Evolution: The US engine roars

Record-breaking revenue in the "Big Three" states proves the North American thesis is stronger than ever.

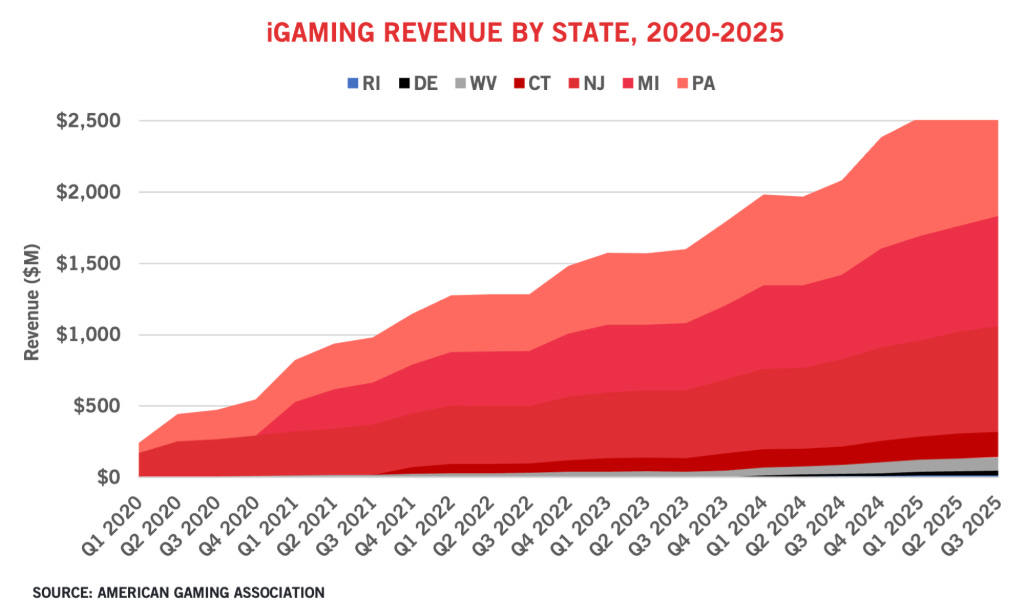

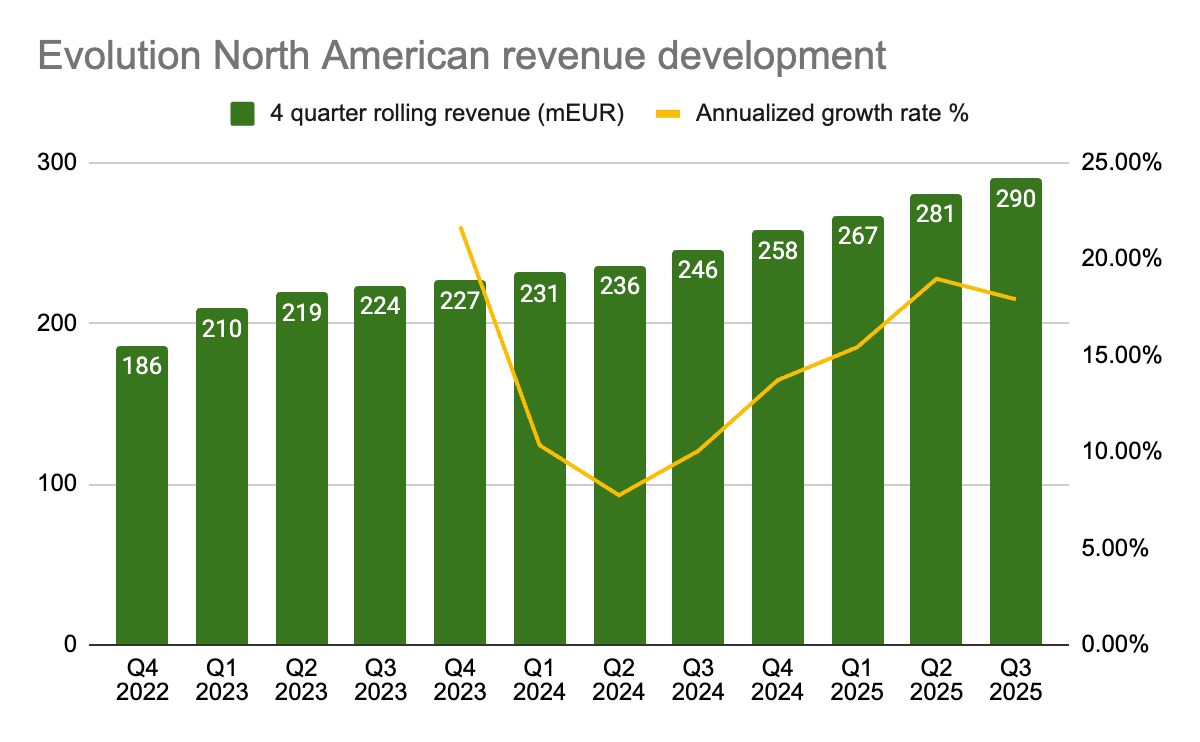

United States represents the most significant long-term opportunity for Evolution AB. While we these days often get bogged down in the day-to-day noise of share price volatility and other headwinds, it is worthwhile to zoom out and look at the recent fundamental data coming out of North America.

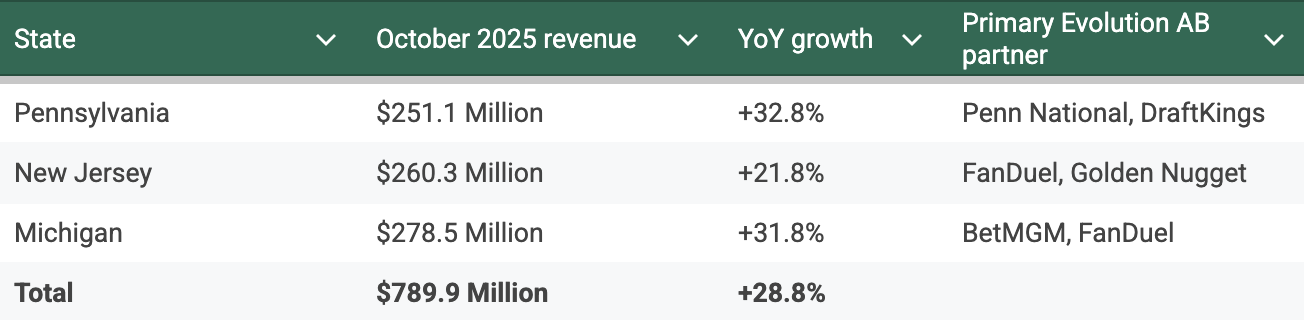

The iGaming numbers for October 2025 are in, and the story they tell is clear. The US growth engine is roaring. The three major regulated states, Pennsylvania, Michigan, and New Jersey, all broke revenue records simultaneously.

Here is the breakdown of the recent development in the US market and why it provides such an important floor for the Evolution investment thesis.

State-by-State performance: October 2025

The data from October is incredibly supportive of the Evolution thesis. When operators make record revenue, Evolution also wins.

1. Pennsylvania: The heavyweight champion

Pennsylvania has become the premier jurisdiction in North America.

The numbers: Total iGaming revenue hit $251.1 million (+32.8% year-over-year).

The takeaway: What’s interesting here is the volume of slot play (PA breaks down iGaming into Slots, Tables and Poker). While Evolution of course is most well-known for live dealers, the ownership of NetEnt, Red Tiger, and Big Time Gaming means they are capturing massive value from the RNG (slots) side, which grew 35%.

2. New Jersey: The mature market that keeps on giving

Usually, older markets slow down. New Jersey is doing the opposite.

The Numbers: Internet Gaming Win reached $260.3 million (+21.8% year-over-year).

