Embracer: Catalysts have started to stir

A modest rally in recent days after a flurry of positive news: Green shoots emerging

Just a few days ago, I published my most recent deep dive, Embracer: Forged in Fire, Awaiting a Catalyst. The conclusion was a very strong BUY, with 37% CAGR pencilled out over the next years and clear multi-bagger potential. Since then, there has been a flurry of optimistic news, and the stock has seen a modest but welcome rally, currently sitting at SEK 100 and +14% since my memo was released just a few days ago. With so much action, I felt it was important to provide a smaller follow-up this week to see if the market is finally starting to listen to the Embracer story.

While it's far too early to declare victory, these recent developments are the first "green shoots" of a potential stock turnaround. They don't guarantee success, but they are tangible, positive signals that the narrative is beginning to shift. Let's break down this week's news, what it truly means, and the significant hurdles that still remain.

A clear vote of confidence: Buybacks

The most concrete news came directly from Embracer's Annual General Meeting (AGM), which authorized a new share buyback program of up to SEK 500 million. This is a significant move. In a market that has previously punished Embracer for its aggressive capital spending, a buyback is a prudent and powerful signal from management. It essentially says: We believe our shares are the best investment we can make right now. It is a vote of confidence, backed by company capital, aimed at creating value for long-term shareholders. While buybacks offer good support for the share price, their real impact will depend on disciplined execution.

Analyst upgrades

Perhaps even more validating for our thesis has been the shift in the analyst community:

