Embracer: Forged in fire, awaiting a new fellowship

Why the market is mispricing a leaner, meaner IP powerhouse after its near-death experience.

Today I turn to another Swedish market darling that has stumbled badly, following my recent memo Evolution AB: The Price of Dominance. Happy reading!

It is not often you get to witness a corporate empire stare into the abyss. For Embracer Group, that moment came in May 2023. After years of a flamboyant, debt-fueled acquisition spree that had turned the small Swedish publisher into a sprawling global behemoth, the music stopped. A verbal commitment for a transformative $2 billion strategic partnership, a deal that was meant to underpin the entire financial structure, vanished overnight. The market’s reaction was immediate and brutal. The stock collapsed, faith evaporated, and the narrative flipped from visionary empire-building to reckless, debt-laden folly.

I have followed this story for years, first with curiosity at the sheer pace of its M&A, and then with intense focus after its fall from grace. The company became a pariah, a case study in what happens when ambition outstrips discipline. In the months that followed, Embracer embarked on one of the most painful and far-reaching restructuring programs I have seen in the European mid-cap space. Studios were closed, thousands of talented people lost their jobs, and entire operating groups, assets that had been acquired for billions, were sold off.

The market, it seems, still sees only the ashes of that fallen empire. The stock languishes, haunted by the ghosts of past mistakes. But what if the fire didn't destroy the company, but instead forged it into something new? Something leaner, stronger, and far more valuable. What if the market, fixated on the trauma of the past, is completely missing the emergence of a deleveraged, IP-focused powerhouse with a clear path to sustainable, high-margin growth?

This memo is the story of that investigation. It is my attempt to look through the smoke and ask a simple question. Is this a story of failure, or of painful but necessary rebirth?

The Setup: Key data & Investment thesis

💰 Stock Price: SEK 88.00

📄 Shares Outstanding: 225.12 million

🏢 Market Cap: SEK 19.81B (approx. EUR 1.7B)

🏦 Net Cash: SEK 4.93B (approx. EUR 420M)

🌐 Enterprise Value: SEK 14.88B (approx. EUR 1.28B)

⚙️ Sector/Industry: Interactive Entertainment

💡 Investment Thesis: The market is still pricing Embracer for its past sins of empire-building, failing to recognize the emergence of a deleveraged, IP-focused powerhouse with a clear path to higher-margin, cash-generative growth.

Sourcing: Company Q1 2025/26 Report, Nasdaq Nordic, Company Press Releases

The business: From sprawling empire to focused fellowship

Origin story

To understand what Embracer is becoming, you have to understand what it was. The company is the brainchild of its founder, Lars Wingefors. His origin story is pure entrepreneurship. He was buying and selling used comics and games as a teenager in Sweden, then building a business by purchasing unsold inventory from larger companies, repackaging it, and selling it on. This DNA, a focus on deal-making and finding value where others don't, defined the company for two decades.

Starting around 2016, this deal-making instinct was put on steroids. Through its listing on Nasdaq Stockholm, the company, then known as THQ Nordic AB, began an acquisition campaign of historic proportions. It became a holding company, an aggregator of forgotten studios and dormant intellectual property (IP). The strategy was decentralized. The acquired studios were largely left to their own devices under one of several operating groups. The empire grew at a breathtaking pace, culminating in a series of blockbuster deals: Gearbox (Borderlands), Asmodee (the world's largest tabletop publisher), Crystal Dynamics and Eidos-Montréal (Tomb Raider, Deus Ex), and, most critically, Middle-earth Enterprises, which holds the vast majority of commercial rights to J.R.R. Tolkien's The Lord of the Rings and The Hobbit.

By its peak, Embracer had become a labyrinthine collection of over a hundred studios and more than 450 franchises.

What they actually do: The new model

The collapse of the $2 billion deal exposed the fatal flaw in this model. It was fueled by cheap capital and ever-rising stock prices, not by operational synergy or disciplined capital allocation. The subsequent restructuring has fundamentally changed the company.

