Fjord Alpha's outlook into 2026

My observations on the 2026 investment landscape and a status report on our core Nordic theses.

First of all, happy new year! I hope you all had a well-deserved break.

I also want to extend a warm welcome to new subscribers. Fjord Alpha added around 40 readers over the holiday period, which is encouraging given the quiet markets - and remarkable considering this newsletter was only started just after the summer.

This remains a small, focused community that is identifying businesses that can compound at 20+% over the coming five years. You can expect deep-dives on companies I follow closely, portfolio updates, and commentary focused primarily on Nordic equities and corporate markets.

Equity markets ended 2025 on solid footing and 2026 has started well. While the growth of this community has been a highlight of 2025, the real work happens now. Rather than offering a broad macro outlook (others do that better!) I want to share my thinking for the year ahead. Think of this as a practical framework for where I am hunting for value in the Nordic small- and mid-cap space today.

My macro expectations into 2026

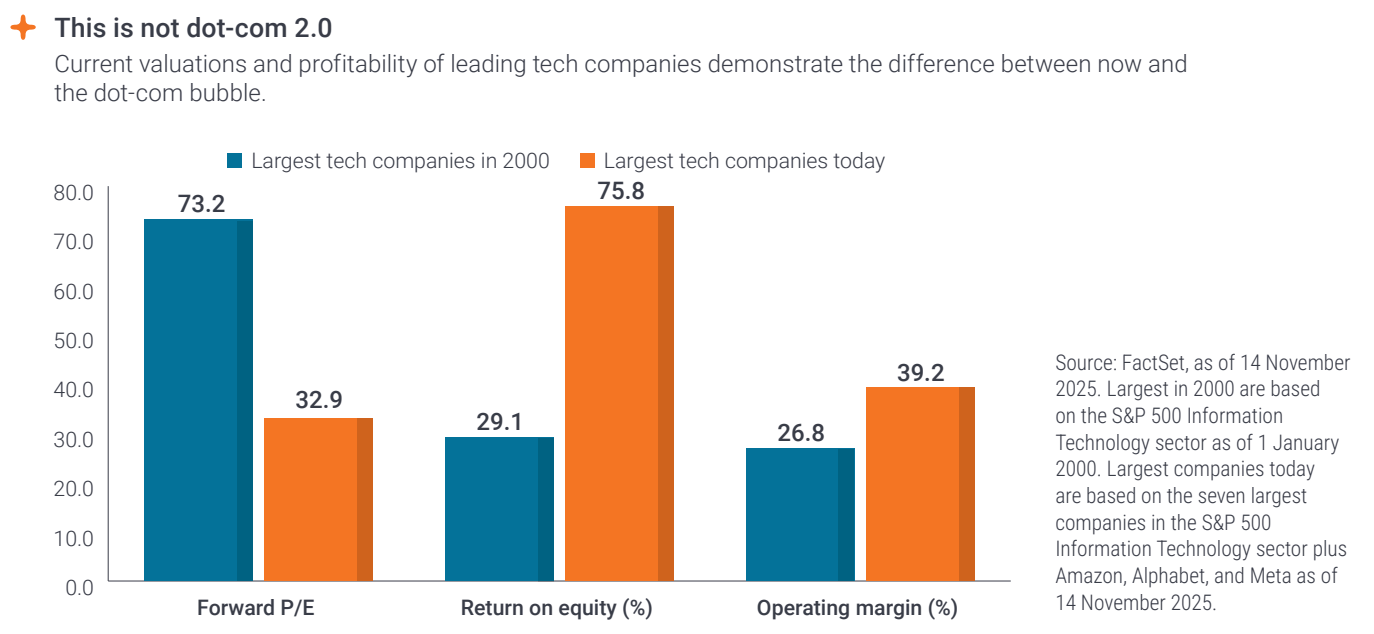

AI moves from hype to results. AI is now translating from experimentation into measurable operating leverage. I would look away from the builders of large language models and hyper-scale infrastructure, and toward the companies applying these tools to expand margins and scale more efficiently.

