Pandora A/S: After the Phoenix, is it a BUY? (Part 2 of 2)

How product mix shift, forward integration, and brand elevation shape Pandora’s 2025–2030 stock returns

In Pandora A/S: A Nordic phoenix (Part 1 of 2), we traced the four-act saga that took Pandora from hyper‑growth to near‑collapse and back to health.

This second piece assumes that history as context. Here we focus on what matters now, i.e., the quality of the franchise and its moat, the revenue model, and of course most importantly; does it meet Fjord’s 20%+ CAGR hurdle rate?

Key stock data

💰 Stock Price: DKK 798 (as of 13th of October, 2025)

📄 Shares Outstanding: 79 million (share buy-backs in process)

🏢 Market Cap: DKK 63.0B

🏦 Net Debt: DKK 15.3B

🌐 Enterprise Value: DKK 78.3B

⚙️ Sector/Industry: Consumer Durables / Apparel, Accessories & Luxury Goods

The business: History & operations

Origin story

Pandora started in a small Copenhagen jewelry shop in 1982, run by Per and Winnie Enevoldsen. They imported pieces from Thailand at first, a link that later became core to the company’s production. As demand grew, Pandora moved from retail to wholesale and, by 1987, hired its first in-house designer.

The real turning point came in 2000 with the launch of the charm bracelet. Simple idea but with big impact, in essence, customers could build and personalize their own stories. It caught on immediately.

That single product powered a decade of rapid expansion. Pandora entered the U.S. in 2003, then Germany and Australia in 2004, scaling from its Nordic roots into a global brand with a serious marketing and distribution engine. Today, it ranks among the world’s most recognized names in affordable jewelry.

The last decade+ has been a roller-coaster for them and an epic corporate drama, again would refer to the Part 1 for that full story.

What they actually do

In short, Pandora designs, manufactures, and sells hand-finished jewelry made from quality materials at accessible prices. Its vertically integrated model means it controls nearly everything, from design and production in its Thai (and soon Vietnamese) facilities to global marketing and distribution through more than 6800 points of sale (concept stores and shop-in-shop) worldwide.

The best way to understand its core business is to make another link to a global Danish brand. Picture the Moments charm bracelet as “Lego for your wrist”. The bracelet is the base and each charm is a block that marks a memory or milestone. Customers don’t just buy jewelry, they start a collection. That built-in collectability drives loyalty and repeat purchases, creating a steady stream of recurring revenue few similar brands can match.

While the charm bracelet remains central, Pandora’s ambition is bigger. They want to use its strong brand and integrated platform to become a full jewelry house, expanding in rings, earrings, and necklaces to capture a larger share of its customers’ jewelry spend.

