Ambu A/S: Beyond the Bag

A high-quality business with a durable moat, but does the valuation offer a compelling return?

Executive Summary

My analysis concludes that Ambu A/S is at a critical inflection point. The market, while acknowledging its renewed growth, appears to be fairly pricing the company's turnaround. While the "ZOOM IN" strategy is creating a higher-quality, more profitable business, my valuation work suggests the current share price already reflects part of this expected improvement.

My base case suggests a target price of DKK 167 by mid-2030, implying a 5-year compound annual growth rate (CAGR) of 12.2%. While a respectable return, this falls short of my 20%+ hurdle for high-conviction investments. The single most important risk remains execution failure in the highly competitive Gastroenterology (GI) segment. Happy reading!

Rediscovering a Danish Champion

A few years ago, I had written Ambu off. Around 2021, as the stock was collapsing from its pandemic-era highs, the story felt broken. It looked like a classic case of a company that had created a market but lost its way, chasing growth at all costs with an unfocused strategy and evaporating margins. My initial read was that Ambu's best days were behind it, a "one-trick pony" whose innovation had been overtaken by its own ambition. I put it in the "too hard" pile and moved on.

What prompted a second, much deeper look was the steady, almost methodical, drumbeat of execution that has emerged over the past two years. The appointment of CEO Britt Meelby Jensen in May 2022 marked a turning point. Quarter after quarter, the company has delivered on its promises of balanced, profitable growth. The narrative from management has shifted from vague ambition to a clear focus on execution, customer needs, and profitability.

I now believe I was wrong, and that the market is still looking in the rearview mirror, haunted by the memory of past missteps. It sees the recovery but remains skeptical of the destination. With a Capital Markets Day scheduled for October 1, 2025, where management will lay out the next chapter of its strategy, I believe this analysis is particularly timely. This is a journey of rediscovering a Danish innovator, and exploring whether the market has grasped the scale of the transformation underway.

The Setup: Key Data & Investment Thesis

💰 Stock Price: DKK 94

📄 Shares Outstanding: 266.39 million

🏢 Market Cap: DKK 25.03B (approx. EUR 3.35B)

🏦 Net Cash: DKK 86.5M

🌐 Enterprise Value: DKK 24.94B (approx. EUR 3.34B)

⚙️ Sector/Industry: Healthcare / Medical Devices

💡 Investment Thesis: Ambu is a high-quality innovator leading a secular shift to single-use endoscopy, but its current valuation appears to fairly price in its future growth, offering a risk/reward profile that does not meet our 20%+ target.

Sourcing: Ambu Interim Report Q2 2024/25, StockAnalysis.com, Morningstar. Data as of August 20, 2025.

The Business: History & Operations

Origin Story

To understand Ambu today, one must appreciate its origins. The company was born not in a boardroom but in a laboratory in 1937, founded by German engineer Holger Hesse, who fled to Denmark to escape Nazi Germany. Initially named Testa Laboratory, its purpose was simple: create innovative products that save lives.

The company's defining breakthrough came in 1956. In collaboration with anaesthetist Dr. Henning Ruben, Hesse developed the Ambu Bag, the world's first self-inflating resuscitator. It was a revolutionary device being portable, simple, and effective, that quickly became a global standard in emergency medicine. Much like Kleenex for tissues, the "Ambu Bag" became the generic term for the product category, cementing the company's brand and identity in hospitals worldwide.

For decades, Ambu built upon this foundation in anaesthesia and patient monitoring. A key turning point came in 2001 with the acquisition of Medicotest, Europe's largest electrode manufacturer, which brought the successful BlueSensor brand into the fold and, crucially, sharpened the company's focus on single-use devices. This strategic shift set the stage for Ambu's most significant innovation. In 2009, Ambu launched the aScope, the world's first single-use flexible bronchoscope. With this move, Ambu didn't just enter a market; it created one, pioneering a new category that is now fundamentally reshaping the field of endoscopy.

What They Actually Do

Today, Ambu operates through two distinct business segments.

Anaesthesia & Patient Monitoring (41% of revenue): This is the company's legacy foundation. It's a mature, stable business that generates consistent cash flow from iconic products like the Ambu Bag and BlueSensor ECG electrodes. It provides stability and brand recognition, growing at a steady, albeit slower, pace.