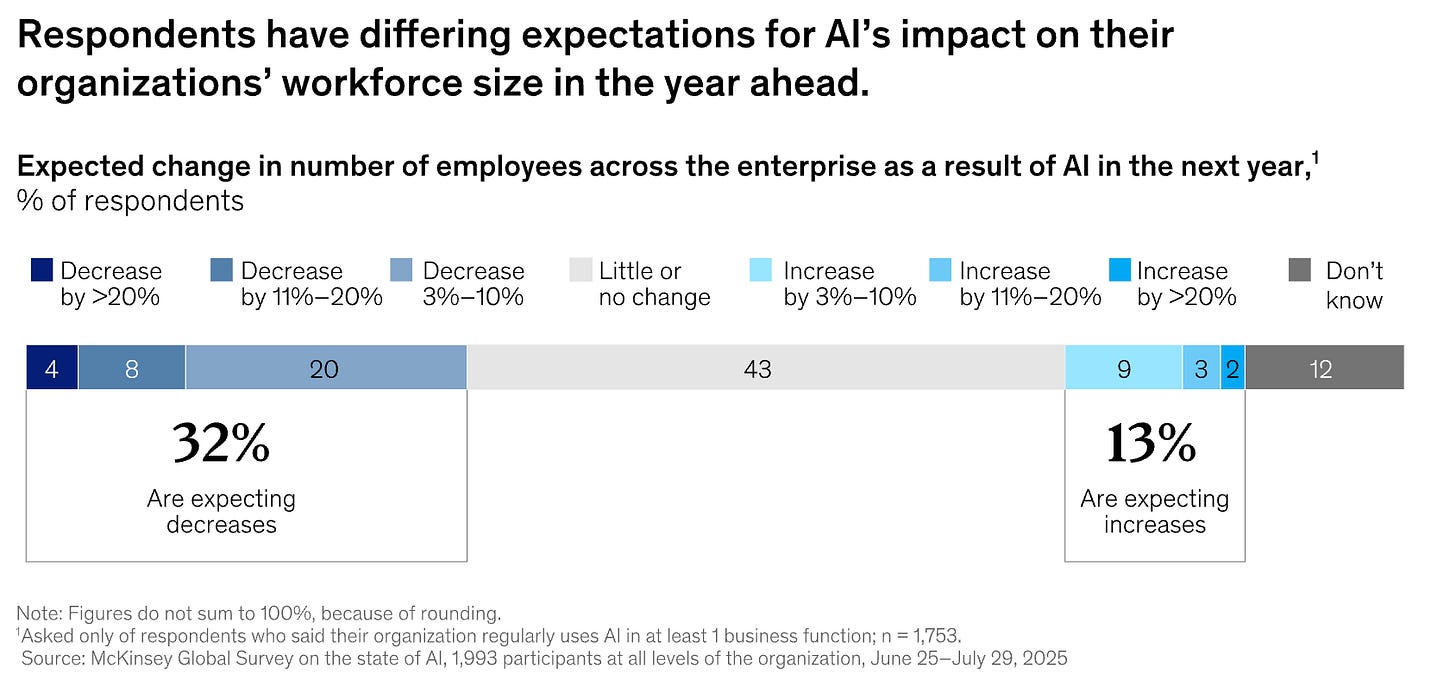

To me, general-purpose AI represents the most significant productivity shock of our generation. Adoption is accelerating rapidly, and its impact will extend well beyond Big Tech. A meaningful share of large organizations expect double-digit workforce reductions within the next year driven by AI adoption alone. This is an extraordinary productivity gain, and over time a profound societal change, but from an investment perspective it reinforces the case for owning companies that capture these benefits.

Small caps still mispriced. Nordic small- and micro-cap equities remain structurally mis-priced relative to large caps, even as macro fundamentals stabilize. This valuation gap has persisted for several years, but history suggests that such differences eventually close (often quickly) once sentiment and capital flows turn.

What makes the current setup attractive is the combination of normalized expectations, easing financing conditions, and gradually improving confidence. Many high-quality small caps are entering 2026 with cleaner balance sheets, better cost control, and clearer growth journeys ahead. When capital begins to flow back into the segment, the re-rating can be swift.

