Embracer: The great unbundling

Coffee Stain IPO's on the 11th of December, thereby splitting Embracer Group into two parts. Here is why this is likely to unlock value for shareholders.

The restructuring journey around Embracer has been a marathon, messy at times, volatile always, and often emotional for long-term shareholders. See my full write-up about Embracer here.

But the finish line is in sight.

Before Coffee Stain rings the bell on December 11, here is a walk-through of what the split actually means and what to look for next. My thesis is straightforward: this separation is a value unlock. The story finally shifts from crisis management (debt reduction, layoffs, divestments) to capital allocation across two cleaner companies with very different risk profiles.

Why the break-up matters

The spin-off isn’t about repairing the balance sheet anymore - that work is done. It is about clarity.

For too long, the conglomerate structure hid the quality of the smaller gems behind the capital intensity of the AAA business. This spin-off removes the “conglomerate discount” and forces the market to price these assets on their own terms:

Coffee Stain: A focused, cash-rich, high-margin compounder.

Fellowship: A heavier, IP-rich platform built around some of the world’s most recognizable franchises.

For investors, you are swapping a murky conglomerate for one clean quality growth story and one higher-beta value/IP play.

Coffee Stain: A true compounder

Profile: High-margin, community-driven indie/AA operator.

Comparables: Paradox, Team17, Devolver.

Coffee Stain arrives on the market with the kind of simple narrative we tend to love. It is not a “hit factory” reliant on a single blockbuster; rather, it is a collection of decentralized studios building games with long tails, sticky communities, and clear creative identities.

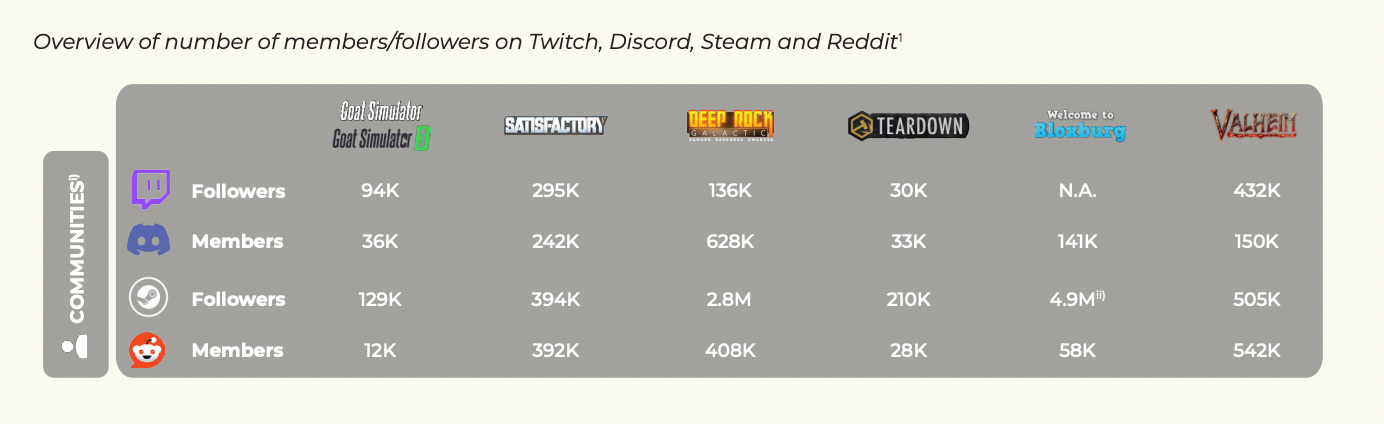

Titles like Deep Rock Galactic, Satisfactory, Teardown, and Valheim have built loyal player bases that keep generating revenue long after release.