Endoscopy Solutions (59% of revenue): This is the high-growth engine of the company. It comprises a rapidly expanding portfolio of single-use endoscopes used for visualizing internal organs in four key areas: Pulmonology (airways), Urology (bladder and kidneys), ENT (ear, nose, and throat), and Gastroenterology (digestive tract).

To make this intuitive, I think of Ambu's core strategy as "The Sterile Razor and Blade Model."

The Razor: This is Ambu's visualization system, the aView monitor or the aBox processor. It's the capital equipment that sits in the hospital room. The initial sale is important, but it's primarily the entry ticket.

The Blades: These are the single-use, sterile endoscopes. Each procedure consumes one scope. They are the high-margin, recurring revenue driver of the business. Once a hospital adopts Ambu's "razor," it is effectively locked into buying a continuous stream of Ambu's "blades." This creates a powerful, predictable business model where revenue is tied directly to hospital procedure volumes.

Recent Developments & Performance

Business Update

Ambu's most recent results from the second quarter of its 2024/25 fiscal year provide clear evidence that the turnaround strategy is delivering. The company reported 11.7% organic revenue growth and an EBIT margin of 14.4%, a healthy expansion from 14.2% in the prior year.

The growth was broad-based. The core Endoscopy Solutions business grew 13.1% organically, continuing its role as the primary growth driver. Impressively, the mature Anaesthesia & Patient Monitoring business also delivered strong organic growth of 9.8%, benefiting from both price increases and solid volume growth. This demonstrates pricing power and resilience in its legacy portfolio.

Crucially, management maintained its full-year guidance for 11-14% organic revenue growth and an EBIT margin between 13-15%.

In her commentary, CEO Britt Meelby Jensen emphasized this balance: "I am proud that Ambu continues to deliver solid growth and profitability, while advancing our innovation for strong future growth.". This language is a deliberate and important signal of the shift from the old regime's growth-at-all-costs mentality to the current focus on sustainable, profitable expansion.

Stock Price Context

The stock has been on a veritable rollercoaster over the past five years. It soared during the COVID-19 pandemic as demand for single-use devices surged, only to crash spectacularly through 2021 and 2022 when the company's strategy faltered and margins collapsed. Since Britt Meelby Jensen took the helm in May 2022 and implemented the "ZOOM IN" strategy, the stock has been on a steady recovery path, albeit with the volatility that comes with being a high-growth story. The market has rewarded the execution but remains sensitive to any hint of a slowdown.

Connecting to the Analysis

These recent results are the bedrock of my thesis. They are tangible proof that the turnaround is not just a plan on a PowerPoint slide; it's translating into real financial performance. However, the market's reaction to these numbers reveals its underlying anxiety. While the headline figures were strong, growth in the key Urology/ENT/GI sub-segment slowed to 18.3% from 33.3% a year prior, and Pulmonology slowed to 8.5% from 13.9%.

This is not a sign of failure; it's a sign of maturation. Growth is naturally becoming lumpier as the business scales and becomes more reliant on the cadence of new product launches. Management's explicit reassurance that the Urology/ENT/GI segment will "return to growth rates above 20%" is a direct attempt to manage this narrative. The market has moved past the initial "is the turnaround real?" phase and is now in the "is the growth durable?" phase.

The Business Model & Unit Economics

Ambu's revenue model is straightforward: it sells disposable medical devices. There are no complex subscription mechanics here; the recurring nature of the business is driven by the non-discretionary, procedure-based consumption of its products.

The Endoscopy Solutions business, as discussed, operates on the powerful "Sterile Razor and Blade" model. The initial placement of the aView or aBox system is a capital sale that establishes a foothold in the hospital. This is the "razor." The real economic value is captured through the subsequent, continuous sale of the single-use scopes, the "blades." Each procedure requires a new, sterile scope, creating a predictable and highly profitable revenue stream that is far more valuable than the initial hardware sale. This model is designed to create high switching costs and a long-term, annuity-like relationship with the hospital customer.