If old Embracer was a sprawling, debt-fueled empire with hundreds of squabbling feudal lords and no clear capital, the new entity, to be renamed Fellowship Entertainment, is a focused guild. Its purpose is to forge new experiences from two of the world's most valuable cultural artifacts: The Lord of the Rings and Tomb Raider.

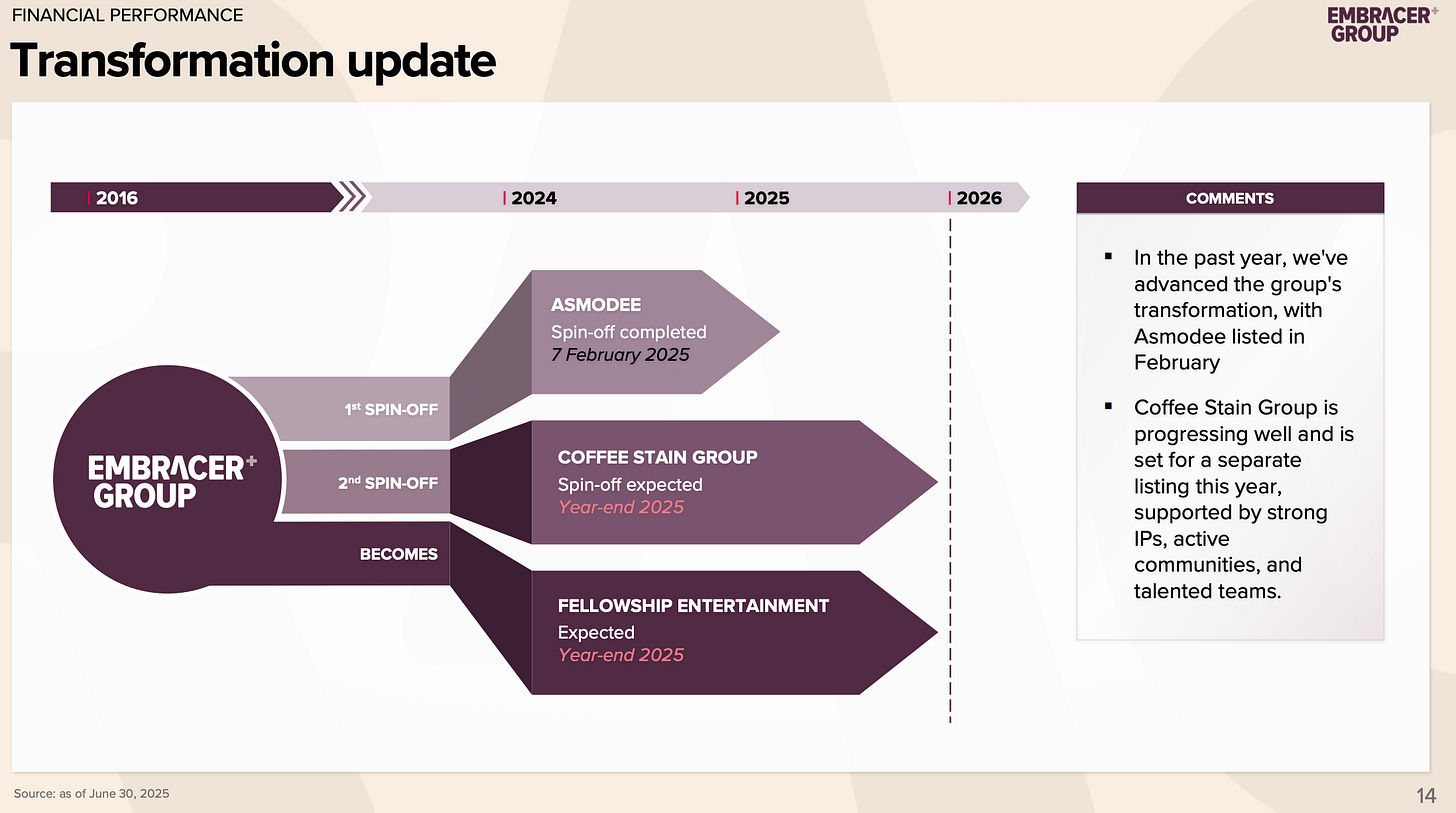

Following the spin-off of the tabletop games business Asmodee and the planned spin-off of the highly successful Coffee Stain Group, the remaining company (Fellowship Entertainment) is a much simpler beast. It is organized into three core segments:

PC/Console Games: This is the heart of the new company. It houses the AAA development studios like Crystal Dynamics, Eidos-Montréal, Warhorse Studios, and THQ Nordic. This is where the blockbuster games based on its key IP will be created.