The investment case:

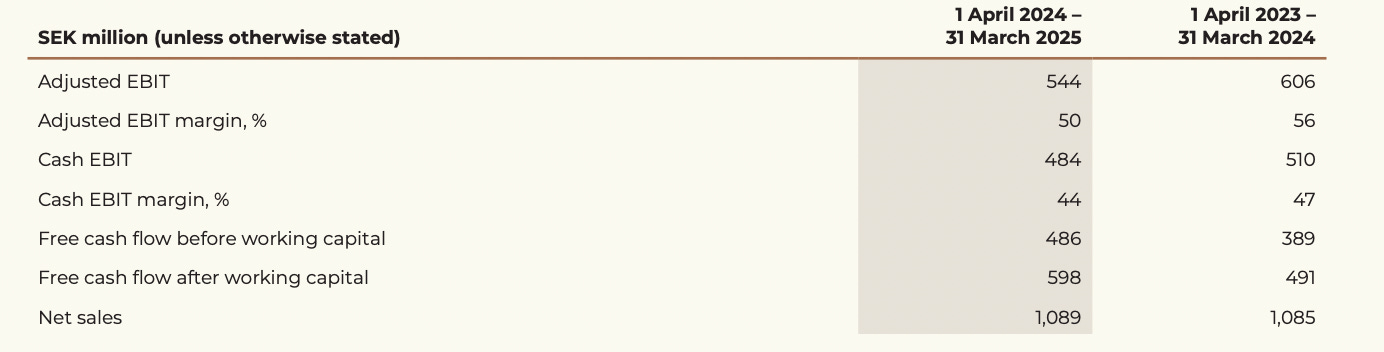

Best-in-Class Margins: Historically delivering >30–40% EBIT margins.

Cash Conversion: Low capex requirements mean profits translate directly to cash.

The Model: Decentralized teams with high autonomy. Green-lighting happens via peer review, not corporate bureaucracy. This fits the Scandinavian development culture perfectly with trust, autonomy, and careful spending.

M&A Firepower: With a net cash position and ~SEK 500m in liquidity, they are perfectly positioned for disciplined bolt-on M&A.

The valuation angle: If the market assigns Coffee Stain a multiple similar to its peers, the spin-off alone could represent a significant chunk of Embracer’s entire current market cap.

Fellowship Entertainment: The IP titan

Profile: AAA development, global IP rights, higher risk/reward.

Key IP: Lord of the Rings, Tomb Raider, Metro, Kingdom Come: Deliverance.

Once Coffee Stain is distributed, the remaining entity evolves into Fellowship Entertainment. This is the heavier engine. It holds the large-scale development pipelines and the crown jewel: Middle-earth Enterprises.

The investment case:

Clean Start: Importantly, Fellowship does not start life as a distressed asset. It launches with Group-level net cash (though ~SEK 1.3bn in earn-outs remain).

The “Lindy” Effect: It owns IP that has survived for decades. The Lord of the Rings rights carry immense high-margin licensing potential across film, TV, and merchandise.

Turnaround potential: This is a classic turnaround story. If the AAA pipeline delivers and costs remain disciplined, the re-rating potential is substantial. Looking ahead, there is both Metro (likely 2026) and Tomb Raider (2026-27) in the pipeline.

What to watch after December 11

For Coffee Stain:

Valuation Settlement: Where does the market price the “quality premium”?

Capital Allocation: How does management talk about that SEK 500m cash pile? Will we see early M&A or dividends?

Pipeline: Any new signals on the publishing cadence for 2026?

For Fellowship (Remaining Embracer):

The AAA Pipeline: Timing and quality are everything here. No more delays.

Licensing Activity: Watch for new LOTR deals, this is pure margin.

Cash Discipline: Can they maintain the new, leaner cost structure?

Final comment

The Coffee Stain listing marks the true end of the Embracer restructuring era. The fire is out.

What remains are two companies with clear paths: Coffee Stain as the stable, net-cash compounder, and Fellowship as the undervalued IP platform. For the first time in years, shareholders can value the pieces separately, and I suspect the sum of the parts will prove to be worth significantly more than the current whole.

Coffee Stain is really interesting. My worries are about the “loss” of Bluxburgs revenue and what they are going to add to compensate that (apart from Deep Core).

Thanks for bringing this up. See you soon.