Recent developments & performance

Business update

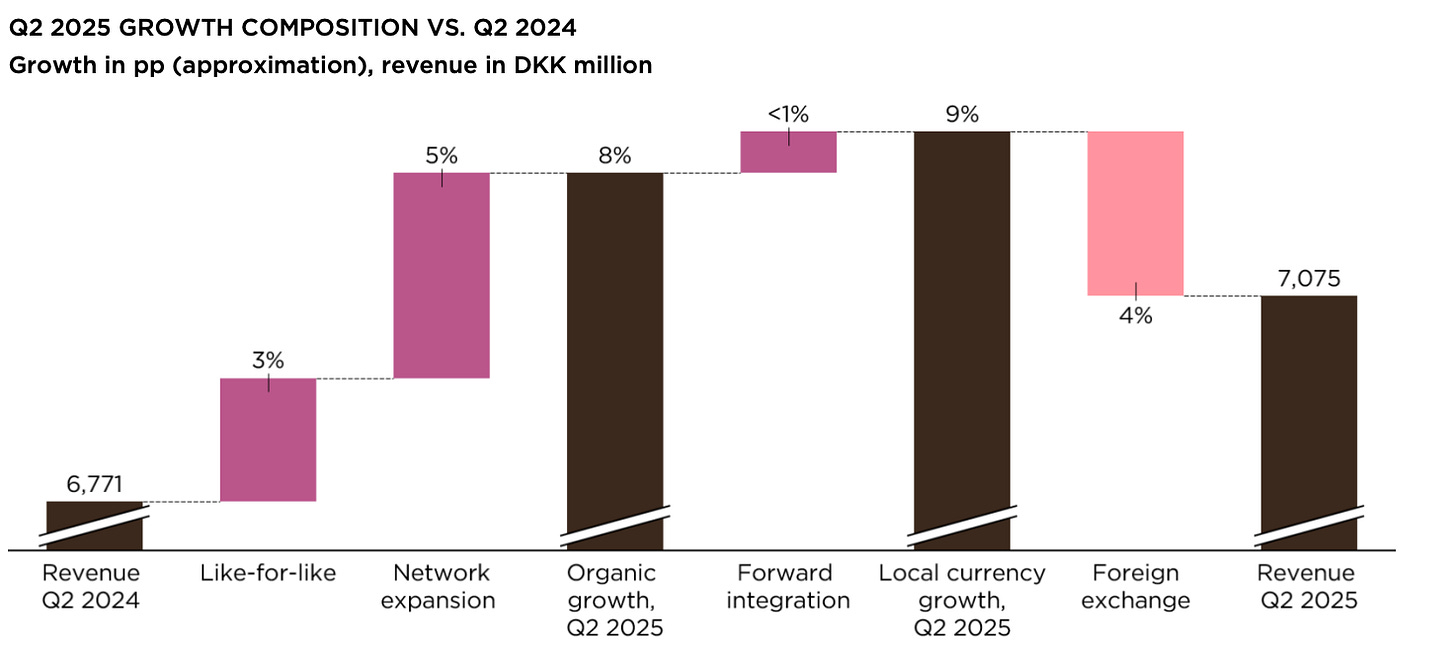

Q2 2025 perfectly encapsulates the bull and bear debate. On one hand, the company delivered a solid 8% organic growth, a respectable figure in what management calls an “increasingly turbulent macroeconomic backdrop”. This was composed of 3% like-for-like (LFL) growth and a healthy 5% contribution from network expansion.

However, digging into the details reveals the source of the market’s anxiety. The growth is not uniform. The US market remains a bright spot, posting a strong 8% LFL growth vs. Q2 2024. But Europe was soft, dragged down by LFL declines in major markets like the UK (-9%), Italy (-8%), and Germany (-6%).

The real headline-grabber was the pressure on profitability. The EBIT margin for the quarter fell to 18.2%, down from 19.8% in the same quarter last year. Management was very clear on the earnings call about the cause being a 230 basis point headwind from a cocktail of negative foreign exchange movements, higher commodity prices (primarily silver), and new tariffs on goods imported into the US. Despite this, CEO Alexander Lacik struck a confident tone, stating:

“we are confident that we will deliver on our targets for the year driven by an exciting product pipeline, new marketing campaigns and operational agility.”

In March 2026, Alexander Lacik will retire. He will be succeeded by the current Chief Marketing Officer, Berta de Pablos-Barbier. I believe this is the right move - more on this further down.

Stock price context

Pandora’s stock had a tremendous run through 2023 and 2024, hitting an all-time high in early 2025. The market loved the story. The “Phoenix” strategy was firing on all cylinders, the brand was gaining momentum, and management consistently beat expectations and raised guidance.

The mood shifted this year. The stock has fallen 40+% from its peak in Q1. The catalyst for the most recent leg down was the Q2 2025 earnings report in mid-August. The combination of slowing LFL growth and the explicit margin headwinds spooked investors, sending the shares down 12% on the day of the announcement. The narrative has flipped (again) from a clean growth story to one of slowing momentum and external pressures.

The business model & unit economics

Revenue model

Pandora’s revenue model is straightforward. It makes money from the one-time sale of physical jewellery. There are no subscriptions or recurring fees. The sales are generated through a global, multi-channel distribution network. This network consists of:

Company-owned and operated concept stores: These are the primary direct-to-consumer (DTC) channel.

Franchised concept stores: Run by partners but dedicated exclusively to the Pandora brand.

Shop-in-shops: Branded sections within larger department stores.

E-commerce: The company’s own websites, a rapidly growing channel.

Multi-brand stores: Third-party jewellers who carry Pandora products alongside other brands.

What the market might be missing is the profound impact of a subtle but powerful shift within this model. Pandora is moving towards owned retail. For years, Pandora’s rapid expansion was fueled by a capital-light franchise model. Now, the company is actively opening more of its own stores and, acquiring existing franchisee stores in a process it calls “forward integration”.