Mobile Games: A smaller segment focused on free-to-play mobile titles.

Entertainment & Services: This is the secret weapon. It includes the comic book publisher Dark Horse and, most importantly, Middle-earth Enterprises. This segment is responsible for the high-margin, capital-light business of licensing its world-class IP to third parties for films, merchandise, and other media.

Recent developments & performance: The painful pivot

Business update: A necessary contraction

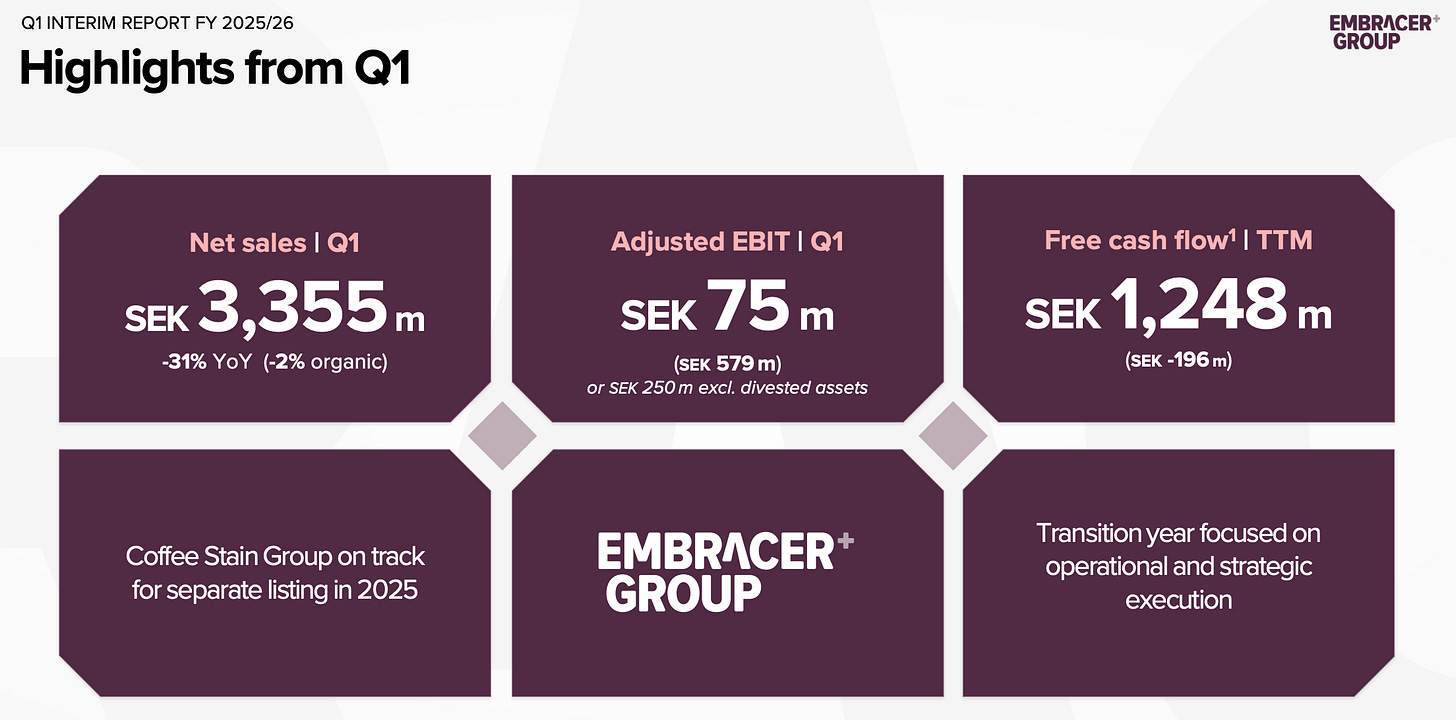

A superficial glance at Embracer’s most recent quarterly report (Q1 FY 2025/26) would paint a grim picture. Net sales were down 31% year-over-year to SEK 3.4 billion, and Adjusted EBIT plummeted 87% to a mere SEK 75 million. The PC/Console segment, the supposed core of the new company, saw sales fall by 38%. My initial read on this was, understandably, one of concern.

However, what the market seems to be missing is that this decline is not a sign of operational failure but a direct and intended consequence of the restructuring. The revenue base is smaller because the company has surgically removed high-revenue but low-margin, high-risk, or non-strategic assets like Gearbox, Saber Interactive, and Easybrain. The company is supposed to be smaller.

To truly understand the health of the business, you have to look past the top line and at the balance sheet and cash flow statement. Here, the story is one of dramatic and successful healing.

From Debt to Cash: In just one year, the company has swung from a precarious net debt position of SEK 14.3 billion to a robust net cash position of SEK 4.9 billion. This is a monumental achievement that fundamentally de-risks the equity story.

Improving cash flow: On a trailing-twelve-month basis, free cash flow has improved to SEK 1.2 billion, compared to a negative SEK 0.2 billion in the preceding period.

Reduced Capex: Capital expenditures are declining as the company cancels non-core projects and focuses its investment on its most promising IP.

This is not a business in collapse. This is a business undergoing a successful, albeit painful, strategic and financial reset.

Stock price context

The stock chart tells the story of the market's journey from euphoria to despair. After peaking in 2021, the share price began a long slide that turned into a capitulation following the failed deal in May 2023. Over the past 12-24 months, the stock has languished, dramatically underperforming both the broader Swedish market and its global gaming peers. It is clear that investors remain deeply skeptical, pricing the company for continued chaos and punishing it for the sins of its past. This is precisely the disconnect that creates the opportunity.