The Anaesthesia & Patient Monitoring business is a more traditional consumables model. It relies on the strength of its iconic brands, like the Ambu Bag and BlueSensor electrodes, and its long-standing relationships with hospital procurement departments. Revenue here is also driven by procedure volumes, but it is a more mature, stable, and lower-growth segment compared to endoscopy. It serves as a reliable cash flow generator that helps fund the innovation and commercial expansion of the endoscopy business.

The Moat: Sustainable Competitive Advantage

My initial skepticism about Ambu was partly rooted in a belief that its moat was shallow. I now believe its competitive advantages are both wider and deeper than they appear, creating a barrier to competition.

Proprietary Technology & First-Mover Advantage: Ambu is not just a player in the single-use endoscopy market; it is the creator of the market. Launching the first single-use bronchoscope in 2009 gave it a full decade's head start on the competition. This has embedded a deep well of institutional knowledge in designing, manufacturing, and scaling these specific devices. This is not easily replicated. The company's innovation engine is accelerating, with a plan to launch 20 new products in the next three years, a four-fold increase over the prior period, driven by a modular design platform that allows for rapid iteration.

High and Rising Switching Costs: The razor-and-blade model is the foundation of the moat. Once a hospital invests in Ambu's aView 2 Advance visualization platform, it is tethered to Ambu's ecosystem of scopes. The cost, time, and training required to rip out this infrastructure and replace it with a competitor's system are substantial. This creates a sticky customer base.

Furthermore, Ambu is cleverly adding new layers to these switching costs. The recently launched "Ambu Recircle" program is a strategically astute move. Hospitals globally are under intense pressure to improve their environmental footprint, and medical waste is a major pain point. By offering a fully compliant, end-to-end recycling service for its used scopes, Ambu is embedding itself into the hospital's operational and sustainability workflows. This transforms a potential negative (the waste from single-use products) into a competitive advantage. A competitor can't just offer a cheaper scope; they must also offer a similarly seamless and compliant recycling solution to eliminate the friction of switching. This is a subtle but powerful moat-widener.

Brand Strength: In medicine, trust is paramount. The "Ambu Bag" is one of the most recognized brands in any hospital, synonymous with emergency resuscitation for over 60 years. This creates a powerful halo effect. When Ambu introduces a new device, it does so with a pre-existing foundation of trust and brand equity that a new entrant would take decades to build. In single-use bronchoscopy, Ambu is the established leader, used in 96% of the top 500 US hospitals, making it the default, trusted choice in the category it pioneered.

Scale-Based Cost Advantages: Ambu is singularly focused on single-use endoscopy. Its manufacturing facilities in Malaysia and its new, strategically located plant in Mexico are designed and scaled for this specific purpose. This focus and scale likely provide a structural cost advantage over larger, more diversified competitors who may be adapting manufacturing lines originally built for reusable devices. This allows Ambu to compete effectively on price while maintaining healthy margins.

The Investment Thesis: The 3-5 Year Outlook

This is the heart of my argument. Looking out to 2028-2030, I believe Ambu will be a larger, significantly more profitable, and more diversified business than the market currently anticipates. My thesis rests on four key drivers.

1. The Secular Tide of Conversion is Still Rising: The shift from reusable to single-use endoscopes is a powerful, secular trend driven by undeniable benefits for hospitals: zero risk of cross-contamination, improved workflow efficiency, and transparent per-procedure costs. This is not a cyclical phenomenon. My analysis suggests the market is still in the early-to-mid stages of this conversion. At its 2023 Capital Markets Day, Ambu estimated its current products address a market of ~23 million annual procedures, yet it only serves ~1.7 million of them. This provides a massive runway for sustained double-digit growth for years to come, simply by increasing penetration in its existing categories.

2. An Accelerating Innovation Engine: Growth will not just come from penetration, but from expansion. Ambu's pipeline is robust. The full commercial launches of the aScope 5 Uretero and the new SureSight video laryngoscope are the next major growth catalysts. The ureteroscope is a higher-priced device that completes their urology portfolio, allowing them to offer a comprehensive solution for urologists. The video laryngoscope does the same for the pulmonology suite, creating a fully integrated airway management platform. These are not just incremental updates; they are significant expansions of the addressable market.