This is a structural upgrade to the quality of Pandora’s revenue. When Pandora sells a charm to a franchisee (wholesale), it captures a certain margin. But when it sells that same charm directly to a customer in its own store (retail), it captures the entire retail margin, which is significantly higher. Every franchise store that is acquired is immediately accretive to Pandora’s gross profit and overall margin percentage, while adding SG&A and working capital. Furthermore, this shift gives Pandora complete control over the customer experience and provides direct access to invaluable point-of-sale data, allowing for smarter inventory management and product development.

This ongoing transition provides a hidden, structural tailwind to profitability that is easily overlooked if you only focus on the headline growth numbers.

The moat - Brand and cost advantage

Many critics argue that Pandora’s moat is fragile, that it is overly reliant on charms which could fall out of fashion. I believe this view is mistaken. It confuses a product-level risk with a business-model-level strength.

In my view, Pandora’s moat is both wide and deep, built on two powerful, reinforcing pillars, 1) the iconic brand and 2) formidable cost advantages.

Brand strength & Customer loyalty

Pandora is a cultural phenomenon. It is the world’s largest jewellery brand by volume and possesses unmatched global brand awareness. In 2024, it was recognized by Interbrand as the 91st most valuable global brand for the first time, a testament to the success of its strategic investments.

The true value of the brand, however, lies in the ecosystem created by its core charm bracelet. Once a customer begins their collection, they are powerfully incentivized to continue buying Pandora charms. Competing charms don’t fit the same aesthetic or carry the same brand cachet. This creates switching costs and a deeply loyal customer base that comes back again and again to mark new life moments. This collectability transforms a one-time purchase into a long-term relationship, giving the company a predictable and recurring stream of demand that is exceptionally rare in the fashion and accessories space.

Cost advantages with in-house production

In 2024, Pandora sold 113 million individual pieces of jewellery. This colossal volume, manufactured in-house at its highly efficient facilities in Thailand, grants the company enormous economies of scale. It can source raw materials like silver and gold on terms that smaller rivals simply cannot access. This scale advantage is a key reason why Pandora can produce high-quality, hand-finished jewellery at an “affordable luxury” price point while still maintaining gross margins of nearly 80%, a figure that rivals true high-luxury houses like Hermès.

This is amplified by its vertically integrated business model. By controlling everything from design to manufacturing to distribution, Pandora captures value at every step of the process and maintains control over quality and costs. This operational machine is the engine that powers the company’s financial performance.

Moats in combination

The true, durable moat is the combination of the globally recognized brand, the sticky product ecosystem, and the hyper-efficient, vertically integrated operational backbone. This powerful machine can be pivoted to design, produce, and market any new jewellery category to a global audience with industry-leading profitability. The company’s current “Phoenix” strategy is exactly this, i.e. a deliberate leveraging of its structural moat to diversify away from a single product line and build an even more resilient enterprise.

The investment thesis: The 5 year outlook

This is the heart of my argument. Looking past the near-term noise, I see a clear path for Pandora to become a larger, more profitable, and more resilient company by 2030. My view is based on four key drivers.

Driver 1: The successful transition to a “Full Jewellery Brand”

The core of the Phoenix strategy is to evolve Pandora’s perception from “the charm bracelet company” to a “full jewellery brand.” The evidence shows this is working. The segment Pandora calls “Fuel with More”, which includes rings, necklaces, earrings, and lab-grown diamonds grew by a staggering 22% in 2024, while the “Core” Moments business grew by just 2%. This is not by chance, rather a deliberate strategic shift.

I believe this trend will not only continue but accelerate. By 2029, I expect the “Fuel with More” segment to represent between 40-45% of total revenue, up from just 26% in 2024. This will create a far more balanced and diversified revenue base, fundamentally de-risking the business from the whims of the charm market.

Driver 2: Brand elevation under new leadership

The recently announced leadership transition could, in my opinion, be a powerful catalyst. In March 2026, CEO Alexander Lacik, the architect of the successful turnaround, will retire. He will be succeeded by the current Chief Marketing Officer, Berta de Pablos-Barbier.

A look at her background provides comfort. De Pablos-Barbier comes with a pedigree steeped in high luxury. She was previously the President & CEO of LVMH’s champagne brands (Moët & Chandon, Dom Perignon), the CMO of Lacoste, and a VP at Kering-owned jeweller Boucheron.

