signal in the noise

After a debt-fuelled crisis of identity, this 150-year-old Danish champion is being deeply misunderstood. The market sees a messy conglomerate; I see a high-quality MedTech core, with Jabra for free.

The puzzle of a complex giant

Our second deep-dive into the Danish MedTech space (after Ambu A/S) takes us into the complex, misunderstood, and, in my view, undervalued case of GN Store Nord. Wall Street loves a simple story, and when a company becomes difficult to categorize, it often ends up in the discard pile, misunderstood and mispriced. This is where we find GN Store Nord, one of the most shorted companies on the Danish stock exchange.

GN Store Nord is a company with a 150-year history of innovation that today operates three distinct businesses: 1) a medical device leader in Hearing, 2) the globally recognized professional audio brand in Jabra, and 3) a premium gaming gear business in SteelSeries. The market, confused by this complexity and spooked by recent cyclical headwinds, has punished the stock. I believe this to be a mistake.

This analysis is timely because GN is at a critical inflection point. The pain from the debt-fueled acquisition of SteelSeries in 2022 and the subsequent, necessary deleveraging is now largely in the rearview mirror. The most recent quarterly results show the first tangible signs of a successful operational turnaround, marked by impressive margin expansion and strong cash flow generation despite a flat top line. The market reacted with a sharp rally, but I believe this is just the beginning.

I actually find the background story similar to that of Carasent AB (see my recent write-up linked), albeit at a different scale.

The central question now is whether this is a temporary reprieve or the start of a sustained re-rating as the market wakes up to a leaner, more focused, and financially healthier GN. My work over the past few weeks suggests the latter. The market still sees a messy conglomerate; I see a high-quality MedTech business on sale, with the upside from an operational turnaround in its other divisions offered for free. It is time to dig in.

The Setup: Key data & investment thesis

💰 Stock Price: DKK 116

📄 Shares Outstanding: 145.61 million

🏢 Market Cap: DKK 16.89B

🏦 Net Debt: DKK 9.85B

🌐 Enterprise Value: DKK 26.74B

⚙️ Sector/Industry: Healthcare / Medical Devices & Audio Technology

💡 Investment Thesis: The market is mispricing GN Store Nord as a low-margin hardware conglomerate, creating an opportunity to buy its world-class, high-margin Hearing franchise at a steep discount while getting the upside from a cyclical recovery and margin expansion in its Gaming/Entreprise businesses for free.

Sourcing: Company Q2 2025 Interim Report, Company Annual Report 2024, Market Data as of 29 Aug 2025.