3. The Path to 20% Margins is Clear and Underappreciated: This is the key assumption you have to believe, and perhaps what the market may be missing. The "ZOOM IN" strategy is laser-focused on profitable growth. Management has explicitly targeted a ~20% EBIT margin within five years (by FY 2027/28), a significant leap from the 12.0% achieved in FY 2023/24. I believe this is achievable, but tough.

As the high-margin Endoscopy Solutions business continues to outgrow the legacy segment and becomes an even larger part of the revenue mix, the company's blended gross margin will rise. More importantly, as revenues scale, the company will gain significant operating leverage over its fixed cost base (R&D and G&A). The steady improvement in EBIT margins over the past two years is the first taste of this leverage at work. The market is modeling margin improvement, but may be underestimating the velocity and the ceiling.

4. The GI "Call Option" is Essentially Free: Gastroenterology is the largest endoscopy market, but it's also where Ambu has stumbled. The DKK 334 million impairment charge taken in Q4 2024 on GI-related assets was a painful admission that the initial strategy following the Invendo acquisition was flawed. My read is that the market has now almost entirely written off Ambu's chances in GI, viewing it as a sunk cost. I see this as an opportunity. The next-generation aScope Duodeno 2, built on the superior aBox 2 platform, is now in clinical evaluation and receiving strong feedback. Duodenoscopes are notoriously difficult to clean and have been linked to serious cross-contamination incidents, making them a prime candidate for single-use conversion.

If Ambu can successfully carve out even a small niche in this massive market, it represents a significant source of upside that is not reflected in my base case valuation or, I believe, in the current share price.

Management & Capital Allocation

A turnaround story is only as credible as the leadership driving it. In this regard, I find Ambu's situation compelling.

CEO Britt Meelby Jensen was appointed in May 2022, and she is the type of leader the company needed. Her resume is impressive, with CEO roles at other medtech and biotech companies (Zealand Pharma, Atos Medical) and formative years at Novo Nordisk and McKinsey. She is a seasoned, professional operator. She arrived with a clear mandate to instill discipline, and her actions speak louder than words. Within six months, she launched the "ZOOM IN" strategy, which involved making the difficult but necessary decisions to cut non-core R&D projects and reduce headcount to restore financial stability. Her tone on earnings calls is consistently sober, focused, and credible.

The company's capital allocation strategy reflects this newfound discipline. The official policy is to prioritize funding organic growth, then consider value-accretive M&A, and finally return excess capital to shareholders, all while maintaining a healthy balance sheet with leverage below 2.5x NIBD/EBITDA.

Two recent actions demonstrate this policy in practice. First, the March 2023 capital raise of ~5% of the share base was a prudent move to de-risk the balance sheet during the most uncertain phase of the turnaround. Second, the decision to reinstate a dividend of DKK 102 million in December 2024 was a clear signal of confidence from the board in the company's future cash-generating capabilities. While the M&A track record has been mixed i.e. the Invendo acquisition in 2017 has led to write-downs, the current focus appears to be squarely on executing the organic growth strategy. I view the current capital allocation as both shareholder-friendly and strategically sound.

Valuation: A Triangulated Approach

My objective in this chapter is to derive a credible fair value estimate for Ambu for mid-2030, representing a five-year investment horizon from my analysis date of August 20, 2025. This valuation is not a single point estimate but a triangulated conclusion drawn from multiple methodologies and scenarios.

My approach is twofold: first, I will conduct a relative valuation, comparing Ambu against a carefully selected peer group of global medical technology companies to establish how the market is pricing similar assets today.

Second, I will perform a scenario-based forward valuation, projecting Ambu's financials to 2030 under three distinct scenarios, Base, Bull, and Bear. By applying justified terminal multiples to these projections, I will derive a target share price and the implied 5-year compound annual growth rate (CAGR).