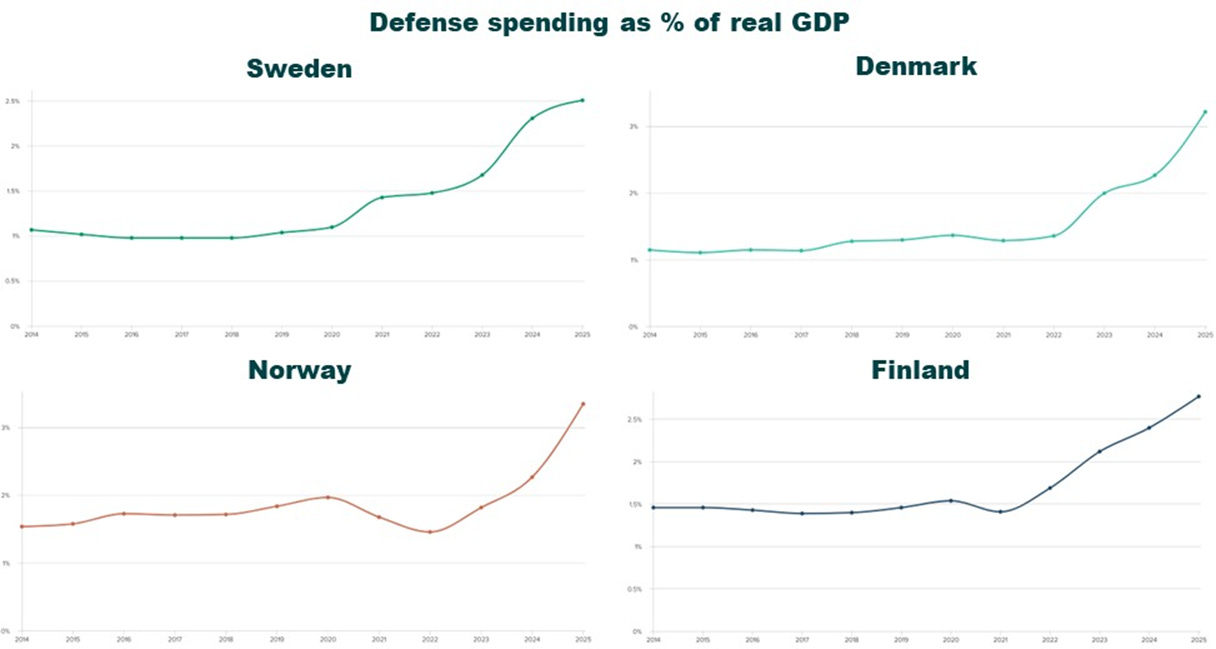

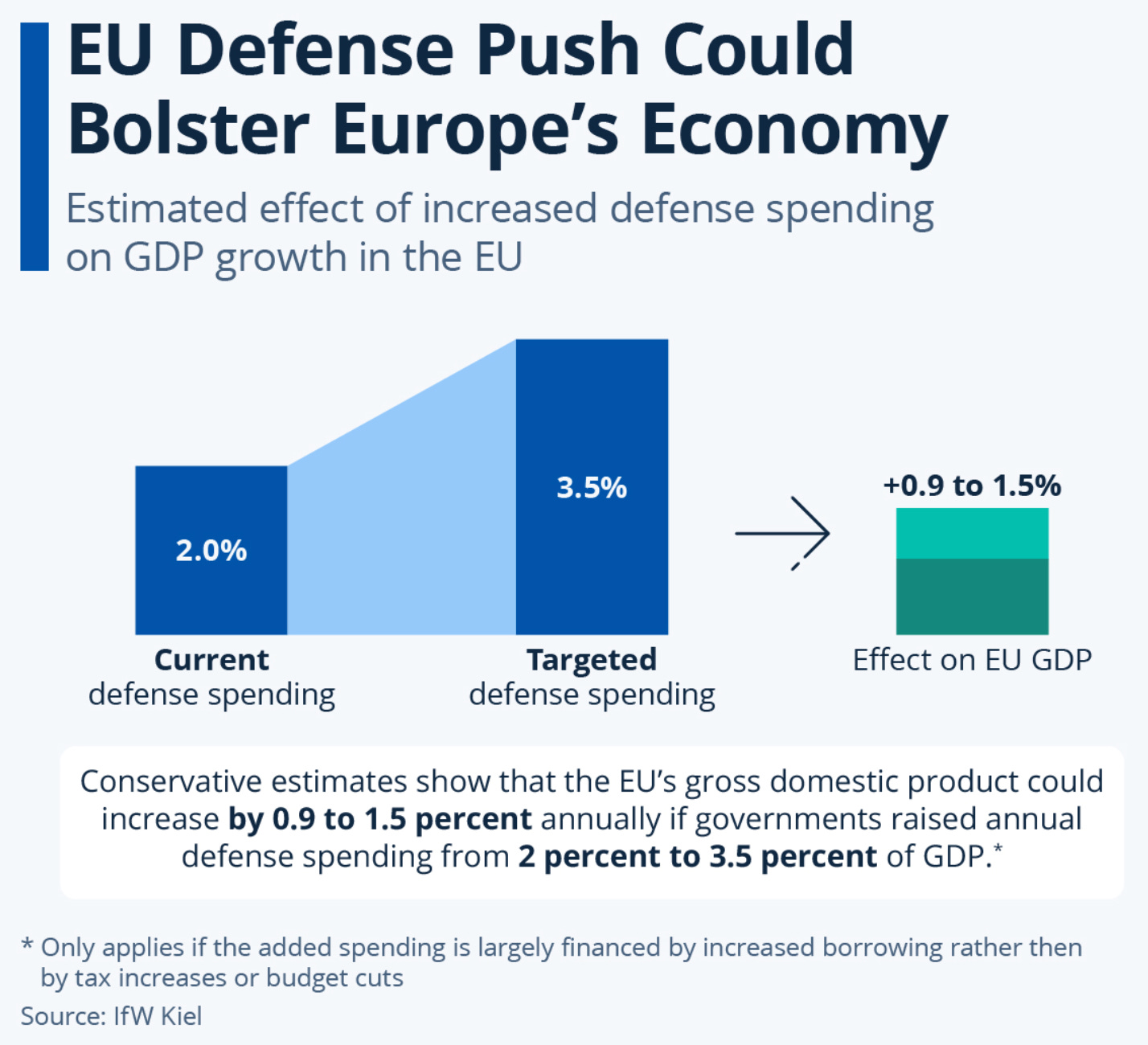

Europe’s defense build-up. Europe’s defense build-up is no longer a short-term response, it is a structural shift that will reshape labor markets, redirect capital, and favor specialized industrial and technology suppliers.

The impact extends beyond prime contractors. Secure communication, logistics, infrastructure, and niche industrial capabilities all benefit from this shift. Companies providing sovereign, on-premise, and security-focused solutions are increasingly strategic assets in a more fragmented geopolitical environment.