The business model: Monetizing modern myths

The new Embracer's business model is evolving from being a pure volume-based game publisher to a more sophisticated, higher-quality IP manager. It makes money in three primary ways:

AAA Game Development & Sales (PC/Console): The traditional model of developing and selling blockbuster games for a premium price. This is capital-intensive and hit-driven, but the potential rewards are enormous. The crucial change here is the pivot towards owned IP. When Embracer develops a Tomb Raider game, it captures 100% of the economic upside, a stark contrast to the past where it might only be a third-party publisher with limited upside, as was the case with Gearbox and Borderlands.

Back catalog sales: The company owns a vast library of over 450 franchises. Sales from these older titles provide a stable, recurring, and very high-margin stream of revenue that helps to smooth out the lumpiness of new AAA releases.

IP licensing (entertainment & services): This is the most attractive and, I believe, the most undervalued part of the business. Through Middle-earth Enterprises and its other major IP, Embracer can license out its worlds to other companies for films, TV shows, merchandise, and theme parks. This is an exceptionally high-margin, capital-light business. Every dollar of licensing revenue from The Lord of the Rings drops almost entirely to the bottom line. As this segment grows, it will structurally improve the profitability and predictability of the entire company.

The moat: A concentrated fortress of IP

A common bear argument is that the restructuring, by selling off dozens of studios, has weakened Embracer's competitive advantage. I believe the opposite is true. It has not weakened the moat. It has rather concentrated its power by removing distractions and focusing resources on what truly matters. The moat is built on one of the most powerful competitive advantages: Unique resources.

The Lord of the Rings: This is not just another piece of IP; it is a foundational pillar of modern fantasy culture. Through the acquisition of Middle-earth Enterprises, Embracer secured the worldwide exclusive rights to motion pictures, video games, board games, merchandising, theme parks, and stage productions relating to The Lord of the Rings trilogy and The Hobbit. While the Tolkien Estate retains literary rights, this gives Embracer near-total control over the commercial exploitation of one of the most beloved fictional universes ever created. This is a truly unique, irreplaceable asset.