The Business: History & Operations

Origin Story

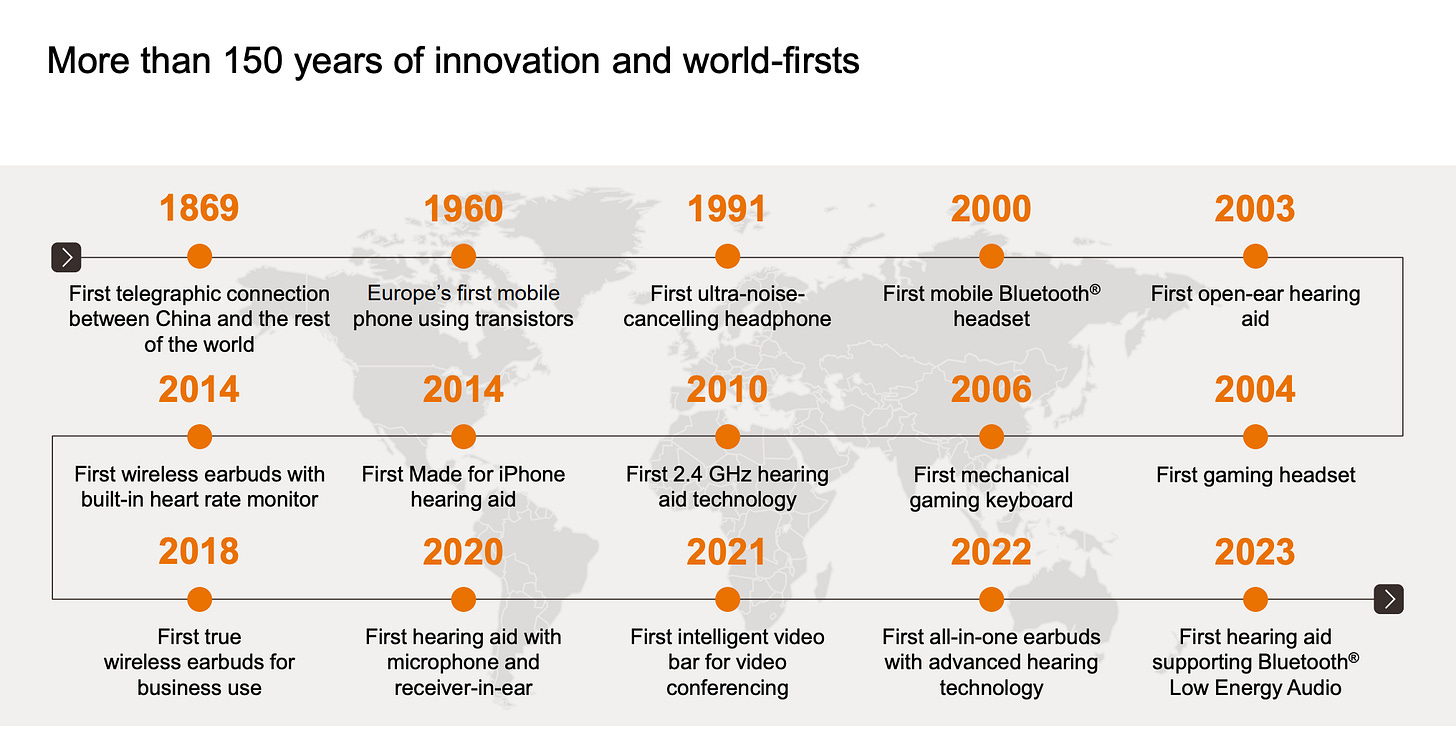

To understand GN Store Nord, you have to appreciate its incredible lineage. This is not a fly-by-night tech company. It was founded in 1869 as the Great Northern Telegraph Company with the audacious goal of connecting the world. This history is more than just trivia. It establishes a 150-year-old corporate DNA rooted in pioneering communication technology and global ambition.

Over the decades, as telegraphs gave way to new technologies, GN consistently pivoted. This legacy of adaptation is what led it into the world of acoustics and audio, laying the foundation for the two distinct pillars of its business today: medical-grade hearing instruments and professional/consumer audio equipment. This is a company that has survived and thrived by reinventing itself, a crucial piece of context for understanding its current transformation.

What They Actually Do

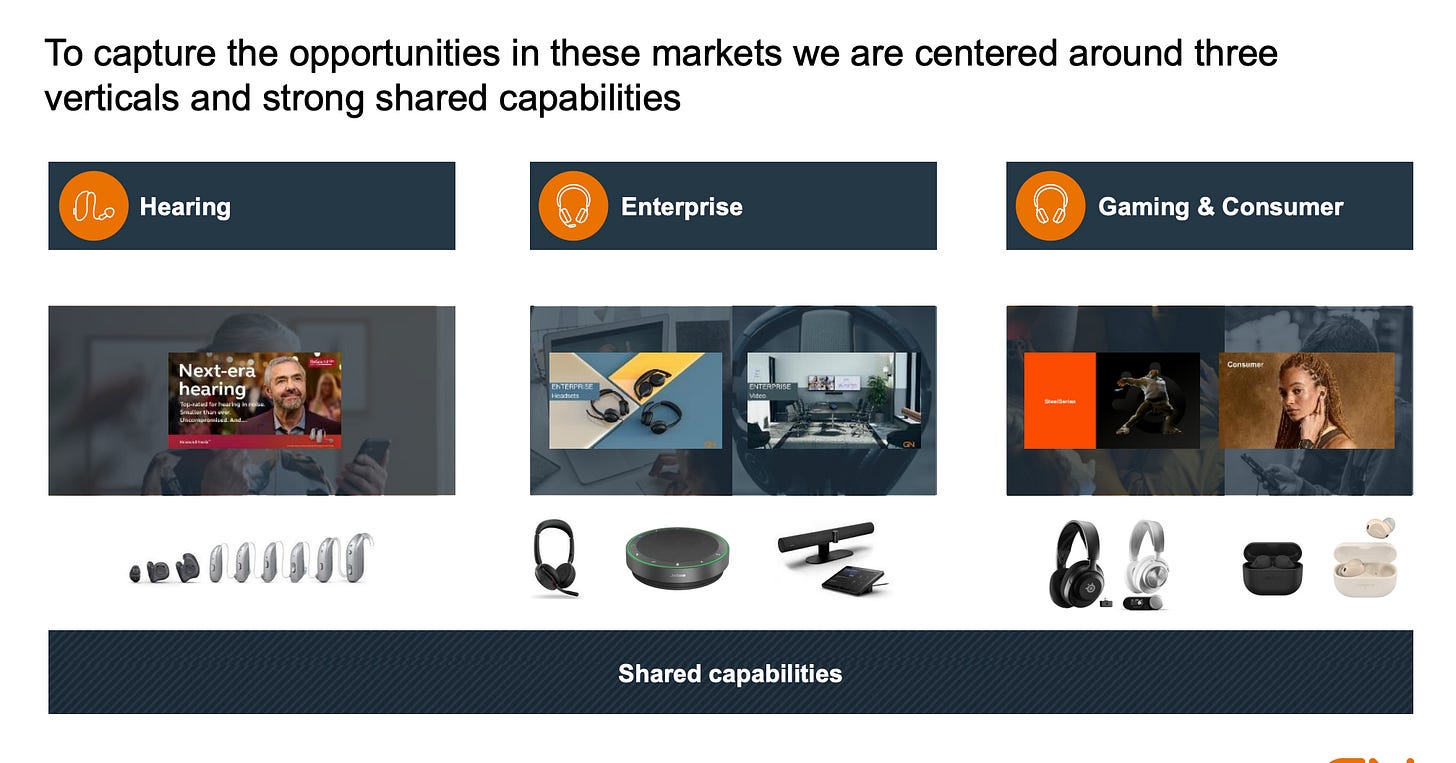

Think of GN Store Nord as a "Three-Legged Stool." Each leg is essential for stability, but they are made of very different materials and possess different strengths. This structure has been the source of both its greatest challenges (complexity, conglomerate discount) and its greatest potential, what they call “Shared capabilities” (synergies, shared R&D).