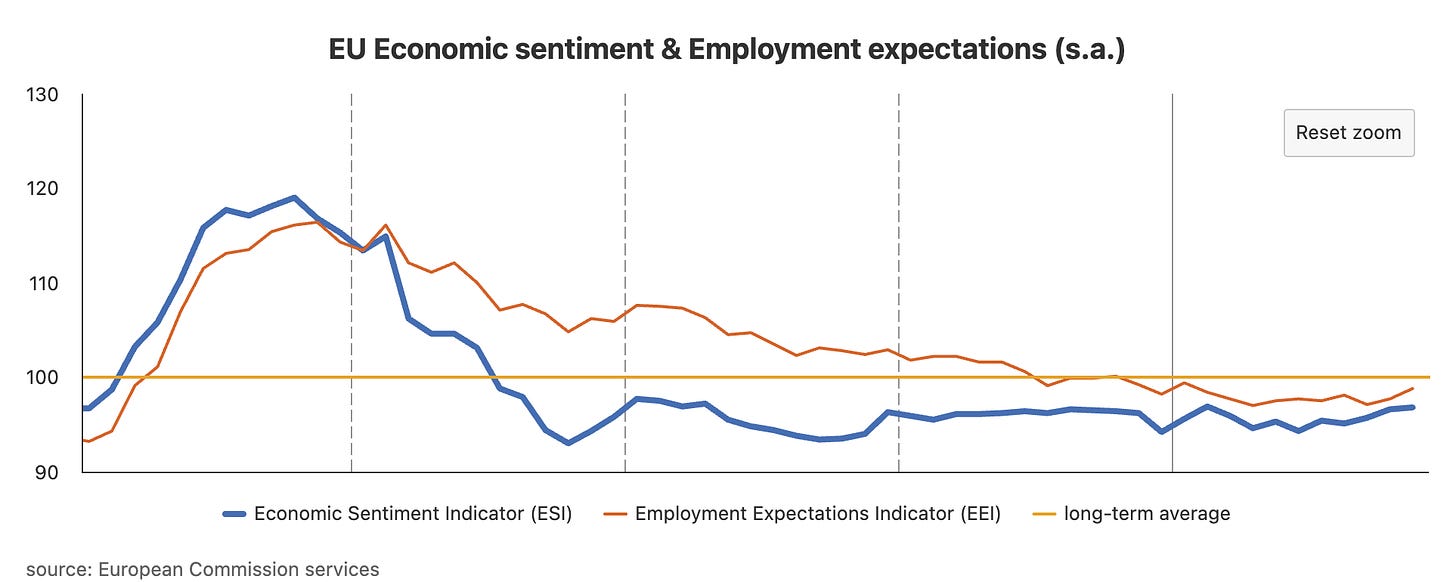

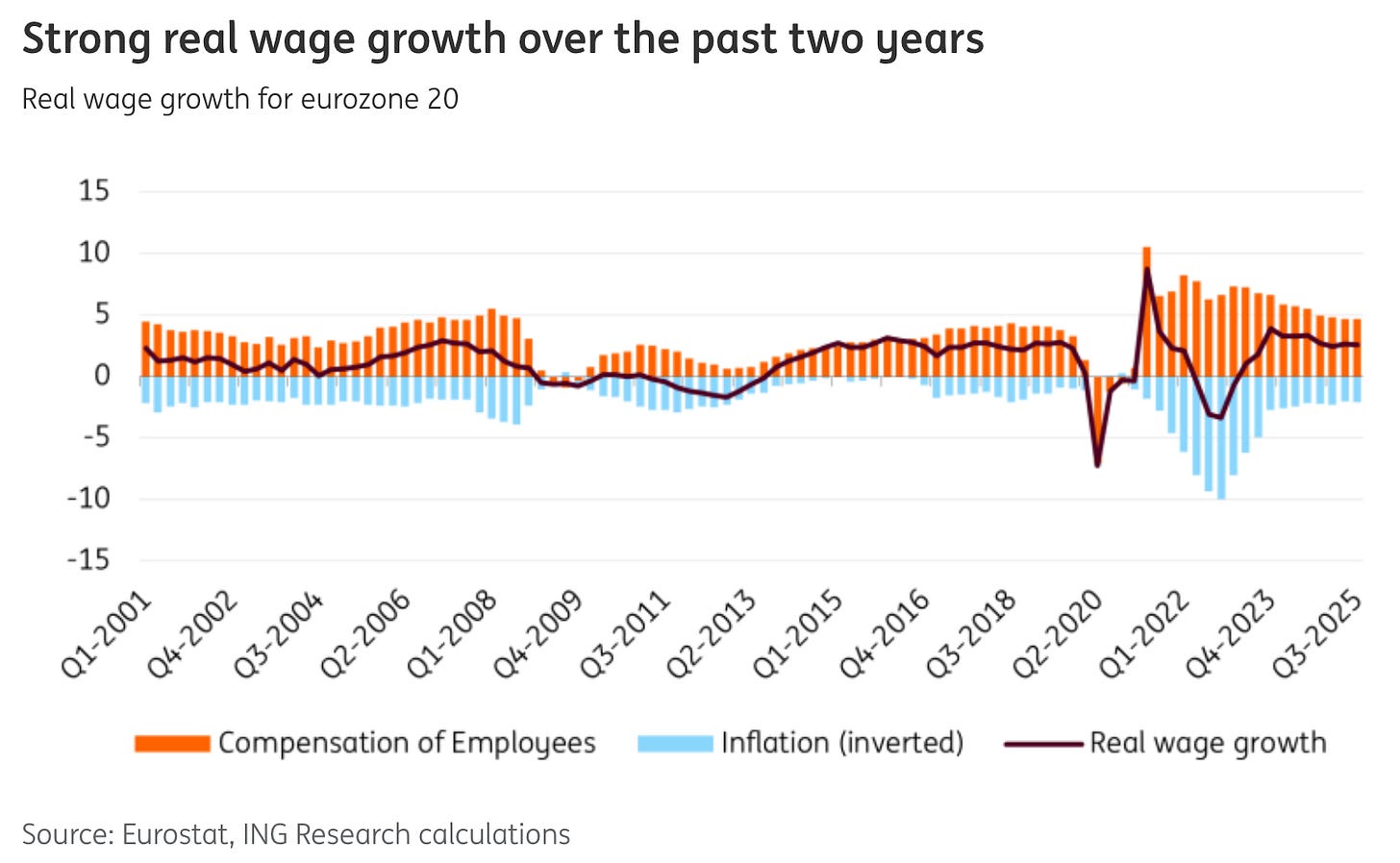

Comeback of the consumer. There is a credible case for improving consumer confidence in 2026. Several years of declining interest rates, real wage growth, resilient equity markets, and gradually stabilizing property prices (+5% across the Eurozone in 2025) should provide support for consumer-facing industries. While confidence remains subdued, early indicators suggest momentum may be shifting.

I will be paying extra attention to sectors such as consumer goods, retail, travel & tourism and the likes.

The “boring” winners from above trends

Let’s look at how the above themes translate into some company-level opportunities.

Vitec Software ($VIT): The compounder’s AI

Vitec’s acquisition-driven model is uniquely positioned to benefit from generative AI. In vertical market software (VMS), the dominant cost centers are development and support and I would see GenAI as a moat-deepening engine.

The competitive advantage here is contextual richness. Vitec’s AI:s are trained on the specific, “boring” niches (pharmacies, energy, real estate and so on) where the switching costs are already massive. By making these products smarter, Vitec makes them un-unpluggable.

Crucially, this is not a “headcount reduction” play. Developers are simply increasing their velocity of value creation. They are shipping features that previously required months of manual coding.

