Carasent Q3-25: The Inflection Point

Stunning profitability development, strong underlying revenue growth and long runway de-risk the investment case.

Investment thesis de-risked

You find my original investment thesis here; Carasent: From messy roll-up to world-class compounder

Carasent reported this morning, and it turned out be an inflection-point quarter. The company finally confirmed its ability to translate a high recurring revenue base into powerful profitability, substantially de-risking the investment case.

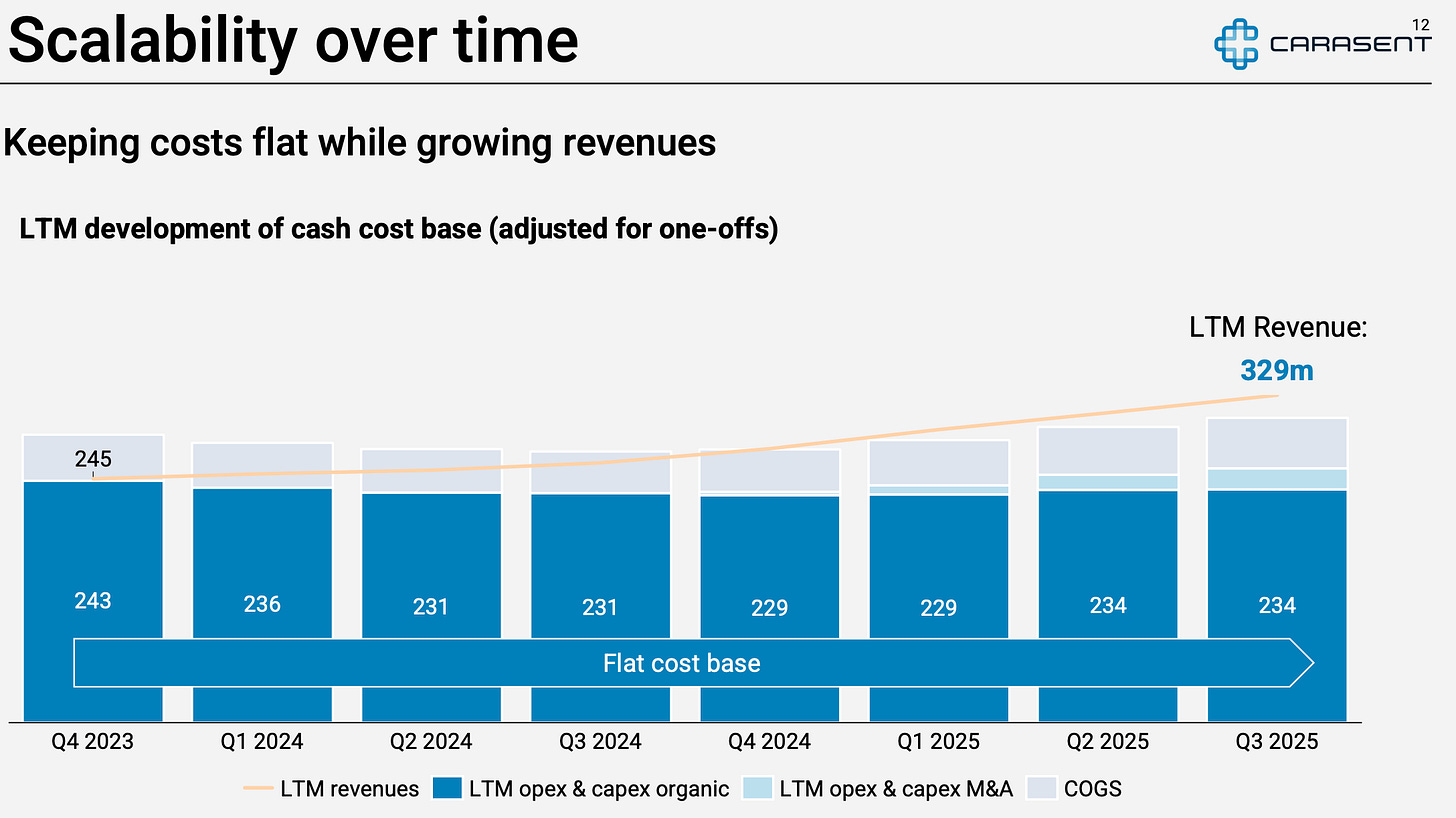

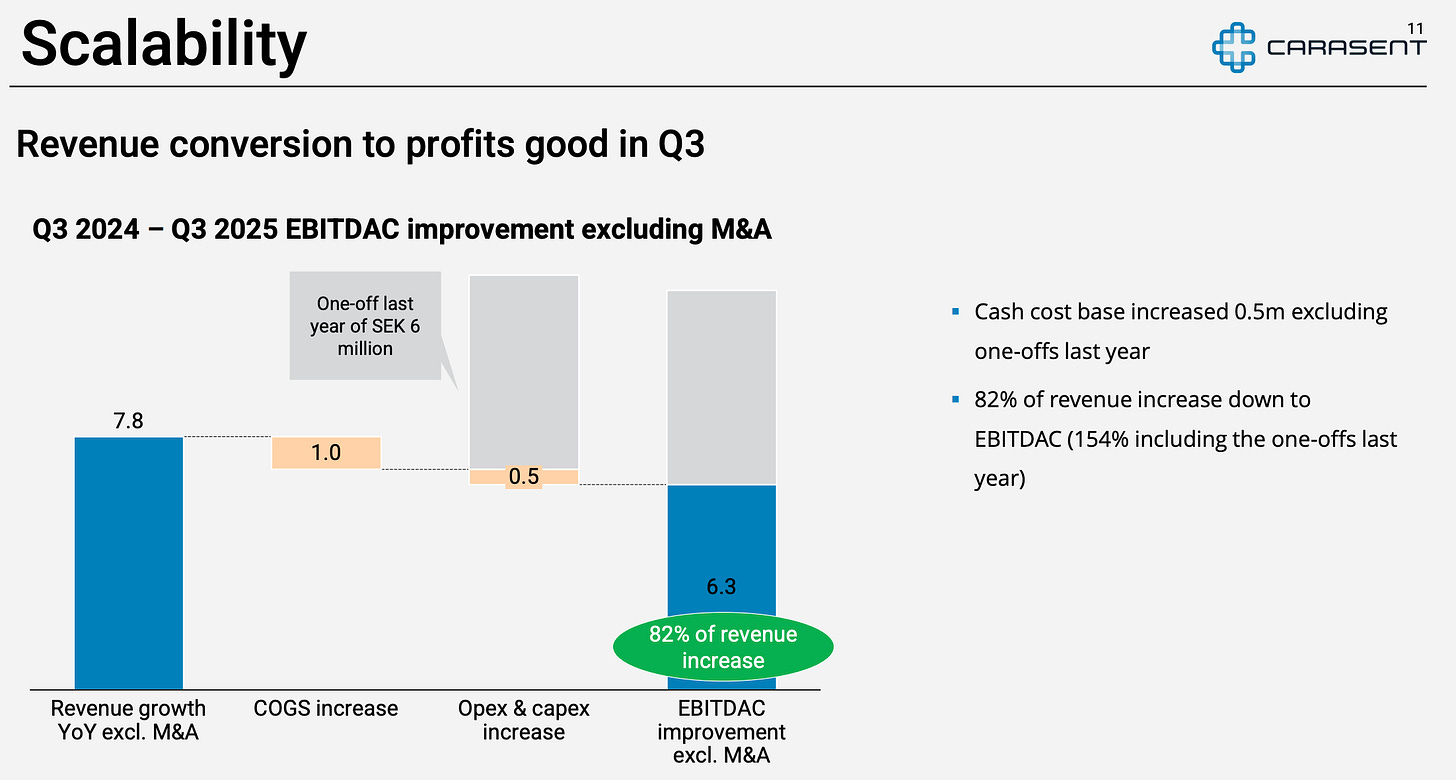

The operational leverage as revenue grows is remarkable, proving the scalability of the business model. While headline organic growth was solid, the more important underlying metric of recurring revenue growth remains very strong, and key investments are now shifting from R&D to commercialization.

This was a thesis-affirming report that the market will likely continue to re-evaluate upwards. These two charts tell a great story;

