GN Store Nord: Thesis and mispricing intact

Q3 2025 validates the turnaround narrative while the market still prices GN like a distressed cyclical.

In my initial coverage of GN Store Nord, I argued that the market’s obsession with short-term noise was obscuring a high-quality industrial turnaround. We outlined a three-pillar thesis for why GN was a mis-priced compounder.

The Q3 2025 report serves as a validation point. Despite negative headlines created by FX headwinds and inventory adjustments, the underlying signal is strong, and the thesis is playing out.

1. Hearing as the Crown Jewel

Organic growth of +7%, well above the ~3% market rate

Continued market share gains versus Demant

2. “One-GN” Efficiency

Gross margin at 54.4%, holding firm despite e.g. tariff-related pressures

Demonstrates operational discipline and scale leverage

3. Balance Sheet De-Risking

Refinancing extended through 2028, removing near-term maturities

Liquidity overhang eliminated, improving financial stability

Let’s dig into the details!

Thesis Pillar 1: The undervalued crown jewel

The argument: The market is undervaluing the crown-jewel Hearing division, a wide-moat, high-margin MedTech business with durable growth drivers.

The Q3 Update:

The Hearing division is accelerating relative to peers. In Q3 2025, GN Hearing delivered +7% organic revenue growth. To put this in perspective, the structural market value growth is estimated at 3-5%. GN is growing roughly 2x faster than the market.

The outperformance is driven by the ReSound Vivia platform. Unlike competitors using off-the-shelf components, GN’s proprietary “dual-core chip” with a dedicated “Deep Neural Network (DNN) accelerator“ is proving to be a commercial winner.

The Competitor Check: While GN grew 7%, key rival Demant reported only +2% growth in Hearing Aids for Q3, explicitly citing “lower sales to a large US retailer” (Costco).

The Costco Verdict: Fears of GN losing shelf space at Costco to Sonova (Sennheiser) were overblown. GN has held its ground, while Demant appears to be the donor of market share.

The market is pricing GN like a distressed hardware manufacturer. The Q3 data proves it owns a premier MedTech franchise winning the innovation cycle.

Thesis Pillar 2: The “One-GN” Margin Story

The argument: The “One-GN” transformation and renewed cost discipline are driving a significant and under-appreciated margin expansion story.

The Q3 Update:

The headline EBITA margin of 11.0% (down from 13.3% in Q3 2024) looks soft at first glance, but it reveals resilience.

Tariff Headwinds: GN faced direct cost increases from US tariffs on Chinese manufacturing.

Inventory Whip: The Enterprise (Jabra) division saw -4% organic growth due to distributor de-stocking, which naturally creates negative operating leverage.

Despite these headwinds, Gross Margin remained flat at 54.4%.

This is the “One-GN” strategy at work. By consolidating supply chains across Hearing, Enterprise, and Gaming, GN has achieved procurement scale that protects unit economics. Management successfully pushed price increases in the US to offset tariffs, a display of pricing power that commodity businesses simply do not possess.

Enterprise Outlook: Management confirmed that sell-out (end-user demand) is positive in North America and APAC. The revenue decline is a channel inventory adjustment. As rates fall and distributors restock in 2026, this headwind will flip to a tailwind.

Thesis Pillar 3: De-Risking the Balance Sheet

The argument: Aggressive deleveraging is de-risking the balance sheet, which will act as a powerful catalyst for a valuation re-rating closer to pure-play MedTech peers.

The Q3 Update:

This is the most significant development of the quarter. Part of the bearish thesis relied on GN hitting a “maturity wall” in 2026. That wall has been dismantled.

In September 2025, GN finalized a massive refinancing package:

EUR 1bn Term Loan + EUR 500m RCF.

Maturities extended to 2028-2030.

Lower interest margins than previous facilities.

With leverage at 4.0x EBITDA and falling, and the liquidity runway cleared for the next 3-5 years, the “bankruptcy risk” premium embedded in the share price must evaporate.

GN generated DKK 410 million in Free Cash Flow in Q3 alone (94% cash conversion). This cash generation engine allows them to organically pay down debt, transferring value from debt holders back to equity holders every single quarter.

Final remarks

The market is currently offering what I see as an arbitrage opportunity between perception (distressed conglomerate) and reality (growing MedTech leader).

Comparative Valuation (2025E EV/EBITA):

GN Store Nord: ~11x

Demant: ~17x

Sonova: ~23x

I know you can’t fully compare these companies today, but remember the 5-year horizon that we apply to our holdings. There is no fundamental justification for GN trading at a 35% discount to Demant when GN is growing its core Hearing business 3.5x faster (7% vs 2%).

The Q3 report confirms that the operational turnaround is doing well (Hearing success) and the financial turnaround is secured (Refinancing). The share price has lagged, providing an attractive entry point for us with a 5-year outlook. The stock remains a BUY for Fjord Alpha.