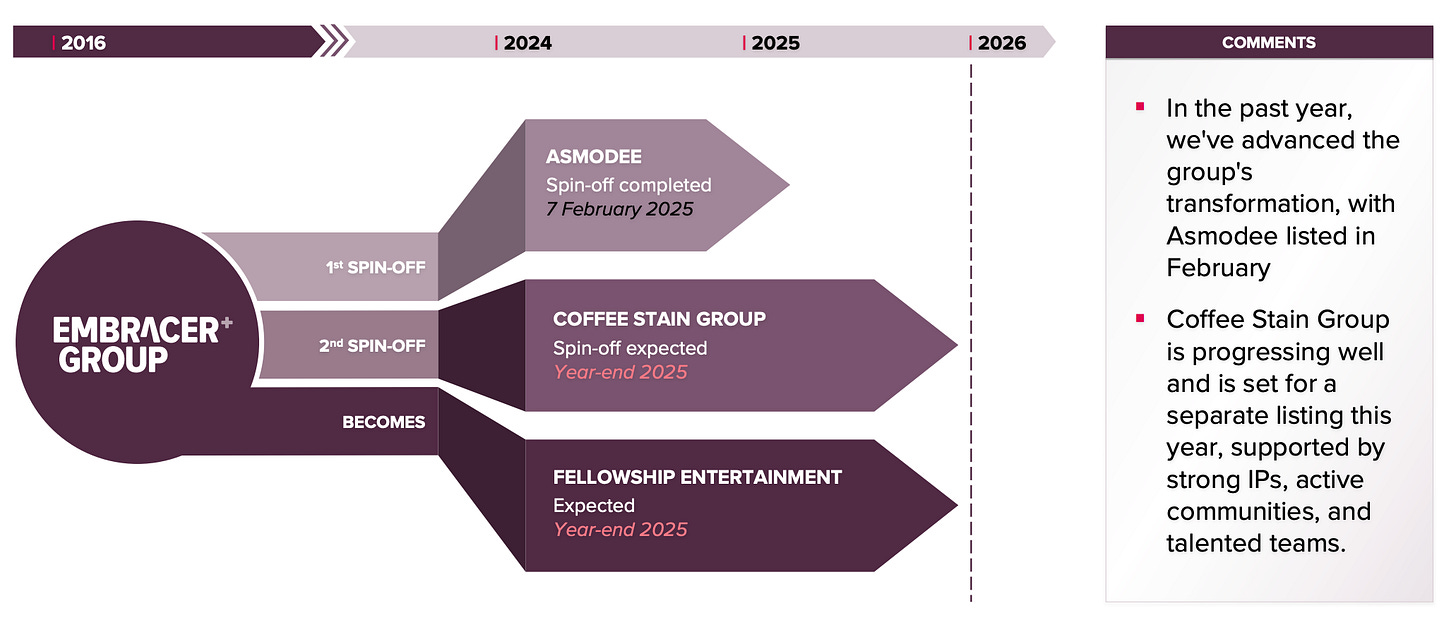

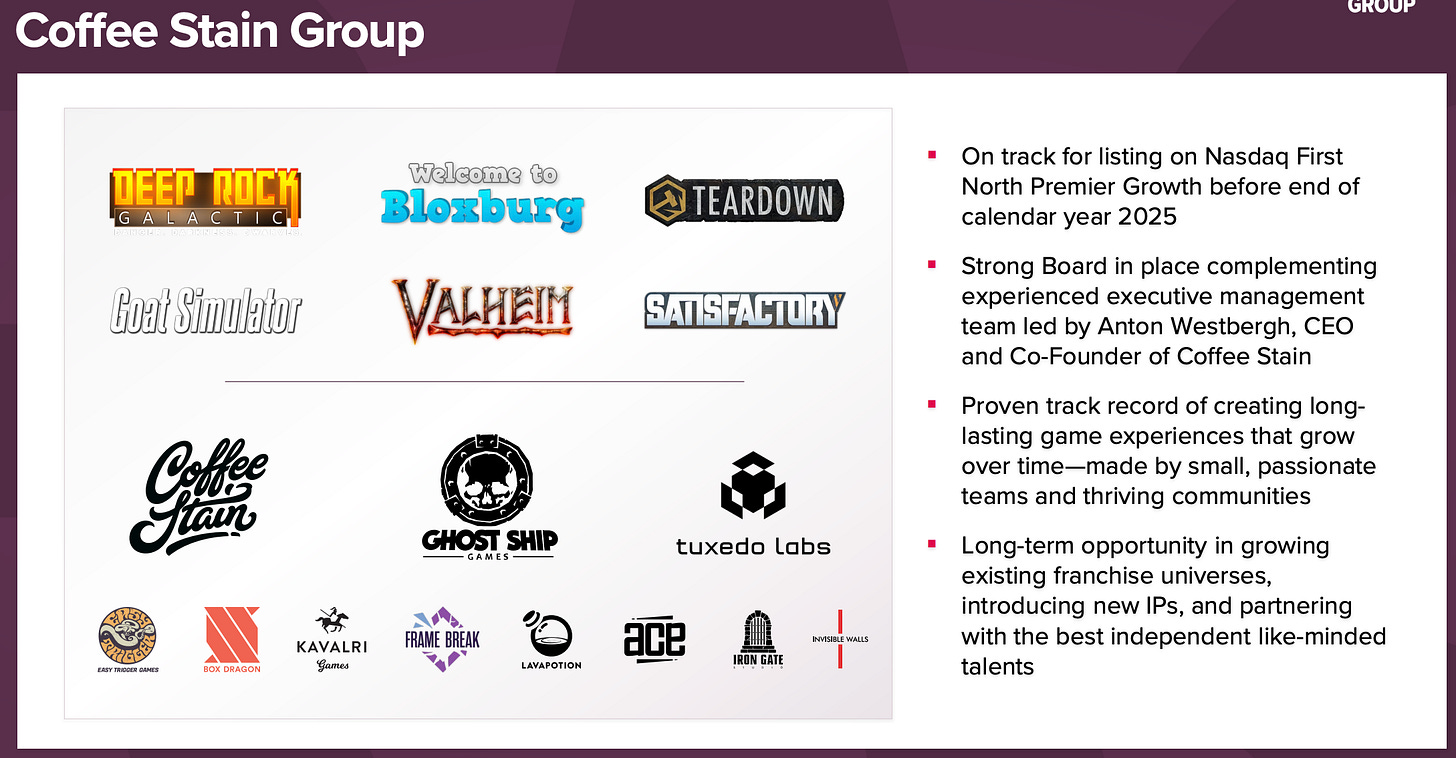

Pareto Securities named Embracer a top TMT pick, setting an ambitious SEK 140 price target. They highlighted the upcoming spin-off of Coffee Stain and argued that the remaining "Fellowship Entertain" entity, with its nine upcoming AAA games, is being valued at an unjustifiably low multiple.

Similarly, Kepler Cheuvreux raised its price target to SEK 116, also pointing to the high quality of the Lord of the Rings and Tomb Raider IPs as key value drivers.

This is a critical development. For months, the consensus view on Embracer has been skeptical at best. These upgrades suggest that at least some corners of the market are now doing the math on the sum-of-the-parts valuation and realizing the significant potential upside. However, it is vital to remember that these price targets depend heavily on future success. They assume the AAA game pipeline delivers, and the corporate split is executed well. They are a sign of what could be, not yet what is.

The road ahead: Execution is everything

The recent news is certainly encouraging, but it is important to keep things in perspective. The turnaround story for Embracer is far from complete. What happens next will be the true test, as discussed in my main article.

The AAA pipeline The market is now well aware of a nine-title AAA game pipeline. This is the engine of future growth for the "Fellowship Entertain" entity. However, these are just numbers on a slide until we see actual gameplay, get firm release dates, and witness successful launches. The gaming industry is full of hotly anticipated titles that ultimately failed to deliver. Great execution on this pipeline is a critical variable for the case. The pressure to deliver on titles linked to beloved IPs like The Lord of the Rings and Tomb Raider will be massive.

The complexity of the split: Dividing a company of Embracer's size into separate entities is a challenging undertaking. While the strategic logic behind it is sound, the operational, financial, and legal complexities are significant. Important questions remain: How will the existing debt be fairly split? Who will lead the new entities? How will internal dependencies be managed? The board's new "Transformation fee" (i.e. extra compensation for BoD members) acknowledges this very complexity. A smooth, well-managed separation is critical to truly unlocking the value that analysts are now starting to forecast. Any missteps could spook a still-nervous market.

Winning back trust: Most importantly, Embracer needs to continue the long, hard process of winning back investor trust. The wounds from the aggressive M&A spree and the subsequent collapse are still fresh. A share buyback and a few positive analyst notes are a good start, but real trust is rebuilt through consistent, predictable execution over quarters and years, not just days and weeks. Management must continue to under-promise and over-deliver to fully restore confidence.

Cautious optimism for a long, promising journey

These recent developments are a very welcome and necessary step in the right direction. They provide the first tangible evidence that the market is beginning to recognize the immense potential value locked within Embracer Group.

These "green shoots" offer a crucial first validation of our original strong buy thesis. They signal that the market is starting to align with the core idea that Embracer is deeply undervalued. This week's news isn't the finish line, but it is a concrete step on the path towards realizing the 37% CAGR we penciled out in the initial deep dive. The narrative is shifting, and the future, though still challenging, looks significantly brighter!