This is not a coincidence. The board has chosen a leader with deep expertise in building aspirational, high-desirability brands. I expect her to double down on the “brand desirability” pillar of the Phoenix strategy, leading to more sophisticated marketing, premium collaborations, and an overall elevation of the brand’s positioning. This will be crucial for supporting pricing power and defending those stellar gross margins.

Driver 3: Continued, low-risk network expansion

While brand transformation is the exciting part of the story, Pandora also has a simple, tangible lever for growth: opening more stores. Management has identified approximately 7000 “white space” locations globally where a Pandora store could viably operate. The company’s financial targets assume a steady 3% annual revenue growth contribution from network expansion alone.

I believe this is a conservative and highly achievable target. The company will likely continue to open 150-200 net new stores per year while also pursuing its profitable “forward integration” strategy of acquiring franchisee locations. This provides a predictable layer of growth that is independent of the more volatile like-for-like sales figures. The continued rollout of the new “Evoke 2.0” store concept will further enhance the in-store experience, supporting the full-brand narrative and driving productivity.

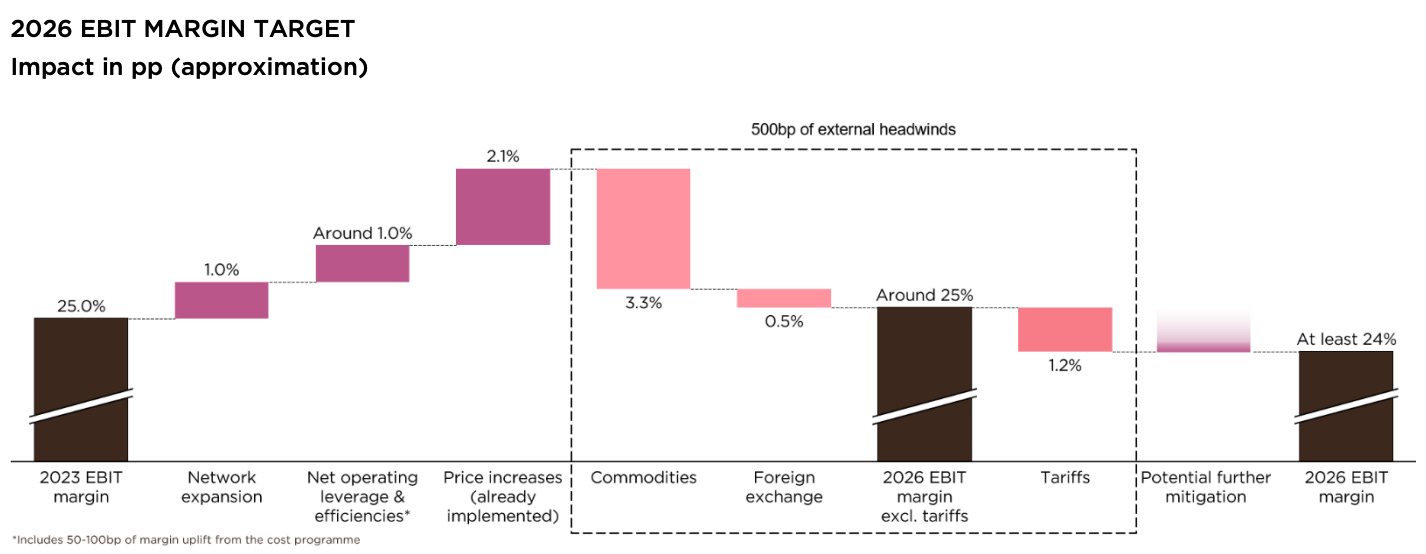

Driver 4: Margin expansion beyond consensus

This is the key assumption you have to believe. The market is currently fixated on the headwinds that are expected to compress the EBIT margin to “around 24%” in 2025.

I believe that as the drivers above play out, Pandora’s profitability will expand significantly. The shift in product mix towards higher-priced “Fuel with More” items will lift average selling prices. The brand elevation under a new CEO will support pricing power, allowing the company to pass on input cost inflation. And as revenues grow, the company will gain operating leverage on its semi-fixed cost base (marketing, G&A).

These structural tailwinds can likely offset the current cyclical headwinds, allowing the EBIT margin to expand back towards and potentially exceed the company’s 2026 earlier communicated target of 26-27%. As of today, given market heads-winds, Pandora states that they should reach “at least 24%” in 2026.