If these efficiency gains materialize, we are looking at a period where Vitec’s margins surprise to the upside.

Carasent ($CARA): A hidden AI play

Healthcare is one of the most administratively burdened sectors in the Nordic economy. Labor shortages and rising demand make productivity gains not just attractive, but necessary.

In light of that, the private market is valuing Tandem Health, a Swedish hype AI ambient listening / doctor note-taking “wrapper”, at SEK 2-3 billion. Tandem is thus valued higher than the entire enterprise value of Carasent, despite Carasent having estimated ~3x the revenue (total revenue) and owning the mission-critical EMR layer - and with functionality in line with Tandem.

Tandem charges SEK 1,500/month per doctor, with a pure-play tool and high churn risk.

Carasent charges ~SEK 750/month for Medsum (same functionality), which is fully integrated into the workflow, i.e. locked-in and with zero friction.

The market is aggressively pricing “AI that reduces admin” at estimated 20+x sales. Carasent shareholders are sitting on that exact same asset, hidden inside a platform trading at ~5x sales. Tandem has a relatively sizeable business, and shows that Medsum can be bundled, upsold, and scaled across the installed base.

This is hidden monetization optionality sitting inside the EMR.

Hexatronic ($HTRO): The “AI fatigue” risk being overstated

A key risk in 2026 is a potential cooling in hyperscaler capex sentiment. If enthusiasm around AI fades, investors may question the sustainability of data center investment.