Key numbers at a glance

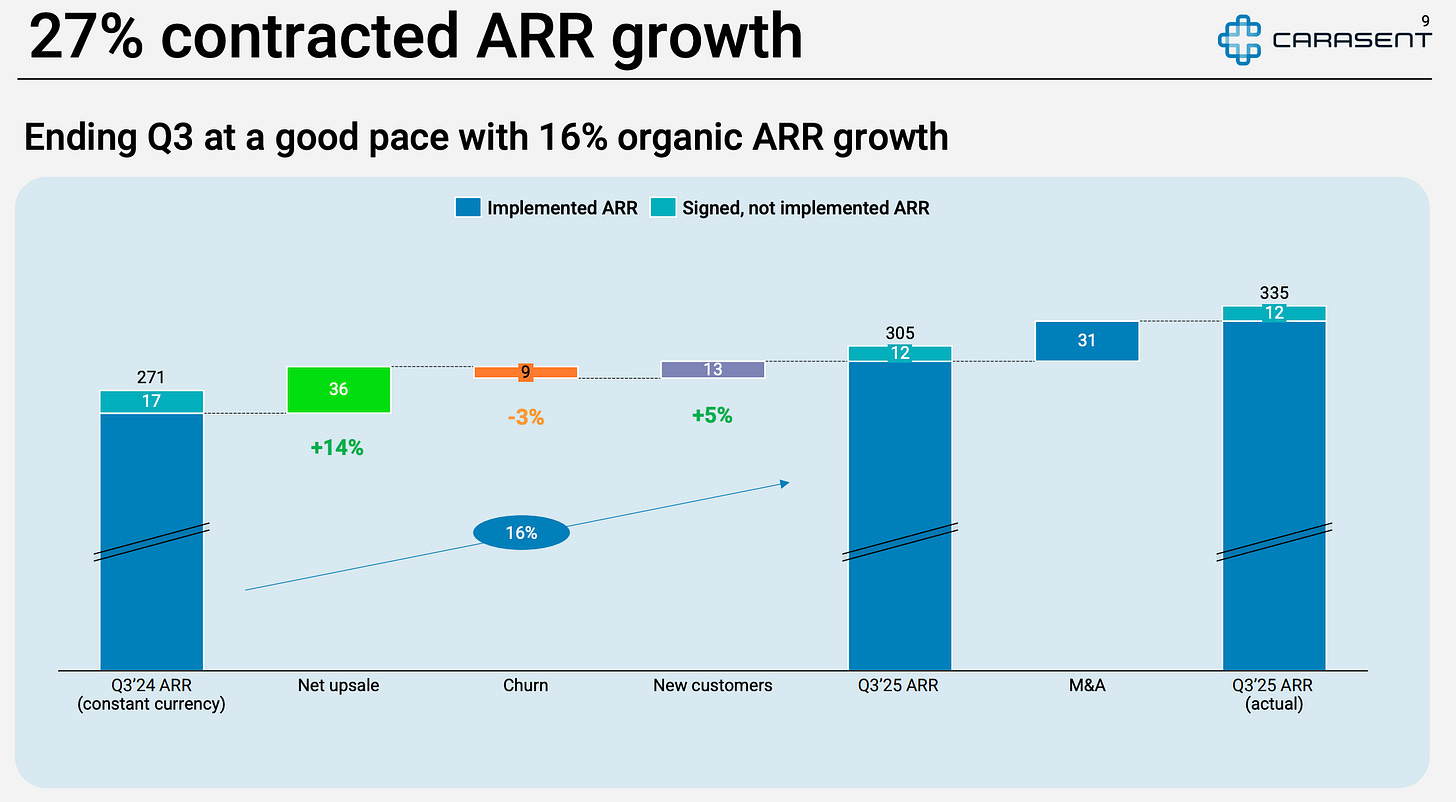

Contracted ARR: SEK 335 million (vs. SEK 317m last quarter,)

Organic Revenue Growth: 13% (vs. 13% in the last quarter)

Organic ARR Growth: 16% (vs. 17% in the last quarter)

Net Revenue Retention (NRR): 111% (vs. 109% in the last quarter)

EBITDA Margin: 29% (vs. 15% in the last quarter)

EBITDAC Margin: 15% (vs. 3% in the last quarter)

My key take-aways

Profitability inflection is real: The standout number is the 29% EBITDA margin, a massive jump from last quarter and a powerful demonstration of the company’s operational leverage. This surge proves that the cost headwinds from Q2 were temporary and clearly indicates that the company’s long-term 35% margin target is highly achievable, most likely way ahead of original FY28 timeline.

Nuanced but strong organic growth: Organic revenue growth was 13%, slightly below the 15% medium-term target due softness in the Webdoc segment, however, explained in the report as of one-time nature (erroneous invoicing now corrected). The more important underlying metric, organic Annual Recurring Revenue (ARR) growth, was a very strong 16%, signaling excellent sales momentum and a healthy subscription base.

