Embracer Q2'25: The fire is out, engine needs to start

Embracer's Q2'25 report was so-so. Still, valuation remains attractive, and stock trading up. Let's dig into the Good, the Bad and the Ugly - and if it is still a Fjord Alpha buy.

A low-quality beat and a sputtering engine

Today’s Q2 report for the 2025/26 fiscal year was an important test for the streamlined Embracer. My “Forged in Fire” narrative, the painful but necessary restructuring, is complete. The balance sheet is cured, the spin-offs are proceeding, and the company is no longer a survival story. The question I have been asking is whether the operational and creative turnaround, would ignite.

The answer from this report is a “no”.

We are looking at two distinct Embracers.

The first is a new, “lean” financial entity that successfully beat market expectations, delivering an Adjusted EBIT of SEK 109 million against a consensus of SEK 101 million.

The second is the “old” Embracer. Still a bit of a mess with a core creative engine that is sputtering, evidenced by a bad new release slate and a back catalog that did not deliver on my expectations.

This headline “beat” is of low quality. It was driven by the lower-margin Entertainment & Services segment (distribution and publishing), which posted a stellar +25% organic growth. The “core” of the company, the PC/Console segment, was shrinking by -4% organically after a string of bad game launches.

The “Catalysts” we have been tracking, chief among them the Coffee Stain spin-off, are materializing as confirmed by the CEO.

Let’s dig into the Good, the Bad and the Ugly.

The Good: The “Forged in Fire” thesis is confirmed

This section must begin by acknowledging the profound success of the financial transformation. The restructuring, as brutal as it was, has worked. The company is stable, the balance sheet is clean, and the key strategic catalysts are on schedule.

The balance sheet is cured

The single greatest earlier risk was the company’s crippling net debt, which stood at SEK 14.6 billion just a year ago.

That risk and era is definitively over.

Driven by the completed divestments of Gearbox, Saber, and Easybrain, as well as the spin-off of Asmodee, the company’s financial position has been radically transformed.

This Q2 report did show a Free Cash Flow burn of SEK 348 million (a point we will dissect in “The Ugly”). However, even after accounting for this burn, the company remains in a robust net cash position of approximately SEK 4.58 billion.

This is a fundamental shift in the investment narrative. The market has seen Embracer as a high-debt, high-risk entity for years. That anchor is now gone. Management is no longer held back by liquidity concerns or restrictive bank covenants. It has the financial freedom and stability to execute its new, long-term, IP-led strategy.

The investor focus must now shift from “Will they survive?” to “Can they execute?” This is a massive and positive structural change.

The (low-quality) beat and profitability stabilization

Objectively, the headline numbers for Q2 were better than consensus. The company beat on both the top and bottom lines, and the +6% organic growth was a significant positive surprise against median analyst estimates of a -5% decline.

The cost-cutting and restructuring program has also clearly flowed through to the bottom line. The net loss for the period was dramatically reduced to just SEK 23 million. This equates to a basic earnings per share of SEK -0.10. This demonstrates that in what management has repeatedly called a “transition year”, the new cost structure is holding up, allowing the company to operate at a breakeven run-rate even in a quiet quarter.

The “Unsung Hero”: Entertainment & Services

The quarter was saved almost single-handedly by the Entertainment & Services segment, which houses PLAION’s distribution and publishing partners, as well as Middle-earth Enterprises and Horse comics.

This segment grew by a massive +25% organically. Its reported sales of SEK 1,462 million smashed consensus expectations of SEK 1,262 million by 16%. This overperformance provided crucial strength to the group’s consolidated figures.

This segment, however, is both a blessing and a curse.

The blessing is obvious: it delivered the revenue and profit beat, allowing management to report positive momentum.

The curse is more subtle: this is a by and large a third-party distribution business. It is an inherently lower-margin operation. This quarter’s success masks the failure in the PC/Console segment.

The final catalyst is on-track

CEO Phil Rogers was unambiguous in his commentary: “Coffee Stain Group’s upcoming Capital Markets Event [November 17] will be an important milestone as the company prepares for its spin-off, targeted for December”.

This de-risks the final step of the transformation. This spin-off will finally unlock the value of this high-performing, community-driven segment and complete the planned separation into three standalone companies. This will leave behind the new, focused “Fellowship Entertainment”.

The Bad: The core creative engine is struggling

Now, we must pivot from the financial successes to the operational failures. The “Good” shows the restructuring worked. The “Bad” reveals that the underlying business needs to be improved. The new, streamlined Embracer was supposed to be a lean, IP-focused creative house. This report is not showing this.