Tomb Raider: Acquired from Square Enix, the Tomb Raider franchise is another global icon. With over 100 million games sold worldwide, Lara Croft is one of the most recognizable characters in entertainment history. The brand has proven its durability and adaptability for nearly three decades.

The old Embracer had a wide but shallow moat, a sprawling collection of hundreds of mostly second- and third-tier IPs. The new Fellowship Entertainment has a narrow but incredibly deep moat. Its defenses rest almost entirely on the successful stewardship and exploitation of these two mega-franchises. By selling off the peripheral territories, management can now pour all its capital and creative talent into reinforcing the walls of this core fortress.

The investment thesis: The path to 2030

This is the heart of my argument. I believe the business that exists today is fundamentally misunderstood, and over the next five years, four key drivers will unlock significant value for shareholders.

Driver 1: The transmedia flywheel in action

My conviction is that the primary value driver will be the successful execution of a "transmedia" strategy, turning their core IP into self-reinforcing ecosystems. This isn't just a corporate buzzword, it is a tangible plan already in motion.

We see clear evidence of this strategy. Embracer has partnered with Amazon for both the next AAA Tomb Raider game and a new live-action series written by the acclaimed Phoebe Waller-Bridge. This creates a powerful synergy. The show will act as a massive marketing vehicle for the game, and the game will deepen engagement for fans of the show. Similarly, the company is working with Amazon Games on a new The Lord of the Rings MMO, tapping into the massive audience of the Rings of Power series. It is also collaborating with Warner Bros. on new films set in Middle-earth, starting with The Hunt for Gollum.

Each piece of media fuels the others. A successful film drives game sales and merchandise. A hit game renews interest in the back catalog of books and films. This creates a powerful flywheel that grows the overall value of the IP far more than any single product could.

Driver 2: The discipline dividend

For years, the market rightly punished Embracer for its value-destructive, "growth for growth's sake" strategy. The near-death experience has forced a permanent cultural shift. Management is now laser-focused on return on investment.

They have been explicit about this. In their Q1 report, they noted that over many years, their "core IP" generated a 3.1x ROI, while "non-core IP" managed only 1.6x. They are now systematically shifting capital away from the latter and towards the former. Core IP, which was only 20% of capex a year ago, is expected to reach 40% this year and could reach 80% long-term.

My view is that as the company proves its newfound discipline over the next several quarters, the market will begin to award it a "discipline dividend" in the form of a higher valuation multiple, rewarding the shift from a speculative aggregator to a rational capital allocator.

Driver 3: Structural margin expansion

The combination of a leaner cost base and a richer revenue mix will drive profitability significantly higher over the forecast period. The restructuring program targeted at least SEK 0.8 billion in annual overhead cost reductions. The divestment of lower-margin businesses (like third-party publishing and certain development studios) and a greater focus on high-margin IP licensing will structurally improve the group's consolidated margin profile. This is not a one-off improvement, I rather see it as a permanent improvement of the company's earning power.

Driver 4: The final catalyst - Unlocking value via spin-off

The planned spin-off of Coffee Stain Group by the end of 2025 is the final, crucial step in the transformation. Coffee Stain is a fantastic business, but its high-growth, community-driven model is very different from the AAA IP focus of Fellowship Entertainment.

Separating the two will remove the last major piece of complexity from the investment case. It will leave investors with a pure-play, high-quality IP and content business that is far easier to understand, analyze, and value. This clarity will attract a new class of investors who were previously deterred by the group's complexity, providing the final catalyst for a valuation re-rating.

Management & capital allocation: A lesson learned?

The long-term success of this thesis rests on one critical question: has management truly learned its lesson?