Management & Capital allocation

Leadership

A company’s strategy is only as good as the people executing it. At Pandora, we are witnessing a pivotal and well-planned transition.

Alexander Lacik (Outgoing President & CEO): It is impossible to overstate the quality of the job Lacik has done. He joined in 2019 when the company was in a period of decline. He quickly stabilized the business with his “Programme NOW” turnaround plan and then launched the “Phoenix” strategy that has put the company on its current growth trajectory. Under his leadership, revenue has grown by 45%. He is leaving the company in a position of immense strength, a far cry from the one he inherited.

Berta de Pablos-Barbier (Incoming President & CEO): As I mentioned, I view this appointment as a positive catalyst. She joined Pandora as CMO in November 2024, and the board has been transparent that she was brought on as a potential CEO successor. This signals a thoughtful, long-term succession plan. Her resume speaks for itself. She has been leading iconic champagne brands at LVMH, driving growth at Mars Wrigley, and repositioning the Lacoste brand. Her deep experience in the world of aspirational and luxury brands is precisely what Pandora needs for the next phase of its journey, elevating brand desirability.

Anders Boyer (CFO): Boyer has been a steady and credible CFO, effectively managing the company’s finances and communicating its capital allocation strategy to the market. While it’s worth noting he sold a block of shares in February 2025, this appears to be part of a planned disposition.

Capital allocation - aggressive returns

Pandora’s approach to capital allocation is simple, disciplined, and very shareholder-friendly. The company’s stated policy is to maintain a conservative leverage ratio of 0.5x-1.5x Net Interest-Bearing Debt to EBITDA and return all excess cash to shareholders.

And they execute this policy with vigor. In 2024, the company returned DKK 5.5 billion to shareholders through a combination of dividends and share buybacks. For 2025, a DKK 4.0 billion share buyback program is already underway, and the proposed dividend will bring the total planned cash distribution to DKK 5.6 billion. This represents nearly 9% of the current market cap.

This is not a one-off. It is a core part of the value creation story. The aggressive buybacks are consistently reducing the share count, which fell by 5.38% in the last year alone. This provides a powerful mechanical boost to Earnings Per Share (EPS) growth, acting as a significant tailwind on top of any operational growth the business generates. This disciplined return of capital is a hallmark of a mature, confident management team that runs the business for its owners.

Valuation: A triangulated approach

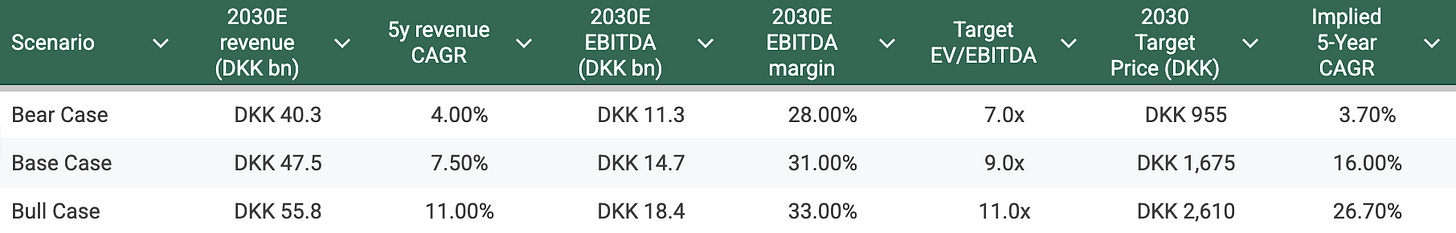

My valuation is grounded in a financial model that projects Pandora’s performance under three distinct scenarios: a Base case, a Bull case, and a Bear case. The final valuation is triangulated using forward-looking Enterprise Value to EBITDA (EV/EBITDA) and Price-to-Earnings (P/E) multiples.

Relative valuation using peers

Given Pandora’s unique position in the “affordable luxury” segment, I have constructed a peer group across three distinct categories to provide a full market perspective. This includes direct jewelry retailers, broader affordable luxury brands, and high-end luxury conglomerates.

Direct jewelry retailers: This group represents the most direct competition. Signet Jewelers (SIG) is the world’s largest retailer of diamond jewelry, operating a multi-brand portfolio including Kay and Zales, making it a good scale comparable. Brilliant Earth Group (BRLT) is a small(!), “digitally native” competitor with a strong focus on ethically sourced materials, providing a benchmark for modern consumer preferences and online business models.