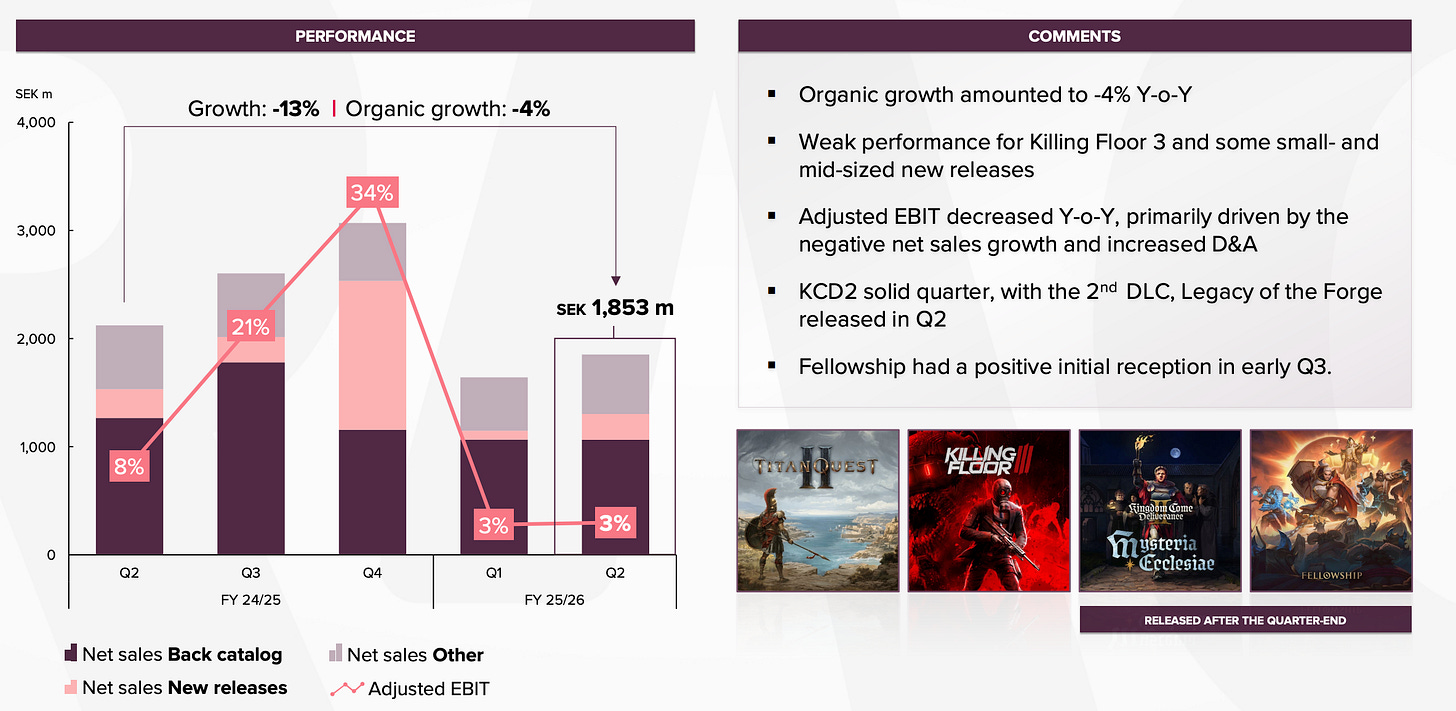

The PC/Console Segment did not deliver

This segment is the new “core” of the company. It is the future “Fellowship Entertainment.” It is where the crown jewel IP:s now resides. This segment did not deliver.

It reported -4% organic growth.

This is a failure in my eyes. In a “transition year”, the one thing that should remain stable is the core business. Instead, it is shrinking. This performance missed analyst consensus for the segment and acted as a drag on the entire group, a weakness that was masked only by the overperformance in Entertainment & Services.

The new release slate: A flop

The -4% organic decline was not simply due to a quiet quarter. It was driven by the failure of the new games that did launch.

The company was forced to admit in its report that several games “performed poorly” or “fell below expectations”. The list of these flops includes: Frosthaven, Echoes of the End, Metal Eden, and Killing Floor 3.

This reveals a crisis of strategy versus execution. The new strategy is to focus on “core IPs” and build “cornerstone” franchises like the next Tomb Raider. This is the story they are selling. But the execution we see this quarter is a slate of non-core, AA-at-best games that all failed simultaneously.