The counterpoint is that the physical infrastructure build-out is already underway and operates on multi-year timelines. Data centers require massive amounts of fiber, ducts, and potential harsh-environment infrastructure regardless of short-term market sentiment. This is where Hexatronic is increasingly exposed.

While legacy fiber markets remain cyclical, Hexatronic’s data center segment is growing rapidly. The market continues to price the company as a construction-linked cyclical, under-appreciating its role as a “pick-and-shovel” supplier to AI infrastructure. That disconnect creates opportunity.

Pexip ($PEXIP): Secure communication a strategic asset

As geopolitical tension rises, secure and sovereign communication is becoming increasingly critical. Pexip’s self-hosted “Secure Spaces” video conferencing solution is designed for environments where US-cloud-based platforms are not acceptable. Growth in its Secure & Custom segment reflects rising demand from defense contractors and government agencies, making Pexip a direct beneficiary of Europe’s broader security and defense realignment.

Our conviction list into 2026

The opportunity set in Nordic equities remains attractive. Many high-quality companies now combine conservative balance sheets with improving fundamentals and exposure to long-term structural themes such as AI-driven efficiency, defense and security, healthcare digitalization, and energy-transition execution.

Fjord Alpha’s conviction list reflects this philosophy. These are businesses that quietly compound value by allocating capital well, improving productivity, and operating in niches where scale, trust, and specialization matter.

The current Fjord Alpha “Conviction List” for 2026 (work in progress)

Hexatronic ($HTRO): Buy the “US local production” moat and Data Center exposure and ignore the fiber cycle noise.

GN Store Nord ($GN): Could this be the turnaround story of the year? Hearing aid demographics and increasing MedTech share + deleveraging = multiple expansion.

Vitec ($VIT): GenAI is shortening dev cycles in "boring" vertical niches. I expect Vitec portfolio companies to ship features faster than ever in 2026, leading to an expansion in EBIT margins. Stock has been painful last 6 months and valuation is at multi-year lows.

Evolution ($EVO): While the market obsesses over Asia, the “Big Three” US states (PA, MI, NJ) are hitting new records, and Europe is positioned for comeback. With a 10% TSR (Dividends + Buybacks) and a sub-10 P/E, you are getting a global monopoly at a value price. Stock also at multi-year lows.

Carasent ($CARA): Long growth trajectory ahead, and optionality in Germany and via AI. Investment phase largely over. As per above, private markets value AI-med tools (like Tandem Health) at 20x sales. Carasent owns the same functionality (Medsum) but trades lower as it is “boring” EMR.

Ørsted ($ORSTED): After the 2025 recapitalization and asset divestments (like the Hornsea 3 stake to Apollo), the balance sheet is finally repaired. 2026 is about execution, not survival.

Embracer ($EMBRAC): Coffee Stain spin-off completed. Focus now shifts to execution and unlocking leverage across a large IP portfolio.

Watch list

Pandora ($PNDORA): While silver prices are a headwind that is clearly visible in the stock chart - market sees “high silver prices” - efficiency gains, price increases and lab-grown diamond expansion should be protecting EBIT. Buy-back program on-going. Trading at sub-10 P/E. Will be coming back to this one, we should be closing in a good entry point.

Pexip ($PEXIP): Great company, but stock has climbed even higher, and we are currently waiting on the sidelines.

ChemoMetec ($CHEMM): Similar to Pexip, still waiting on the sidelines for a more attractive entry

Ambu ($AMBU): Also here to much priced in, waiting for the right entry.

More companies will definitely be added during 2026.

That’s it for now. Stay tuned for more company deep-dives and quarterly updates.

Hi, and thank you for your writeups.

Have you looked at ROIIC for Vitec? After the new CEO took over in 2021, the ROIIC numbers have deteriorated. TTM ROIIC is only 1.84% according to Gurufocus, meaning that their capital allocation has been terrible for their last aquisitions. ROIIC last three years is only 4,6% compared to Constellation's 13.5%. It is not directly apples to apples comparison, but worth keeping an eye on.

Also you need to consider that under IFRS, they report consolidated numbers even if they only own 75-80% of their subsidiaries.