Lars Wingefors, the founder, has transitioned from CEO to Executive Chair. He is the visionary, the empire-builder whose ambition drove the company's meteoric rise. But it was his lack of restraint that nearly led to its fall. His continued presence is both an asset, he is the company's soul and largest shareholder, and a risk. The key will be whether he can embrace his new role as a strategic guide rather than a relentless dealmaker.

The appointment of Phil Rogers as the new Group CEO is a clear signal of the new era. Rogers is an industry veteran with a reputation for operational excellence, not excessive M&A. His leadership should bring a much-needed focus on execution and profitability.

The company's stated capital allocation policy has shifted 180 degrees. The past was defined by issuing shares to fund ever-larger acquisitions. The future, according to their own "Open Letter" on the restructuring, is about using internally generated cash flow to fund high-ROI organic growth. The balance sheet is now healthy, and the temptation to revert to old habits will be there. Investors must watch their actions, not just their words. If they remain disciplined, the value creation will be immense. If they relapse, the market's trust will be lost for a very long time.

Valuation: A triangulated approach

I will in this section outline a five-year forward-looking valuation for Embracer Group, effective as of September 15, 2025. The current share price of approximately SEK 88 serves as our baseline for calculating the potential five-year compound annual growth rate (CAGR).

To arrive at a robust valuation, I am employing a triangulated approach. This methodology combines a relative valuation against a carefully selected peer group with a multi-scenario analysis projecting financials to mid-2030.

Relative valuation: Finding a relevant peer group

The selection of a relevant peer group is paramount given Embracer's profound transformation. Therefore, my chosen peer set includes a mix of large-cap publishers who are direct competitors, specialized developers revered for high-quality IP, and other diversified gaming holding companies that provide essential market context.

The Titans (Large-Cap Publishers): Electronic Arts (EA) and Take-Two Interactive (TTWO) are the quintessential comparables. They own and masterfully operate massive, annually recurring AAA franchises like EA Sports FC and NBA 2K, demonstrating the immense long-term monetization potential of evergreen IP. Their valuation multiples serve as the primary benchmark for what a successful, scaled AAA publisher can command in the public markets. Conversely, Ubisoft (UBI) is a crucial, albeit cautionary, comparable. While it owns a stable of valuable IP such as Assassin's Creed, it has historically struggled with execution and pipeline management, making it a useful proxy for the risks Fellowship Entertainment must navigate.

The Artisans (High-Quality IP Specialists): CD Projekt (CDR) and Capcom are included as models of quality over quantity. CD Projekt's intense focus on its core franchises, The Witcher and Cyberpunk, has earned it a premium valuation, mirroring Fellowship's stated goal of doubling down on its own core IP. Capcom represents a masterclass in IP revitalization, having successfully leveraged its back catalog (Resident Evil, Monster Hunter) to achieve operational excellence and industry-leading margins, a clear blueprint for what Fellowship can achieve with properties like Tomb Raider and The Lord of the Rings.

The Giants & Neighbors (Broader Context): Global giants like Tencent and NetEase are included to provide a wider market context, as their investment activities and valuation metrics influence the entire sector. European mid-caps such as Paradox Interactive and Keywords Studios offer a regional market perspective on how more specialized players are valued.

The following table presents the key financial metrics for this peer group, utilizing Next Twelve Months (NTM) consensus estimates to maintain a forward-looking perspective.

¹ Take-Two's NTM multiples are distorted by the expected landmark launch of Grand Theft Auto VI, reflecting peak cycle earnings.

² Ubisoft's NTM EV/EBITDA is based on recovering margins, its TTM multiple is not meaningful due to depressed profitability.

My analysis of the peer group reveals a stark valuation disconnect. Embracer's trailing multiples (EV/Sales of ~0.7x, EV/EBITDA of ~2.4x) are at a profound discount not only to premier publishers like EA and Capcom but to the entire peer median.

While this discount is currently justified by a year of painful restructuring, negative growth, and significant execution risk, it also frames the core investment opportunity. If Fellowship Entertainment can successfully execute its turnaround, stabilize the business, and deliver on its AAA pipeline, a significant re-rating toward the peer group median is not only possible but, in my view, highly probable.