This shows a troubling disconnect. If the company’s green-lighting process, quality control, and marketing apparatus are failing on smaller, manageable titles, it creates low confidence in their ability to handle the AAA-level budgets, timelines, and execution required to successfully deliver a “cornerstone” franchise like Tomb Raider.

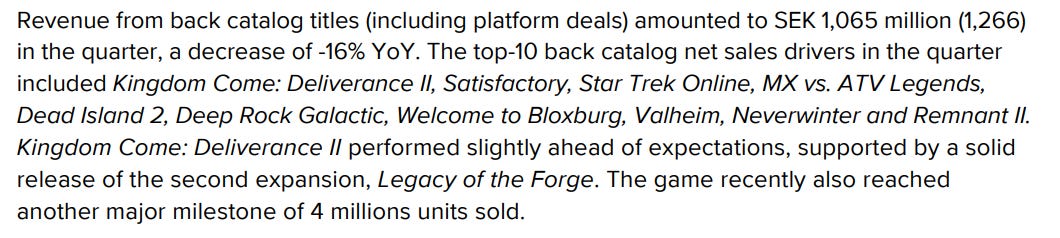

The back catalog is decreasing

This is a worrying data point. Buried in the segment commentary is the reason for the PC/Console segment’s -4% organic decline. It was “mainly driven by decreased catalog sales (including platform deals)“.

This is a bit of an alarm bell for me.

The investment thesis for an IP-holding company rests on the predictable, “long tail” of its back catalog. This catalog is supposed to function as a high-margin, stable, and growing annuity. This cash flow “annuity” is what funds the high-risk, lumpy, and expensive development of new AAA games.

This Q2 report shows that Embracer’s annuity is shrinking. This means that the pressure for future profits and cash flow now falls even more onto new releases. And as we just established, the company’s new release engine is not working great. This could turn into a vicious cycle that fundamentally undermines the new “IP-led” strategy.

The Ugly: The cash burn and the Mobile segment

This section explores the high-stakes risks that this report reveals. These are “ugly” challenges to the investment case.

The free cash flow hole

The new, “lean” Embracer is still burning cash. The report showed negative Free Cash Flow of SEK 348 million. This follows a negative Free Cash Flow of SEK 223 million in Q1, for a total H1 cash burn of SEK 571 million.

The cause is simple. Net Investments in intangible assets (game development) were SEK 838 million, far outpacing the anemic SEK 405 million in cash flow from operating activities.

The promise of the restructuring was a “highly cash-flow generative business”. The data from the first half of this fiscal year shows the opposite. This connects directly back to “The Bad”. The shrinking back catalog and the failing new releases mean that profits are too low to fund the new IP-led strategy.

The company is funding its Tomb Raider future by burning its (thankfully large) cash pile. This is not sustainable. Embracer must start generating positive free cash flow, or the “cured” balance sheet will slowly get sick again.