Affordable Luxury & Accessory Brands: These companies compete for the same consumer discretionary spending, offering a valuable perspective on valuations within the accessible luxury space. This includes Tapestry, Inc. (TPR), the parent of Coach and Kate Spade, and Capri Holdings (CPRI), which owns Michael Kors and Jimmy Choo; both are multi-brand houses focused on handbags and accessories. Movado Group (MOV) and Fossil Group (FOSL) are primarily watchmakers that also compete in the affordable jewelry and accessories market, offering a view on more challenged, lower-growth business models in the same sector.

Global luxury conglomerates: While operating at a higher price point, these firms are great examples of brand stewardship and command premium valuations. They serve as an aspirational benchmark. This group includes LVMH Moët Hennessy Louis Vuitton (LVMH), Kering (KER), and Compagnie Financière Richemont (CFR), all of which own well-known jewelry and watch brands like Tiffany & Co., Bulgari, and Cartier.

The peer analysis reveals a valuation disconnect. Pandora exhibits a profitability profile that is superior to its affordable luxury and direct jewelry retail peers and is directly comparable to the premier luxury houses like Kering and LVMH. Its forward growth rate of 6.5% is also robust and in line with the luxury sector leaders.

Despite these premium operating metrics, Pandora trades at an NTM EV/EBITDA multiple of 6.2x, a discount to the luxury players (10x-18x) and even to some of the lower-quality affordable luxury brands like Tapestry (15.7x). It trades lower/in line with Signet Jewelers (7.6x), a company with substantially lower margins and growth. This suggests the market is not believing and pricing in Pandora’s “Phoenix” strategy and its transformation into a higher-quality, full-line jewelry brand.

Triangulated valuation and scenarios

To determine a fair value for Pandora in mid-2030, I have developed three scenarios based on the potential outcomes of its “Phoenix” strategy. The valuation is triangulated using an EV/EBITDA multiple, suitable for comparing companies across capital structures.

My projections account for the completion of the DKK 4.0 billion share repurchase program by early 2026, which I estimate will reduce to approximately 74 million, providing a significant boost to per-share value.

Base Case: This scenario assumes Pandora successfully executes its strategy, achieving growth and profitability in line with its long-term targets. I project a revenue CAGR of 7.5% through 2030, driven by continued market share gains and network expansion. The EBITDA margin expands to and stabilizes at 31.0%, reflecting sustained operational excellence.

Bull Case: This scenario envisions an accelerated market share capture in the key US and China markets, surpassing management’s goals. I project a revenue CAGR of 11.0%, with strong operating leverage driving the EBITDA margin to 33.0% by 2030.

Bear Case: This scenario assumes a challenging macroeconomic environment that dampens consumer demand for affordable luxury. Competitive pressures intensify, and growth in China stalls. I project a revenue CAGR of 4.0%, with EBITDA margin compression to 28.0% due to increased promotions and negative operating leverage.

My primary valuation is based on a forward EV/EBITDA multiple, as it provides the clearest comparison for companies with varying capital structures and tax rates. The table below outlines this analysis, which forms the basis of my final conclusion.

Valuation outcome - Below the 20+% hurdle rate

My analysis indicates a wide range of potential outcomes for Pandora, but the risk-reward profile is skewed to the upside.

The Bear Case scenario implies a 5-year CAGR of only 3.7%, suggesting that if the company’s growth strategy falters or a significant consumer recession materializes, the stock offers minimal upside from its current price. However, the Base and Bull cases present a more compelling picture.

Based on my analysis, my Base Case fair value estimate for Pandora in mid-2030 is DKK 1675 per share. This implies a 5-Year CAGR of 16% from the current share price of DKK 798. This return profile is solid, but of course falls short of the Fjord Alpha target of 20%+ annual returns.

The pre-mortem: A case for failure

To maintain intellectual honesty, we must rigorously challenge our own thesis. Let’s assume it’s 2030, and our investment has been a total failure. Our thesis was wrong, and we’ve lost significant capital. Working backward from this failed future, what went wrong?