What’s the structural crown jewel?

Leg 1: The MedTech engine (Hearing Division)

This is the steadiest, most valuable leg of the stool. The Hearing division is a pure-play medical technology business. It develops, manufactures, and sells sophisticated, regulated hearing aids under the flagship ReSound brand, alongside Beltone and Interton. Its customers are individuals with hearing loss, but its primary channel is a global network of professional audiologists who prescribe and fit the devices. This is a classic MedTech model: high barriers to entry, significant R&D investment, strong intellectual property, and attractive, non-cyclical growth driven by powerful demographic tailwinds like aging populations. This division is the company's crown jewel.

What’s cyclical and with upside?

Leg 2: Enterprise Division

This leg is strong but cyclical. Operating under the globally recognized Jabra brand, the Enterprise division sells professional-grade audio and video equipment such as headsets, speakerphones, and video conferencing systems. Its customers are businesses, ranging from massive call centers to global corporations outfitting their employees for a hybrid work environment. This is a B2B technology market that is highly sensitive to corporate IT spending cycles and macroeconomic confidence, as we've seen in the recent slowdown.

Leg 3: Gaming division

This leg is the most competitive and most volatile. Through the 2022 acquisition of SteelSeries, this division sells premium gaming peripherals, including headsets, keyboards, and mice, to a global audience of gamers and esports professionals. This is a competitive, hit-driven consumer electronics market where brand loyalty is hard-won and technological edges are fleeting. It offers high growth potential but comes with lower margins and greater earnings volatility than the other two legs.

Recent Developments & Performance

Business Update

The most recent quarterly report for Q2 2025 perfectly illustrates the "Three-Legged Stool" in action and provides the catalyst for this memo. The results presented a clear "tale of two companies."

The star of the show was the Hearing division. It delivered an impressive 8% organic revenue growth, a remarkable achievement in a market that management noted was "growing below the structural trends". This outperformance was driven by significant market share gains from the successful global launch of its new ReSound Vivia platform, demonstrating its continued innovation leadership.

In stark contrast, the other divisions faced headwinds. The Enterprise division saw organic revenue decline by 7%, hit by ongoing macroeconomic uncertainty in Europe and a difficult comparison to the prior year. The Gaming division was flat at 0% organic growth. While this was a resilient performance that represented market share gains in a challenged consumer electronics market, it still points to the cyclical pressures facing that business.

However, the top-line story was not what ignited the stock, which surged over 17% on the day of the announcement. The real story, and what the market is just beginning to price in, is the dramatic improvement in profitability. Despite flat organic growth at the group level (ex-wind down effects),

Group EBITA surged 46% year-over-year, and the EBITA margin expanded by a massive 480 basis points to 13.1%, up from 8.3% in the same quarter last year.

This was the first undeniable sign that the "One-GN" transformation and its associated cost-cutting programs are delivering tangible results. Management's tone on the earnings call was one of quiet confidence, repeatedly emphasizing "strong execution" and their ability to navigate a "challenged market environment". The market is finally starting to believe that the margin recovery is not just possible, but is already underway.

Stock Price Context

GN's stock has been on a wild ride. From its peak in mid-2021, the share price collapsed by over 80% into 2025. This brutal decline was driven by a perfect storm. The market soured on the debt-fueled acquisition of SteelSeries, while the post-COVID normalization slammed the brakes on the booming demand for enterprise headsets and gaming gear. The balance sheet was stretched, and the narrative was broken.

The stock bottomed out in Q2 25 and has been in a gradual recovery since. The rally following the Q2 2025 results marks a potential turning point, suggesting that institutional investors are beginning to look past the cyclical noise and appreciate the fundamental operational improvements.

Connecting to the Analysis

These recent developments are the very reason for this deep dive. The divergence in the performance of the divisions, Hearing strong, Enterprise/Gaming weak, and the simultaneous surge in group profitability validates my core thesis. The market has punished the entire company for the cyclical weakness in two of its three legs. Now, as the "One-GN" strategy proves its worth through margin expansion, the true earnings power of the consolidated entity is being revealed.

The Business Model & Unit Economics

Revenue Model

GN's revenue model is straightforward: it is driven almost entirely driven by one-time hardware sales with pockets of recurring (accessories, service) and no material subscription revenue today. The critical insight comes not from how the company makes money, but from how profitably it does so in each of its distinct segments. A look at the divisional profit margins reveals the true composition of the business.

Hearing: This is a high-value MedTech business, and it has the margins to prove it. In Q2 2025, the division reported a profit margin of 36%. This is a function of deep intellectual property, regulatory barriers, and the medical nature of the product, which supports significant pricing power.

Enterprise: This segment is also highly profitable, delivering a divisional profit margin of 34% in Q2 2025, even on declining revenues. This demonstrates the premium branding of Jabra and strong cost control.