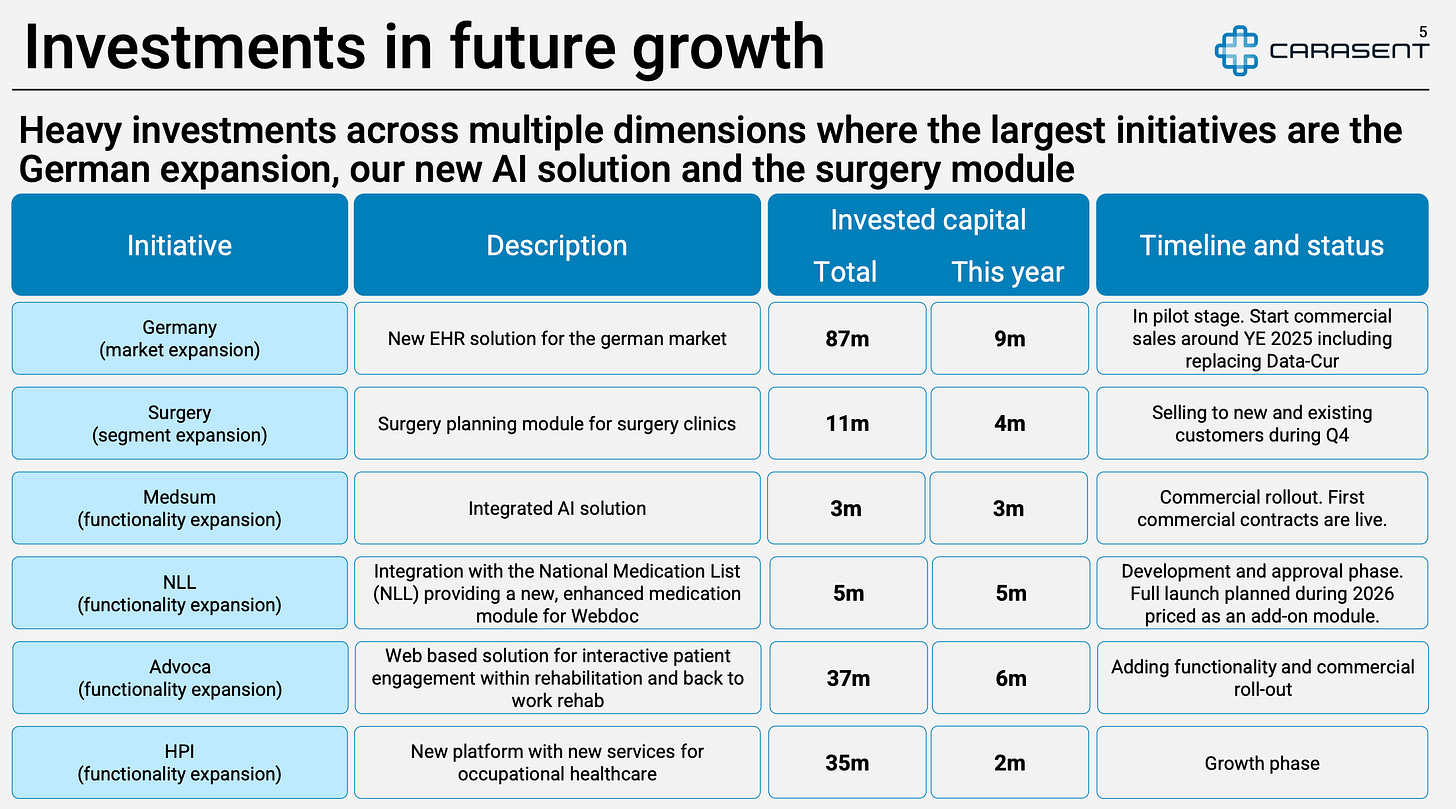

Investments done, growth journey ahead: The report presentation outlines the heavy investment that have been done in R&D for growth drivers like the new Surgery module and Webdoc X (Germany), with management expecting to “reap the benefits soon”. In practice, the Surgery module is now in commercialization, while commercial sales in Germany is expected to start by year-end

Smart capital allocation: The company repurchased 2.4 million shares for SEK 69 million during the quarter. With the stock up significantly today, this has already proven to be a smart and value-accretive use of capital, signaling management’s confidence in the underlying business.

Strengthened outlook

The Carasent thesis rests on its ability to compound value through steady organic growth and operational discipline. This report shows the profitability engine is running exceptionally well, while the organic growth engine remains strong at its core (ARR).

The thesis is not just holding, it’s been strengthened and de-risked. Carasent has proven its ability to generate significant cash flow to fund its own growth ambitions.

My conviction is high, with attention now focused on the commercialization of the new modules and the expansion into Germany.

The stock jumped 9% on the news but is still trading below its peak from earlier this year. I expect a further upward adjustment from the market, as this report was simply too strong to ignore.

CEO Daniel Öhman divesting 51k shares (still holding 146k) in Carasent today was a bit of a downer, after the strong report last week. Will be interesting to see if there is any further update on underlying reason for the divestment. Stock now trading at same level as before the Q3 report was issued.