Relative Valuation: A Justified Peer Group

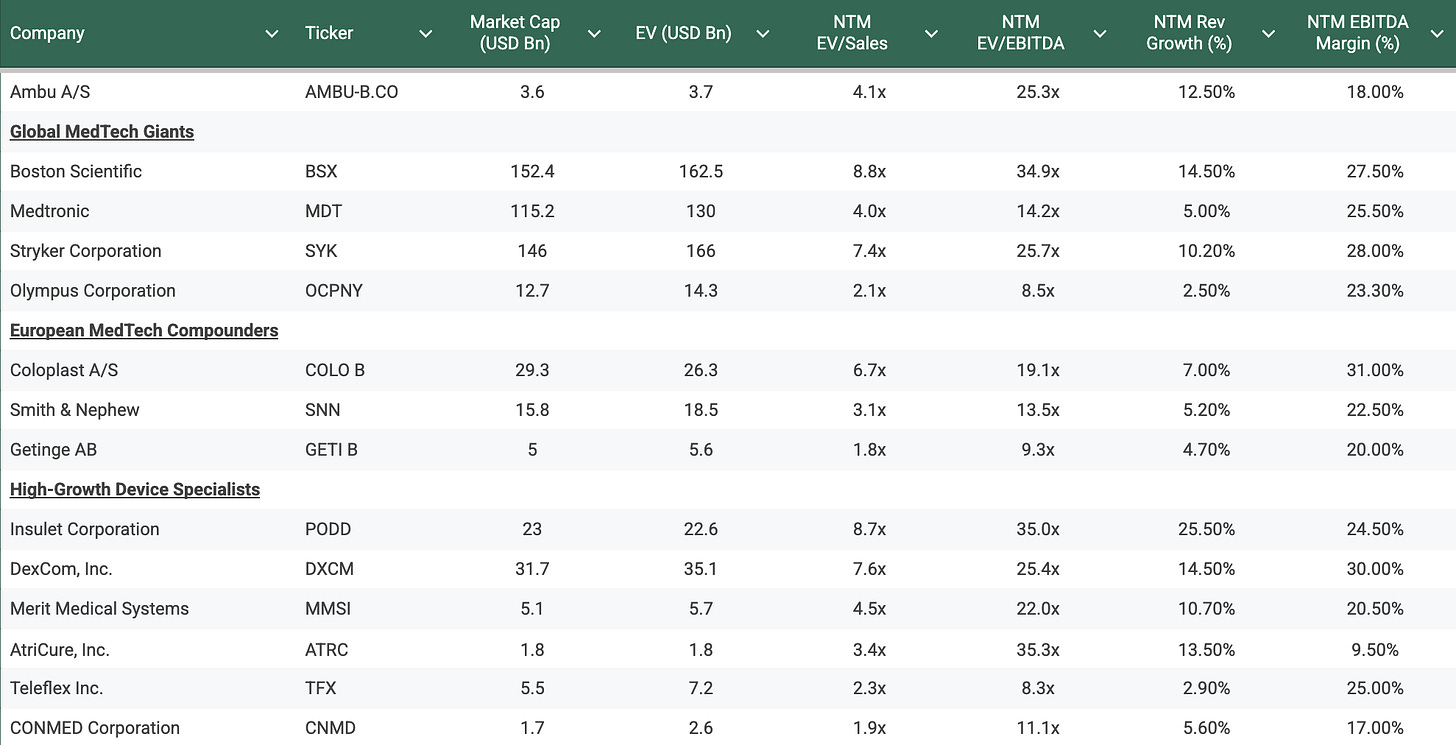

To properly contextualize Ambu's valuation, I have constructed a peer group that serves as a mosaic, viewing the company from multiple critical angles. This group is not a simple collection of competitors but is intentionally diverse to triangulate value across different business models, growth profiles, and geographic investor bases. It includes:

Global MedTech Giants (Endoscopy Focus): Boston Scientific, Medtronic, Stryker, and Olympus are the titans of the broader medical device and endoscopy markets. While their growth is slower, their immense scale, established profitability, and market power provide a crucial valuation ceiling and represent the primary competitive threat. Their multiples reflect mature, diversified businesses that Ambu will increasingly be compared against as it scales.

European MedTech Compounders: Coloplast, Smith & Nephew, and Getinge offer the most relevant geographic context. Coloplast, as a fellow Danish high-performer, is a particularly important benchmark for how the European market values quality and steady compounding. These companies are prized for their stability and profitability, providing a template for what Ambu could be valued at as it matures and delivers on its margin targets.