Gaming: As a consumer electronics business operating in a fiercely competitive market, this division has the lowest profitability, with a margin of 12% in Q2 2025 (excluding wind-down effects).

The blended Group EBITA margin of 13.1% in the last quarter is a mathematical average, but it’s a poor representation of the underlying quality of the enterprise. The market, in its search for a simple metric, values GN based on this blended, lower margin. This creates a quantifiable "conglomerate discount," where the world-class Hearing business is penalized for its association with the more cyclical, lower-margin Gaming business.

My thesis rests on the conviction that as the balance sheet heals and the "One-GN" strategy simplifies the narrative, investors will be forced to re-evaluate the company on a sum-of-the-parts basis, assigning a much higher multiple to the stable, high-margin earnings stream from the Hearing division. Over the coming years it is not unlikely that the company may divest one or two of the division, creating an even cleaner business.

The Moat: Sustainable Competitive Advantage

GN's competitive advantage is not uniform across its businesses; it is deepest and most durable in the Hearing division, which is the anchor of the entire investment case.

Proprietary Technology & Innovation

The moat in Hearing is wide and deep, built on decades of specialized R&D. This is a medical device industry, not consumer electronics. Bringing a product to market requires profound audiological expertise, extensive clinical trials, and navigating complex regulatory approval processes with bodies like the FDA. These are formidable barriers to entry for any potential new competitor.

GN's commitment to innovation is evidenced by its consistent R&D spending, which has historically run at around 9% of revenue, amounting to DKK 1.8 billion annually. This sustained investment fuels a powerful innovation engine and a robust patent portfolio of over 1,800 documents. The recent launches of the AI-powered ReSound Vivia and the ReSound Enzo IA, the world's smallest rechargeable Super Power hearing aid, are clear proof of their technology leadership. This is not a company that can be easily disrupted by a generic hardware manufacturer.

Brand Strength & Customer Loyalty

GN's brands are powerful assets, each tailored to its specific market.

ReSound is a globally respected brand among audiologists, who are the critical gatekeepers to the end market. Built on a heritage dating back to 1943, the brand is synonymous with innovation and quality, consistently winning industry awards for its technology.

Jabra is a dominant force in the enterprise headset market. The fact that it is trusted by over 80% of Fortune 500 companies speaks volumes about its quality and reliability. This B2B focus creates a sticky customer base, as large corporations are slow to switch providers once a product is integrated into their IT infrastructure.

SteelSeries is a premium, aspirational brand in the gaming community. It has cultivated a loyal following among esports professionals and enthusiasts who are willing to pay a premium for performance.

Switching Costs & Distribution

In the Hearing division, switching costs are significant. For the end-user, there is a period of physical and neurological adaptation to a new hearing aid's sound profile. For the audiologist, there are switching costs associated with learning new fitting software and building familiarity with a new product portfolio. GN has intelligently fostered this by positioning itself as a "trusted partner" to independent audiologists, providing them with marketing and business support to build a loyal and effective distribution channel.

My overall assessment is that GN possesses a wide and defensible moat in its Hearing division, grounded in proprietary technology, a trusted medical brand, and high regulatory barriers. The moats in the Enterprise and Gaming divisions are narrower, relying more on brand perception and staying ahead in rapid innovation cycles. The long-term value of this company is fundamentally anchored in the durability of its Hearing business.

The investment thesis: The 5 year outlook

This is the core of my argument. Looking out to 2030, I see a fundamentally transformed GN Store Nord and a company that is leaner, significantly more profitable, and financially robust. This future state will be achieved through four key drivers that the market is currently under-appreciating.

Key Driver 1: The hearing compounding machine

I believe the Hearing division is a classic compounding machine that will continue to be the engine of value creation for GN. The market is structurally attractive, with expected volume growth of 4-6% annually, driven by irreversible demographic trends like aging populations and the fact that hearing loss remains a significantly underpenetrated condition. I am confident that GN will continue to outgrow this market, fueled by its technological leadership demonstrated by the strong uptake of the ReSound Vivia and Nexia platforms. I project the Hearing division will grow revenue at a 6-8% CAGR through 2030 while maintaining its best-in-class divisional profit margins in the mid-30s. This provides a stable, high-margin foundation for the entire group.

