Ørsted Q3'25: It is windy - but now a buy!

The underlying numbers were dreadful, but this report was not about operations. It was about the balance sheet - and management delivered!

…all eyes were on Ørsted’s Q3’25. The core question was simple: has the bleeding stopped?

On the surface, the report was dreadful. A swing from a DKK 5.2 billion profit to a DKK 1.7 billion net loss, a 31% tumble in underlying EBITDA vs. last year, and an operational miss against analyst forecasts.

And yet, the stock traded flat on the news today.

That paradox is the story, and it reinforces the thesis from my original Reset, Recapitalized, Repriced memo. This quarter was never about operational beats. It was about the Reset. Management threw the entire “kitchen sink” of bad news at investors, but they did so after having secured a fortress balance sheet. They delivered 1) the cure and 2) the sickness at the same time, neutralizing the bad news and validating the turnaround plan.

THE GOOD: The balance sheet is de-risked

This is the entire reason for the market’s relief. Management has executed the “Recapitalized” pillar of the thesis perfectly.

The “Apollo Validation”: This is the most important news to me. Ørsted’s sale of 50% of its Hornsea 3 project to Apollo for DKK 39 billion is a massive de-risking event.

It confirms asset values. A smart and sharp-elbowed investor like Apollo just validated Ørsted’s asset book.

It proves the “farm-down” model. It confirms that institutional appetite for these assets is alive and well, which is critical to Ørsted’s entire capital-recycling model.

It provides capex relief. Apollo is also funding 50% of all future construction costs, providing significant cash flow relief.

The balance sheet fortress is built: The company completed its DKK 60 billion rights issue. This cash, combined with the Apollo deal, gives Ørsted a DKK 99 billion war chest to execute on its focused plan. The “Recapitalized” pillar of the thesis is now in place.

The core business is stable: Amidst the U.S. chaos, management maintained its full-year EBITDA guidance of DKK 24-27 billion. This was a strong signal of confidence.

THE BAD: The noise that the market ignored

This is the backward-looking noise that the market, now focused on the balance sheet, was prepared to forgive.

The operational miss: Underlying EBITDA came in at DKK 3.06 billion, a miss from the DKK 4.0 billion analysts had forecasted. This was driven by lower-than-expected wind speeds.

The revenue drop: Revenue fell a sharp 22.2% year-over-year (albeit flat for YTD).

The “Repricing” impairment: The DKK 1.7 billion net loss was entirely explained by a DKK 1.8 billion impairment charge, the non-cash accounting clean-up of the failed U.S. strategy.

THE UGLY: The underlying sickness

The underlying sickness that caused this crisis, U.S. political volatility, is still very real. This report quantified the cost:

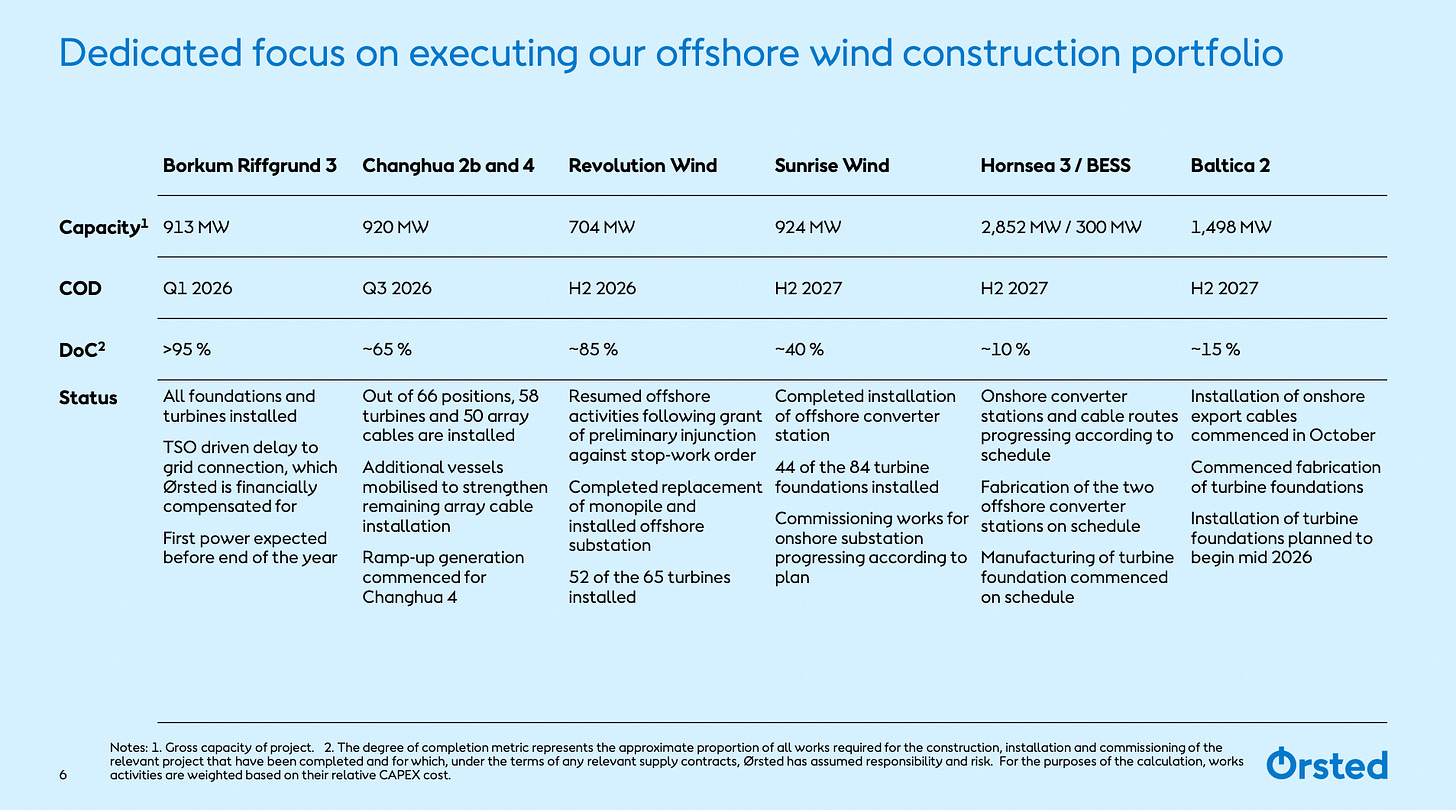

The political cost: The presentation revealed a gross loss of DKK 3.0 billion from U.S. political friction alone. This includes a DKK 0.5 billion loss on the Revolution Wind project from a “baseless” 30-day political stop-work order. This confirms that the pivot to a “Europe-first” focus is the correct strategic move.

Final verdict: An upgrade to BUY

This Q3 report confirms the “Reset, Recapitalized, Repriced” thesis is firmly underway.

“Reset” was the maintained guidance and the “Europe-first” focus.

“Recapitalized” was the DKK 99 billion in combined capital from the rights issue and the “Apollo Validation”

“Repriced” was the DKK 1.8 billion U.S. impairment and the stock’s collapse.

The company has successfully navigated a near-death experience. The balance sheet is now strong, the core business is stable, and the “farm-down” model is validated. The path forward is clearer than it has been in years.

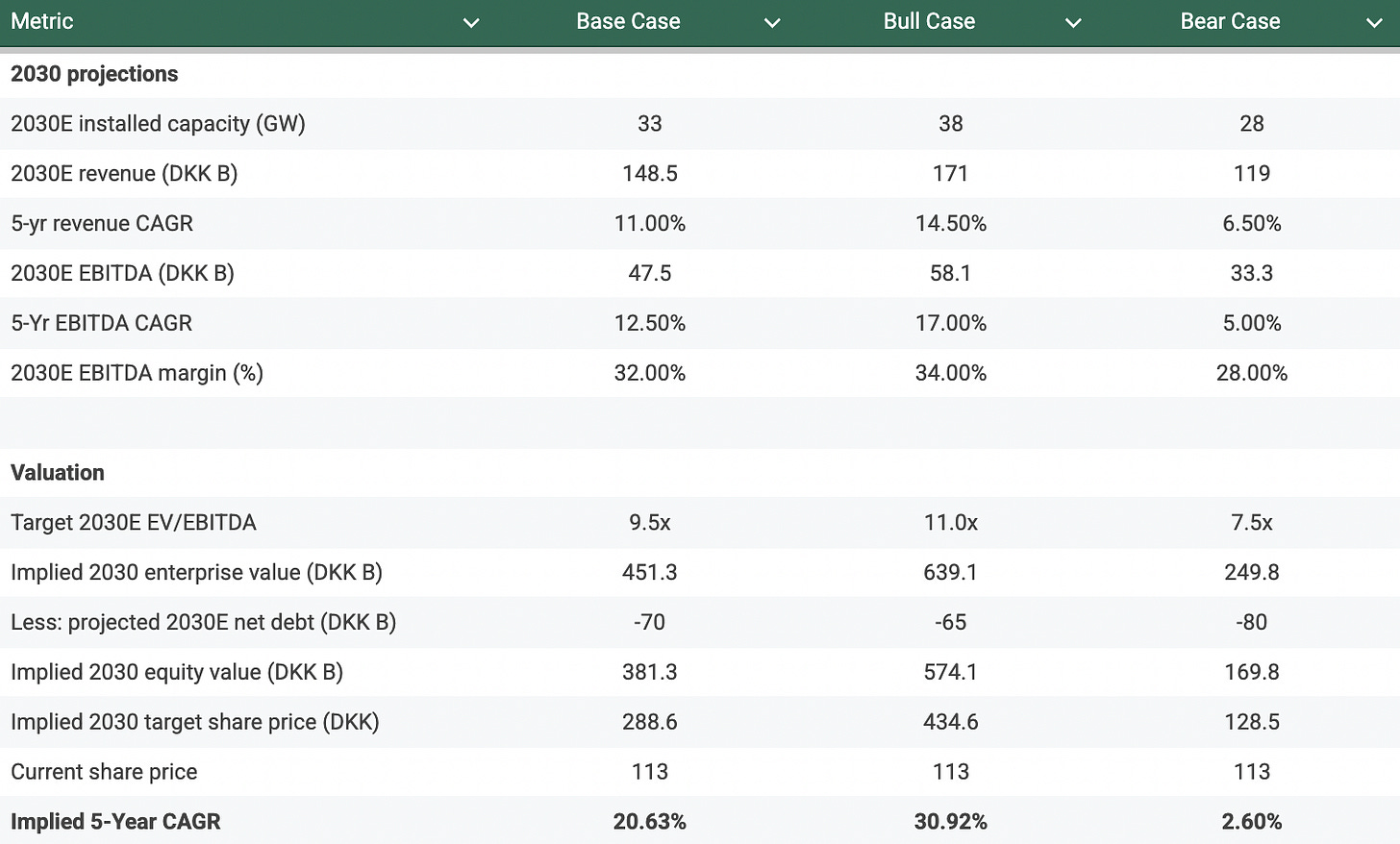

I see no reason to change the underlying assumptions in my original valuation. With the thesis more de-risked and the stock now offering a base-case 5-year CAGR of 20.6%, Ørsted officially meets Fjord Alpha’s 20% threshold, see below for details

It remains windy, but this is a Buy.