High-Growth Device Specialists: Insulet, DexCom, Merit Medical Systems, AtriCure, Teleflex, and CONMED form the most vital sub-group for valuing Ambu's growth component. These companies are innovators, often leaders in single-use or high-tech disposable devices, and command premium multiples based on their disruptive potential and high revenue growth rates. They help answer the critical question: "What is the market willing to pay for sustained, double-digit growth in the medical technology space?"

Note: Data as of August 2025. NTM figures are based on consensus estimates and management guidance. Ambu's EV is based on DKK converted to USD.

This analysis reveals a clear "show me" valuation for Ambu. Its multiples sit comfortably between the mature, low-growth giants (Medtronic, Getinge) and the high-growth, premium-valued disruptors (Insulet, Boston Scientific). The market acknowledges Ambu's successful turnaround and leadership in the secular growth market of single-use endoscopy, affording it a valuation premium over slower-moving peers. However, it is not yet willing to award the top-tier multiples commanded by companies with a longer track record of sustained high growth and profitability.

This implies the market is waiting for Ambu to prove it can consistently execute its "ZOOM IN" strategy, particularly in delivering on its long-term target of a ~20% EBIT margin by fiscal 2027/28. The strategic review and impairment in the GI business likely contributes to this skepticism, as it highlights the execution risk inherent in penetrating large, competitive new markets. This valuation gap between potential and current perception represents the core investment opportunity; successful execution should lead to a significant multiple re-rating over our investment horizon.

Triangulated Valuation & Scenarios

To quantify this opportunity, I have modeled three distinct scenarios for Ambu's performance over the next five years. These are not merely different growth rates but represent coherent narratives about the company's strategic execution and the evolving competitive landscape. My primary valuation metric is the 2030 Enterprise Value to EBITDA (EV/EBITDA) multiple. By 2030, with its margin expansion targets hopefully realized, Ambu will be a more mature and consistently profitable enterprise, making an earnings-based multiple the most appropriate measure of value.

Base Case: Executing the Plan. This scenario assumes management successfully delivers on its stated long-term financial targets. Growth is robust, driven by the continued shift to single-use scopes, and the company achieves its goal of industry-level profitability through scale and operational efficiency.

Bull Case: Dominating the Shift. This scenario envisions an accelerated adoption of single-use endoscopes globally. Ambu not only executes flawlessly but also captures a dominant share in new, large markets like GI, leading to superior growth and profitability that exceeds its long-term guidance.

Bear Case: Competitive Squeeze. This scenario models the impact of intensified competition from well-capitalized giants like Boston Scientific and Medtronic. This leads to market share erosion, significant pricing pressure, and a failure to achieve the margin expansion central to the investment thesis.

The table below synthesizes these narratives into a quantitative framework, projecting Ambu's financials to mid-2030 and deriving a target share price and the implied 5-year CAGR from the current price of DKK 94.

The valuation is sensitive to the terminal EBITDA margin assumption. The difference between the Bear Case (19%) and Bull Case (27%) is the primary driver of the wide valuation range. While Ambu's revenue growth is supported by a powerful secular trend, the shift to single-use devices for infection control and efficiency, the real battleground, and the source of investment risk and reward, is profitability. The "ZOOM IN" strategy is as much about creating a scalable, efficient business as it is about top-line growth. The ability to defend and expand margins against formidable competitors who can afford to sacrifice profitability for market share will ultimately determine the investment outcome.

Conclusion on Valuation

My triangulated analysis provides a clear spectrum of potential outcomes for Ambu over the next five years. The Bear Case projects a negative return of -1.9% annually, driven by a failure to execute on margin targets amidst rising competition. The Bull Case, predicated on flawless execution and market dominance, suggests a potential upside to a 23.9% CAGR.

I am anchoring my conclusion on the Base Case, which I believe represents the most probable outcome. This scenario assumes management capably navigates the competitive landscape and delivers on its strategic promises. My Base Case fair value estimate for Ambu in mid-2030 is DKK 167 per share. From the current share price of DKK 94, this implies a 5-Year CAGR of 12.2%.