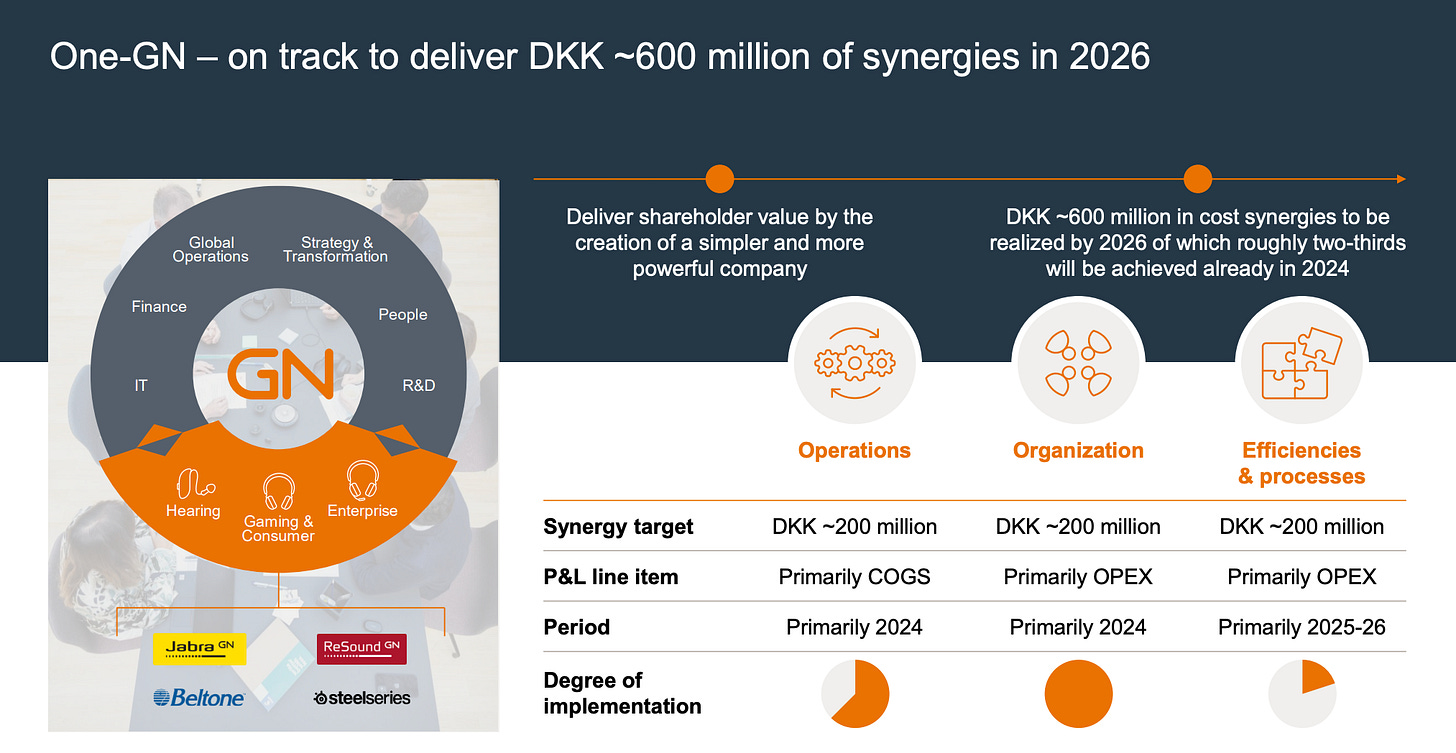

Key Driver 2: Margin expansion from "One-GN"