In terms of external coverage 7 out of 14 analysts also have GN Store Nord as a “Buy”, vs. 2 for “Underperform” or “Sell”, with average target price of 142 DKK (marketscreener.com)

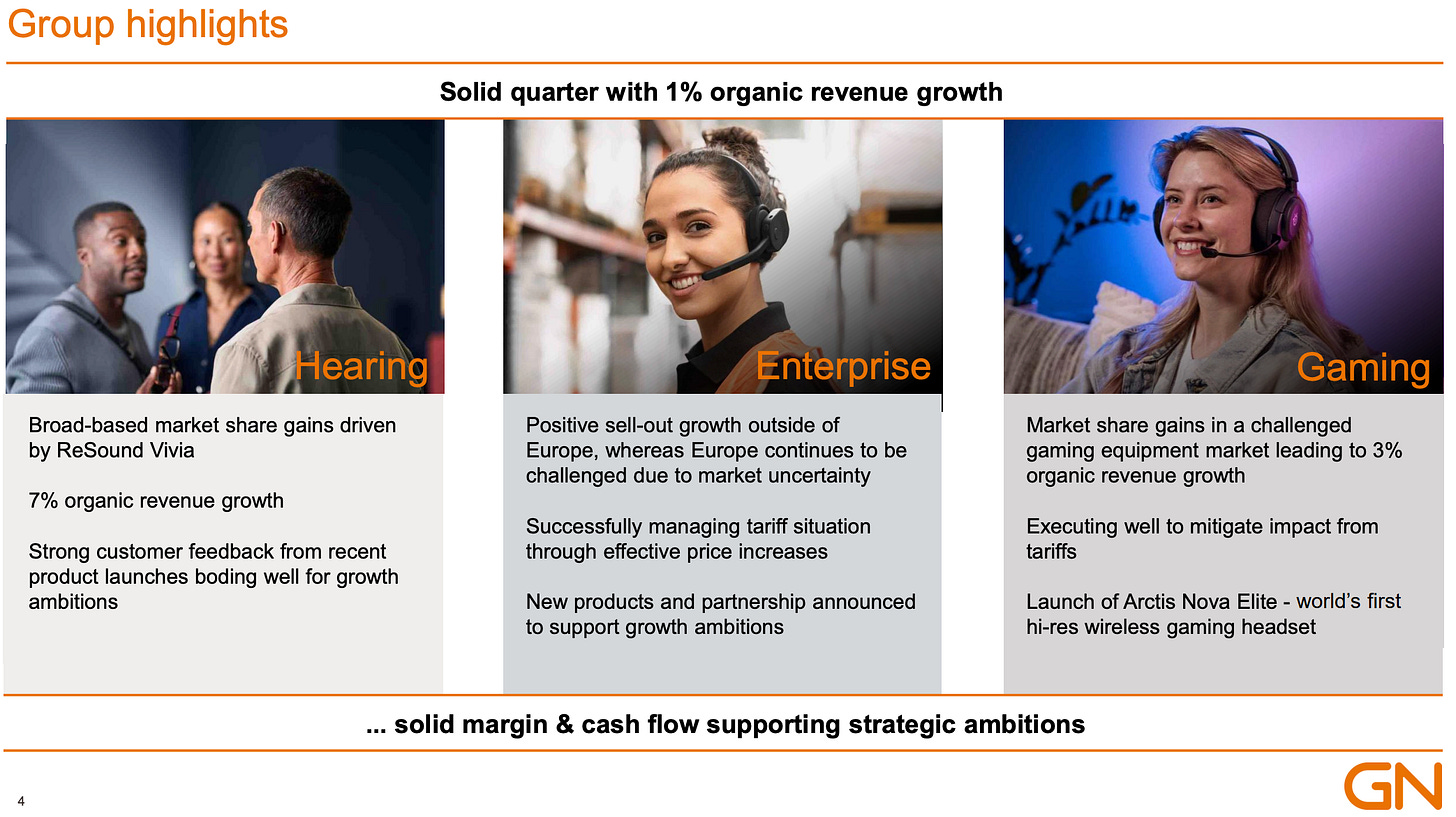

Finally, to conclude, I really liked the below slide in the Q3-report. GN Store Nord are clearly delivering top-quality products also beyond Jabra and the Hearing division.

Over and out.

Brilliant dissection of the valuation arbitrage here. The propriatry DNN accelerator in ReSound Vivia is exactly the kind of moat that separates commodity hardware from defensible medtech, but markets always undervalue R&D payoffs until revenue growth makes it undeniable. I ran a similar comp anlysis last month and the 35% discount to Demant while growing 3.5x faster is borderline absurd. The refinancing through 2028 removes the biggest overhang, and with 94% FCF conversion they're basically printing deleveraging. Probly takes 18 months for the market to fully re-rate this, but the setup is there.