This projected return falls meaningfully short of the Fjord Alpha target of 20%+ annual returns. While the Bull Case demonstrates that a 20%+ return is achievable, it requires strong execution and a market environment that remains highly favorable. Given the execution risks highlighted by the GI business review and the certainty of intensifying competition from the world's largest medical device companies, the risk/reward profile at the current valuation does not meet my stringent investment criteria.

The Pre-Mortem: A Case for Failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. The stock is trading at DKK 60. Working backward from this failed future, what went wrong?

The Giants Woke Up and Crushed the Pioneer. Our thesis underestimated the competitive response from Boston Scientific and Olympus. They leveraged their immense scale, deep hospital relationships, and massive R&D budgets to rapidly innovate in single-use. Their portfolios became "good enough," and they bundled them with their must-have reusable scopes and other devices. This turned the single-use market into a price-driven, commoditized space, permanently compressing Ambu's margins and growth. Ambu's first-mover advantage was eroded by the sheer scale of its competitors.

GI Was a Quagmire. We were wrong to see GI as a "free call option." It turned out to be a capital-destroying quagmire. The Duodeno 2 launch failed to gain meaningful traction. The procedural complexity and the deeply entrenched relationships of the reusable scope giants proved to be an insurmountable barrier. The capital and management attention poured into GI yielded minimal returns, becoming a major drag on profitability and destroying management's credibility. The Q4 2024 impairment wasn't the end of the story; it was just the beginning.

The "ZOOM IN" Magic Faded. The operational discipline that marked the early years of the turnaround proved unsustainable. As the company grew, complexity crept back in. New product launches were delayed, supply chain issues re-emerged, and the promised operating leverage never fully materialized. EBIT margins stagnated in the low-to-mid teens, far from the 20% target, and the market re-rated the stock as a mediocre growth story, not a best-in-class compounder.

A Disruptive Technology Blind-Sided Us. We were so focused on the single-use vs. reusable battle that we missed a left-field technological shift. A breakthrough in rapid, low-cost sterilization technology for reusable scopes dramatically altered the economic and safety equation for hospitals. This blunted the core value proposition of single-use devices, stalling the conversion trend far earlier than anyone anticipated.

Conclusion: The Final Verdict

My deep dive into Ambu has transformed my initial skepticism into a firm conviction on one dimension: this is a high-quality, innovative company that created and still leads a secularly growing market. The turnaround under the "ZOOM IN" strategy is real, durable, and has created a more disciplined and profitable business.

However, an investment requires not just a great business, but also an attractive price. My valuation work concludes that the current share price partly reflects a successful execution of management's base case plan. The implied 12.2% CAGR is a solid return, but it does not meet the 20%+ threshold I require for a high-conviction investment, nor does it offer a sufficient margin of safety to compensate for the very real execution risks outlined in the pre-mortem.

For this reason, while I believe Ambu is an excellent business to follow, I cannot call it a compelling investment opportunity at today's price. My verdict is to place Ambu on the watchlist. A significant pullback in the share price or clear evidence that the company is on track to outperform my bull case would be a trigger for me to reconsider this a compelling opportunity.

✅ Thesis Pillar 1: Market leader in the secularly growing single-use endoscopy market with a long runway for conversion from reusable scopes.

✅ Thesis Pillar 2: The disciplined "ZOOM IN" strategy is driving significant operating leverage that will expand EBIT margins toward 20%.

✅ Thesis Pillar 3: A strong innovation pipeline provides a path to continued market leadership.

⚠️ Key Risk (from Pre-Mortem): Intensifying competition from scaled players like Boston Scientific and Olympus could commoditize the market and compress margins.

🎯 Target Price (Base Case): DKK 167 (approx. EUR 22.4) by 2030.

📈 Implied 5-Year CAGR (Base Case): ~12.2%.

Primary Sources Used:

Ambu A/S Interim Report for Q2 2024/25

Ambu A/S Interim Report for Q1 2024/25

Ambu A/S Annual Report 2023/24

Ambu A/S Q4 2024 Earnings Call Transcript

Ambu A/S Capital Markets Day Materials (March 2023)

Ambu A/S Investor Presentations

Ambu A/S Company Website & Press Releases