Three Swedish compounders: What is the verdict?

Summarizing the key takeaways from my first three deep dives on Carasent, Evolution, and Vitec - and a look at what comes next.

About a month ago, I began the journey at Fjord Alpha with deep dives into three fascinating Swedish software companies that I have had on my watch list for quite some time: Carasent AB, Evolution AB, and Vitec Software AB. The goal was to put my thoughts on paper and my investment philosophy into the public by analyzing different similar yet different businesses, that all share the potential for long-term compounding.

Each memo was a standalone analysis, now it is the time to connect the dots. What was learned? How do these companies compare? And which, if any, represent compelling opportunities today? This post will summarize the key outcomes of my first three analyses and a comparison for how I view these businesses side-by-side.

The Common Thread: A Focus on Quality

At first glance, these three companies seem different. Carasent is a turnaround story in a niche health-tech vertical. Vitec is a decentralized, 40-year-old M&A machine. Evolution is a dominant, global B2B giant in the iGaming space.

Yet, they were all chosen for a reason. They each possess the foundational qualities that I believe are prerequisites for long-term value creation:

Durable Moats: All three have powerful competitive advantages, primarily rooted in extremely high customer switching costs.

Recurring Revenue: Their business models are built on sticky, predictable, and high-margin recurring revenue streams.

Disciplined Capital Allocation: Each has a clear framework for how they reinvest capital to create shareholder value.

No doubt they all represent great businesses. However, the core of the Fjord Alpha process is to identify these high-quality businesses and then, most importantly, to determine if the market is offering them at a price that provides a path to 20%+ annualized returns.

A Tale of Three Theses: A Comparative Look

While the businesses share a foundation of quality, the investment thesis for each is unique.

Carasent: The “Turnaround & Growth” thesis The story here is one of transformation. Carasent is a high-quality business that is evolving from a messy, acquisition-driven roll-up into a focused, disciplined vertical SaaS platform. The investment case is a bet on a proven new CEO to execute this pivot, driving significant margin expansion and outperforming the company's own conservative guidance. The primary catalyst is the strategic, low-risk entry into the massive German market, which provides a material, asymmetric upside growth opportunity.

Vitec Software: The "Fallen Angel" thesis Vitec is a classic, quiet compounder with a 40-year track record of excellence. The opportunity here is born from market pessimism. The stock has been punished due to a cyclical slowdown in a small, non-core part of its business. The investment thesis is that the market is making a classic "category error," confusing a temporary issue with a structural decline. The core subscription business remains robust, and with a newly reloaded balance sheet, the company is poised to reignite its proven M&A engine.

Evolution AB: The "Misunderstood Dominator" thesis Evolution is a world-class, near-monopolistic global leader. The investment thesis is that the market has become overly fixated on a temporary and strategic slowdown in growth. It has de-rated this exceptional business, pricing it as a mature, slow-growing entity rather than the durable compounding machine it is. The opportunity lies in the market's failure to appreciate the long-term growth runways in the Americas and Asia, and the power of its widening competitive moat.

Key Outcomes & Verdicts

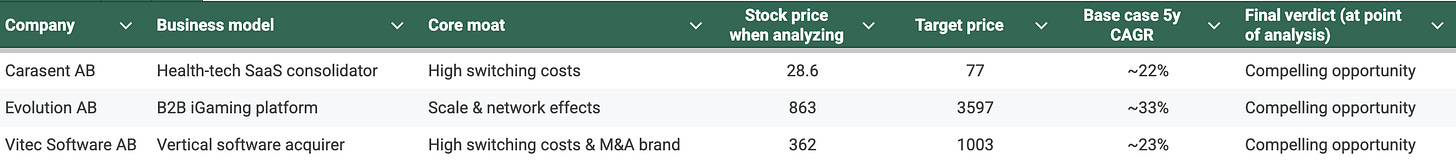

After thousands of words of analysis, it all comes down to the numbers. The table below summarizes the key metrics and, most importantly, the final verdict for each company based on the detailed valuation work.

Compelling Opportunity

The conclusion is clear, I believe all three companies represent compelling investment opportunities at their current valuations, as each offers a base case path to returns that comfortably clear our 20%+ hurdle.

While all three are attractive, Evolution AB stands out as having the most powerful combination of a world-class moat and a significant valuation disconnect, leading to the highest expected CAGR of the group.

Vitec Software and Carasent AB represent more classic "special situation" opportunities, where the market appears to be mispricing a temporary issue or a strategic transformation.

What Comes Next: From Swedish Software to Danish Medtech

It is time to broaden our horizons. The Fjord Alpha mission is to hunt for compounders across Northern Europe, and our next area of focus will be another pocket of regional excellence: Danish Medtech.

This is a sector where Denmark has long been a global leader, producing innovative and high-quality companies. Over the coming weeks (Fridays), I publish deep-dive research into three fascinating and very different Danish medtech businesses:

Ambu A/S: A global leader in single-use medical devices and a high-profile turnaround story.

GN Store Nord: A complex "sum-of-the-parts" value case with strong brands in hearing aids and enterprise audio.

ChemoMetec A/S: A "hidden champion" compounder with a dominant niche in automated cell counters.

I look forward to sharing my findings with you.

Thank you for joining me on this journey. The hunt for 20%+ compounders continues.

Have you ever looked at River Tech? (RIVER.OL)

Curious to know your opinion, if any.