The Takeaway: As mentioned above, the “Digital Flip” occurred here. Atlantic City is transforming from a tourist destination into a digital server hub. For Evolution, whose US studios are anchored there, this cements their role as essential infrastructure for the state’s economy.

3. Michigan: The innovation hub

Michigan continues to punch above its weight, often adopting new game formats faster than other states.

The Numbers: Gross receipts hit $278.5 million (+31.8% year-over-year).

The Takeaway: The tax revenue here is being split between the state and the city of Detroit. This dual-benefit model is proving to be very stable, and the high adoption of new games suggests Michigan players are hungry for the “Game show” style content.

4. The “Stealth” growth markets

While the big three get the headlines, the smaller states are printing cash at high margins, e.g.;

West Virginia: Growing at nearly 50% year-over-year. It is a smaller pie, but it is expanding rapidly.

Connecticut: October marked the launch of Crazy Time in the state. Historically, bringing this flagship game online boosts total gaming revenue as it attracts casual players who don’t usually play Blackjack.

The Good, The Bad, and The Ugly

Here is the “back of the napkin” take on the current US landscape:

The Good

The “Big Three” in sync: Pennsylvania, Michigan, and New Jersey hit all-time highs in the same month. This strongly indicates a structural shift in how Americans gamble.

The “Digital Flip” in NJ: For the first time (outside of the pandemic), New Jersey online casinos generated more money than the physical casinos in Atlantic City. The computer screen has officially overtaken the physical slot floor.

Tax revenue is king: Pennsylvania collected over $112 million in taxes from iGaming in a single month. This is a very strong lobbying tool for opening up new states (e.g., New York and Maryland).

The Bad

Legislative pace: Nothing new here, but despite the revenue numbers, new state legalizations (like Maryland) are a slow grind. Bureaucracy moves at a glacial pace.

The Ugly

The “Cannibalization” myth: In Massachusetts, land-based operators (specifically Wynn Resorts) are still aggressively arguing that online gaming destroys physical jobs. While the data from Pennsylvania proves this is false (retail grew there, too!), it remains a political narrative that delays expansion.

Outlook: The path forward in the US

The US market development is currently the strongest pillar supporting Evolution’s stock. Looking ahead to 2026, two major factors are at play:

1. The Sweepstakes Crackdown

Regulators in New York and other states have finally launched a coordinated attack on “sweepstakes casinos” (unregulated sites using loopholes to offer gambling).

Why this matters: These sites were sucking up hundreds of millions of dollars in “grey market” revenue. By shutting them down, states create a vacuum of demand. This puts immense pressure on legislators to legalize regulated iGaming to fill that void and capture the tax revenue. This is a massive and under-the-radar bullish signal for Evolution.

2. The Resilience of Demand

The most critical takeaway from the October report is that despite economic uncertainty, US consumers are not cutting back on digital entertainment. The market has proven to be stable.

Conclusion

Evolution’s moat in the US is widening. The regulatory barriers are high, the tax arguments for new states are becoming very clear, and the existing markets are growing at 20-30% annually. The North American fortress remains secure and growing.

I recently exited Evolution. But I will follow-up. Once the company sees growth again, I might re-enter. So the company has something to prove.

Really like how you frame this around tax receipts and legislative physics instead of just “moat + TAM.” The October numbers make it hard to argue with the core: when the Big Three are all printing record iGaming revenue at once, EVO is basically riding a regulated revenue utility that governments are now fiscally addicted to.

Where my brain goes from here is the through-cycle question: if North America really is the fortress pillar, how much of that 20–30% growth and widening moat is already embedded in the multiple? The structural story you lay out is rock solid – high barriers, entrenched studios, regulators quietly choosing tax flows over moral panic – but at some point the stock stops being “mispriced growth” and starts being a toll road everyone knows about.

Either way, this is a great reminder that the real risk isn’t demand, it’s the pace and terms of new state openings. The sweepstakes crackdown + record tax months feel like a powerful one-two combo for EVO’s long game.