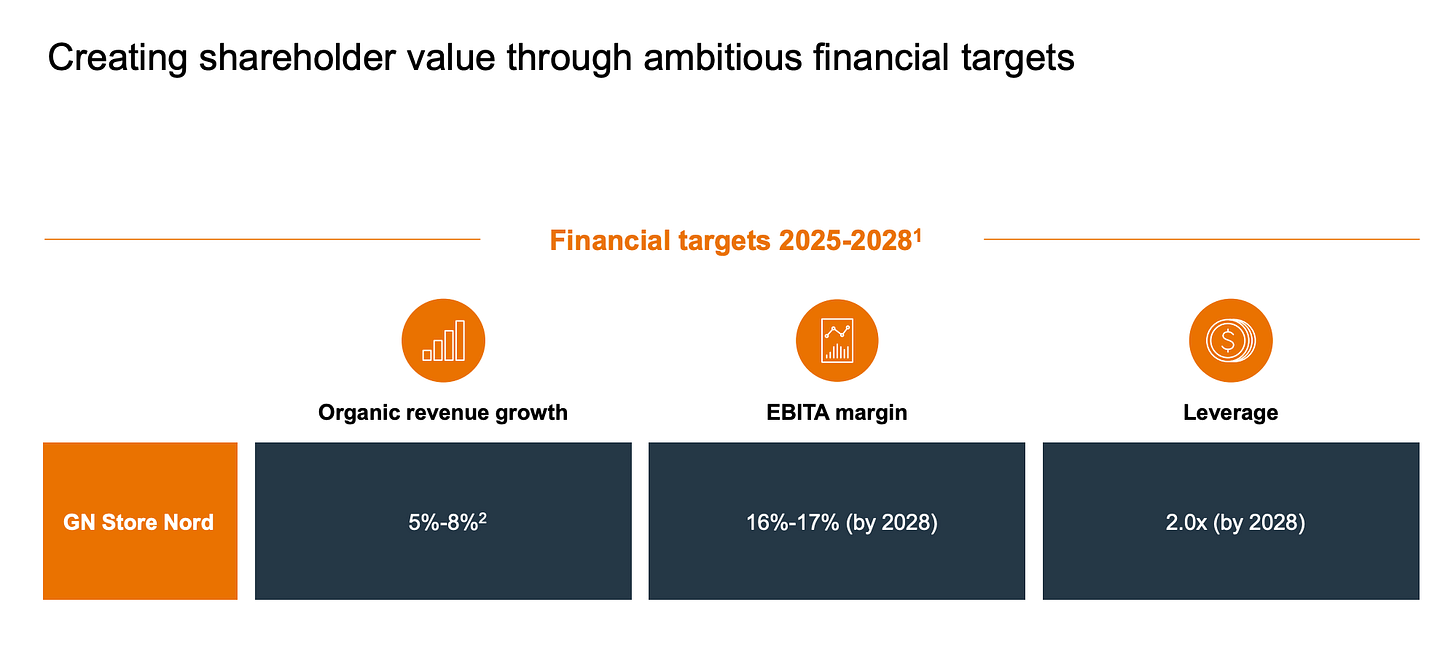

What the market seems to be missing is the sheer scale of the operational leverage and cost savings embedded in the "One-GN" transformation. Management has explicitly targeted DKK 600 million in annual cost synergies by 2026 from integrating R&D, operations, and back-office functions. The 480 basis point margin expansion in Q2 2025 was the first powerful proof point that these are not just paper-based promises. I believe these synergies, combined with the operating leverage from a growing top line, will be the primary driver of earnings growth over the next five years. This will propel the Group EBITA margin from the 12-14% guided for 2025 toward management's long-term target of 16-17% by 2028. This margin expansion story is central to the re-rating thesis.

Key Driver 3: The great deleveraging

For the past two years, high debt has been the primary objection to owning GN stock. That is changing rapidly. Management's number one capital allocation priority is now debt reduction. Net interest-bearing debt is already down significantly from its peak, and the leverage ratio has fallen to 4.0x as of Q2 2025, down from 4.9x a year prior. The company's stated long-term target is a much more comfortable 2.0x leverage. As debt is paid down, three positive things happen:

The company's risk profile decreases,

Interest expenses fall, which directly benefits the bottom line (a process aided by a recent successful refinancing at better terms), and

Free cash flow available to shareholders increases.

This de-risking process will make the stock attractive to a much broader set of investors and should, in itself, command a higher valuation multiple.

Key Driver 4: A cyclical rebound in Enterprise

The Enterprise division is currently in a cyclical trough, weighed down by cautious corporate IT spending. However, the fundamental drivers for this market in the permanence of hybrid work and the need for high-quality unified communications tools, remain firmly intact. The current weakness is cyclical, not structural. As the macroeconomic environment inevitably improves over the next few years, I expect to see a robust recovery in this segment. My model assumes a return to low-to-mid single-digit organic growth from 2026 onwards, an outcome that is certainly not priced into the stock today.

In essence, the durable moat and cash flows of the Hearing business provide the stable foundation to execute the "One-GN" strategy and repair the balance sheet. This financial fortification will allow the company to weather the current cyclical downturn in its other businesses and emerge as a more resilient, more profitable, and ultimately more highly valued enterprise.

Management & Capital Allocation

Profile of the CEO

Peter Karlstromer took the CEO role in October 2023, and I believe he is precisely the right leader for this phase of GN's journey. His resume, with senior leadership roles at operationally intensive tech giants like Cisco and a background as a Partner at McKinsey & Company, points to a deep expertise in strategy, execution, and efficiency. This is a stark contrast to the previous era, which was defined more by ambitious, and ultimately risky, M&A.

Karlstromer's actions speak louder than his resume. In less than two years, he has overseen the simplification of the corporate structure into three clear divisions, launched the "One-GN" synergy program, and made the tough but necessary decision to wind down the underperforming consumer Elite and Talk product lines to reallocate capital to more profitable ventures. His tone on earnings calls is direct, confident, and focused on execution, exactly what is needed to rebuild investor trust.

Capital Allocation Strategy

The story of GN's capital allocation is one of a dramatic pendulum swing.

The Past: The DKK 8.1 billion ($1.2 billion) acquisition of SteelSeries in early 2022 was the defining event of the last five years. While strategically interesting, it was executed at a peak valuation and funded with debt, just as interest rates began to rise and consumer demand started to wane. This single decision was the primary cause of the balance sheet stress and the subsequent collapse in the share price. The strain became so acute that management was forced to propose a large equity raise in early 2023, which was ultimately rejected by shareholders, signaling a deep dissatisfaction with the M&A-heavy strategy.

The Present & Future: That shareholder revolt was a watershed moment. The pendulum has now swung decisively away from large-scale M&A and towards organic growth and aggressive debt reduction. This is the most important strategic shift at the company. Management has suspended dividends and share buybacks, with all free cash flow now dedicated to deleveraging. The recent wind-down of the consumer product lines is another clear signal of this newfound capital discipline; management explicitly stated that the "investment required for future innovation and growth in this very competitive space is deemed unjustified in the long-term".

My assessment is that the current capital allocation strategy is exactly right. It directly addresses the market's primary concern, the balance sheet, and is methodically rebuilding the credibility that was lost. This disciplined approach is the necessary foundation for unlocking the company's intrinsic value.

Valuation: A Triangulated Approach

My valuation approach is centered on a five-year forecast horizon to 2030, applying a terminal multiple to my estimate of the company's future earnings power. The key to unlocking value is understanding how the combination of modest revenue growth, significant margin expansion, and debt reduction will translate into a much higher share price.