The most plausible reason for failure is that the brand simply failed to evolve. Our thesis rested on the successful transition to a “full jewellery brand.” In this failed future, the “Fuel with More” strategy sputtered. The new collections didn’t resonate, and Pandora remained locked as the “charm bracelet company” for a specific demographic. The brand became dated, a fad that had passed. Younger consumers, particularly Gen-Z, moved on to the next trend, and Pandora was unable to capture their loyalty, just as critics had warned years earlier.

A second, related failure point would be a botched CEO transition. The magic of the Lacik turnaround proved to be person-specific. The new CEO, despite her impressive resume, failed to grasp the nuances of Pandora’s “affordable luxury” positioning. An attempt to push the brand too far upmarket alienated the core customer base without successfully capturing a new, wealthier demographic. This created a brand identity crisis, leaving the company stuck in the middle, too expensive for its old customers, and not prestigious enough for new ones.

Third, our thesis assumed a relatively stable macroeconomic environment. In this failed timeline, a deep and prolonged global consumer recession took hold. Discretionary spending was crushed for years, not quarters. Jewellery, even at Pandora’s accessible price point, was one of the first categories consumers cut from their budgets. Like-for-like sales turned negative and stayed there, and the operating leverage we expected worked in reverse, crushing margins and cash flow.

Finally, we could have been blindsided by competitive disruption. A new, nimble competitor might have emerged, perhaps born on TikTok, with a more compelling and culturally relevant take on customizable jewellery. At the same time, the major luxury houses could have successfully launched more accessible entry-level product lines, squeezing Pandora from both above and below. In this scenario, Pandora’s moat proved to be less durable than we believed, and it slowly lost its relevance and market share.

Conclusion: A high-quality business, for the watchlist

Pandora is a high-quality and wide-moat enterprise. The brand power is undeniable, its vertically integrated manufacturing provides a clear cost advantage, and its “Phoenix” strategy seems to be successfully building a more resilient and diversified business for the future. The management team is executing well, and the planned CEO transition appears to be a strategic move to further elevate the brand.

However, a great business is not always a great investment. Based on my Base Case valuation, which projects a 2030 share price of DKK 1675, the implied 5-year CAGR from the current price of DKK 798 is 16%. While this is a respectable, market-beating return, it falls short of our required threshold. Therefore, I cannot issue a BUY recommendation at the current valuation. The investment thesis is sound, but the price does not offer a sufficient margin of safety to achieve our target return.

Path to a BUY Rating

My stance would change under two conditions, either the price comes down to meet our return target, or new evidence emerges that compels us to raise our fair value estimate.

Price target for entry: To achieve our 20% target CAGR based on the DKK 1675 mid-2030 valuation, an entry point of approximately DKK 675 per share or below would be required. This represents a further ~15% downside from the current price. With stock currently in a bad trend, it is not unlikely that this may materialize, e.g. via;

Further margin pressure: If near-term headwinds from FX or input costs are worse than expected in Q3/Q4 2025, it could push the stock down toward the target entry point.

General market sell-off: A broader market downturn would of course drag Pandora down, offering an attractive entry point irrespective of company-specific news.

Key signposts for investors: I will be monitoring the following catalysts closely, which could trigger a re-evaluation:

Accelerated “Fuel with More” growth: Evidence that the non-charm segments are growing even faster than projected would increase confidence in long-term growth and diversification.

Successful CEO transition: A smooth handover to Berta de Pablos-Barbier in March, 2026, followed by brand initiatives that clearly drive pricing power and desirability, could warrant a higher valuation multiple.

✅ Thesis Pillar 1: The “Phoenix” strategy is successfully transforming Pandora into a more resilient, diversified “full jewellery brand.”

✅ Thesis Pillar 2: The company’s vertically integrated model supports best-in-class margins and durable profitability.

✅ Thesis Pillar 3: An aggressive capital allocation policy provides a powerful, direct return to shareholders.

⚠️ Key Risk: Execution risk in the CEO transition and a failure to innovate beyond the core charm business could lead to brand fatigue.

🎯 Target Price (Base Case): DKK 1675 (approx. EUR 224) by mid-2030.

📈 Implied 5-Year CAGR (Base Case): 16% (Below 20% Hurdle)

💡 Target Buy Price: DKK 675 or below.

Primary Sources Used:

Pandora A/S Annual Reports

Pandora A/S Interim Reports

Pandora A/S Capital Markets Day Presentation, October 2023

Pandora A/S Earnings Call Transcripts (Q3 2024 - Q2 2025)

Company Announcements & Press Releases