Triangulated Valuation & Scenarios

To quantify the potential outcomes, I have developed three distinct five-year scenarios. My valuation is anchored primarily on an EV/Adjusted EBITDA multiple, as it is capital-structure neutral and best reflects the operational cash flow generation at the heart of this turnaround story. I use EV/Sales as a secondary cross-check, providing a valuation floor based on the strategic value of the company's IP portfolio.

Bear Case (The Fellowship Breaks): This scenario assumes significant execution failures. Key AAA titles are delayed beyond our forecast period or underperform commercially, similar to the mixed reception for Killing Floor 3. The strategic pivot to core IP fails to drive meaningful margin expansion, and transmedia deals generate lower-than-expected revenue.

Base Case (The Quest Succeeds): This scenario aligns with a successful execution of management's stated strategy. The AAA pipeline delivers largely on schedule, producing a mix of solid hits and at least one major commercial success. The intense focus on core IP, which has historically generated a 3.1x ROI versus 1.6x for non-core projects, drives significant margin expansion toward the low end of the premier peer range. IP licensing deals, such as the major partnerships with Amazon for Tomb Raider and The Lord of the Rings, are executed successfully, providing stable, high-margin revenue streams.

Bull Case (King of Gondor): This scenario envisions flawless execution coupled with significant upside surprises. The AAA pipeline delivers multiple blockbusters, with titles based on Tomb Raider and The Lord of the Rings becoming mega-hits that exceed all sales expectations. The transmedia strategy unlocks unforeseen value, leading to larger and more frequent licensing deals. Operational leverage proves greater than anticipated, pushing margins into the upper echelon of the industry.

The following table synthesizes these narratives into a quantitative framework, projecting key metrics to mid-2030 and deriving a target share price and 5-year CAGR for each scenario.

Conclusion on Valuation

My triangulated analysis reveals a wide but compelling range of potential outcomes for Embracer Group as it transitions into Fellowship Entertainment. The Bear Case, characterized by continued operational missteps, would result in a disappointing 5.9% CAGR, offering little reward for the risk undertaken. Conversely, the Bull Case presents a spectacular opportunity, with a potential 60.6% CAGR driven by flawless execution on its world-class IP, a scenario that would place the company among the industry's elite performers.

However, my conviction lies with the Base Case as the most probable outcome. This view is predicated on the immense strategic value of the core IP portfolio, the demonstrated commercial success of recent releases like Kingdom Come: Deliverance II, and the installation of a more credible and focused management structure. The painful but necessary restructuring has created a leaner company with a clear mandate: disciplined capital allocation and a relentless focus on maximizing the ROI of its best franchises.

Based on this analysis, my Base Case fair value estimate for Embracer Group's stock in mid-2030 is SEK 430 per share. From the current price of SEK 88, this implies a 5-Year CAGR of 37.3%. This result decisively exceeds the Fjord Alpha target of achieving 20%+ annual returns.

The pre-mortem: A case for failure

Let's assume it's 2030, and our investment has been a total failure. Our thesis was wrong, and we've lost significant capital. Working backward from this failed future, what went wrong?

The most plausible reason for failure is not a market downturn, but a catastrophic failure of execution. The new Lord of the Rings MMO, developed with Amazon, launched to terrible reviews and failed to find an audience, becoming a costly write-off. The much-hyped Tomb Raider game was delayed multiple times and ultimately underwhelmed, failing to reignite the franchise. The transmedia flywheel we banked on never started spinning, it simply rusted on the launchpad.

Internally, the culture never recovered from the brutal restructuring. The best creative talent at Crystal Dynamics and Eidos-Montréal, demoralized by the chaos, left for competitors. We were left with B-teams trying to manage A-list IP, and the quality of the output suffered irrevocably. The "discipline dividend" never materialized because the discipline itself was fleeting. With the balance sheet repaired and the memory of the crisis fading, Lars Wingefors, in his role as Executive Chair, convinced the board to relapse into old habits. A new, ill-advised acquisition spree began, funded by new debt, and the company once again became a complex, unfocused mess, destroying all the value that had been so painfully created.