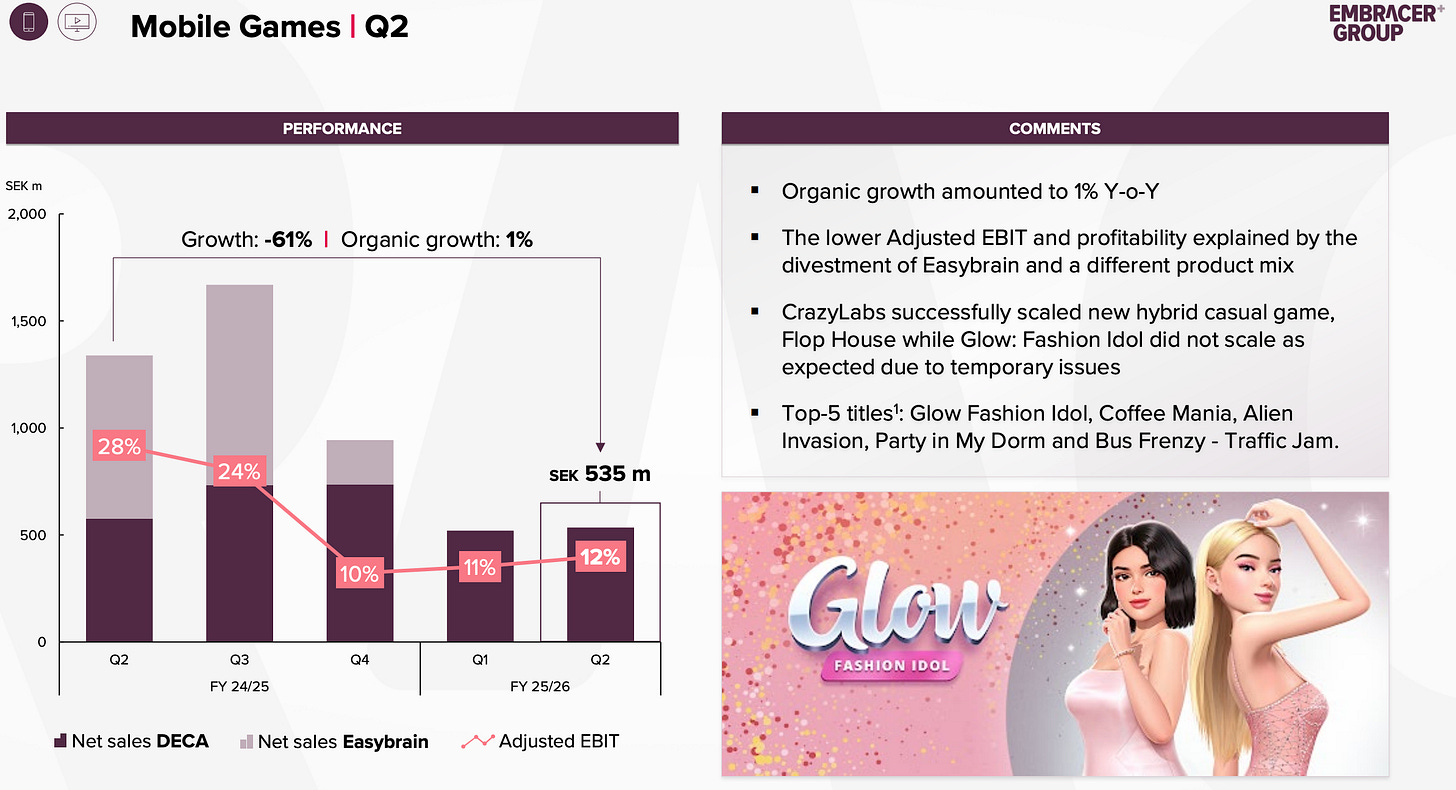

The Mobile segment

The headline-grabbing -61% sales decline in the Mobile segment is, for analytical purposes, just noise. It is an accounting reflection of the divestment of the highly profitable Easybrain.

The “Ugly” truth is found in the organic number: +1% growth.

After selling its crown jewel, Embracer is left with the rump DECA Games business. This business is now sub-scale and, as the +1% organic growth shows, is stagnant. It no longer contributes meaningfully to growth or profit (analyst consensus was for only SEK 59 million in EBIT).

This segment is not dead, but it’s not alive. It is a strategic distraction that I fear consumes capital and management attention while contributing nothing to the new “IP-led” thesis, albeit the jury is still out.

Final Take: A bad quarter, but still a “Buy”

Synthesizing the “Good, The Bad, and The Ugly”

The “Good” is that the financial restructuring was a complete success. The “Forged in Fire” thesis is closed. The balance sheet is strong and has moved from net debt to net cash. The final catalyst, the Coffee Stain spin-off, is on track for December.

The “Bad” is that the core operational business is struggling. The PC/Console segment, the very heart of the new “Fellowship Entertainment” is shrinking (-4% organic). This is due to a failure of execution on new releases and a worrying erosion of its back catalog.

The “Ugly” is the direct consequence of this operational failure. A company that still burns cash and with a mobile segment that takes management attention.

Short-catalyst and attractive valuation

In my original memo (“Embracer: Forged in fire, awaiting a new fellowship“) I wrote the following; The risks, primarily centered on execution and the potential for a relapse into old habits, are real. However, the valuation provides a substantial margin of safety.

This still holds true. Based on this quarter I do have some concerns regarding execution, but the margin of safety here is significant, and I don’t see any immediate need to do any larger changes to my original assumptions.

The Coffee Stain spin-off in December is a clear, tangible, and positive catalyst. With a “sum-of-the-parts” perspective, this remains an attractive opportunity. The CMD next week should also provide more (positive) fuel on the fire. Looking ahead, there is both Metro (likely 2026) and Tomb Raider (2026-27) in the pipeline.

Even with these operational stumbles, an EV of ~15bn SEK for this collection of assets implies the market is pricing in zero future success. That is too pessimistic. The margin of safety is what keeps this a BUY. I do also expect further buy-backs at this level. All-in-all, Embracer still looks to beat my 20+% CAGR hurdle rate.