Relative Valuation: A Justified Peer Group

A single peer group is insufficient to value GN Store Nord. The company is a classic sum-of-the-parts story, operating in two fundamentally different worlds: regulated, high-margin medical devices and hyper-competitive, cyclical consumer/enterprise technology. Therefore, my analysis utilizes a mixed peer group to establish a proper valuation context, revealing the conglomerate discount currently applied to the shares.

Group 1: Hearing Health Pure-Plays This group represents GN's Hearing division, a business characterized by high barriers to entry, stable demographic-driven growth, and premium valuation multiples.

Sonova Holding AG (SOON): As the global leader in hearing care solutions, Sonova is the primary benchmark for GN Hearing. Its broad portfolio across hearing instruments, cochlear implants, and audiological care provides the best direct comparison.

Demant A/S (DEMANT): A direct Danish competitor with a highly similar business model spanning hearing aids, diagnostics, and a communications division (EPOS), making it a crucial comparable for understanding both synergies and competitive pressures.

Eargo, Inc. (EAR): Included as a representative of the disruptive direct-to-consumer (DTC) and over-the-counter (OTC) channel, a market where GN also competes via its Jabra Enhance brand. Eargo's historically lower valuation reflects its different business model and financial challenges, providing a useful floor for this segment.

Group 2: Audio & Collaboration Technology This group represents GN's Audio division (Jabra and SteelSeries). This is a more competitive, cyclical space with a wider range of valuation outcomes.

Logitech International S.A. (LOGI): A key competitor in PC peripherals, webcams, headsets, and gaming gear. Its broad portfolio and scale make it an excellent comparable for the combined Jabra Enterprise and SteelSeries segments.

Corsair Gaming, Inc. (CRSR) & Turtle Beach Corporation (HEAR): These are pure-play competitors to SteelSeries in the high-performance PC and console gaming peripherals markets, respectively. Their valuations provide a direct read-through for the potential of GN's Gaming segment.

Zoom Video Communications, Inc. (ZM) & RingCentral, Inc. (RNG): While not direct hardware competitors, these are leading Unified Communications as a Service (UCaaS) platform providers. Their performance is a key indicator of the end-market demand driving GN's Enterprise (Jabra) segment. Their software-based models command structurally different multiples, but they provide essential context for market health.

The following table grounds the valuation in current market realities. It visually demonstrates the valuation premium of Hearing Health peers over most Audio & Collaboration peers, highlighting the valuation disconnect I believe exists for GN.

Note: Data as of August 2025. NTM figures based on author's synthesis of consensus estimates. GN.CO financials converted from DKK to USD for comparison.

The data clearly shows that hearing aid companies like Sonova and Demant trade at NTM EV/EBITDA multiples in the 15-17x range, significantly higher than gaming peripheral companies like Corsair and Turtle Beach at 7-12x.

GN's current blended valuation of approximately 11.9x is being suppressed by the market's intense focus on the cyclical challenges in its Enterprise segment and the fierce competition in Gaming. The company's recent results show this divergence in action: the Hearing division grew 8% organically while the Enterprise division declined 7%.

This suggests that if the "One GN" strategy succeeds in stabilizing and improving margins in the Enterprise division, there is significant potential for a multiple re-rating across the entire enterprise. The market is currently pricing in execution risk and cyclicality, not the potential of a streamlined, higher-margin entity. This creates a powerful double-lever effect on the share price if management executes successfully.

Triangulated Valuation & Scenarios

My valuation is built upon three distinct scenarios for GN's operational and strategic evolution over the next five years.

Base Case: "Successful Execution" This scenario assumes management delivers on the "One GN" promise, achieving modest market share gains in all segments, realizing cost synergies, and expanding margins toward the higher end of their historical range. It reflects a normalization of the Enterprise market and continued strength in Hearing, driven by an aging global population and superior product technology.

Bull Case: "Accelerated Outperformance" This narrative assumes the "One GN" synergies are greater than expected, leading to best-in-class margins. It also assumes significant market share gains in Hearing (driven by new technology like ReSound Vivia), a rapid rebound in corporate spending on UC solutions, and SteelSeries outperforming a strong gaming market.

Bear Case: "Stagnation & Execution Failure" This scenario assumes the "One GN" strategy fails to deliver meaningful synergies, margins remain compressed due to competition and cost pressures, and the company's debt load becomes a significant burden. It envisions continued market share pressure in Enterprise and a weaker-than-expected gaming market.

I have selected EV/EBITDA as the primary valuation metric. It is capital structure-neutral, which is crucial given GN's significant debt load. It also normalizes for non-cash charges, providing a better proxy for cash flow generation, which is paramount for deleveraging. I will use EV/Sales as a secondary, sanity-check metric, useful for valuing segments where profitability might be temporarily depressed, though I recognize its weakness in ignoring profitability differences between segments.

My financial projections are built from a base of DKK 18.0 billion in 2025 revenue (the midpoint of current guidance) and assume that approximately half of the cumulative free cash flow over the period is used for debt reduction, lowering Net Debt from DKK 10.7 billion to DKK 8.2 billion by mid-2030. The target multiples are a judgment on the future quality of the business; my Base Case assumes the market will reward successful execution with a modest re-rating but will still apply a small conglomerate discount relative to pure-play hearing peers.

Note: Calculations based on a starting share price of DKK 116.00, 145.6M shares outstanding, and projected 2030E Net Debt of DKK 8.2 billion.