Finally, it's possible our core assumption was simply wrong. The market wasn't mispricing a turnaround. It was indeed correctly pricing in a permanently damaged company with deep-seated cultural flaws. We saw a phoenix rising from the ashes, but it was just the last flicker of a dying fire.

Conclusion: The final verdict

The story of Embracer Group over the past few years is a cautionary tale of unchecked ambition. But I believe the next chapter will be one of disciplined value creation. The trauma of the 2023 crisis and the subsequent restructuring program was not the end of the story, but the crucible in which a new, more resilient, and ultimately more valuable company was forged.

The investment case is built on a clear and compelling foundation. The company has transformed its balance sheet from a major liability to a source of strength. It has pivoted its strategy from unfocused, low-return aggregation to a highly focused plan to exploit world-class, wholly-owned intellectual property. And it has a clear set of catalysts. From major transmedia partnerships to the final spin-off of Coffee Stain Group, which should unlock the value that is currently obscured by the complexity and chaos of the recent past.

The risks, primarily centered on execution and the potential for a relapse into old habits, are real. However, the valuation provides a substantial margin of safety. The market is offering investors the chance to buy into a portfolio containing The Lord of the Rings and Tomb Raider, two of the most durable IPs in entertainment, at the valuation of a distressed, no-growth company.

My final verdict is that Embracer Group represents a compelling investment opportunity for investors with a 5-year time horizon. The asymmetry is highly favorable. If management simply executes on its stated plan, the returns should be significant. If they manage to truly harness the power of their IP in a coordinated transmedia strategy, the returns could be extraordinary.

This is a bet on the enduring power of great stories and on a management team that has been humbled by fire and, I believe, has emerged wiser and more disciplined. The fellowship is smaller now, the journey ahead is arduous, but the prize is immense.

✅ Thesis Pillar 1: A dramatic, forced restructuring has created a leaner, financially robust company with a net cash balance sheet, a stark contrast to its debt-laden past.

✅ Thesis Pillar 2: The new "IP-first" strategy focuses capital on crown jewel assets (The Lord of the Rings, Tomb Raider) which have demonstrably higher ROI, promising improved profitability and cash generation.

✅ Thesis Pillar 3: The market is applying a "distressed" multiple to a business that is no longer distressed, creating a significant valuation disconnect and an opportunity for re-rating as the new strategy proves out.

⚠️ Key Risk (from Pre-Mortem): Execution risk on flagship AAA titles. A major flop in either the Tomb Raider or Lord of the Rings franchises would severely impair the core thesis.

🎯 Target Price (Base Case): SEK 430 by 2030

📈 Implied 5-Year CAGR (Base Case): 37%

Primary Sources Used:

Embracer Group Annual Report 2024/25

Embracer Group Interim Report Q1 FY 2025/26

Embracer Group Q1 FY 2025/26 Investor Presentation

Embracer Group Press Releases (2023-2025)

Embracer Group Open Letter by CEO on Restructuring Program (June 2023)

This was an absolutely fantastic piece.

I've been in Embracer since the 'Saudi-drop' for the exposure to the key IP (how LOTR was acquired for just 400 mill I will never know...) and have experienced first-hand how much they just love chaos over there!

But with the amazing Asmodee spin off (genuinely did not expect the share prices that's pushing), the recent resurgence (and even preference) of AA titles - Dead Island 2 and KCD2 really showcasing big long-term franchise potential - and a refocus on their core IPs (like you say, TR has big blockbuster power, if done right) I'm genuinely really excited about their future.

The next stage of this rollercoaster is ofc the Coffee Stain spin off - any estimates on what we can expect the stock price split to be between Fellowship Entertainment and Coffee Stain?

Very detailed, thx. I’m also in (and received Asmdee & CS) and I also share the opinion of “watch and check” if they really have a different culture now. That’s key. Apart from that, it seems undervalued, BUT they must grow, they are stagnant now. And I think they are still going to be for the upcoming quarters (sadly).