Conclusion on Valuation

The analysis presents a wide range of potential outcomes, with an implied 5-year CAGR ranging from -1.5% in the Bear Case to a compelling 32.9% in the Bull Case. This suggests a meaningfully asymmetric risk/reward profile, where the potential upside from successful execution far outweighs the downside from a failure to deliver on the "One GN" strategy.

My conviction lies with the Base Case scenario. This outcome does not require heroic assumptions; rather, it assumes competent execution against a clear strategic plan in markets with favorable long-term tailwinds. This leads me to a 2030 fair value estimate for GN Store Nord of DKK 298 per share.

Based on my analysis, the implied 5-Year CAGR of 20.7% in the Base Case meets the Fjord Alpha target of targeting 20%+ annual returns.

The Pre-Mortem: A Case for Failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The "One-GN" dream was a mirage. The most likely culprit is a failure of execution. We assumed that integrating three vastly different business cultures, a conservative Danish MedTech firm, a fast-moving Danish B2B tech company, and an aggressive American gaming brand, would yield massive synergies. Instead, it created a bureaucratic nightmare. The promised DKK 600 million in savings were never fully realized, eaten up by restructuring costs and internal friction. Margin expansion stalled well below the 16% target, and GN remained a messy, inefficient conglomerate that the market continued to shun.

The Enterprise headset market was structurally impaired. Our assumption of a cyclical recovery in the Enterprise division was wrong. The market underwent a structural shift. The rise of sophisticated AI-powered audio processing directly within software like Microsoft Teams and Zoom made "good enough" audio from built-in laptop microphones a viable alternative for a large portion of the corporate world. The demand for premium, dedicated headsets contracted, and the market was flooded with low-cost Asian competitors, permanently commoditizing the category and crushing Jabra's margins.

Big Tech entered the "Hearables" market. This was the black swan event we feared. Apple, leveraging its vast ecosystem and brand power, secured FDA approval for a new line of AirPods with integrated hearing aid functionality. While not as sophisticated as a dedicated ReSound device, it was "good enough" for the millions with mild-to-moderate hearing loss. This move decimated the entry-level and mid-tier segments of the traditional hearing aid market, compressing margins and growth prospects for all incumbent players, including GN.

Management fumbled the execution. A key executive departure, a major product recall in the crucial Hearing division, or a premature return to debt-fueled M&A before the balance sheet was fully repaired could have shattered the fragile investor confidence we banked on. A single major misstep was all it took to derail the turnaround narrative and send the stock back into the penalty box.

Conclusion: The final verdict

GN Store Nord is a classic case of a good business that, after a period of strategic missteps, found itself with a bad balance sheet. The market has rightly punished the company for this. However, the story is changing fast. This is rapidly becoming a story of a good business with a rapidly improving balance sheet, and the market has not yet caught up.

The market's obsession with the cyclical headwinds in the Enterprise/Gaming divisions and the now-receding debt concerns has created a window of opportunity. The intrinsic quality of the Hearing division, the clear execution of a new and credible management team, and the visible path to significant margin expansion and deleveraging are not fully reflected in the current share price. While the risks in the consumer-facing segments are real, I believe they are more than compensated for by the current low valuation and the stability and profitability of the core MedTech business. We might also see potential divestments, e.g. the company exiting the Enterprise division when finding the right buyer for the ultra-strong Jabra brand, which would make the business even cleaner and more attractive.

My final verdict is that GN Store Nord is a compelling investment opportunity for investors with a five-year horizon. The current valuation offers an attractive entry point into a high-quality, market-leading medical device business that is in the early innings of a significant operational and financial turnaround.

It beats Fjord Alpha’s 20+% hurdle rate in the base case at 20.7% expected CAGR. I believe that by 2030, investors will look back at today's price and see a clear case of the market having missed the forest for the trees, focusing on the cyclical noise while ignoring the powerful signal of fundamental business improvement.

✅ Thesis Pillar 1: The market is undervaluing the crown-jewel Hearing division, a wide-moat, high-margin MedTech business with durable growth drivers.

✅ Thesis Pillar 2: The "One-GN" transformation and renewed cost discipline are driving a significant and under-appreciated margin expansion story.

✅ Thesis Pillar 3: Aggressive deleveraging is de-risking the balance sheet, which will act as a powerful catalyst for a valuation re-rating closer to pure-play MedTech peers.

⚠️ Key Risk (from Pre-Mortem): Competition from Big Tech (e.g., Apple) entering the regulated hearing aid market, which could structurally impair the long-term profitability of the core Hearing division.

🎯 Target Price (Base Case): DKK 298 by 2030.

📈 Implied 5-Year CAGR (Base Case): 20.7%

Primary Sources Used:

GN Store Nord Annual Report 2024

GN Store Nord Interim Report Q2 2025

GN Store Nord Interim Report Q1 2025

GN Store Nord Capital Markets Day Presentation (May 2024)

Q2 2025 Earnings Call Transcript

Q1 2025 Earnings Call Transcript

Q4 2024 Earnings Call Transcript

Q3 2024 Earnings Call Transcript

Again, detailed without being pedantic. Great read.